- Name:

- Juho Kostiainen

- Title:

- Nordea Chief Analyst

Juho Kostiainen

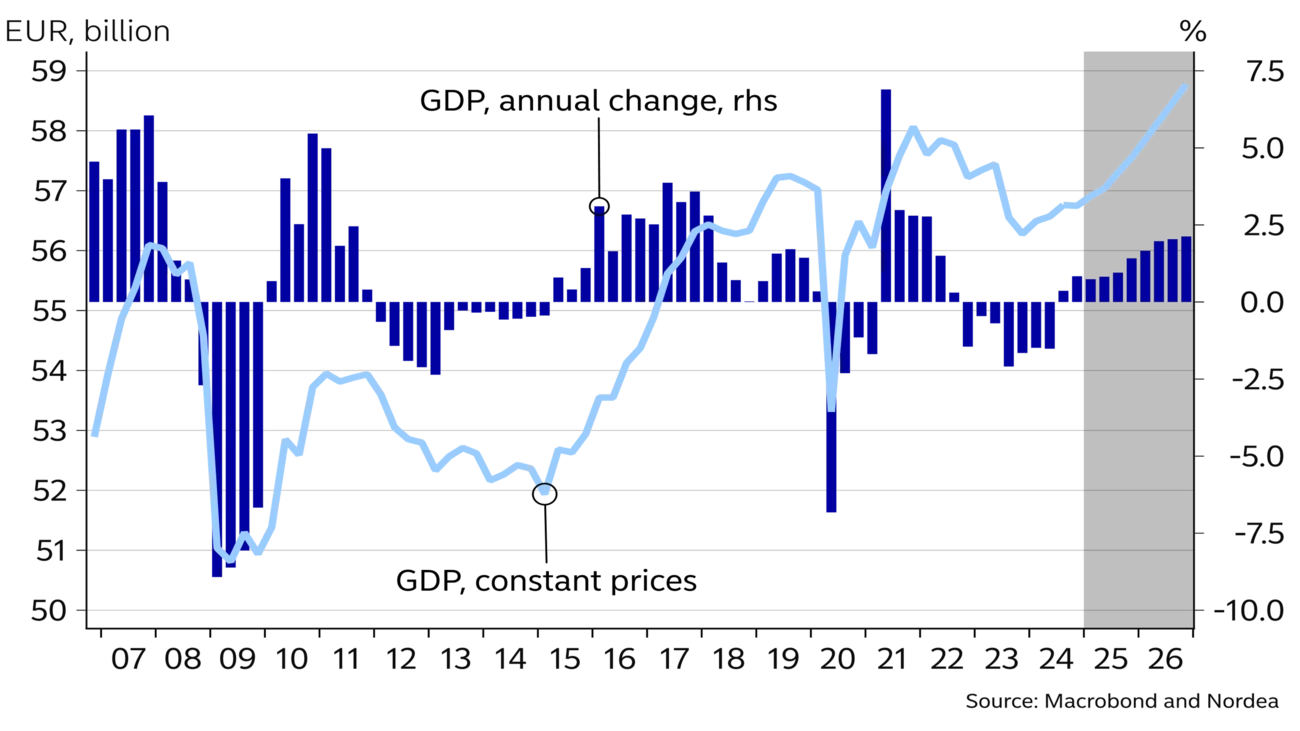

The Finnish economy has seen cautious growth, but the economic cycle remains weak. Consumers are still cautious, even though purchasing power has started to improve and interest rates have fallen. The contraction in the construction sector has ended, but the abundant supply of housing continues to limit activity. The rise in prices, interest rates and wages has weakened public finances significantly in recent years.

The Finnish economy saw some cautious growth last year, even though GDP contracted for the full year. However, economic growth has so far relied on net exports and public sector spending, as investment and private consumption have been subdued.

Consumer purchasing power remains weak despite improving slightly. Private consumption has also been dampened by weak consumer confidence, which has raised the savings ratio. Consumer purchasing power will continue to recover this year as lower interest rates are passed on to households and wages rise faster than prices. Employment is also expected to gradually improve this year.

Lower interest rates have gradually stimulated housing sales, and the slide in house prices has also levelled off. The trough in the construction cycle seems to be at hand, but construction investments this year still depend on subsidised rental construction and renovation.

