+3.2%

Expected GDP growth in 2025

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaJan Størup Nielsen

As a small, open economy Denmark is traditionally highly sensitive to global developments. So the trade war is definitely bad news for economic activity in Denmark. However, it comes at a time when the Danish economy is exceptionally well prepared to handle the wave of uncertainty flowing across its borders. This is mainly due to a substantial savings surplus, solid public finances and a flexible labour market. Combined, this makes Denmark well prepared to handle the new global trends.

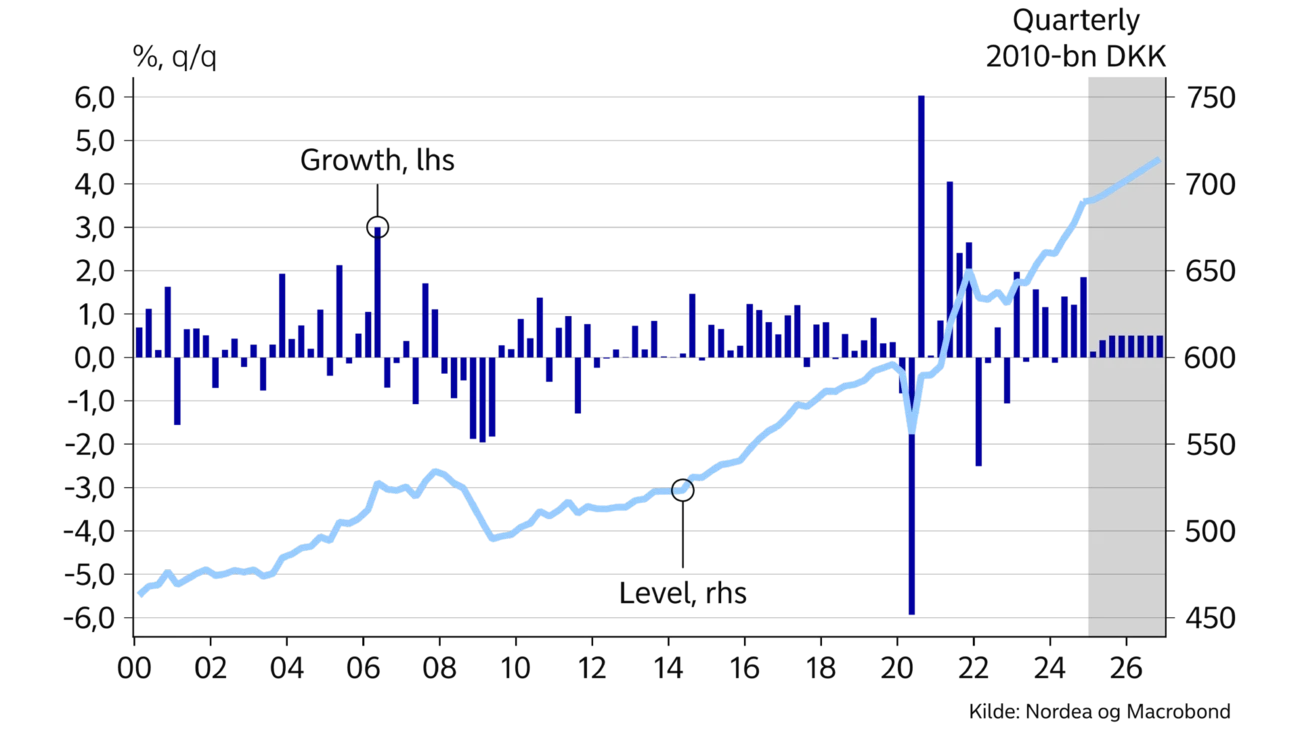

The Danish economy got through 2024 in very good shape. Preliminary figures show economic growth of 3.7% – the highest since 2021. This ranks Denmark among the countries in Europe with the highest growth last year.

The strong development, especially in late 2024, meant that activity levels were very high in early 2025. Purely from a calculation standpoint, this means that even if activity stagnates at current levels, GDP growth for 2025 should still end up at 2.3% overall. Against this backdrop, we revise our 2025 growth estimate to 3.2% versus 2.8% in our January forecast.

We also lift our growth estimate for 2026 to 2.0% versus 1.7% previously. Thus, we expect recent years’ growth to continue – albeit at a slightly slower pace.

