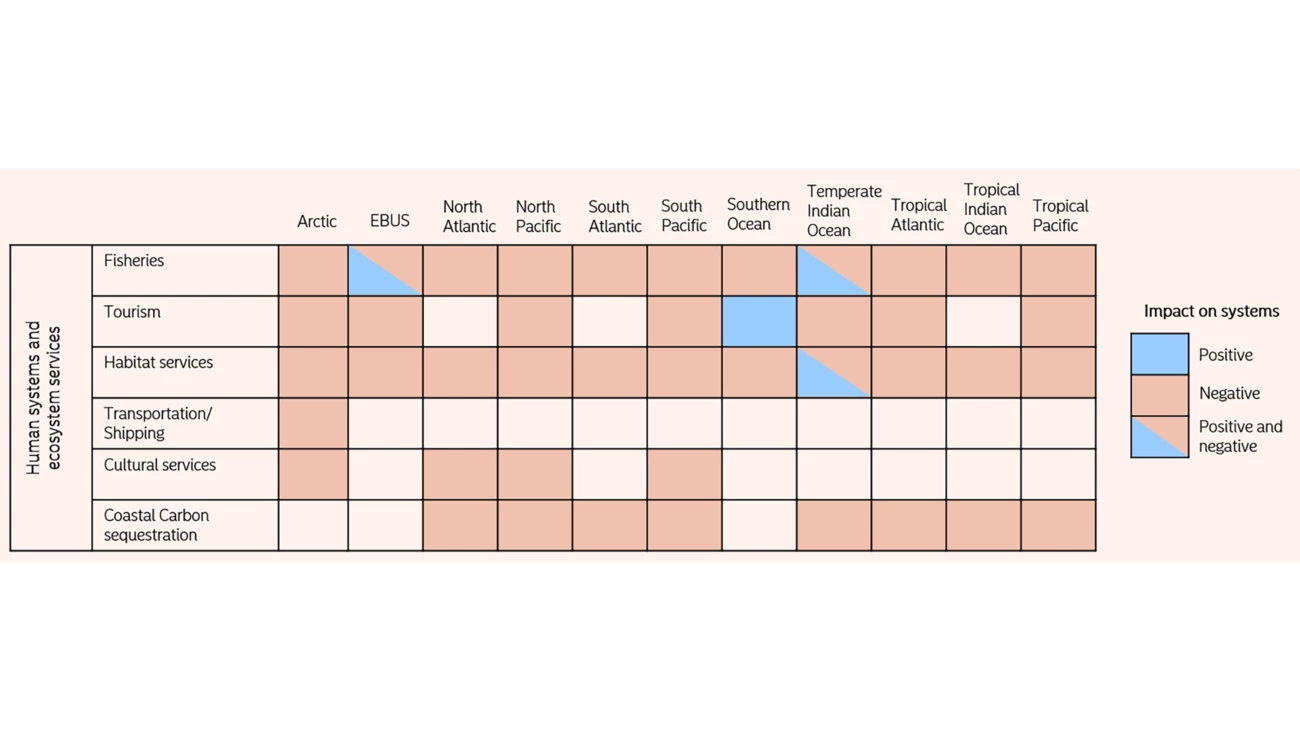

Source: IPCC Special Report on the Ocean and Cryosphere1 in a Changing Climate (SROCC)

The human and economic impact, and funding opportunity

Beyond climate and ecosystems, there is a clear documented human and economic impact from declining ocean health. According to a report by the United Nations, over 3 billion people worldwide depend on marine and costal biodiversity for their livelihoods, making the preservation of these ecosystems not only an ecological necessity but a social and economic imperative.

The opportunity for funding, and more importantly protecting, a currently underfunded and overexploited sustainable ocean economy is clear. Ocean trade alone is estimated to be worth $2.5 trillion a year and the full potential of the marine economy, including currently untapped areas such as ecosystem services, is estimated to be worth at least $24 trillion. Aiming to draw sustainability-aligned funding from the global financial market’s largest asset class, blue bonds have the potential to pull investments towards sustainable marine activities and to kickstart initiatives that will benefit ocean ecosystems and societies that rely upon them.

What is a blue bond?

Similar to green bonds, blue bonds are a use-of-proceeds format, meaning that money from the bonds is explicitly earmarked for financing activities that fall under pre-defined categories deemed beneficial for the development of a sustainable marine economy. Such bonds serve the function of connecting investors seeking “blue” investments with issuers in need of funding for projects considered beneficial to ocean or marine environments.

