- Name:

- Jan Størup Nielsen

- Title:

- Chief Analyst, Nordea

The Danish economy is on a firm footing. Inflation has been brought under control, employment is at a record high, the current account surplus has never been higher and public finances are among the best in Europe. Not everything is positive, though. Household sentiment is weighed down by higher interest expenses and rising prices. Private residential construction is relatively low, and many companies are feeling the effects of increased uncertainty over the outlook for global trade. Despite these challenges, we expect the Danish economy to continue to grow in 2025. It will be supported by further central bank rate cuts and rising household purchasing power.

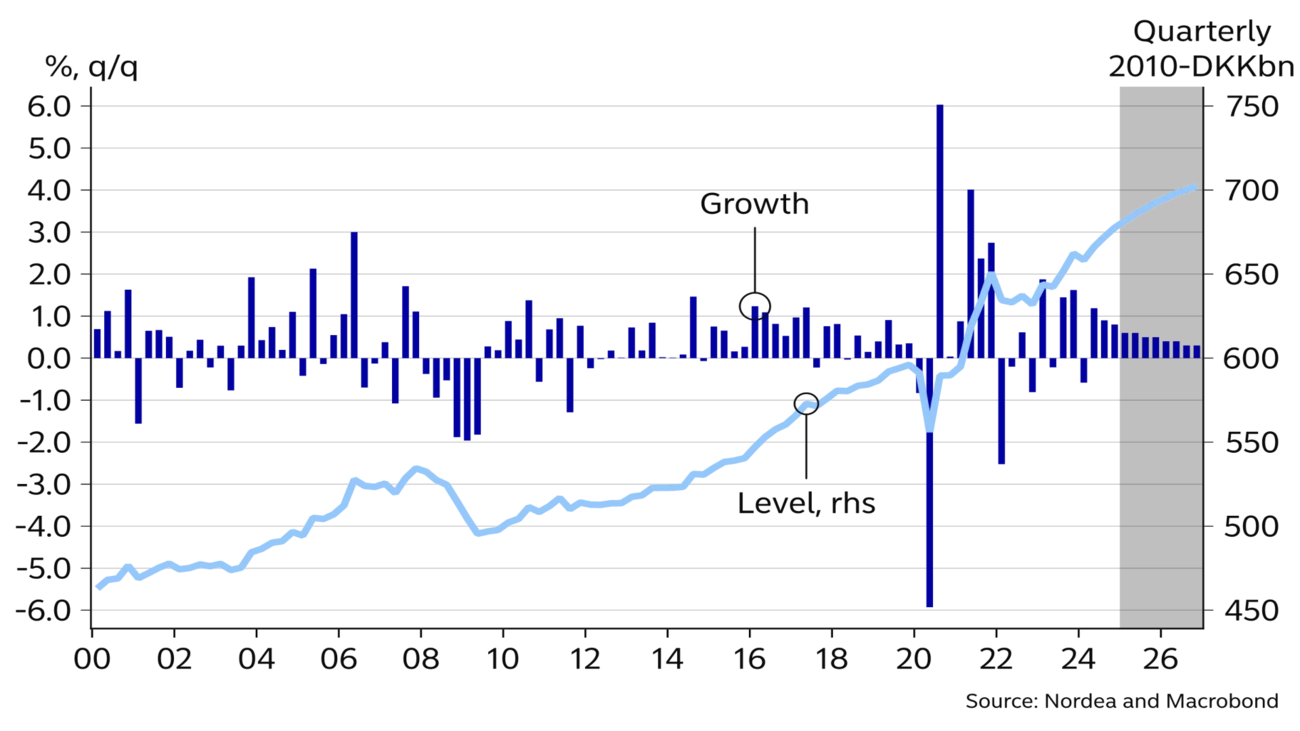

The Danish economy got through 2024 in very good shape. The national accounts figures for Q4 2024 have not yet been published, but the leading indicators suggest that overall growth landed at just under 3%. If so, this is the largest increase recorded since 2021. Also, it is significantly higher compared to many other European countries. The progress provides a solid starting point for the current year, when we expect growth in the region of 2.8%. For both years, this is a significant upward revision compared to our September 2024 forecast of an increase of 1.7% in 2025. Lastly, we reiterate our growth forecast of 1.7% for 2026.