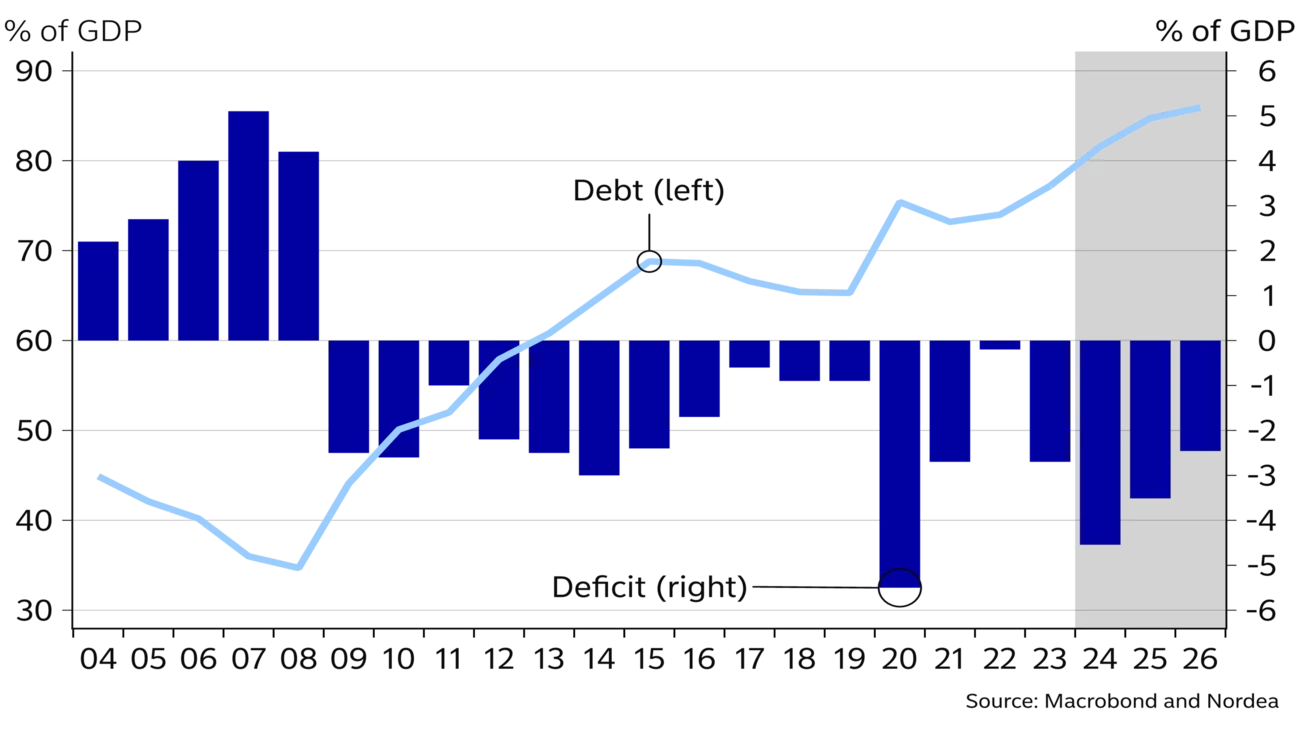

The economic cycle has been particularly bad for public finances, which have suffered from rapid increases in prices, interest rates and wages. However, the fiscal situation is expected to improve this year and next, as a result of adjustment measures and an improvement in the economic cycle.

We expect the economy to grow by 1% this year. For 2026, we forecast growth of 2% on the back of fully recovered private consumption and construction.

Uncertainty over global trade policy casts a shadow over this year’s economic growth outlook and is the biggest downside risk in the forecast. Read more about trade with the US in our theme article. Conversely, an improvement in household confidence and thus a faster-than-expected recovery in private consumption are seen as potential positive factors.

The harmonised index of consumer prices (HICP) for Finland was 1% on average in 2024. Domestic consumer price inflation (CPI), which accounts for interest on loans, also fell to 1.6% last year.

Inflation has mainly been sustained by the rise in service prices by more than 3% year-on-year, while the fall in energy prices has dragged inflation downwards. In the final months of the year, a hike to the standard VAT rate accelerated inflation somewhat. Core inflation excluding energy, food and interest payments remained slightly above 2% in the second half of the year. At the beginning of 2025, the VAT rate on certain goods and services rose from 10% to 14%, which will further raise prices slightly in January.

