Sign up for the Sustainable Finance Monthly newsletter

Register below for the latest insights from Nordea’s Sustainable Finance Advisory team direct to your mailbox.

Read moreSustainability has taken root in corporate treasuries, and the focus is expected to increase in the coming years, according to our annual Treasury Survey for 2024.

Sustainability continues to climb the agenda for Nordic corporates and their treasury departments. The same goes for companies’ use of sustainable financing products.

These were two key findings of our latest annual treasury survey, “Treasury 2024: The World in 2030.” As part of the study, we asked over 150 treasurers and CFOs how sustainability features in their company and treasury, as well as what role sustainable financing plays now and into the future.

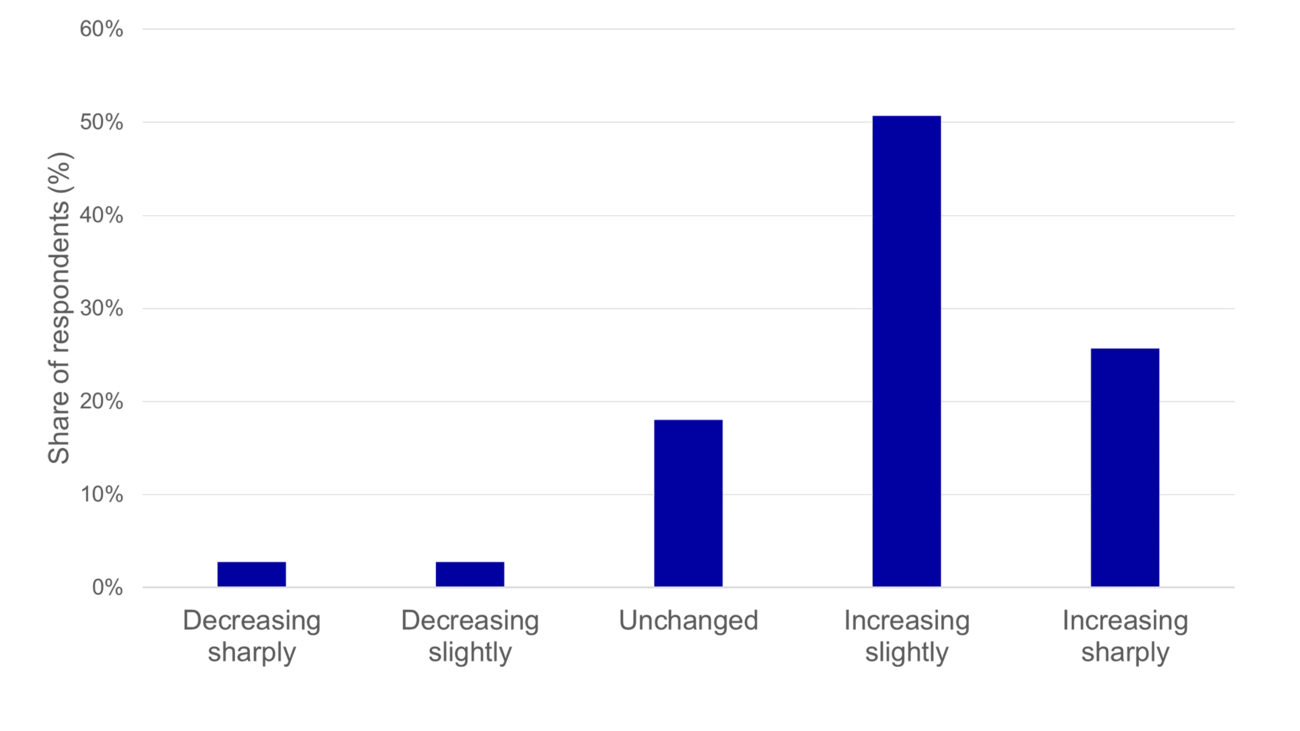

Around three-quarters of respondents expect their companies’ focus on sustainability to increase in the coming years. Over half say the same for the company’s treasury department.

