In July 2022, a year after the European Central Bank’s launch of a dedicated workstream on decarbonisation as part of its broader climate agenda, the ECB governing council published a decision to tilt the Eurosystem’s corporate bond issuances towards issuers with better climate performance. The decision comes within the context of the ECB’s aims to mitigate the climate-related financial risks in the Eurosystem’s balance sheet through deeper alignment of its corporate bond holdings with the goals of the Paris Agreement. The ECB will begin regularly reporting climate-related information on its corporate bond portfolio from Q1 of 2023.

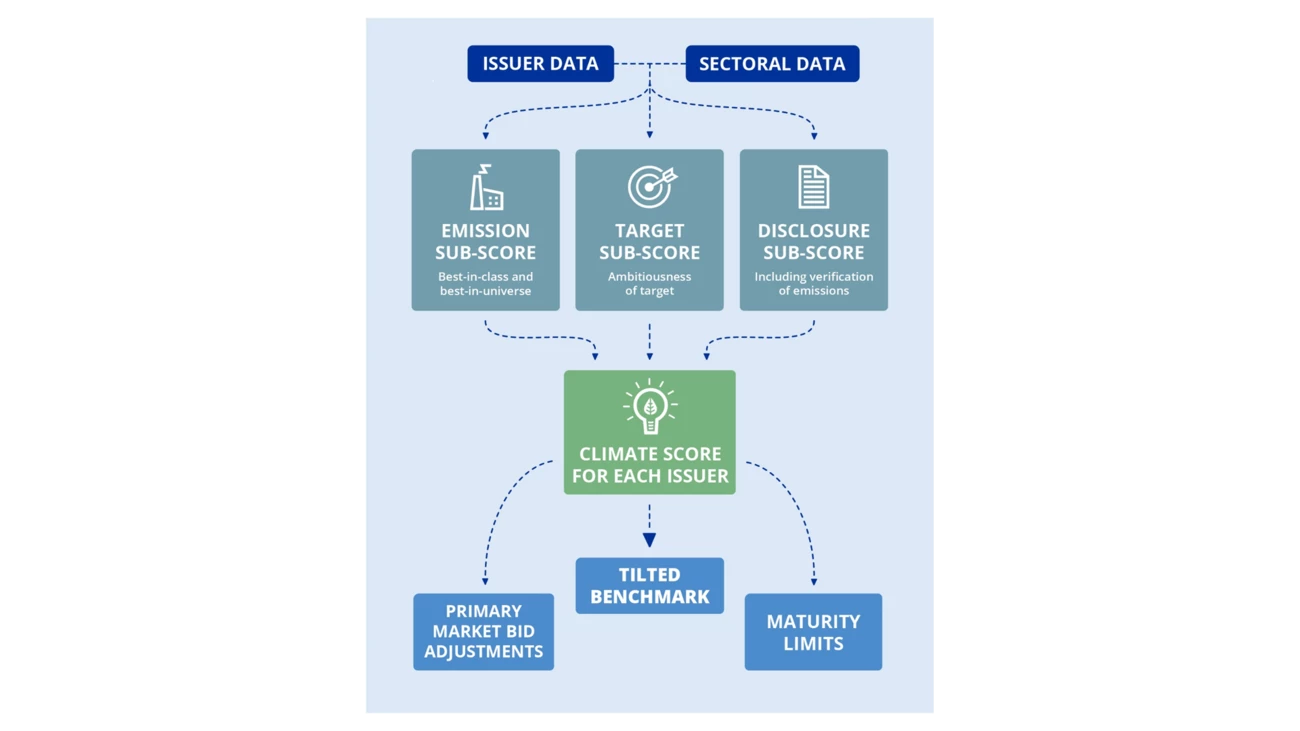

In September 2022, the ECB published details on how the announced decarbonization is to be practically implemented. The decarbonisation efforts will rely on a climate scoring model that will be applied at the level of the individual issuer. Outcomes of the climate scoring model will impact the relative weighting of issuers in the benchmark that guides the Eurosystem’s ongoing reinvestment purchases of corporate bonds, with purchases of low-scoring issuers to be constrained or potentially even halted. As the ECB’s primary aim is to mitigate longer-term exposure to transition and physical risks, lower-scoring issuers will have maturity limits placed on the purchases of their bonds.

As of 1 October 2022, ECB will be applying this tilting to all corporate bond purchases settled, encompassing both the corporate sector purchase programme (CSPP) and the pandemic emergency purchase programme (PEPP). The ECB notes that the plan will support the green transition and will incentivize companies to become more transparent on carbon reporting while also reducing issuers’ carbon footprint.

Scope and application of climate scores

The ECB has stated that the primary aim of the scores is to address the risk profile of the bond issuer with the ultimate result of catalysing “the purchase of more bonds issued by companies with a good climate performance and fewer bonds from those with a poor climate performance.”

- The climate scoring model is based on three sub-scores:

- The backward-looking emissions sub-score

- The forward-looking targets sub-score

- The climate disclosure sub-score

- Issuers that perform well on the aggregate climate scoring will receive a greater weighting in the ECB’s portfolio.

- Issuers with lower climate scores will have maturity limits placed on the purchases of their bonds.

- The ECB does not foresee that a low climate score will trigger sales of already existing bonds held by the ECB, but that further purchases of low-scoring issuers may be constrained or halted.

- The climate scores of individual issuers will not be published, and the methodology will be reviewed after one year, at the latest.

Although there is currently a lack of certainty around the exact criteria to be used within the three sub-scores, we do know that the scores will look at issuer-level, sector-specific peers in addition to all eligible bond issuers. It is therefore likely that best-in-class issuers, and those with a strong transition story, are likely to benefit most from the ECB’s announced tilt. It is worth noting that this approach has already received some criticism for not strictly excluding issuers in high-emitting industries.