However, since inflationary pressures are low, harmonised inflation is expected to remain at below 2% this year, despite the price increase resulting from the VAT hike. Domestic inflation (CPI) is expected to fall to just over 1%, driven by falling interest rates.

| 2023 | 2024E | 2025E | 2026E | |

| Real GDP, % y/y | -1.2 | -0.5 | 1.0 | 2.0 |

| Consumer prices, % y/y | 6.3 | 1.6 | 1.3 | 1.1 |

| Unemployment rate, % | 7.3 | 8.4 | 8.7 | 8.1 |

| Hourly earnings, % y/y | 4.2 | 3.0 | 3.4 | 3.0 |

| General gov. budget balance, % of GDP | -2.7 | -4.5 | -3.5 | -2.5 |

| General gov. gross debt, % of GDP | 77.2 | 81.6 | 84.7 | 85.9 |

| Monetary policy rate (end of period) | 4.00 | 3.00 | 2.25 | 2.25 |

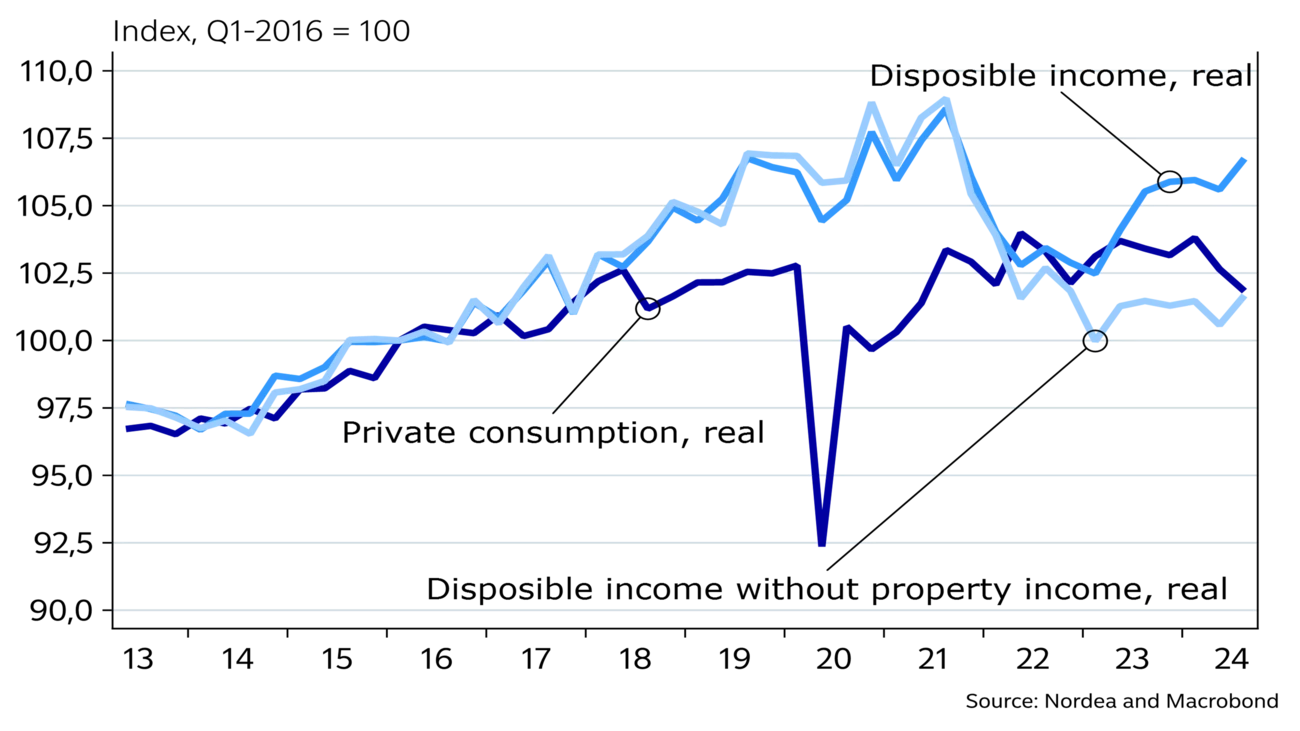

Households’ disposable income in real terms, or purchasing power, has improved for about a year but is still a couple of per cent below the peak reached in 2021. The growth in real income has been helped by lower inflation, higher wages and, in particular, index-linked increases to pensions. About 5% of the growth in disposable income over the past three years has come from higher property income. However, increased property income has not been channelled into consumption.