However, the impressive growth prospects are subject to a significant degree of uncertainty, which is particularly linked to global trends – where growth forecasts are very sensitive to developments in the ongoing trade war – even though the risk of a very severe trade war has diminished in recent weeks.

+3.2%

Expected GDP growth in 2025

DKK 2,300bn

Denmark’s foreign assets by end-2024

-0.40 %-point

Spread between deposit rates – Danish central bank and the ECB

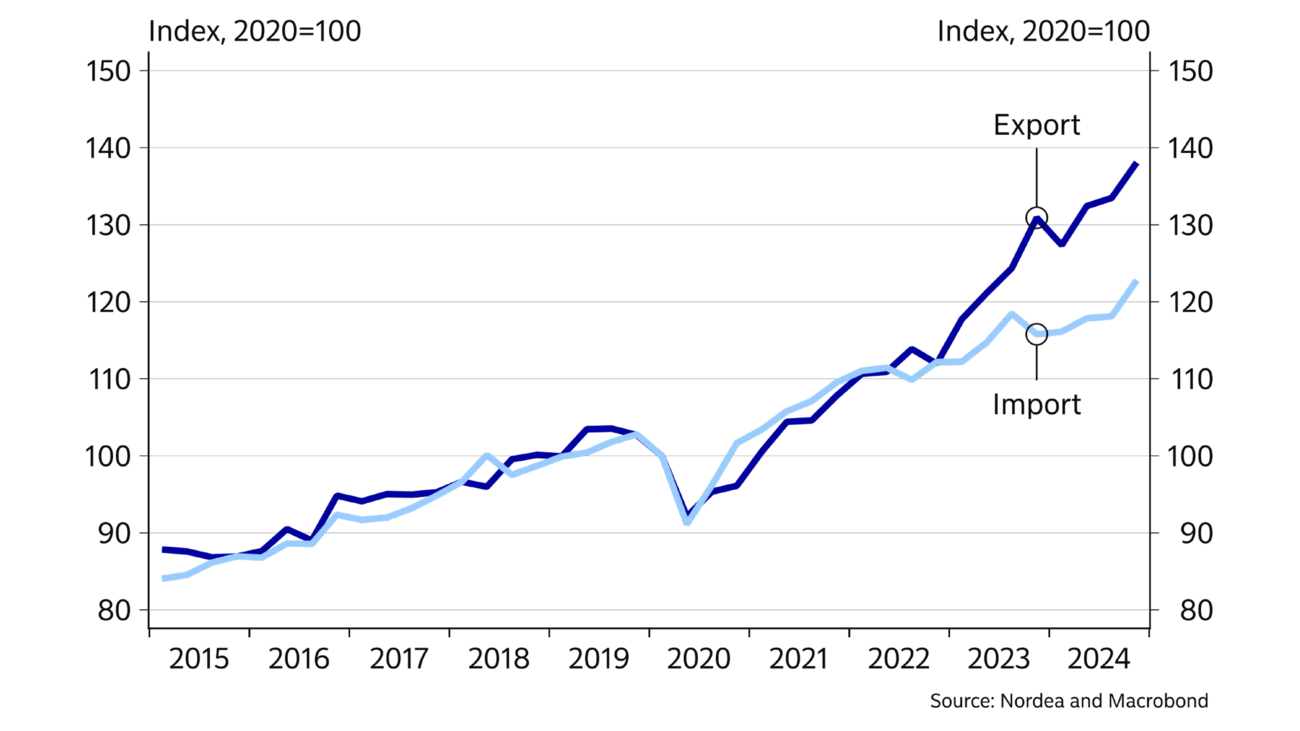

Over the past three years, the strong economic growth in Denmark has mainly been driven by a large positive contribution from net exports, which have grown more than twice as fast as imports. The substantial rise in exports is largely driven by the pharmaceutical industry. Measured by gross value added, the pharmaceutical industry has more than doubled over the past two years.

However, Danish industrial output data took a nosedive in Q1 2025. Total output in Q1 2025 was thus down more than 7% on the previous quarter. The biggest decline can be ascribed to the pharmaceutical industry where monthly figures have shown historically huge fluctuations. That is why we see this as a temporary correction after a long period of massive increases.

