- Name:

- Juho Kostiainen

- Title:

- Nordea Chief Analyst

Juho Kostiainen

The US has become the most important export market for Finland. This makes Finland quite sensitive to any trade barriers imposed by the US. In addition to direct tariffs, indirect effects such as counter-tariffs, foreign exchange rates and increased uncertainty will have an impact on Finland’s economy.

The importance of the US for Finnish foreign trade has grown significantly in recent years, as the total value of Finnish exports to the country has doubled in the last four years. Last year, around 11% of Finnish goods exports went to the US. In Europe, the US share of exports is the second highest in Finland, topped only by Ireland, and around the same level as in Germany and Italy. In Sweden and Denmark, a little over 8% of goods exports are bought by the US.

The main class of goods exports in Finland is capital goods, consisting of various machinery and equipment. Their sales to the US amounted to 2.7 billion euros in the past year. The growth in capital goods exports reflects the strong growth in investment in the US economy over the past few years, while the economies of Finland’s other key export markets, Sweden and Germany, have grown sluggishly. Moreover, exports to Russia have almost ceased completely.

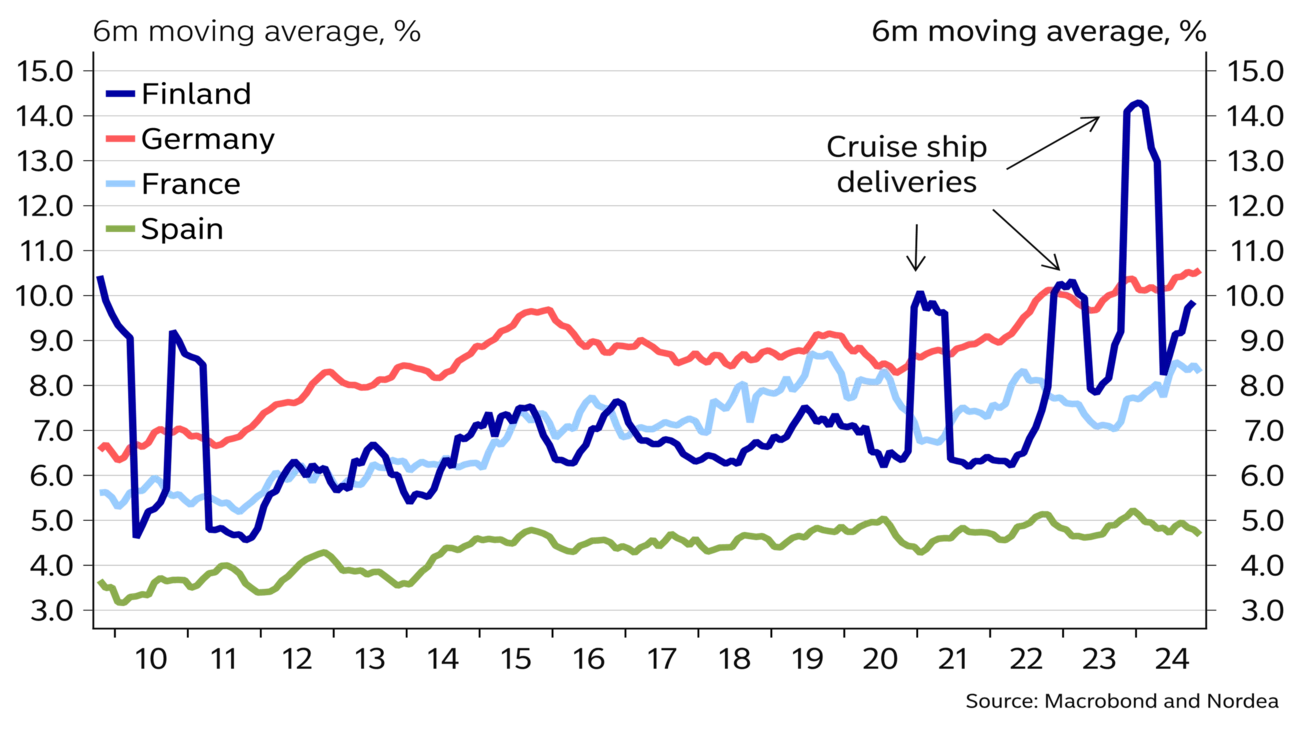

Finland exports metal, forestry and chemical industry products to the US to the tune of 2 billion euros every year. Fuels exports are valued at one billion and pharmaceuticals at about 0.5 billion annually. In 2023, the delivery of a cruise ship increased the value of transportation equipment exports to more than 2 billion euros. The export destinations of cruise ships vary from year to year.

Meanwhile, the US has accounted for around 5% of goods imports, which means Finland has a clear current account surplus with the US.

As for service exports, the US has been a key market for Finland for a long time. In recent years, 15 to 20% of service exports have gone to the US, with ICT services representing about half of these exports.

Potential new import tariffs imposed by the US on European products will also hurt Finnish exports. The value added in Finland from exports to the US is approximately 6 billion euros annually. If an import tariff of 10% imposed on Finnish products were to lead to an equivalent drop in the value of goods exports, this would lead to a decline of about 600 million euros, or 0.2%, in Finland’s GDP. However, the threat of tariffs has already weakened the euro by more than 5% versus the dollar, so half of this impact has been compensated for by the exchange rate.

The biggest negative impact will come from growing uncertainty over trade policy.

Trump has mostly talked about imposing tariffs on cars, a product in which Europe has a clear current account surplus with the US. Car tariffs would not impact Finland directly, but they could have indirect impacts through German industry.

The EU and other countries are likely to impose counter-tariffs on the US, which would potentially have a larger negative impact on the Finnish economy than US tariffs because trade barriers would hamper global trade.

However, the biggest negative economic impact will come from growing uncertainty over trade policy. This uncertainty will force Finnish and foreign businesses alike to postpone their investments, which will weaken demand for investment and exports in Finland. Despite this, the effects of the uncertainty are expected to be temporary, easing once we have more concrete facts about the tariffs.1

Trump is using tariffs as a bargaining chip to force Europeans to increase their defence expenditure. For Finland, it would actually be good if European countries spent more on defence, as this could boost defence-related production in Finland. But first and foremost, it would increase security and boost confidence in the economy.

This article first appeared in the Nordea Economic Outlook: Consumer comeback, published on 22 January 2025. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more