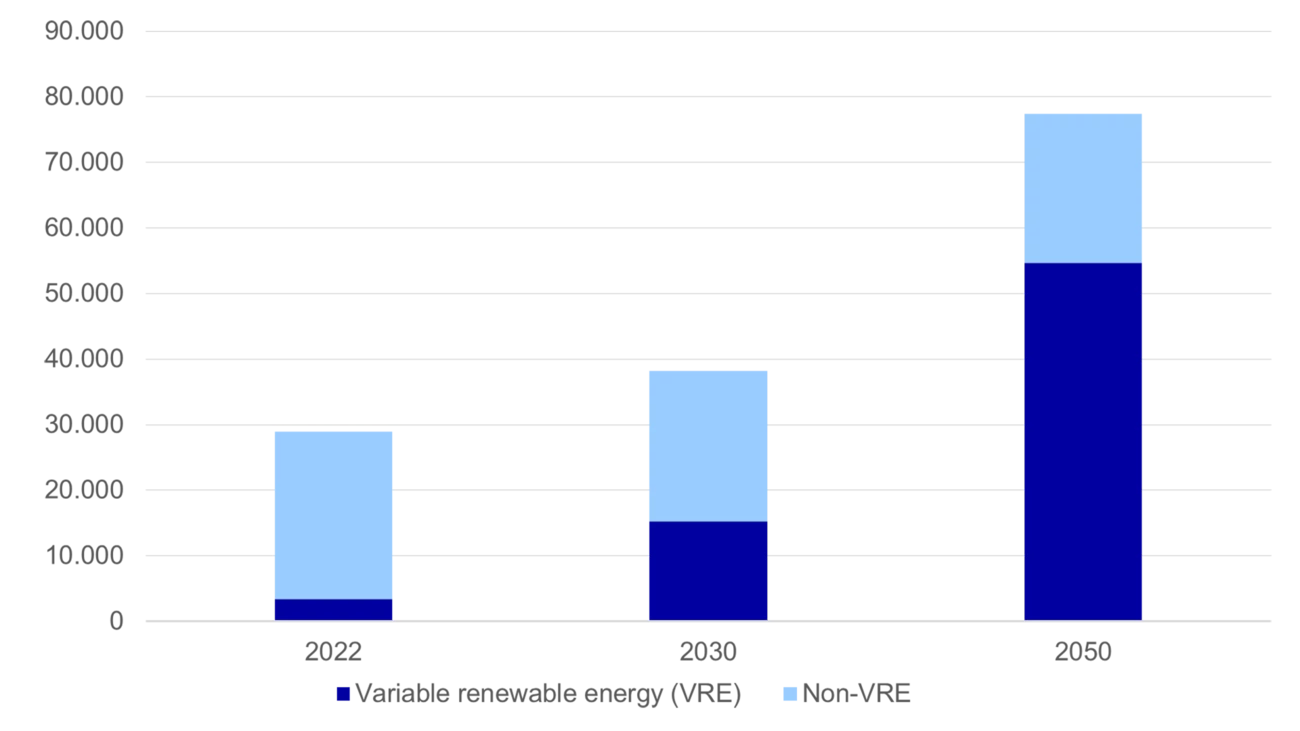

These changes mean a fundamental shift in the way the grid works, moving from a system of centralised, dispatchable electricity to one where power generation is highly fragmented and subject to weather variability.

The grid of the future: larger, interconnected and flexible

Electricity grids must be in constant balance, with supply matching demand at any point in time. Traditionally, coal and nuclear plants provide the baseload power for the grid, supplemented by more agile plants that fire up when demand surges. However, renewable energy sources, such as wind and solar, can’t be fired up on demand. They’re also dependent on the weather.

