- Name:

- Kjetil Olsen

- Title:

- Chief Economist Norway

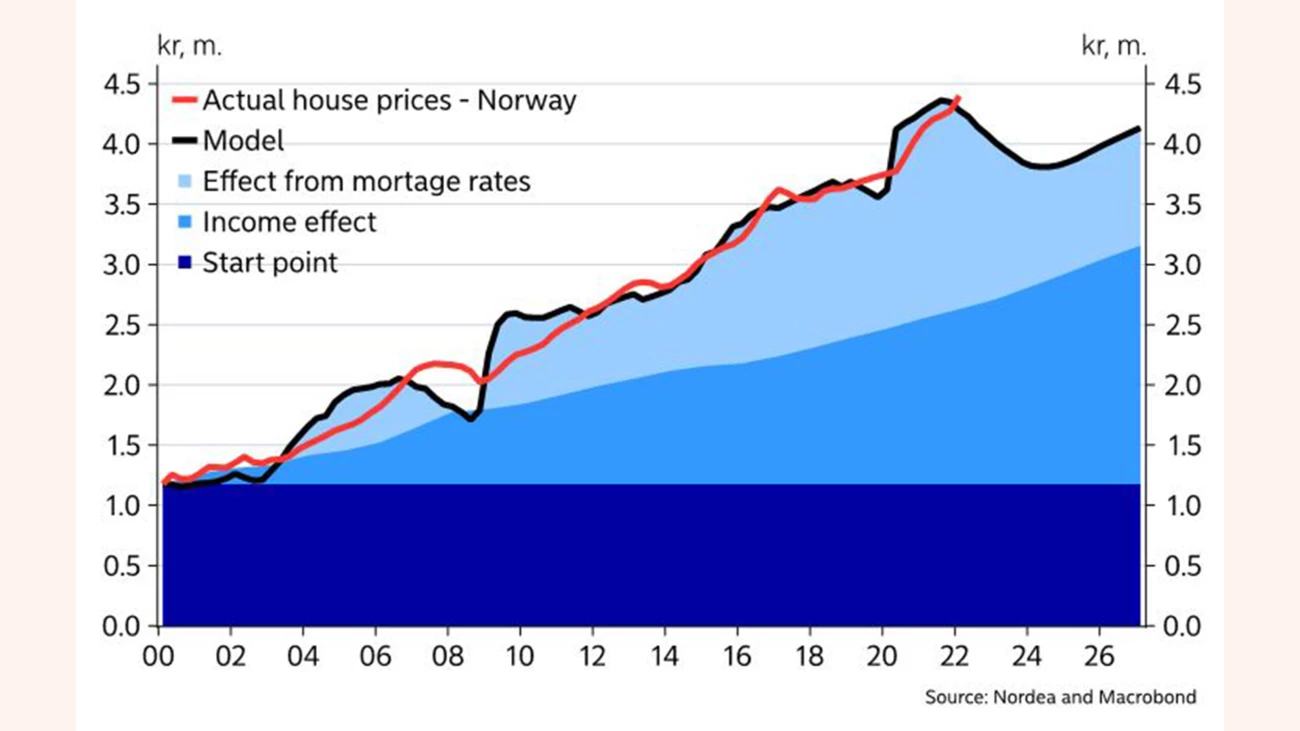

In the past 20 years, housing prices have more than tripled in Norway. A doubling of household income is only half the explanation. The rest is mainly due to lower interest rates. With zero interest rates during the pandemic, the policy rate and thus rates on housing loans bottomed out. We will not see this interest-rate effect again. The housing market rally – with significantly higher growth in housing prices than income growth – is over.

In the past 20 years, housing prices have more than tripled, see chart A. Even if deflated by income, housing prices are still significantly higher today than at the beginning of the 2000s. For a median family, an average home today costs five times the disposable income compared to three times the disposable income 20 years ago. Many believe that housing prices are artificially high.