In this context, it should be noted that a large and growing part of the production in the pharmaceutical industry takes place outside Denmark. Consequently, a quarter of total Danish goods exports does not currently cross the Danish border.

We expect exports to continue on their upward trend – even though there may be substantial bumps along the way. The increase is expected to be supported by higher demand in Europe, which will also benefit companies outside the pharmaceutical industry. However, in export markets outside the Euro area, Danish companies may face headwinds from a strengthened trade-weighted DKK exchange rate, which reached a 15-year high during the spring.

| 2023 | 2024E | 2025E | 2026E | |

|---|---|---|---|---|

| Real GDP, % y/y | 2.5 | 3.7 | 3.2 | 2.0 |

| Consumer prices, % y/y | 3.3 | 1.4 | 1.7 | 2.0 |

| Unemployment rate, % | 2.6 | 2.9 | 2.9 | 3.0 |

| Current account balance, % of GDP | 9.8 | 13.0 | 13.2 | 13.5 |

| General gov. budget balance, % of GDP | 3.3 | 4.5 | 2.7 | 2.3 |

| General gov. gross debt, % of GDP | 33.6 | 31.1 | 29.3 | 28.1 |

| Monetary policy rate, deposit (end of period) | 3.60 | 2.60 | 1.60 | 1.60 |

| USD/DKK (end of period) | 6.75 | 7.17 | 6.54 | 6.21 |

The substantial rise in goods exports has also led to a record-high current account surplus of 13% of GDP. The persistently large current account surplus is also driving growth in Denmark’s total net foreign assets, which amounted to more than DKK 2,300bn by end-2024. This is a doubling in just seven years.

Despite historically high employment, tax relief, positive real wage growth and a growing housing market, household consumption rose by less than 1% last year. Consumption is thus still below the level of three years ago.

