Each year, our ESG Research team updates its ESG ratings for the approximately 300 companies covered by Equity Research at Nordea. In addition to upgrades and downgrades for specific companies, the update provides a picture of how Nordic companies’ ESG efforts have progressed during the past financial year. So how are Nordic companies performing when it comes to sustainability?

Progress continues across most areas, although momentum has slowed down somewhat compared to previous years, says Marco Kisic, Head of ESG Research.

Based on data from 2023, 80% of companies in our coverage universe have both climate and other ESG targets, and 40% now have CEO pay linked to those targets – up from 29% in 2022.

Better environmental footprints

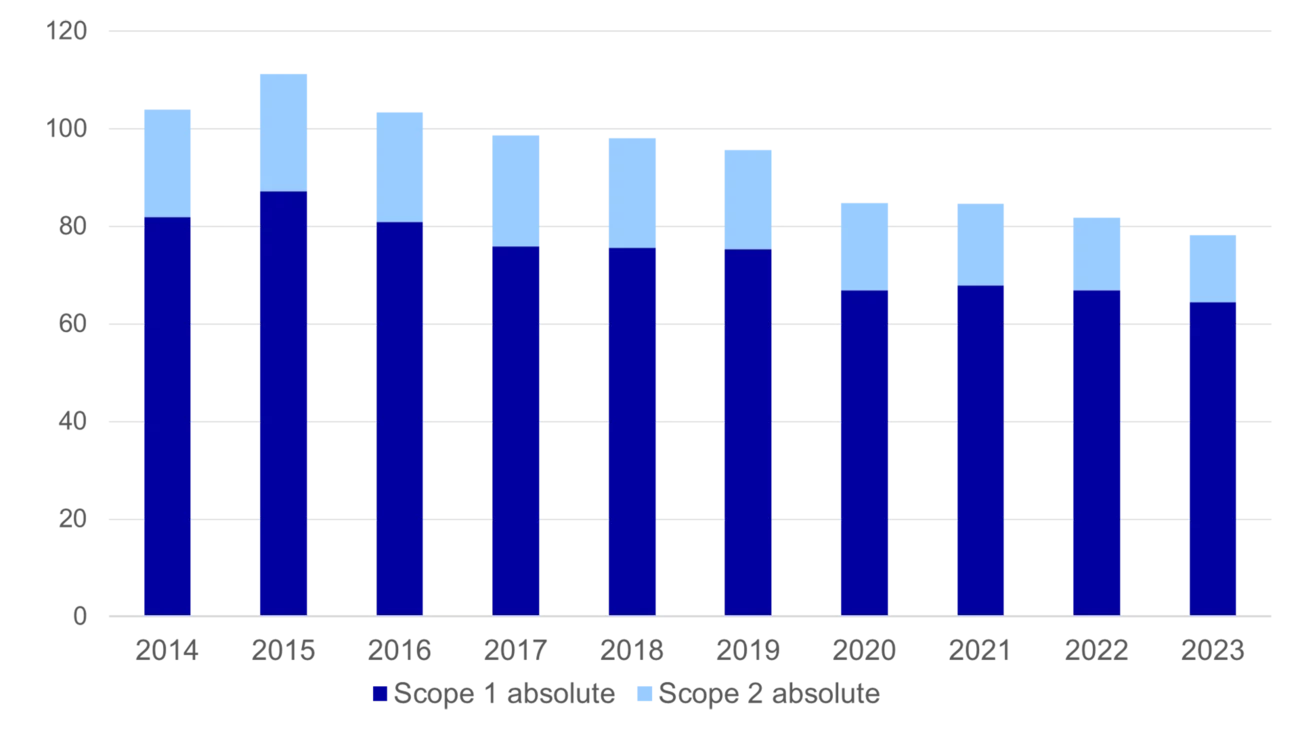

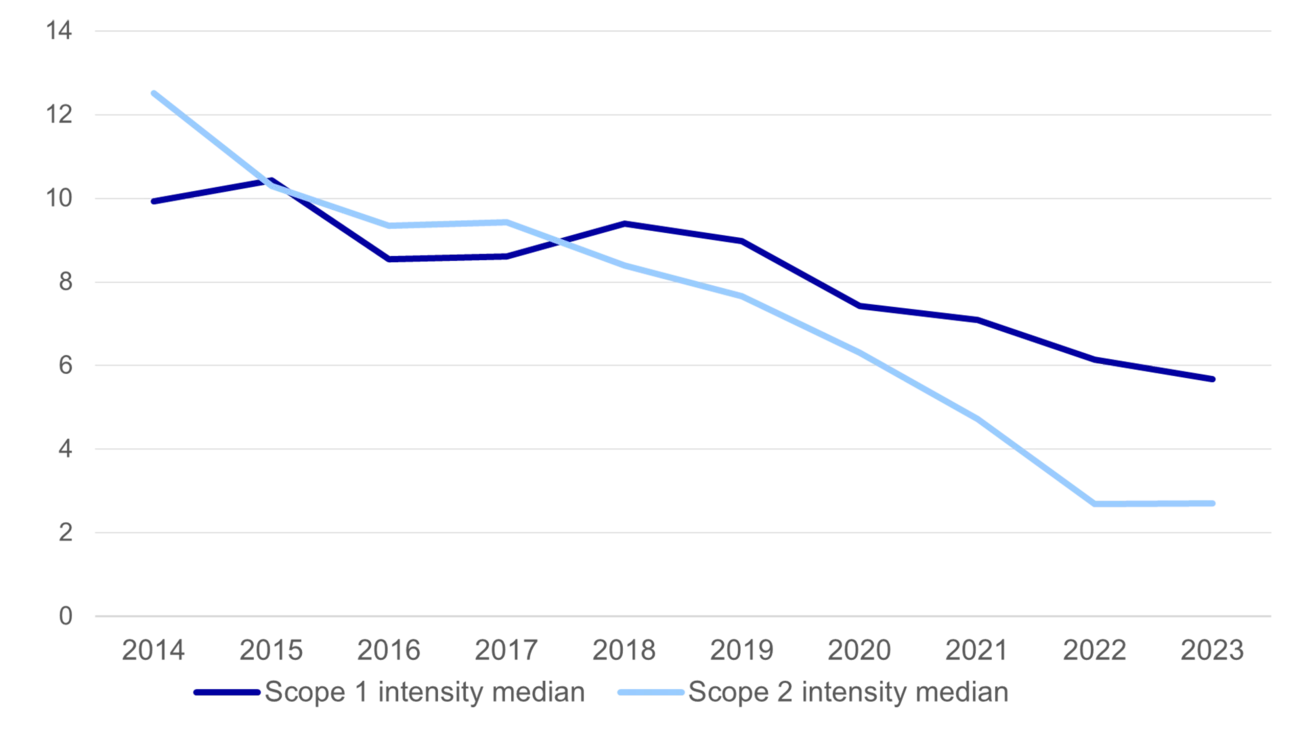

On environmental metrics, absolute scope 1 and 2 emissions came down 4%, in line with previous years. But the momentum in reducing emissions intensity (emissions/revenues) slowed down to -5%, compared to the -13% compounded annual growth rate seen in 2018-22, and the -7% needed to meet the Paris Agreement targets.

Kisic sees the trend as temporary: “We’ve seen many companies where this was driven by difficult market conditions reducing the efficiency of industrial processes. We expect momentum to accelerate again in the coming years, as technology shifts materialise in some key sectors,” he says.

He adds that delivery on other environmental metrics remains strong, for example, with 60% of energy now renewable (compared to 56% in 2022), less water used, less waste produced and energy intensity improving.