The growing momentum struck study co-authors Johan Trocmé and Viktor Sonebäck from Nordea’s Sustainable Finance Advisory team.

“We’ve seen this pattern in our treasury studies for the past six or seven years, that the focus on sustainability continues to increase. It’s interesting that the trend still seems to be in the acceleration phase,” says Sonebäck.

Trocmé adds: “When we hear about a sustainability hangover or ESG backlash, we’re not seeing that in the companies’ reported focus. It couldn’t be farther from the reality.”

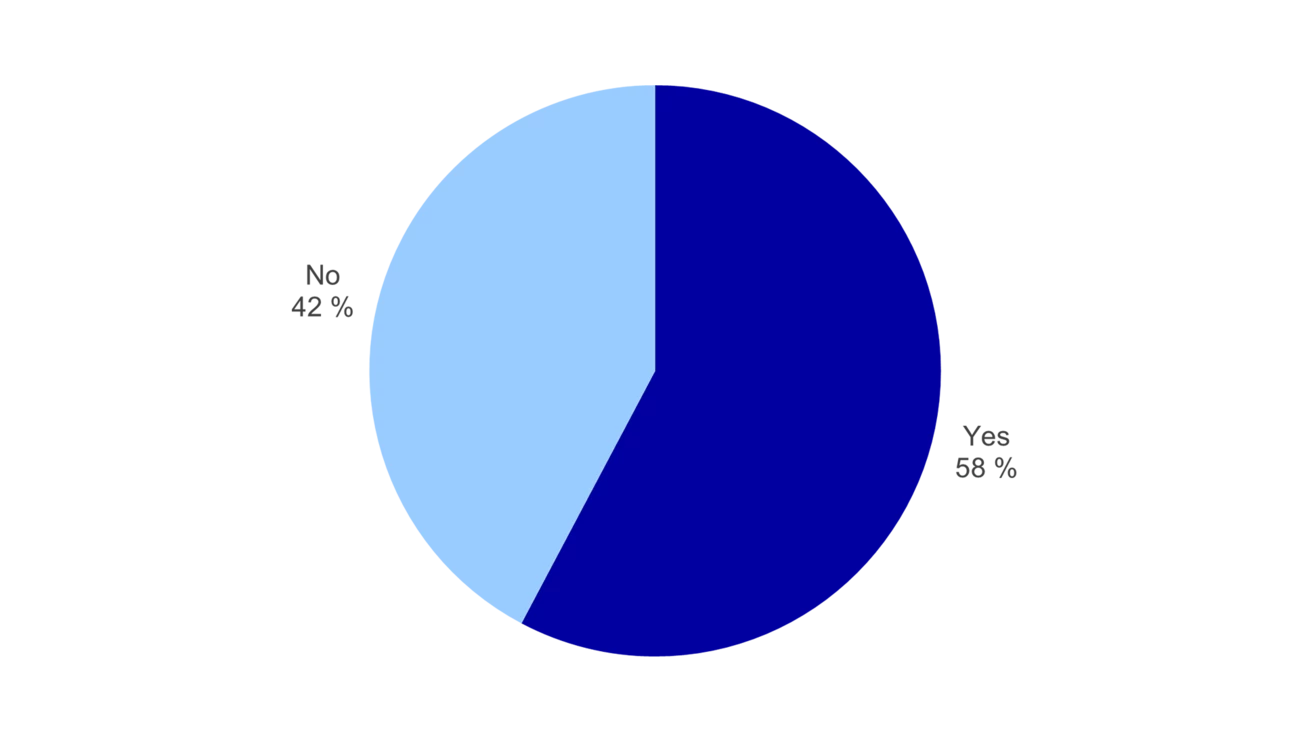

