- Name:

- Joel Lundh

- Title:

- Analyst, Nordea

As the summer of 2025 draws to a close, Nordea analyst Joel Lundh provides a comprehensive overview of the global economic landscape. From financial markets to world events, this article summarizes the key developments that have shaped the international economy in recent months.

Financial markets have generally responded positively to announced trade deals, improving "risk-on" sentiment. The USD index (DXY) has strengthened by 2.0% since early July. Currently, the USD trades at 1.157 against the euro.

While government bond yields have risen in Europe and Sweden, they have fallen in the United States, particularly following the labour market figures published on 1 August. Yield curves have steepened in Japan and the US but flattened in Sweden and Europe.

Since July 1, the net changes for 10-year government bonds (and 2-year bonds) are +14 (+18) basis points for Sweden, +3 (+7) basis points for Germany, and -1 (-3) basis points for the US.

Equity markets have shown resilience, with the S&P 500 reaching new all-time highs during the summer and rising 0.5% since 1 July. The Swedish OMXS30 is up 1.6%, although it remains below pre-"Liberation Day" levels. The VIX index stands at 20.4, slightly above its historical average.

In Japan, the yen has weakened by more than 2% against the USD, while government bond yields have increased between 8-23 basis points.

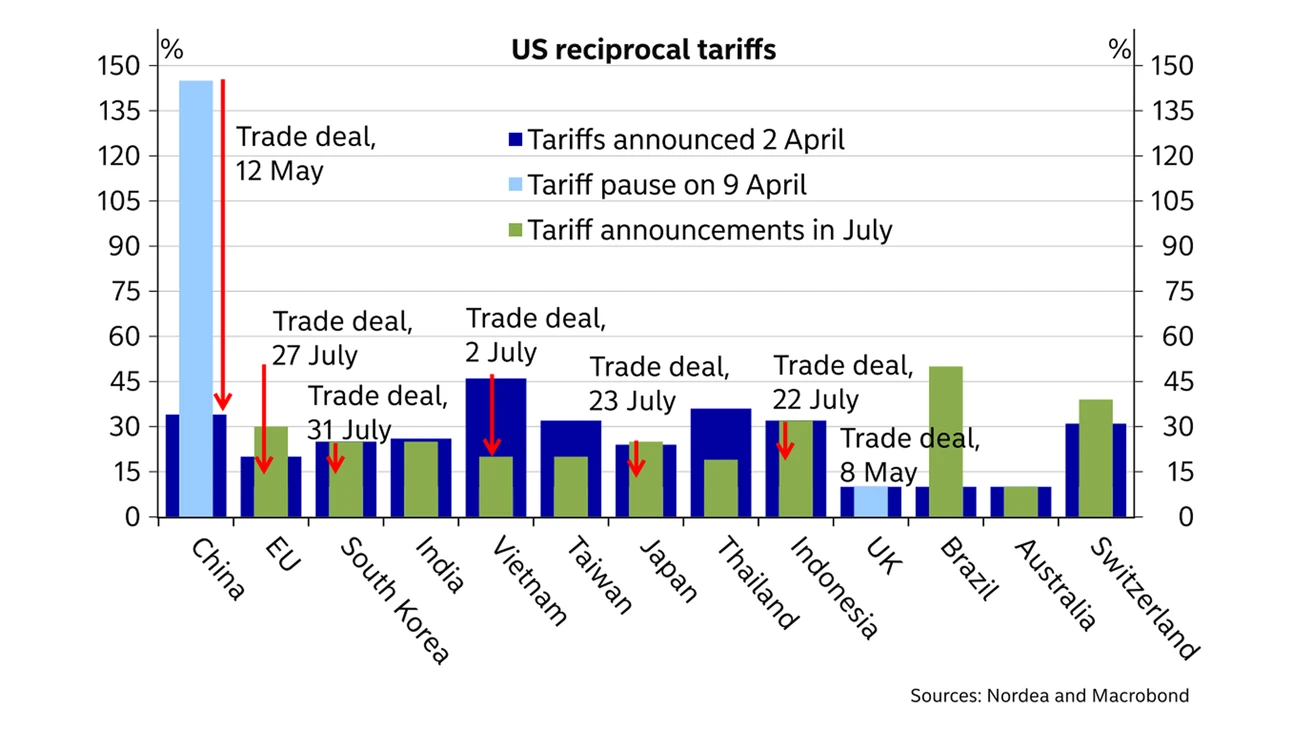

The summer has been dominated by trade-related developments, particularly involving the United States. The Trump administration extended the reciprocal tariff pause initially until 1 August and later again until 7 August. Trade partners have been informed of new tariff levels between 10% and 50%.

The US has reached trade deals with several nations, including Indonesia, Japan, South Korea and the European Union. Notably, goods imports to the US from the EU will be subject to a 15% tariff rate, except for steel and aluminium (50%). The EU has committed to significant investments in the US and substantial purchases of energy-related products.

Trade negotiations between the US and China have continued, with a third meeting concluded in Stockholm. While China says the current trade truce is extended by 90 days, US officials maintain that the final decision rests with President Trump.

In early July, Trump announced a 50% tariff rate on copper products, effective 1 August, and indicated a possible 200% tariff on pharmaceutical products.

Global trade has shown signs of weakness, with a further decline of 0.3% month-on-month in May following April's plunge. Since the beginning of the year, trade has increased by only 1.2% (0.7% for advanced economies).

China's GDP growth slowed to 5.2% year-on-year in Q2, down from 5.4% in Q1, although still in line with the annual target. The People's Bank of China maintained its loan prime rates in July.

Oil prices have risen by 8% since 1 July, with Brent crude trading at USD 69.5 per barrel. Natural gas futures prices have increased by 3%, trading at EUR 34 MWh.