The improved purchasing power has not yet been reflected in growth in private consumption. On the contrary, consumption decreased last year, which has resulted in weak employment and bankruptcies among companies involved in both the goods trade and the service sectors.

Consumer confidence remains low despite a slight improvement. The increased threat of unemployment and the growing share of property income in household income have raised households’ saving ratio to over 4%.

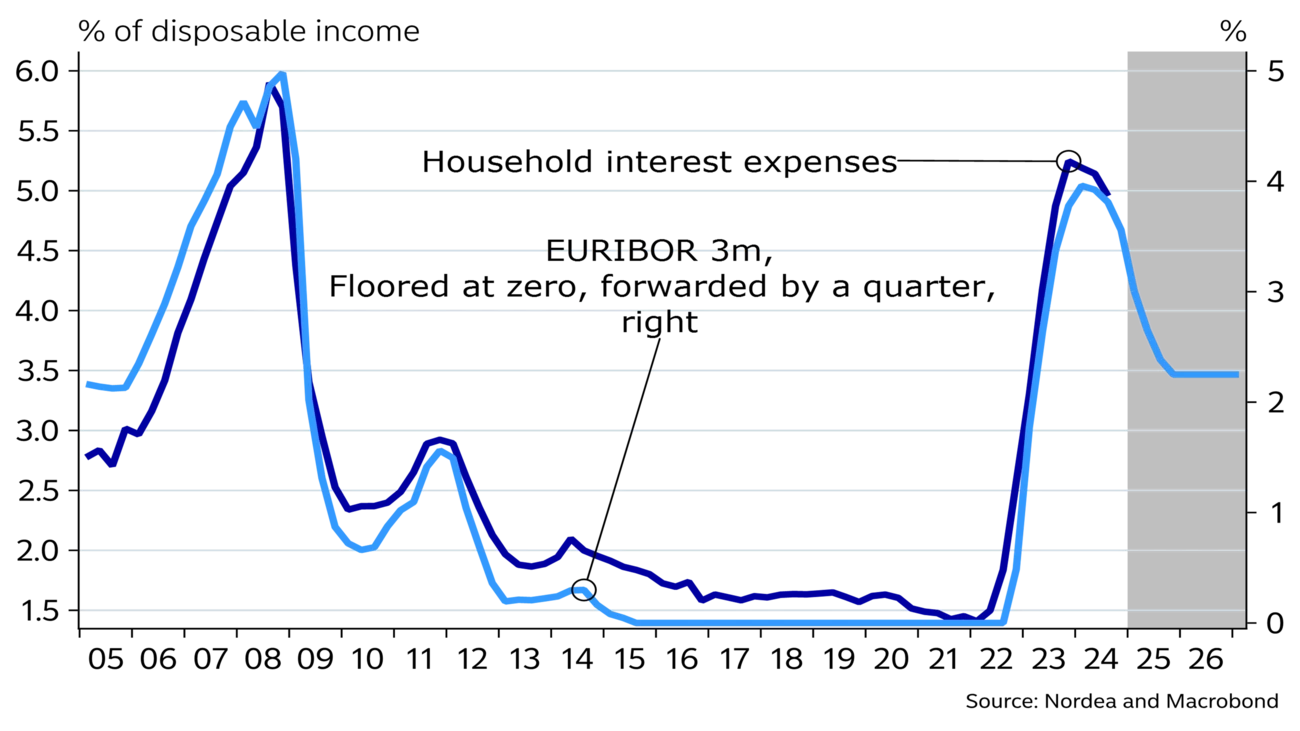

Households’ interest expenses rose 3.5-fold over a couple of years, which has contributed to a decrease in consumption. However, the situation is improving, as lower interest rates have started to be passed on to households in the form of lower debt-servicing costs. Households’ interest expenses are expected to fall by around one-third, or 2 billion euros, this year.

We therefore expect private consumption to turn to growth this year, as inflation remains clearly lower than wage increases and lower interest rates decrease households’ debt-servicing costs. There is potential for stronger-than-expected growth in consumption if household confidence starts to improve more clearly, which could lead to a decline in the savings ratio from the current high level.