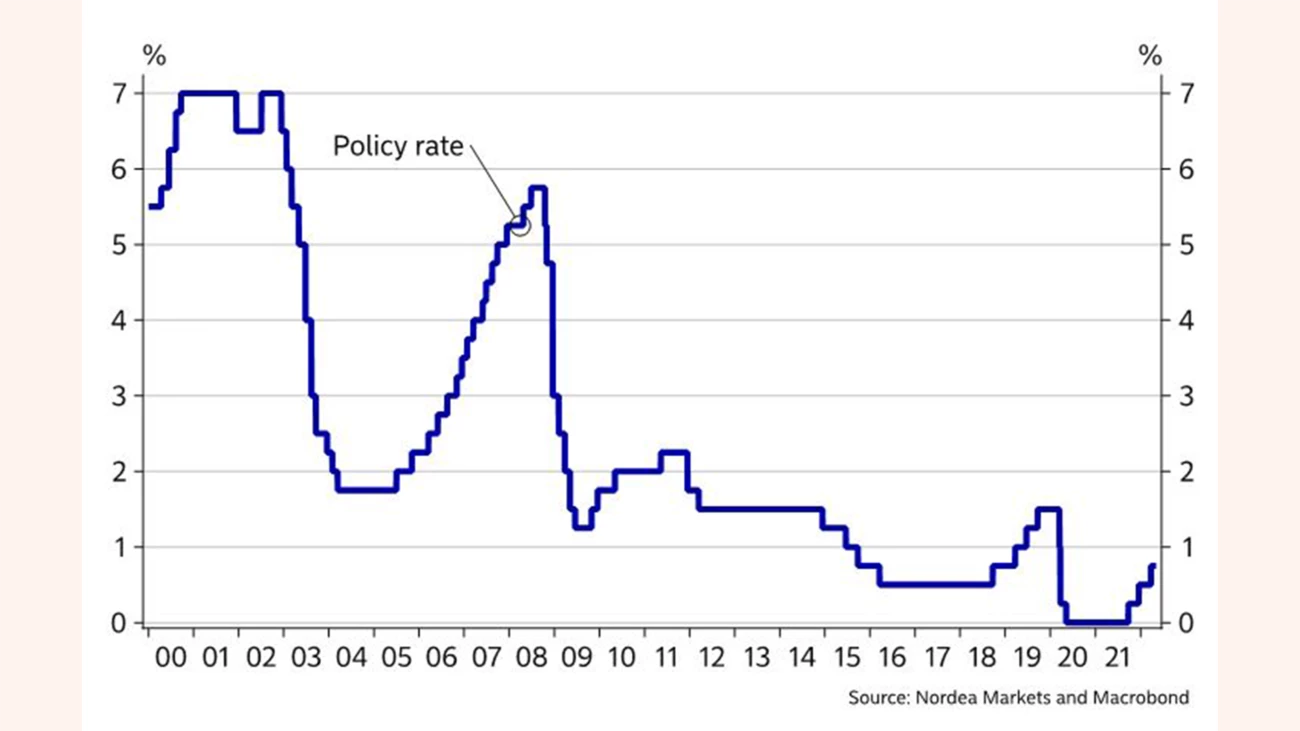

The pickup in housing prices should, however, be seen in light of both income and interest rate trends. Since 2002, the disposable median income has doubled and the general interest rate level on housing loans has dropped from around 8% to well below 2% during the pandemic. Hence, the development in housing prices can largely be explained by the trends in these two factors. In our analysis, the share of income a median family spends on servicing its housing loan is kept constant at the average level of the past 20 years. The black line in chart A shows how much a family can afford to pay for an average home over time, given the trends in income and interest rates. The red line shows the actual price of an average home.

As a percentage of income, it costs roughly just as much to pay interest and principal when buying a home today as it did in 2012. Measured this way, the average home nationwide is actually slightly “cheaper” than 20 years ago.

In chart A, the modelled price development is broken down into an income effect and an interest rate effect. Around 50% of the rise in housing prices in the past 20 years can be ascribed to income growth, while the remaining part is attributable to lower interest rates. During the pandemic interest rates fell to an all-time low, see chart B. It is unlikely that interest rates will become lower than they were then. Therefore the extra boost to the housing market from declining interest rates is a closed chapter. In that respect, the housing market rally is basically over.

The extra boost to the housing market from declining interest rates is a closed chapter.

This does not necessarily mean that housing prices will decline. Over time, the purchasing power in the housing market will be driven up by a steady rise in income. But over the next two years, interest rates are likely to increase by around 2 percentage points. Thus, purchasing power in the housing market will decline over this period despite the higher income, see chart A. The consequence may be a small decline in housing prices. At the same time, construction costs are skyrocketing, and developers are holding back projects. This may contribute to keeping housing prices up. We have also seen previously that lower purchasing power in the housing market does not necessarily lead to a fall in housing prices as long as the economic situation is good, unemployment remains low and there is a feeling of job security. New home buyers may thus have to spend a slightly larger amount of their income on interest and principal payments on their home loans in future. Higher interest rates and a sideways trend in housing prices mean that homes measured this way will be more “expensive”.

This article first appeared in the Nordea Economic Outlook: Under Pressure, published on 11 May 2022. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more