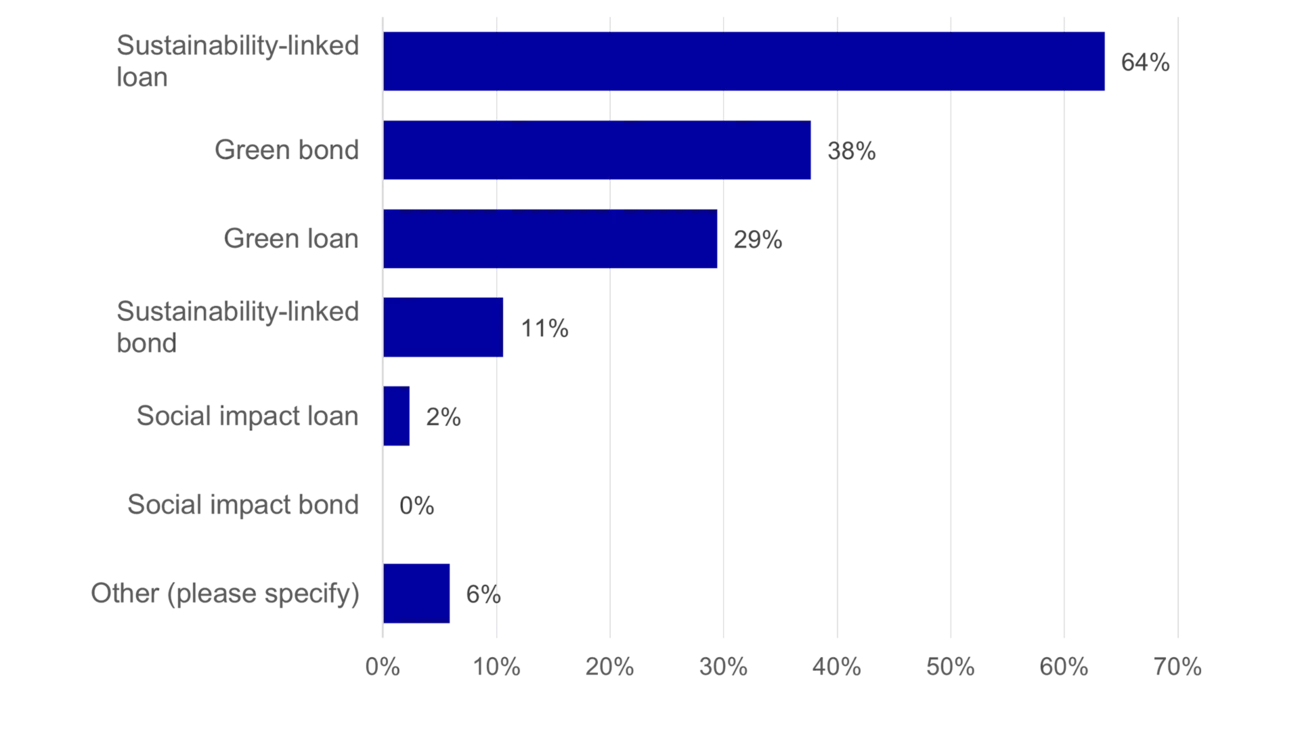

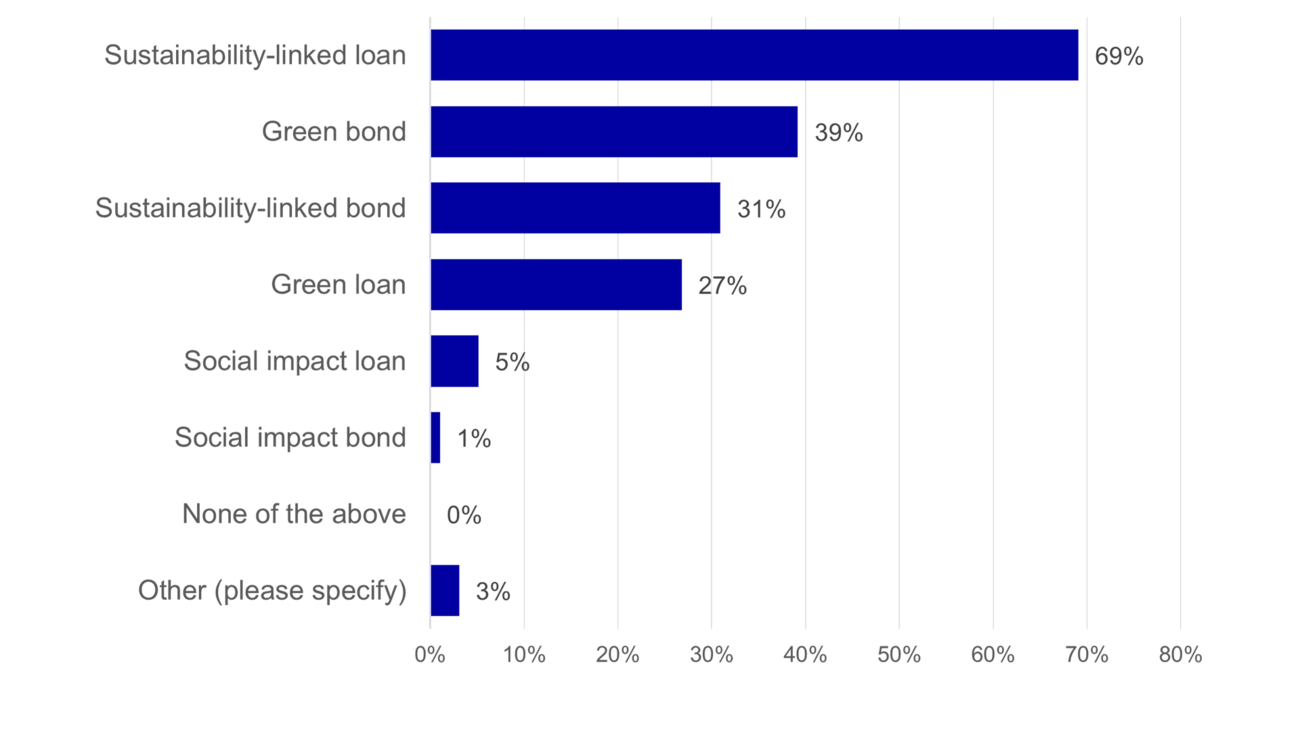

The results also show a high penetration of sustainable financing products. Close to 60% report using some form of sustainable financing. Of those, 64% report having a sustainability-linked loan, 38% a green bond and 29% a green loan.