The good growth prospects mask a considerable degree of uncertainty. On the domestic front, it is particularly linked to household consumption trends, which in our baseline scenario are assumed to be one of the main growth drivers. As a starting point, there is a strong foundation for increased consumption, but as described in the theme article, the low consumer confidence could be a stumbling block. The same is true internationally, where harsher global trade restrictions could hit a small open economy like Denmark.

Over the past four years, total production in the pharmaceutical industry has almost tripled. This has been a major contributing factor to industrial production growing significantly faster in Denmark than in neighbouring countries. Thus, the rapidly advancing pharmaceutical industry accounts for more than half of the total growth in the Danish economy in recent years.

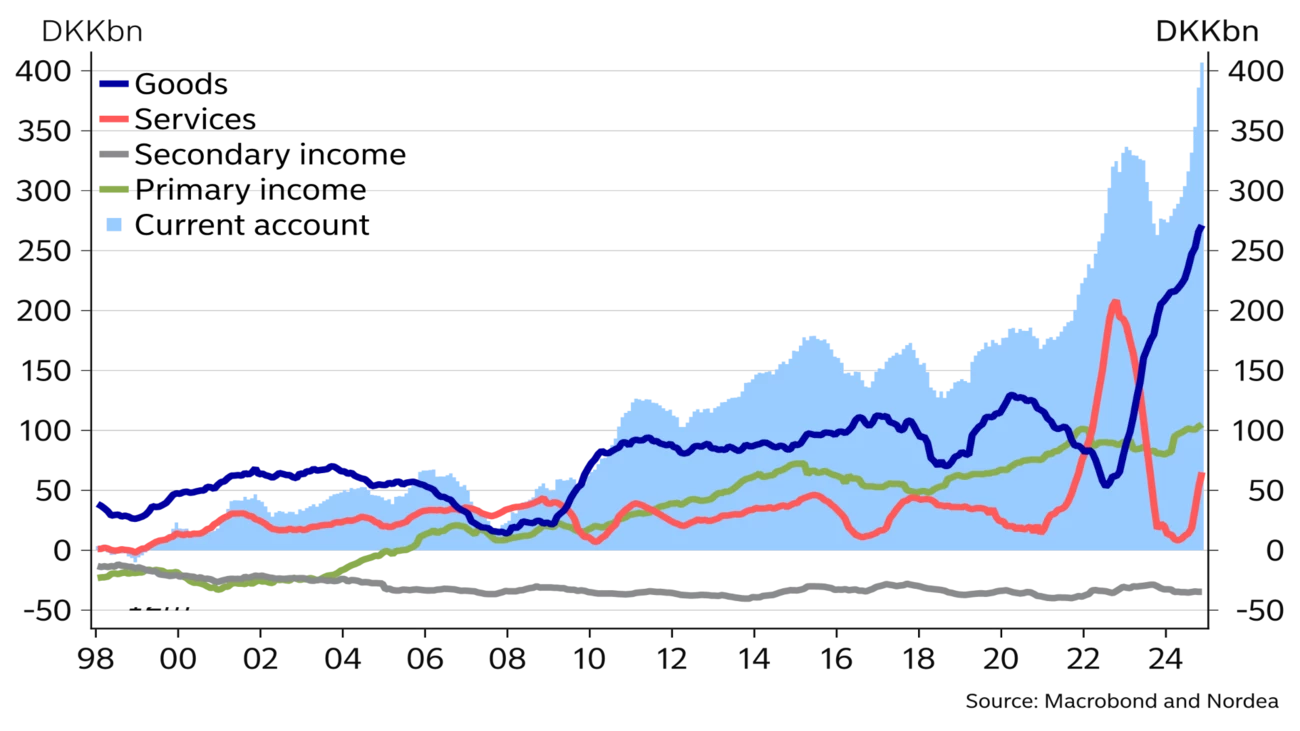

The pharmaceutical industry is also a main contributor to the current account surplus. Over the past year, it has risen to more than DKK 400bn, which is equivalent to about 14% of GDP. In addition, the large current surplus has lifted Denmark’s total foreign assets, which amounted to more than DKK 1,600bn at the end of Q3.