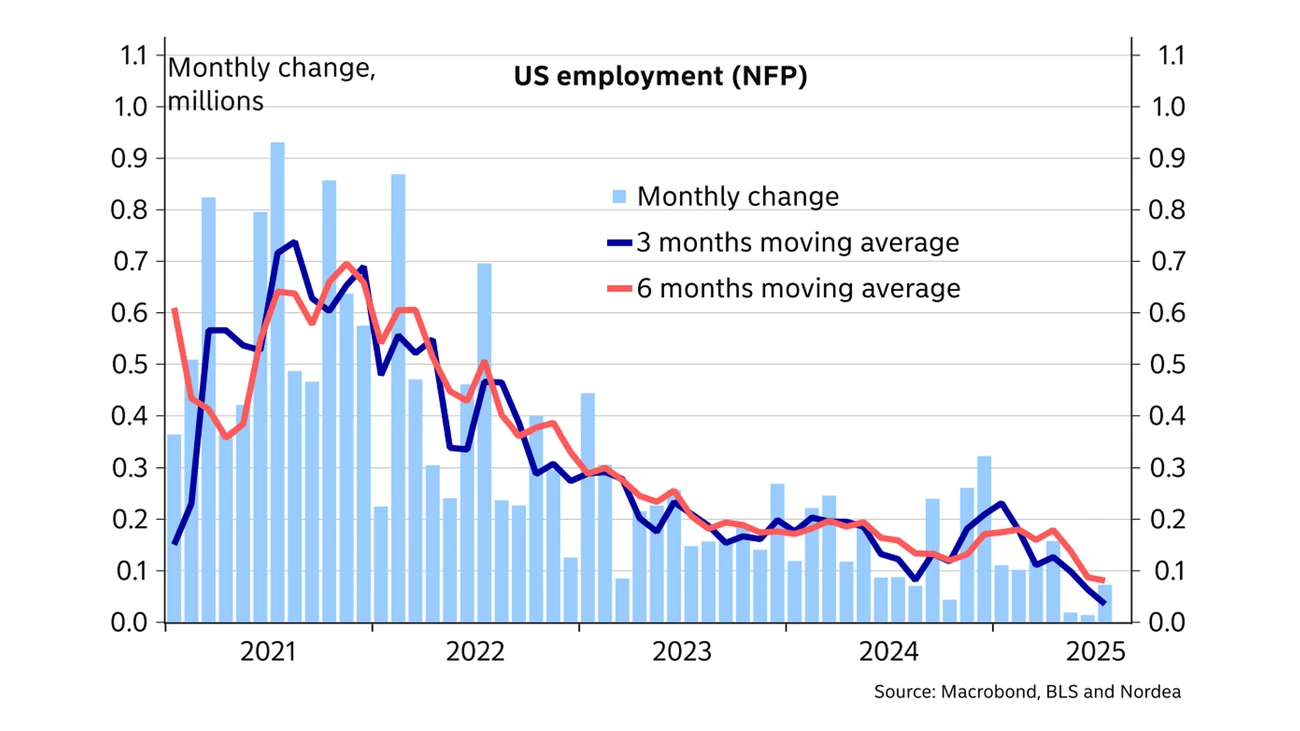

The United States has seen mixed economic signals. Non-farm payrolls rose by 73,000 in July, below consensus expectations, while unemployment increased to 4.2%. Headline CPI inflation accelerated to 2.7% year-on-year in June, with core CPI rising less than expected to 2.9%. Details in price data continue to show a small impact of tariffs on inflation, while companies’ price plans have edged higher in recent months.

GDP rebounded better than expected in Q2, growing at a 3.0% annualized rate quarter-on-quarter. However, housing prices fell for the third consecutive month in May. Consumer confidence improved in July, reaching 97.2, up from 85.7 in April, according to the Conference Board.

The Senate passed the “Big Beautiful Bill,” signed into law by President Trump on 4 July, which the Congressional Budget Office estimates will add USD 3.4 trillion to US debt over the next decade.

In the Euro area, headline HICP-inflation remained stable at 2.0% year-on-year in July, while core inflation held steady at 2.3%. GDP growth slowed less than expected in Q2, rising by 0.1% quarter-on-quarter.

The preliminary composite PMI for the Euro area improved to 51.0 in July, up from 50.6 in June. However, economic activity in Germany was sluggish, with GDP falling by 0.1% quarter-on-quarter in Q2, according to preliminary figures.

The EU presented a new proposal for the Multiannual Financial Framework, amounting to around EUR 2,000 billion for the years 2028-2034. Additionally, Bulgaria is set to become the 21st country to adopt the euro in 2026.

Major central banks have maintained a cautious stance. The Federal Reserve left the federal funds rate unchanged at 4.25-4.50% in July, with Fed Chair Powell giving no clear signals regarding the prospect of a rate cut in September. The European Central Bank also kept its policy rate unchanged at 2.0%, emphasising data dependence in future decisions.

The Bank of Japan maintained its policy rate at 0.5% in July, in line with expectations. Market expectations for further monetary easing from the ECB and the Riksbank have decreased throughout the summer.

In conclusion, the global economy continues to navigate uncertain waters, with trade tensions, mixed economic indicators and cautious central bank policies shaping the landscape as we move into the latter half of 2025.

See the full presentation: Summer holiday wrap-up

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Markets and investment

As the European regulatory environment for cryptocurrencies has matured and the demand for virtual currencies and cryptocurrencies is growing across the Nordics, Nordea has decided to allow customers to trade in a crypto-linked product on its platforms.

Read more

Markets and investment

Our analysis of the main public infrastructure programmes in Europe points to a substantial step-up in investment due in 2026, which contrasts with the capital drain we’re seeing for US cleantech. This is driving investors’ sentiment for infrastructure, which, for the first time in years in Q2 2025, was higher in Europe than in the US, topped by the Nordics.

Read more

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more