Fiscal stimulus worsens the problem of overcapacity

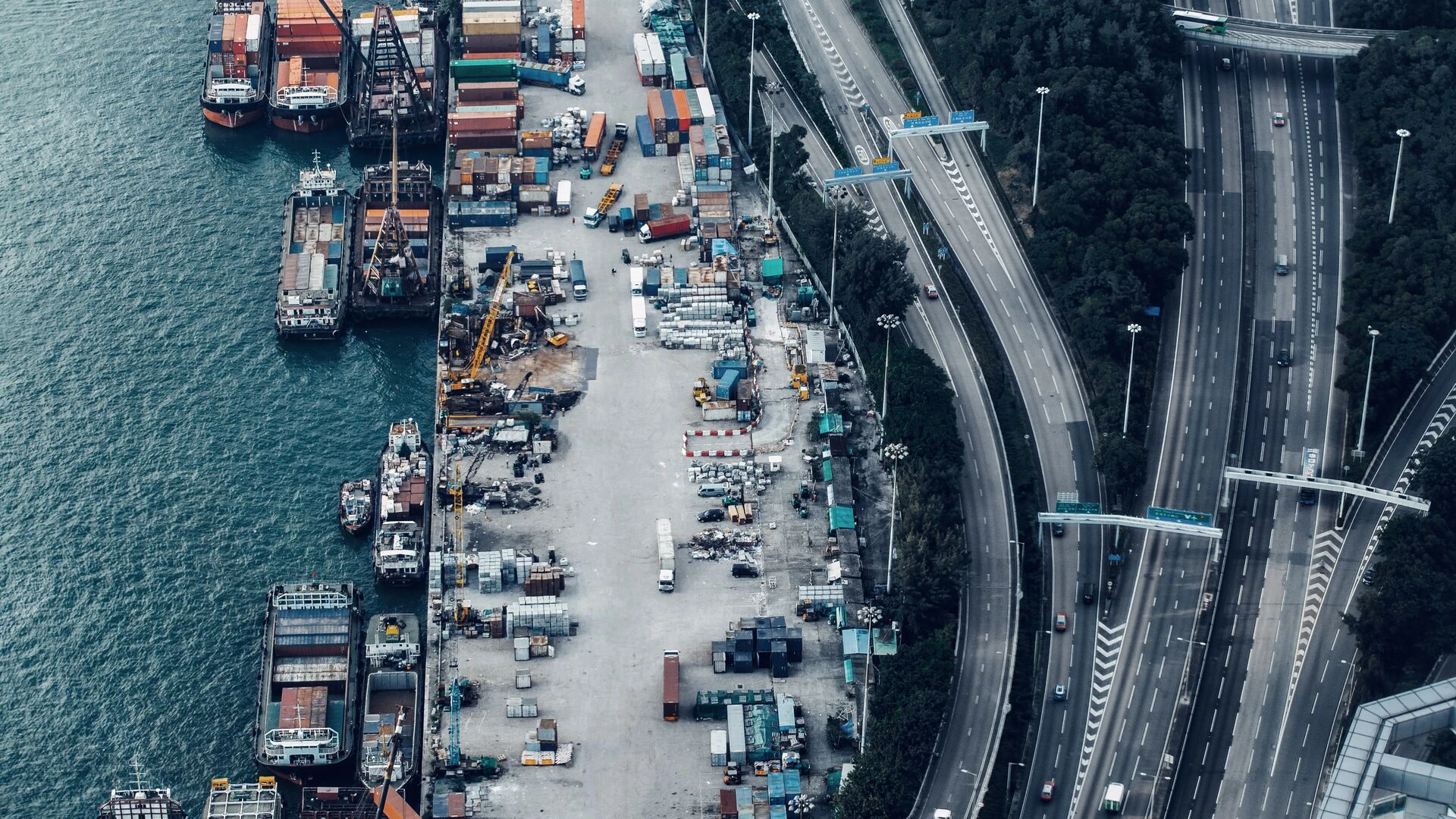

China’s growth in recent years has relied heavily on fiscal stimulus, which has boosted fixed asset investments in manufacturing and infrastructure. Although we now expect consumption to play a somewhat more important role in the economy, the fiscal stimulus increase of nearly 2% of GDP announced at the National People’s Congress in March implies that strong growth in fixed asset investment in many sectors will continue in 2025.

However, this has worsened the problem of overcapacity, negative price pressures and low profitability. The trade war and weaker global outlook may exacerbate these issues.

While the Chinese leadership has emphasized promoting consumption, concrete measures have remained limited. The broadly defined public sector deficits are already large (8-13% of GDP), limiting the potential for significant household income boosts.

Is China ready for a trade war?

China has been decreasing its dependency on the US economy, investing in self-sufficiency and strengthening ties with emerging markets. However, the intensified trade war will still hurt China’s growth prospects. We estimate the total effect of the trade war to remove 0.5-2% of China’s GDP growth in 2025-2026.

There are no signs of a start to fruitful negotiations between the US and China, and in our baseline, the bilateral tariffs will remain in place at least for some months.

Given that the trade war will have a significant negative effect on China’s GDP growth, China either will continue to aim for the high growth target and increase stimulus to the economy or blame the US for its challenges and accept that growth will be significantly lower in 2025. If China continues to target ambitious growth, we expect increased fiscal and monetary stimulus, including:

- Another boost to fiscal spending, possibly focusing more on consumption

- A couple more interest rate cuts from the People's Bank of China (PBoC)

- A somewhat weaker CNY against the US dollar. We expect the moves to be gradual, with the CNY moving within the 2% trading band to avoid instability in the FX market

Read the full analysis on Nordea Corporate: Is China ready for a trade war?