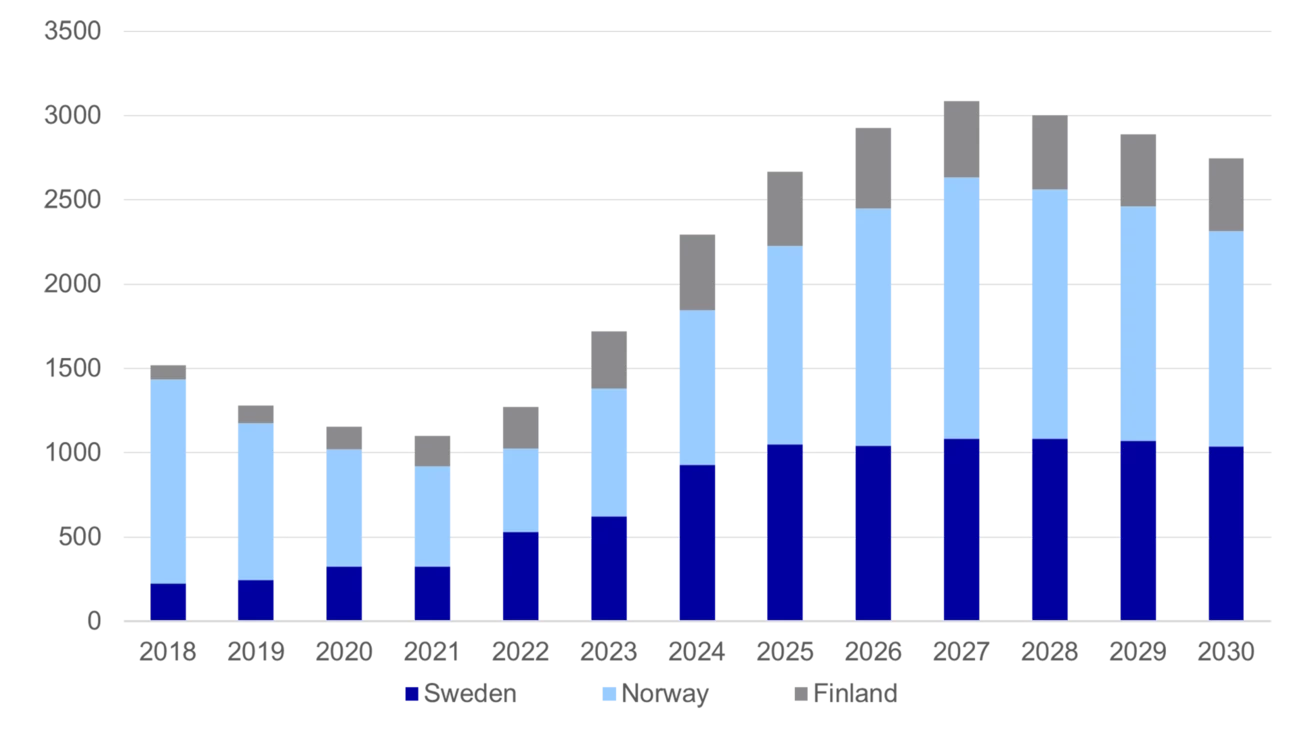

For example, on a windy summer day, Germany can produce around 70% of its power from wind and solar, and close to zero on a still winter day. On the other hand, on a windy summer day, renewable sources can also produce more power than the grid infrastructure can handle, leading to “curtailment,” or deliberate limiting of power generation to avoid overloading the system.

In the new global energy economy, the grid will need to be able to balance periods with no renewable generation to periods with excessive generation. In addition, while the flows today go in one direction – from producers to consumers, future flows will be bidirectional. Energy from residential solar panels, for example, flows back to the grid.

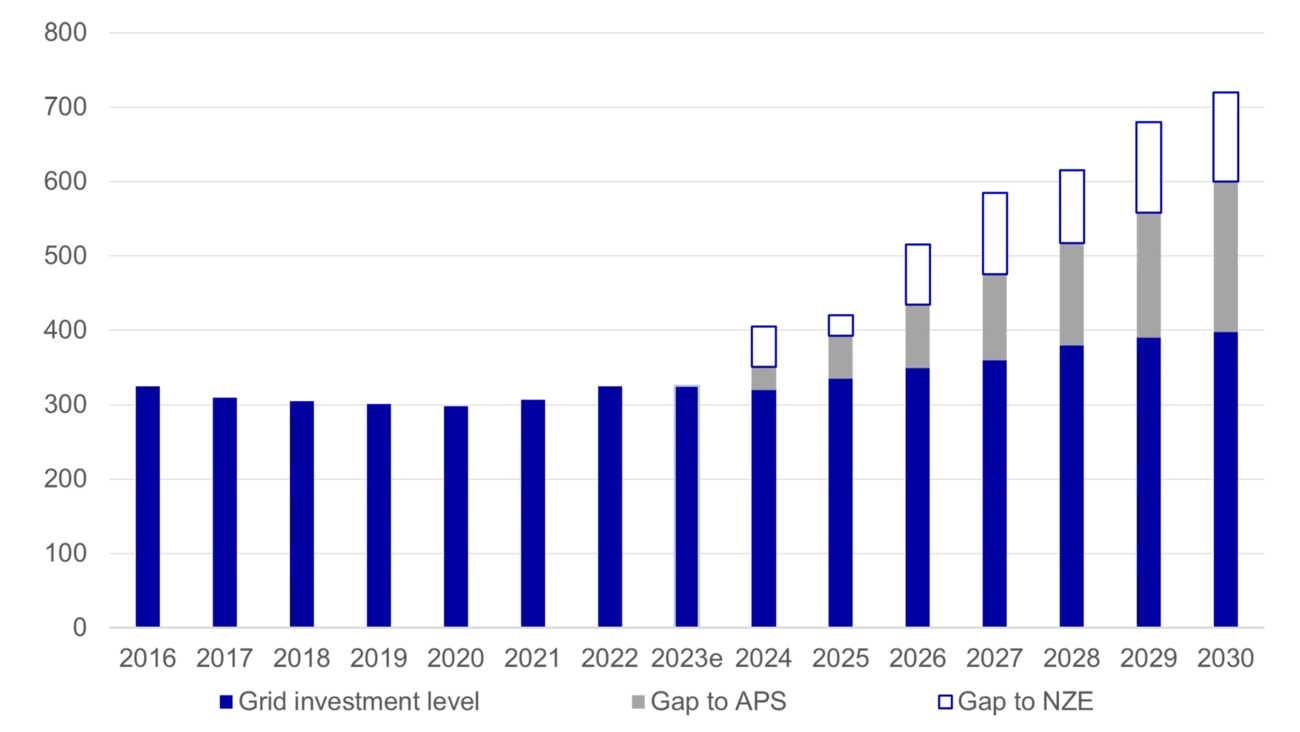

“The only way to make this work is with an unprecedented upgrade of the electrical grid,” says Kisic. “The grid of the future will need to be larger, more interconnected and more flexible.”

He points to interconnectors, energy storage, smart grids and demand management as some of the ways to keep the grid balanced, even in the face of dynamic conditions.