It should be noted, however, that a large and growing part of the production in the pharmaceutical industry takes place outside of Denmark. Consequently, one-quarter of total Danish goods exports does not currently cross the Danish border. The US has become an increasingly important trading partner and now absorbs about 20% of the total exports of goods, of which up to three-quarters are not produced in Denmark. This could help protect the Danish export sector in case new import tariffs are introduced.

| 2023 | 2024E | 2025E | 2026E | |

| Real GDP, % y/y | 2.5 | 2.9 | 2.8 | 1.7 |

| Consumer prices, % y/y | 3.3 | 1.4 | 2.1 | 2.0 |

| Unemployment rate, % | 2.8 | 2.9 | 2.9 | 3.0 |

| Current account balance, % of GDP | 9.8 | 14.2 | 12.8 | 11.9 |

| General gov. budget balance, % of GDP | 3.3 | 3.8 | 2.4 | 2.0 |

| General gov. gross debt, % of GDP | 33.6 | 32.4 | 30.4 | 29.3 |

| Monetary policy rate, deposit (end of period) | 3.60 | 2.60 | 1.85 | 1.85 |

| USD/DKK (end of period) | 6.75 | 7.17 | 7.23 | 7.03 |

After a period of very high inflation, growth in Danish consumer prices has eased again. Last year, the average inflation rate was 1.4%, which was the lowest annual rate of increase since 2020 and more than a halving compared to the level in 2023.

Since mid-2024, however, inflation has started to edge higher again – albeit from a low level. This is partly due to higher food prices and a larger contribution from energy prices. This trend is expected to continue into next year, when the effects of the stronger USD are also likely to contribute to slightly higher inflation. Specifically, we expect average inflation in both 2025 and 2026 to reach some 2.0%.

In 2024, the rate of wage growth in the private sector reached around 5%. In contrast to the years leading up to the financial crisis, wages in the Danish labour market have not risen faster than wages among Denmark's key trading partners. Thus, the current wage increases do not erode Danish companies’ wage competitiveness.

We project wages in the private sector to increase by about 3.5% this year, with the pace declining slightly in 2026. In both years, wages will thus continue to grow faster than consumer prices, paving the way for a further increase in household purchasing power.

The Danish economy is on a firm footing. This provides strength to tackle the challenges of a changing world.

Despite the increase in household purchasing power, household consumption has developed sideways throughout 2024. However, this also means accumulated savings, as not all of the increase in disposable income has translated into consumption. This is also reflected in retail sales, which have likely increased by just over 5% since the start of 2023 – but are, on the other hand, still significantly below the level of previous years.

We expect private consumption to pick up again. The main driver will be higher incomes, which will also be supported by reductions in personal taxes totalling around DKK 10bn in 2025 and 2026.