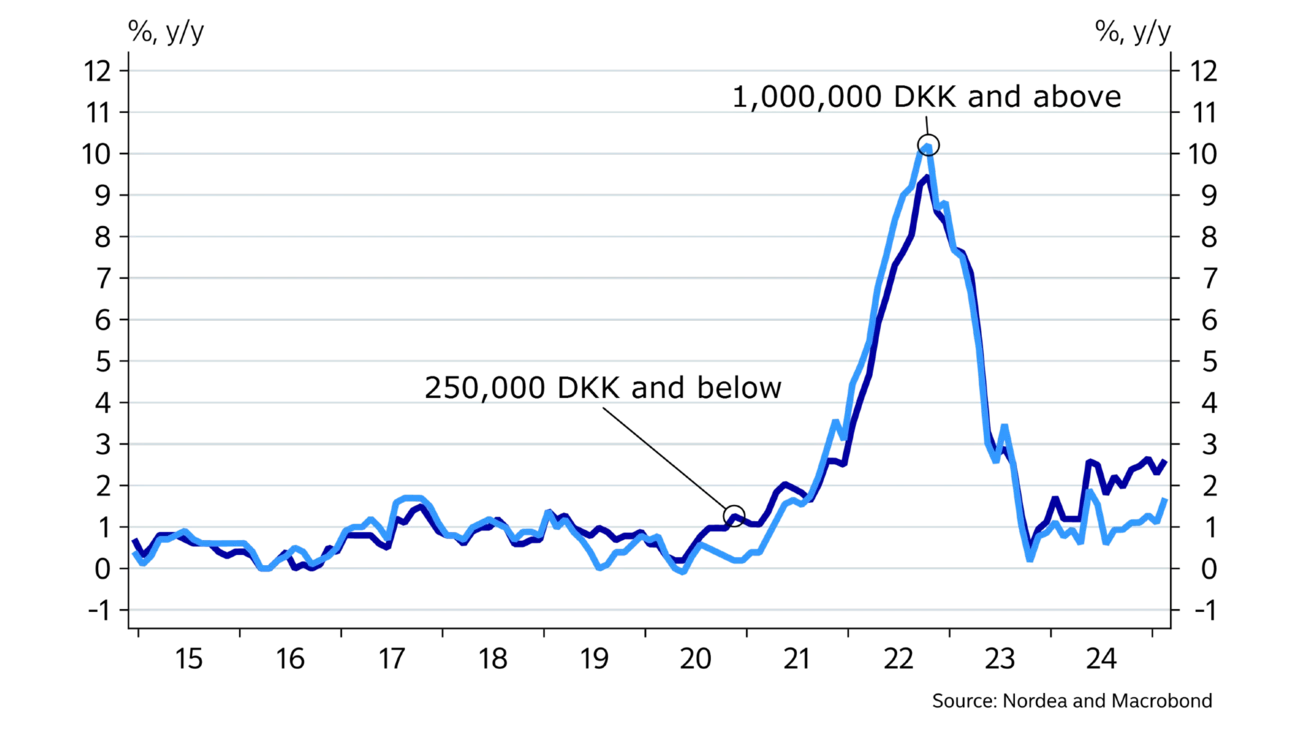

This also means that savings have increased as households have set aside about 10% of their disposable incomes. Danish households now have bank deposits of almost DKK 1,200bn – an all-time high, corresponding to about 40% of total GDP. But it is important to emphasise that these savings are very unevenly distributed across income brackets.

The substantial household savings could potentially trigger a strong consumer-driven recovery. However, there are no indications near term that this is about to happen as consumer confidence figures have dropped to the lowest level in several years.

Since the autumn of 2023, headline inflation has been stable around 1.5%. However, under the surface, two opposing forces have been at play, meaning that price growth in services has gradually fallen to the current level of just around 2.5%. On the other hand, goods prices have risen slightly faster.

The renewed pick-up in goods prices is, among other things, due to renewed upward pressure on food prices, which account for more than 11% of the total consumer price index. Over the past year, food prices have thus risen by 4% – and measured relative to early 2020, the increase is nearly 30%. This trend may very well continue over the summer, when most retail stores expect higher sales prices.

The rapidly increasing food prices are likely also an important reason for the large drop in consumer confidence. Moreover, the rise in food prices has contributed to inflation increasing more rapidly over the past year for households with the lowest incomes. The reason is that food consumption represents a larger share of total spending for these groups.

We expect Danish inflation to average 1.7% in 2025 and 2.0% in 2026. The prospect of slightly higher inflation is partly due to expectations of a continuously rising contribution from goods prices and upward pressure from rents.

The Danish economy is very well positioned to handle a period of trade war and heightened geopolitical tensions.

Since early 2024 more and more wage earners have entered the Danish labour market every month. This has lifted employment to a record-high level at the same time as gross unemployment rate has been stable, just below 3%.

The improvement in the labour market has been supported by a large influx of foreign labour, which now accounts for more than 13% of total employment. Also, thanks to a number of labour market reforms, the labour force participation has increased, especially for the 60-plus age group.

We forecast the unemployment rate to remain around the current level. In line with this, employment is expected to continue its upward trend – albeit at a more moderate pace compared to previous years.

In the private-sector labour market, average wage growth was 4.5% last year. Thus, the erosion of real wages caused by the high inflation in 2022 has now been recouped for most income groups. This also applies to those employed in the public sector, where wage increases have been higher than in the private-sector labour market since mid-2024.

At the beginning of 2025, new three-year collective agreements were concluded in the private-sector labour market, resulting in annual wage increases of about 3%. This is roughly in line with international trends and it means that Danish companies will not fall behind in terms of international wage competitiveness. At the same time, wage growth will likely be high enough to improve wage earners’ purchasing power over the forecast period.

