- Name:

- Jan Størup Nielsen

- Title:

- Nordea Chief Analyst

Sivua ei ole saatavilla suomeksi

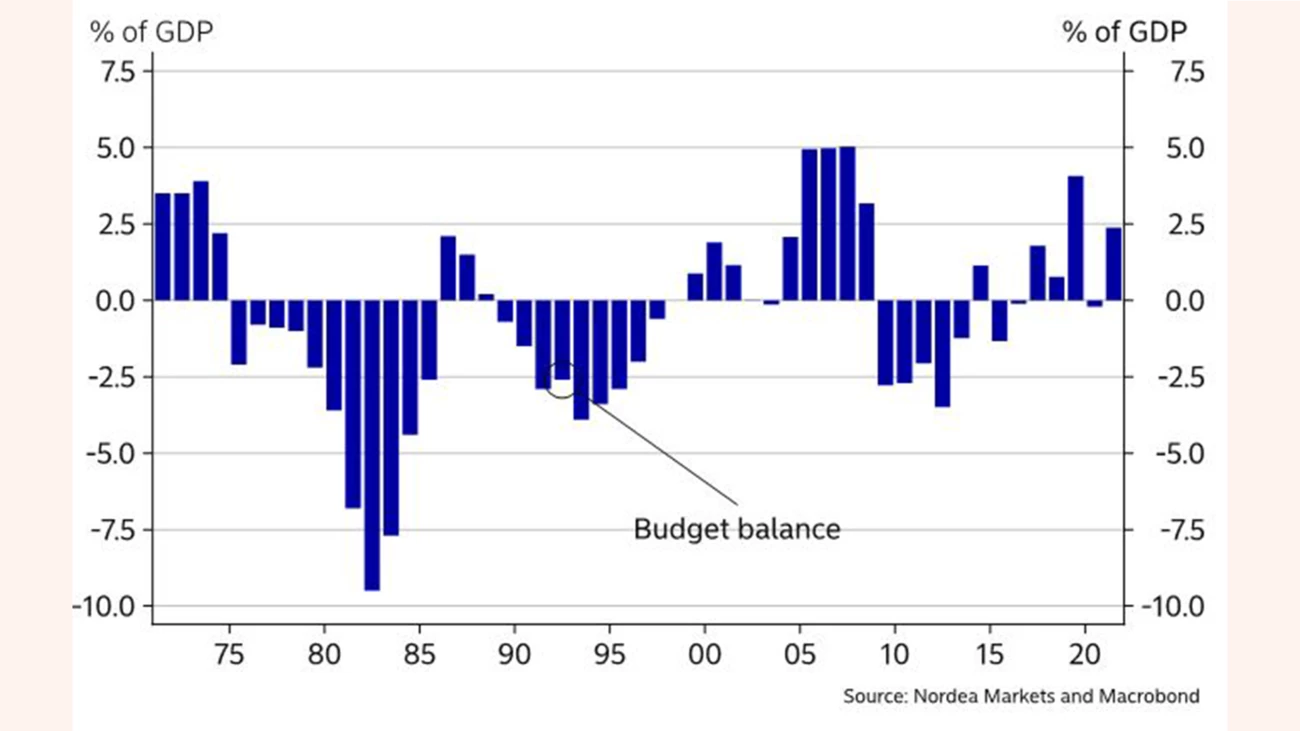

Pysy sivulla | Siirry aiheeseen liittyvälle suomenkieliselle sivulleSince 2012, the management of public finances has been rooted in the Danish Budget Act. The act is about to be amended at the same time as the green transition and Danish defence spending put an increasing strain on public finances. Is this the beginning of a regime shift in public budget man-agement?

In the wake of the sovereign debt crisis, a broad majority of the Danish MPs passed the Budget Act in 2012. With the act, the requirement of the EU's Fiscal Compact that public budgets must be balanced was implemented into Danish legislation. In connection with this, Denmark chose to set the budget deficit limit for the structural balance to 0.5% of GDP, even though Denmark could have opted for the higher deficit limit of 1% thanks to its low public debt.

In a new proposal, the government now suggests that the Budget Act be amended so that in future a structural deficit of 1% is accepted. The proposal is presented at a time when the expenditure side of the public budgets has come under huge pressure. That includes additional expenses to handle the influx of refugees from the war in Ukraine and various aid packages to partly compensate selected groups for the steep rise in consumer prices (for example, the so-called “heating cheque”) as well as an extraordinary increase in the deduction people can claim for transport between home and work.

In the longer run, public expenditure will likely come under increased pressure. The increased expenditure especially relates to a faster transition of the energy supply to ensure that Denmark becomes independent of Russian natural gas and, at the same time, that the green transition is accelerated.

The amendment to the Budget Act follows in the wake of a particularly strong period for public finances. During the coronavirus crisis in 2020, revenues and expenditure basically balanced out, and in 2021 a surplus of 2.3% of GDP was registered, placing Denmark among the only two EU countries with a surplus on their public finances last year. It also helped to reduce the government’s gross debt to around 37% of GDP.

The war in Ukraine and the green transition put pressure on public expenditure.

An important explanation for recent years’ very strong development in Denmark’s public finances is the pension return tax. Over the past two years alone, pension return tax receipts contributed more than DKK 110bn in revenues. Moreover, the government also received large one-off revenues from the frozen holiday pay in both 2020 and 2021. Excluding those revenues and the extraordinary large pension return tax receipts, the public budget balance would have shown a deficit in 2021.

Over the past three years alone, total pension assets have grown by more than DKK 1,000bn, which explains the steep rise in public revenues from the pension return tax. Total pension assets accounted for nearly 180% of GDP by the end of 2021. However, the challenge is that the amount of pension return tax is determined by the fluctuations in the financial markets – and therefore it is naturally difficult to predict.

This year we expect the surplus on the public finances to be significantly lower than in 2021, as expenditure will be affected by a number of one-off payments. In addition, revenues from the pension return tax are expected to be markedly lower. Seen in this light, this year’s surplus is expected to decline to around 0.4% despite record-high employment and tailwinds from the economic cycle to the public budget balance. This also applies to next year, when a relatively small surplus is also expected.

In a longer perspective, the amendment to the Budget Act may potentially lead to a larger deficit on the public budget balance. Nonetheless the basis is very strong, so it will not in itself be a huge problem for the credibility of the public finances’ sustainability.

This article first appeared in the Nordea Economic Outlook: Under Pressure, published on 11 May 2022. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more