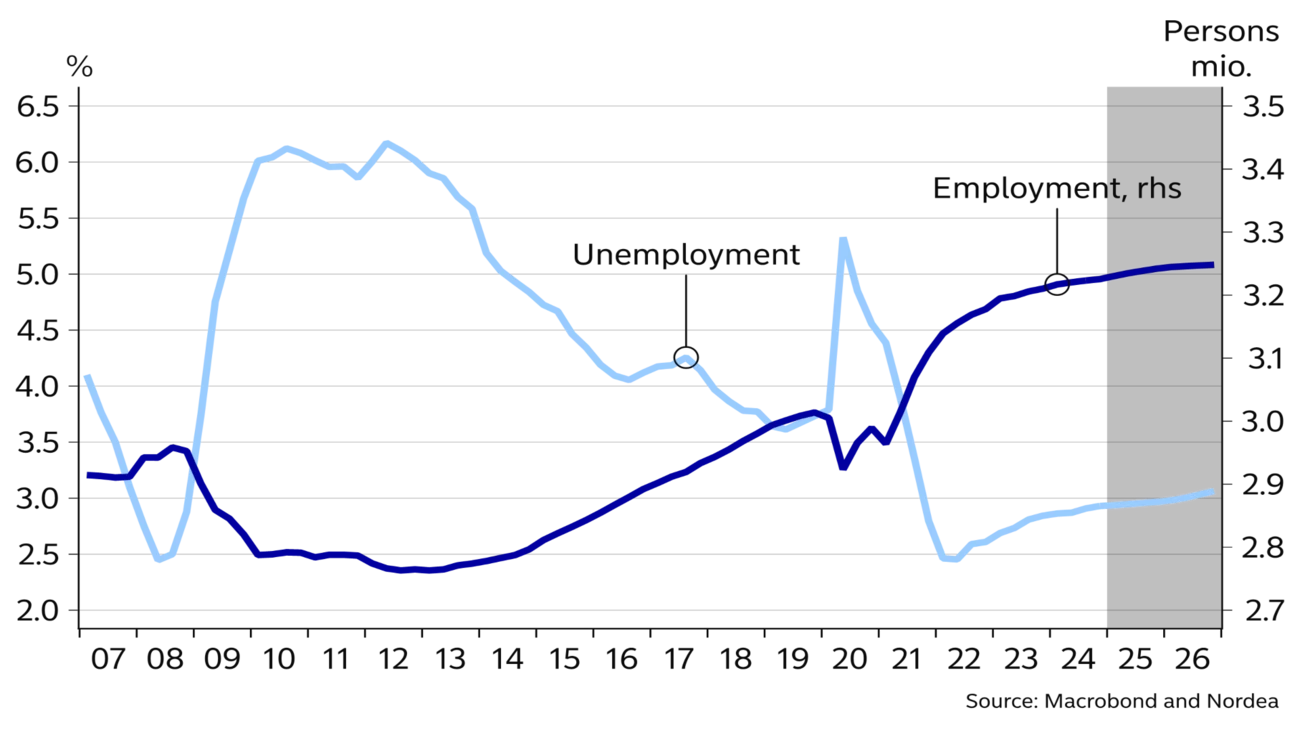

Throughout 2024, more and more wage earners have entered the Danish labour market every month. Over the past three years, this has lifted employment to a record-high level. The rapidly increasing employment has drawn a growing proportion of the population into the labour market, lifting the labour force participation rate to above 82%. This is about 6 %-points higher than ten years ago – and a decisive factor for recent years’ substantial surplus on public finances.

The improvement in the labour market has been supported by a large influx of foreign labour, which now accounts for more than 13% of total employment. In addition, a number of labour market reforms have succeeded in increasing labour force participation, especially for the 60+ age group.

In the ongoing economic surveys from Statistics Denmark, a majority of the surveyed companies across industries estimate that employment will increase further. This is in line with our forecast of a slight further increase in employment this year. At the same time, this will help to maintain unemployment around the current low level.

Since early 2021, the current annual public budget has been around DKK 100bn. This corresponds to more than 3% of GDP and places Denmark among the countries in Europe with the strongest development in public finances.

At the same time, the large current surpluses have contributed to reducing gross public debt, which is now less than 33% of GDP. This is the lowest level since the years leading up to the financial crisis. As a result, net public financial wealth has risen to an all-time high.

The development in public finances gives the authorities a strong starting point for financing the large and highly costly expansion of the Danish armed forces over the coming years. It also contributes to ensuring the Danish state low financing costs in an environment where many other countries struggle to maintain credible management of public finances.