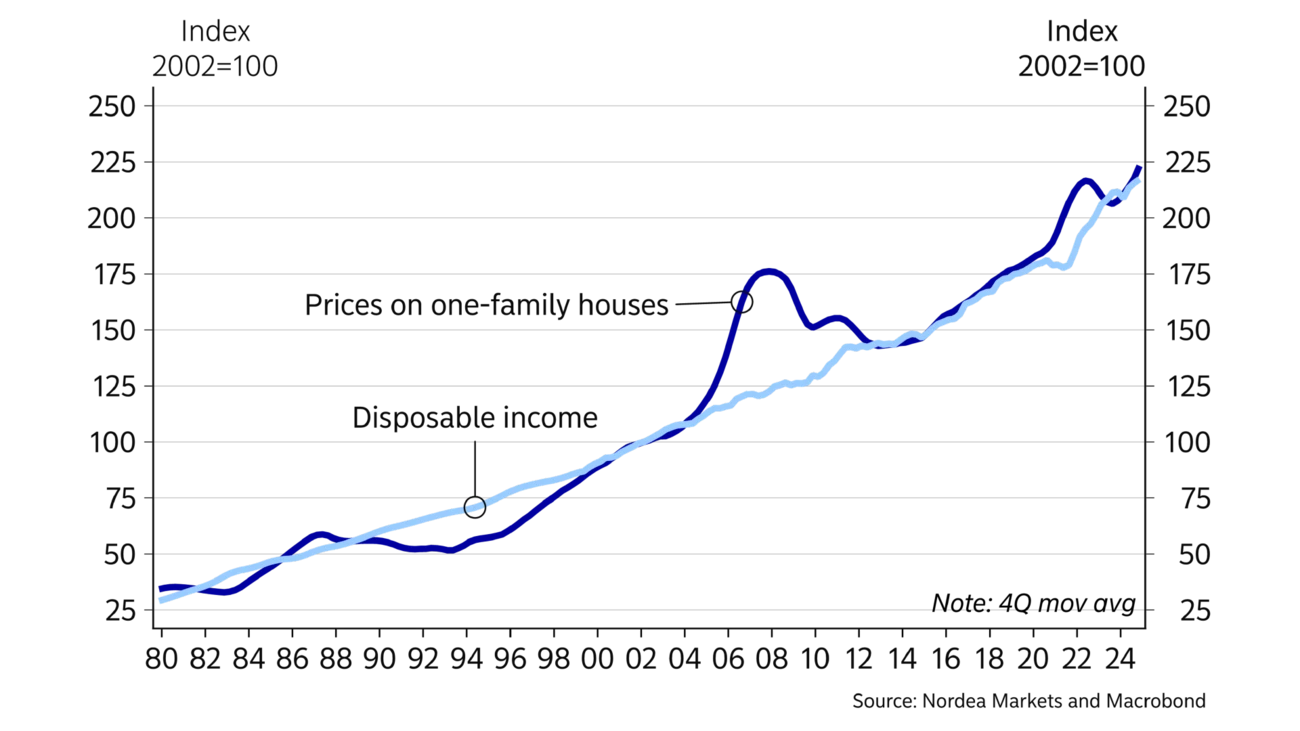

After the temporary dip at end-2022, the Danish housing market has seen a strong recovery. Last year sales prices for houses rose by 3.5% on average, while prices of owner-occupied flats rose by 3.9%. Nominal house prices are thus at an all-time high. When adjusted for inflation, real house prices are still more than 5% below the previous peak at end-2021.

Price increases were mainly driven by the metropolitan area where prices of owner-occupied flats in Greater Copenhagen were by end-2024 8% above the year-earlier level. Here the price trend is underpinned by low supply and limited inflow of new homes in the market. The situation is different in other major cities, where a larger supply of homes for sale has contributed to moderating price increases.

We expect house prices to rise by 4.6% in 2025 and an additional 3.6% in 2026. These expected increases will primarily be driven by continued growth in household disposable income and a strong labour market. In addition, price increases will be supported by the low number of newly built houses in the market for several years, driving up prices of the existing housing stock. However, towards the end of the forecast period we expect the housing market to dampen slightly as the normalisation process comes to an end.

Since June 2024, the Danish central bank has cut its policy rate by a total of 1.75 %-points. The Danish central bank’s deposit rate is now at 1.85% – the lowest level since early 2023. The rate cuts have tracked those of the ECB and the interest rate differential has thus remained unchanged throughout the period.

The combination of a prolonged period with an unchanged monetary policy interest rate spread and strong public finances also means that Danish government bond yields are lower than in Germany. At the same time, it helps to keep Danish mortgage rates firmly anchored, which are now relatively low versus many other countries.

Our baseline scenario assumes an additional rate cut in the Euro area. This would reduce the Danish central bank deposit rate to 1.60%. Longer yields, on the other hand, are set to move slightly higher as we approach the end of 2026.

This article first appeared in the Nordea Economic Outlook: Weathering the storm, published on 21 May 2025. Read more from the latest Nordea Economic Outlook.

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more