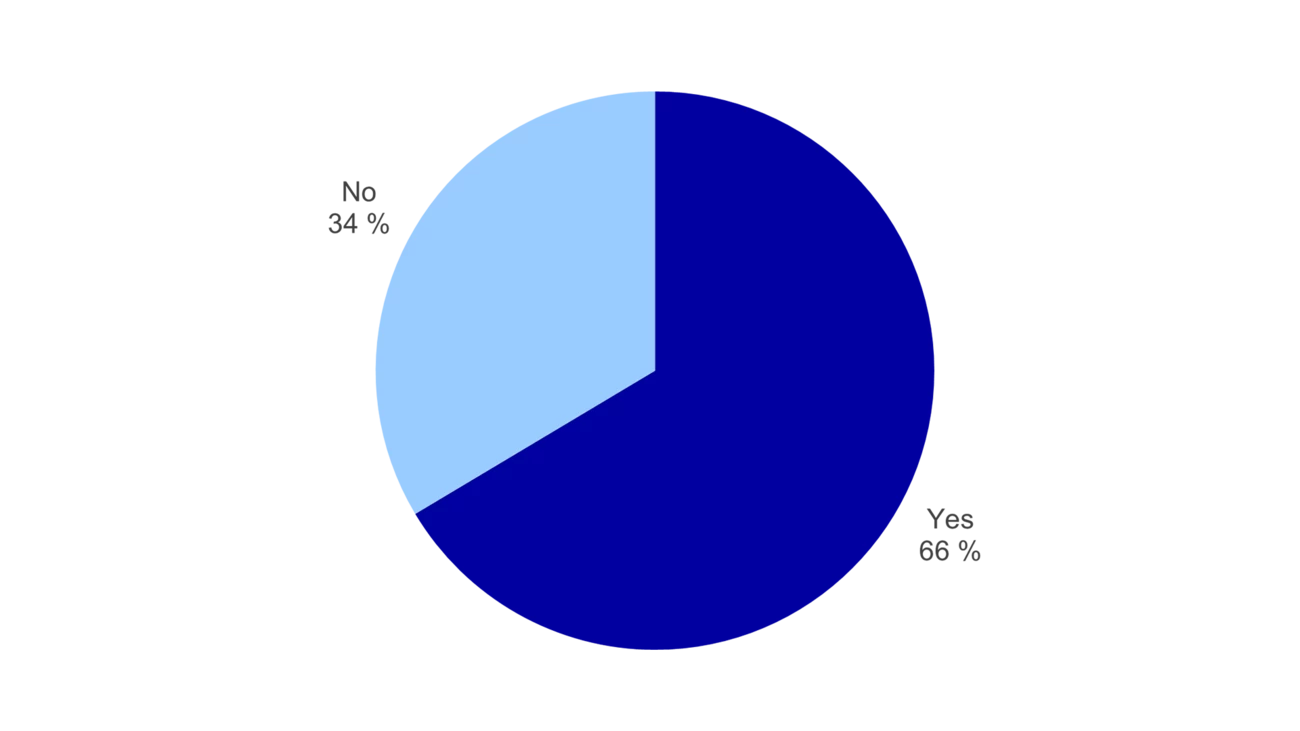

The trend continues to rise, with even more Nordic companies expecting to use sustainable financing products in the future. Two-thirds say they are considering or planning to obtain funding via sustainable financing products within the next 1-3 years, with the majority of those opting for sustainability-linked loans, followed by green bonds, sustainability-linked bonds and green loans.