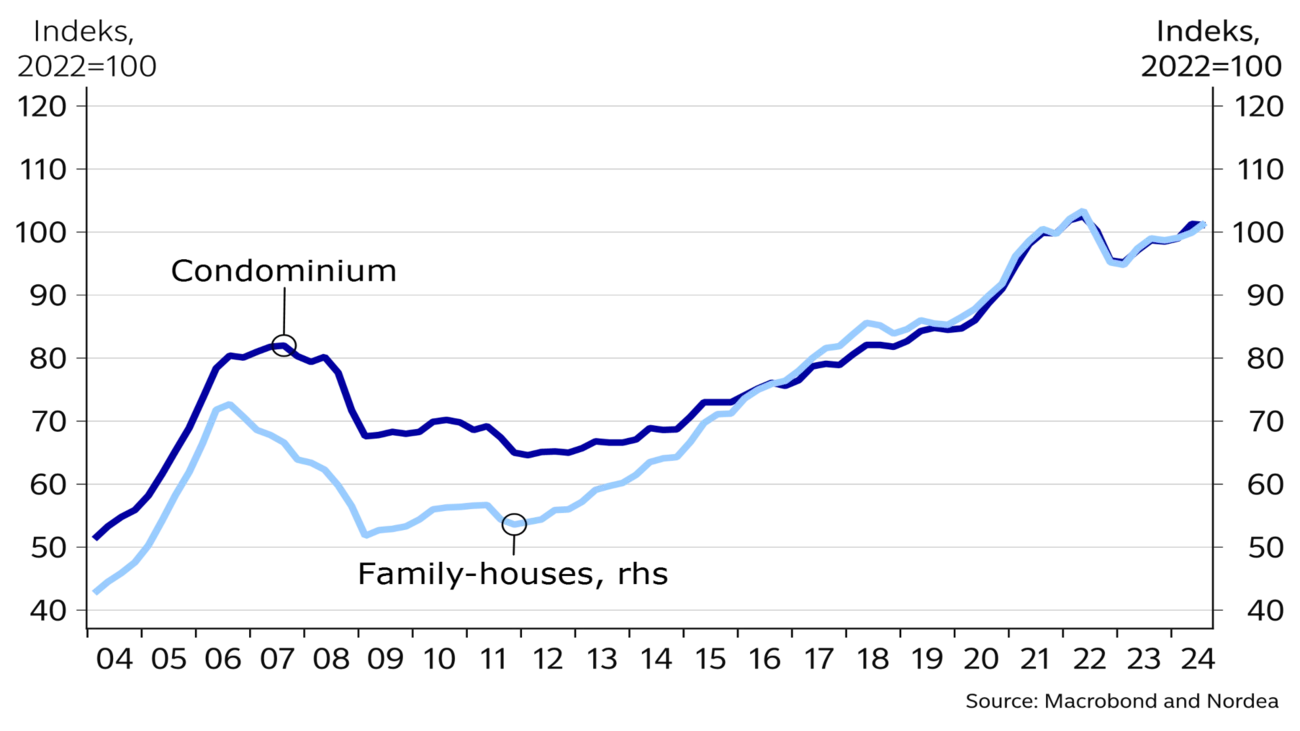

Throughout 2024, sales prices of houses as well as owner-occupied flats have increased by about 4%. Thus, 2024 will go down in history as having the largest annual price increases since 2021, and price levels are thus rapidly approaching the peak from the first half of 2022. The rising prices come in the wake of a period of growing employment and higher disposable incomes.

Sales prices have risen even though the supply of homes for sale has been growing over the past few years. So far, however, the rising prices have been absorbed by the market, where turnover has been high and where the average sales time remains short compared to before the COVID-19 period. However, there are also very large geographical differences in housing market trends. The largest price increases and the highest turnover have been centred around the capital area, while developments in other parts of the country have been somewhat more moderate.

We expect sales prices to increase by 4-5% in both 2025 and 2026. The expected increases will mainly be driven by the ongoing strengthening in household purchasing power. At the same time, the development will be supported by the fact that the number of newly built houses has been limited in recent years, driving up the value of the existing housing stock. Lastly, the falling mortgage rates in the second half of 2024 could also help boost sentiment in the housing market in 2025. Towards the end of the forecast period, however, we expect the housing market to lose a bit of steam, as the market will likely have caught up with the price declines from the period with steep rate hikes in 2022-2023.

Since June 2024, the Danish central bank has cut its policy rate by a total of 1 %-point. The rate cuts have tracked those of the ECB and the interest rate differential has thus remained unchanged throughout the period. The stability of the Danish fixed exchange rate policy is also underlined by the fact that the central bank has not needed to intervene in the foreign exchange market since January 2023. This is the longest continuous period without intervention since the creation of the Euro area.

The prolonged period of an unchanged monetary policy spread combined with the strong public finances also means that Danish government bond yields are now lower than in Germany. At the same time, it helps to keep Danish mortgage rates firmly anchored, which are now relatively low versus many other countries.

Our baseline scenario assumes three further rate cuts in the Euro area towards the middle of the year. This would reduce the Danish central bank deposit rate to 1.85%. On the other hand, Danish long-term interest rates are expected to move moderately higher over the forecast period. The slightly higher Danish interest rates are partly expected to stem from potential ripple effects from the US.

This article first appeared in the Nordea Economic Outlook: Consumer comeback, published on 22 January 2025. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more