- Name:

- Juho Kostiainen

- Title:

- Nordea Economist

Public spending in Finland has increased so much that the government budget is in balance only when the economy is in an upswing and interest rates are at zero. Large-scale fiscal adjustments are needed to return public finances to a sustainable footing.

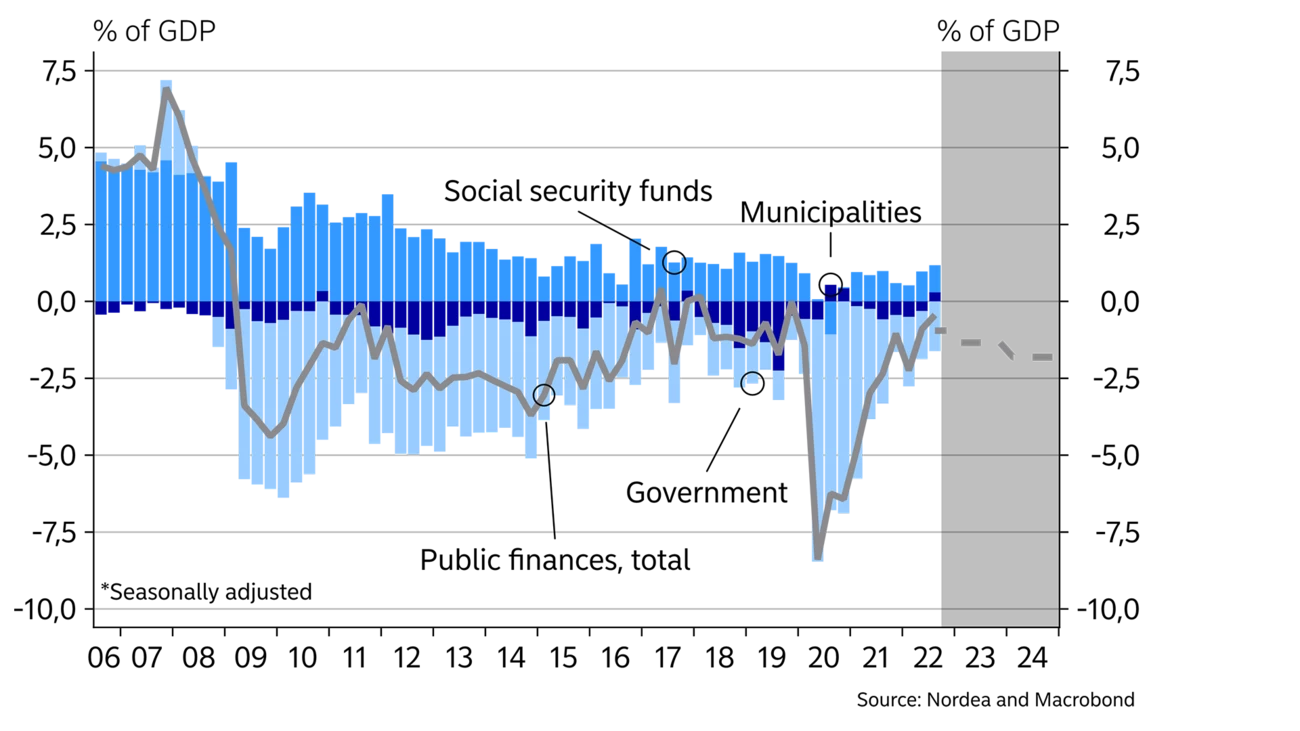

Finnish public finances found a better balance last year, with tax revenue growing sharply on the back of in-creased employment, corporate earnings and consumption. Meanwhile, the growth in public expenses slowed down, as COVID subsidies were discontinued and the unemployment rate fell. The public sector deficit fell to 1% of GDP, whereas in 2020 it was more than 5% of GDP.

As a result of high economic growth and inflation in particular, nominal GDP grew rapidly last year, driving the public debt ratio clearly down. On the surface, Finland’s public finances seem relatively stable. But further scrutiny reveals that there will be problems ahead unless substantial corrective action is taken.

The tailwind behind public finances is dying down this year, as economic growth is expected to come to an end. This means that we’ll also see tax revenue clearly level-ling off. At the same time, elevated inflation is reflected in higher costs. Pensions and other welfare benefits were generously adjusted for inflation at the beginning of the year, public sector wage increases will be close to 5% in 2023 and higher interest rates will raise the interest expenses on debt by more than EUR 1bn. Moreover, the first instalment of more than EUR 1bn as part of Finland’s fighter jet deal will have to be paid this year, and the energy bill relief scheme to support Finnish households will cost the government EUR 0.5bn.

In addition to these short-term expenses, there’s immense pressure to increase expenditure on health care, especially elderly care, since the percentage of people over age 75 is forecast to grow by 30% over the next two parliamentary terms. If no additional investments are made, Finland’s elderly care will be at risk of no longer meeting the standards expected of a civilised society.

If no fiscal adjustments are made, there will be budgetary issues ahead.

Public spending in Finland has increased so much that the government budget is in balance only when the economy is in an upswing and interest rates are at zero. Large-scale fiscal adjustments are needed to return public finances to a sustainable footing. According to the Ministry of Finance, public finances must be strengthened by EUR 9bn over the next two parliamentary terms. Such a large amount, about 3% of GDP, will require measures to be taken in expenditure, employment and taxation alike.

The fiscal adjustments should begin with re-introducing government spending limits, which would help implement expenditure cuts in a systematic way. But more than just strict spending limits are needed because nearly half of public expenditure consists of various forms of financial assistance to households. Decisions to cut benefits must also be made. Financial assistance can be adjusted without cutting the benefits to disadvantaged people since in many cases this assistance goes to the high and middle-income households. Higher education degrees that count towards pension and the adult education allowance are all benefits mainly designed for current or future high earners.

Boosting employment will also be a key factor in securing the sustainability of public finances. In recent years, employment has increased as a result of careers lasting longer but the unemployment rate has been stuck at around 7%. Without improving incentives for those receiving unemployment benefits, increasing active labour market policies and targeting adult education to low-skill workers, we are set to have a reserve of over 200,000 unemployed persons despite having a high number of job vacancies.

A modest increase in taxes seems unavoidable even if progress is made with efforts to cut expenditure and boost employment. With regard to taxation, the government should continue systematic efforts to move from taxes on labour towards Pigouvian taxes and indirect taxes instead.

This article originally appeared in the Nordea Economic Outlook: The Balancing Act, published on 25 January 2023. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more