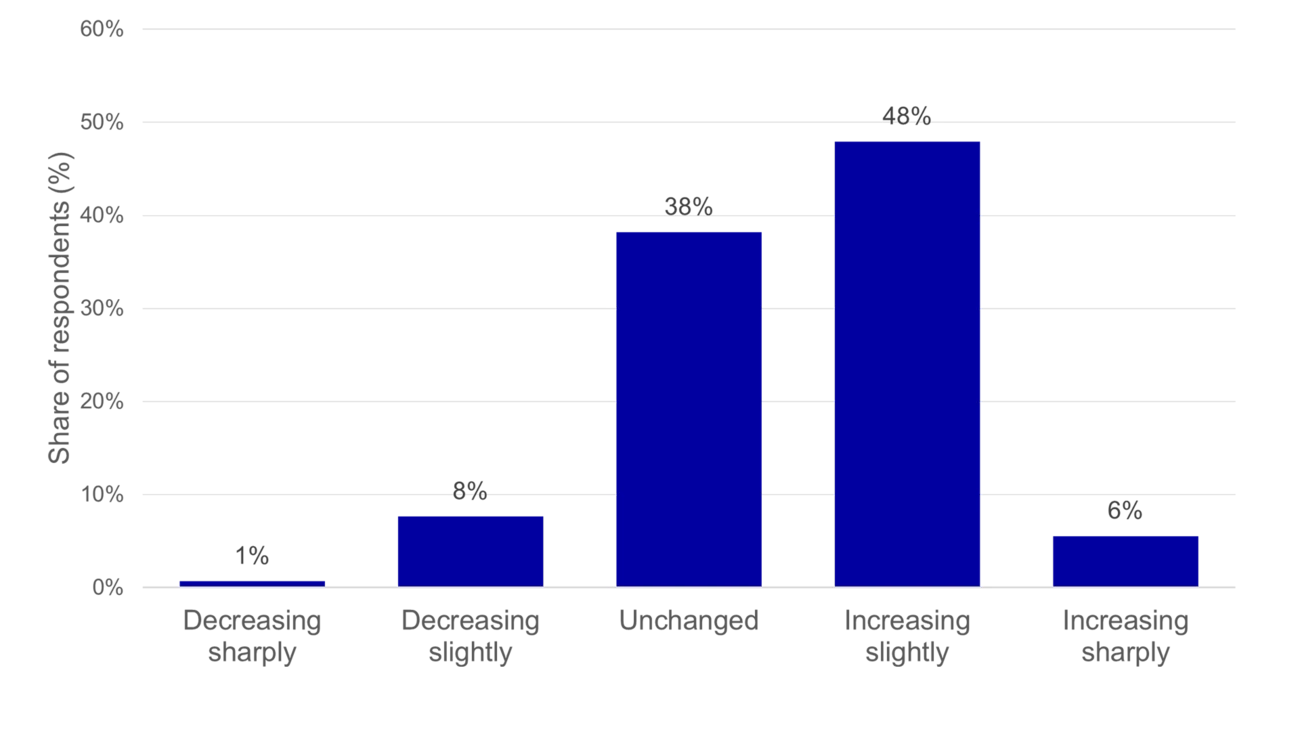

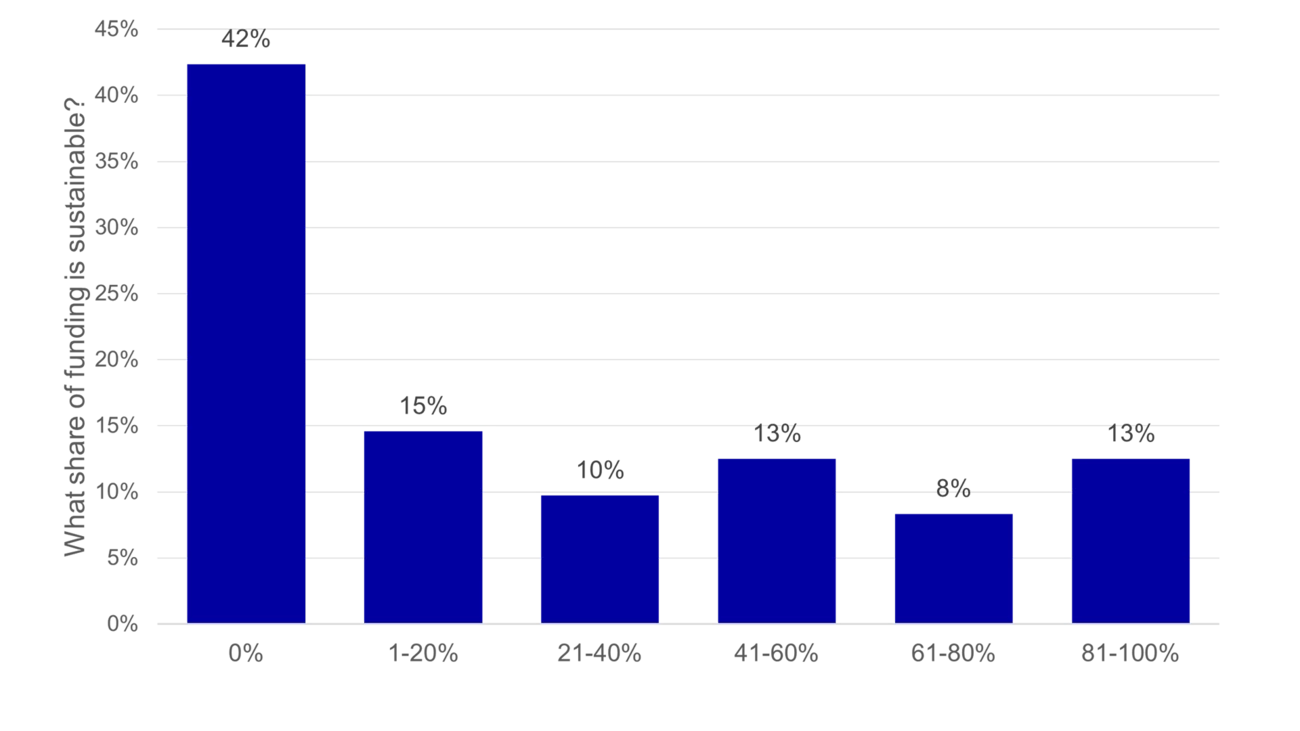

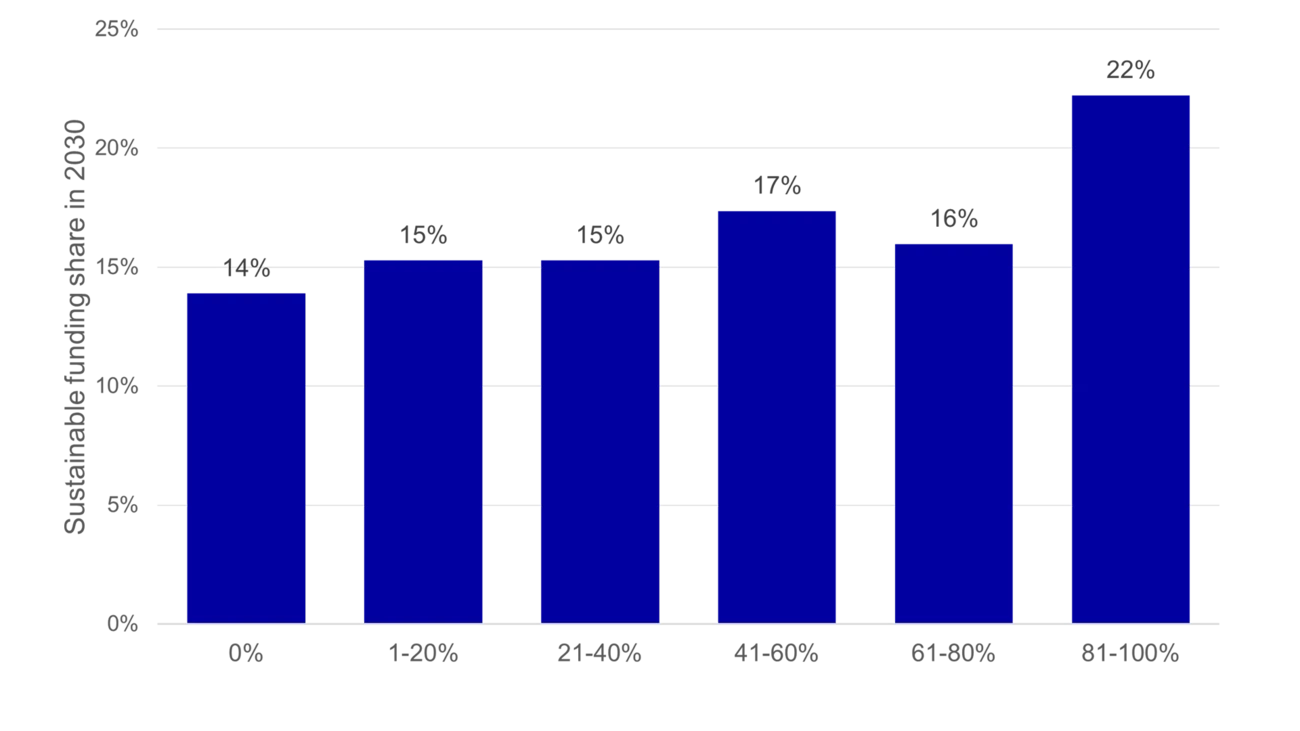

To assess the extent of use, we asked them what share of their total funding is currently sustainable finance products and how they expect this to change by 2030. The results show a clear shift further towards sustainable financing in the next five years.