The employment situation continued to deteriorate throughout 2024, as the unemployment rate rose to 9% in November. The number of job vacancies also fell clearly, indicating weak demand for labour. In addition to the construction sector, the employment situation in the service and retail sectors has deteriorated markedly, as households have consumed moderately due to weak purchasing power.

Employment is expected to recover gradually this year as improved purchasing power begins to accelerate consumption and construction activity gradually resumes. The growth of the working-age population driven by immigration and the government’s measures to improve labour supply are also expected to boost employment as the economic situation improves.

Growth in property income has not been channelled into consumption.

The rapid decline in market interest rates since last summer has brought a long-awaited boost to the housing market. As a result, the number of housing transactions has been increasing since the summer. However, housing transaction volumes are still 10% below the normal level, with sales of new dwellings lagging in particular. The increase in house prices and rents is expected to be moderate this year, as there is still an ample supply of housing both in the rental and owner-occupied markets.

The trough in residential construction volumes was reached last year. Although the sales of new dwellings and private rental construction are still weak, growth in interest-subsidised construction starts is helping the residential construction sector turn the corner.

Residential construction is expected to recover gradually, as the accelerating population growth in growth centres removes oversupply from the housing market. Currently, there is still quite a lot of supply on the market for both investors and home buyers, which will curb new construction. Nevertheless, some major residential building starts have already been seen. We expect renovation construction to recover in 2025 after a few weaker years, because many residential buildings have postponed necessary repairs.

Investments in machinery and equipment contracted last year, as capacity utilisation was still low, especially in manufacturing, and demand in the service sector was weak. Arms deliveries to Ukraine were reflected in negative investments. The procurement of fighter aircraft for the air force and the government’s investment programme will increase public investment this year and next. Uncertainty over global trade policy is likely to keep private investment weak this year.

Total exports were positive last year thanks to the strong performance of service exports. In the third quarter, service exports grew by 14.5% year-on-year. In particular, ICT service exports and the value of patent income developed favourably.

Finland’s goods exports also increased year-on-year in the second half of 2024. However, the figure for November fell short of the previous year because November 2023 included the delivery of a cruise ship worth two billion euros. There were no similar deliveries in 2024.

New orders in manufacturing picked up last year, and industrial output also remained at a higher level than the year before in the second half of 2024, which also predicts an improvement in goods exports.

There are still some challenges ahead for exports, as economic growth continues to be sluggish in the rest of Europe, which is Finland’s most important export market. Moreover, possible import tariffs imposed by the US would hurt trade flows across the Atlantic, where Finland’s exports have grown significantly in recent years, compensating for weakness in Europe.

Despite this uncertainty, we expect exports to grow this year, driven by service exports.

The economic cycle has significantly weakened the balance of public finances over the past two years. High inflation has raised pension indices and other index-linked expenditure significantly. At the same time, large wage increases in the regional government sector and an increase in the volume of outsourced services have increased expenditure in health and social services areas and municipalities. Interest expenses have also increased rapidly. Weaker employment has eroded income taxes, and consumers’ weak purchasing power has kept consumption tax revenues subdued. In addition, reductions in social security contributions decreased the accrual of contributions last year. The public sector deficit reached an estimated 4.5% of GDP last year.

We expect renovation construction to recover this year.

The situation with public finances is expected to begin to improve this year. Index increases of social benefits will remain low, as inflation has slowed. Wage growth will also be more moderate than in previous years, but the expensive wage settlement in the public sector will have an impact for several years to come. Growth in interest expenses will also level off this year. At the same time, central government adjustment measures will curb expenditure growth and, on the other hand, increase tax revenues together with the slowly recovering economic cycle. The Finnish Defence Forces’ fighter aircraft procurement will begin to burden public finances this year, slowing down the reduction of the public sector deficit. The deficit is not expected to fall below 3% of GDP until 2026.

The public debt ratio has increased to 81%, and it is expected to continue to grow this year and next.

This means the public sector will still have to be streamlined by future governments, as the measures implemented by the current one will not be sufficient to permanently reduce the debt ratio, even if the economic situation improves. About half of the public sector deficit is structural.

This article first appeared in the Nordea Economic Outlook: Consumer comeback, published on 22 January 2025. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more