Central to the issuance of a blue bond, eligible projects for financing must be identified. In line with the existing Green Bond Principles criteria, blue bond projects must fall within one of the five categories in order to be considered eligible:

- Climate change mitigation

- Climate change adaptation

- Natural resource conservation

- Biodiversity conservation

- Pollution prevention and control

These categories are rather broad, as they predate the latest blue bond guidance and are applicable elsewhere. ICMA has therefore identified an indicative list of blue project categories and sub-categories to aid issuers in the identification of suitable projects. While further detail is provided directly in the guidance, the following list serves as an indication of project types that are expected to be commonly supported by the blue bond market and align with observed best practices:

- Coastal climate adaptation and resilience

- Marine ecosystem management, conservation, and restoration

- Sustainable coastal and marine tourism

- Sustainable marine value chains

- Marine renewable energy

- Marine pollution

- Sustainable ports

- Sustainable marine transport

While there is some room for interpretation as to precisely what each category encompasses, some activities have been explicitly excluded from funding via “blue” formats. “Non-renewable extractive industries” have been excluded from ICMA’s definition of “sustainable blue economy,” thereby locking activities such as deep-sea mining, dredging and any offshore oil and gas out of eligible use categories.

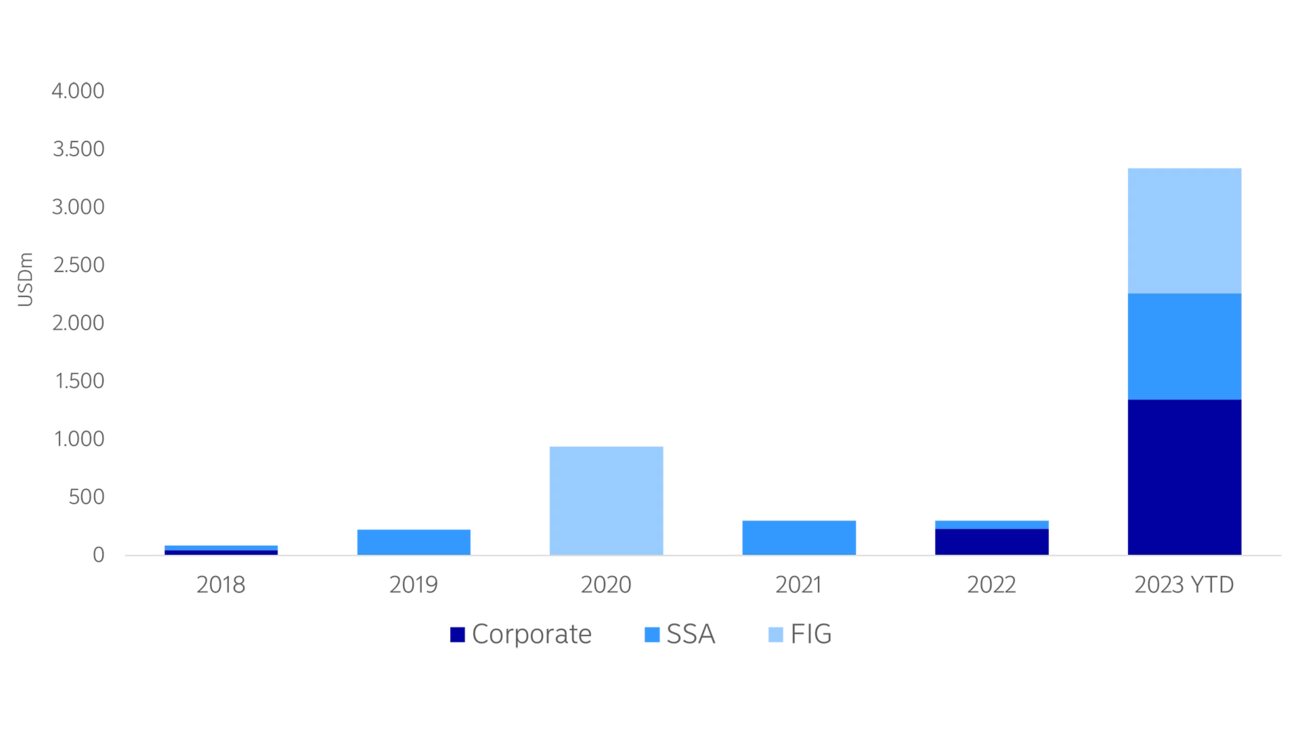

What has the blue bond market looked like so far?

Blue bonds are relevant across a range of issuers, including sovereigns and sub-sovereign agencies, multilateral development banks and other financial institutions, and large and medium-sized companies. The distribution of the relatively small blue bond market has been somewhat evenly distributed across issuer type since inception. Despite not entering the market until 2020, FIG issuers have been the most prominent overall, with a cumulative volume of just over USD 2bn.

Blue bond volume by issuer type (2018 – 2023 YTD)