One notable finding from the survey relates to companies’ motivation for using sustainable financing. We asked the companies currently using sustainable finance products to rate their drivers. At the top of the list is “Support our brand, reputation and sustainability narrative” followed by “Increase investor universe” and “Secure access to future funding.” “Potential reduction in funding cost” comes lower down.

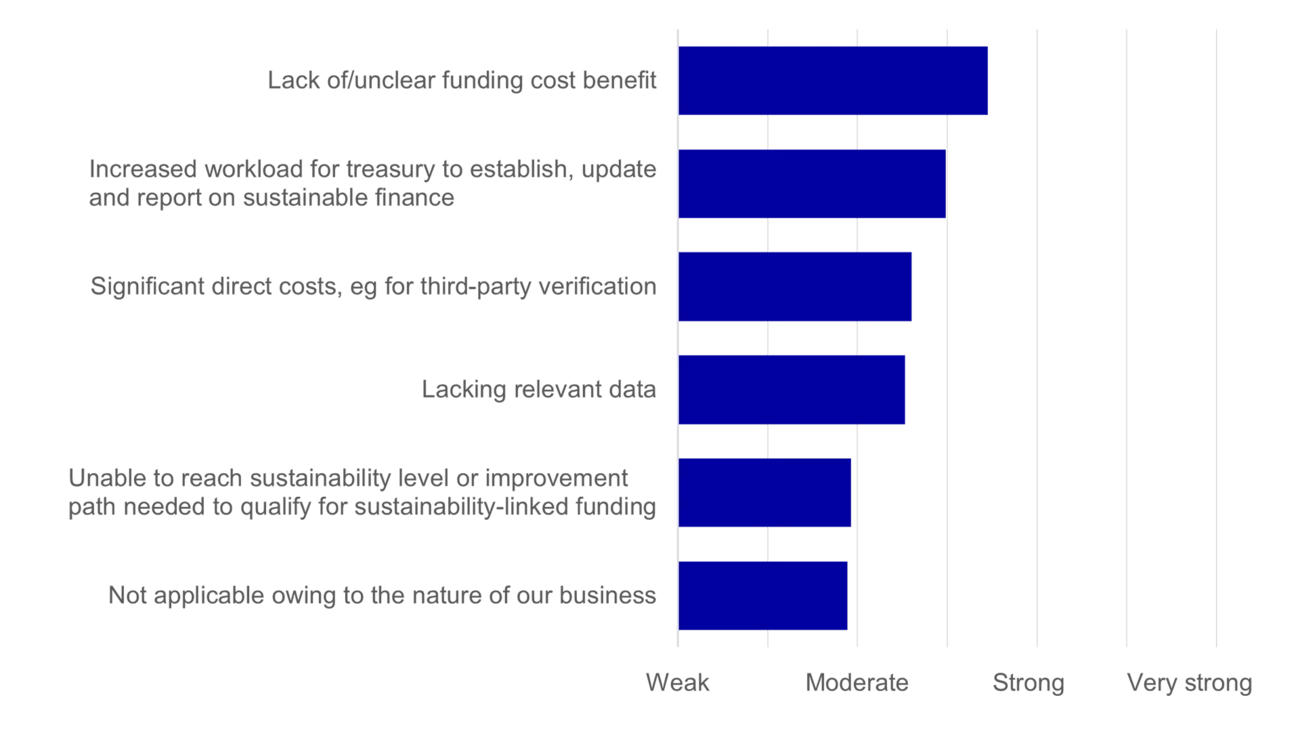

On the other hand, for companies not currently using sustainable finance products, they rate the lack of a funding cost benefit as the main reason for not doing so.

For Trocmé, the findings about the main drivers are some of the most compelling from the survey:

“We sometimes hear from treasurers that the work and cost of obtaining sustainable financing outweighs the small funding discount companies stand to gain. We sympathise with that. But the point is not the cost savings. Rather it’s the big picture benefits tied to the brand, the company’s sustainability narrative and access to a wider pool of investors and capital.”

Register below for the latest insights from Nordea’s Sustainable Finance Advisory team direct to your mailbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more