3.3%

Global GDP growth in 2025.

The global economic outlook for 2025 reflects a very high level of uncertainty, and economic developments could easily surprise in either direction. Our baseline story remains unchanged, and we expect monetary policy easing to support growth especially in the Euro area and China – and in both regions consumer spending could surprise to the upside. In the US, the strong growth momentum has been supported by productivity growth, immigration and robust risk taking. But the sentiment may change if Trump’s policies turn out to be more radical than expected. A high level of uncertainty typically supports the USD.

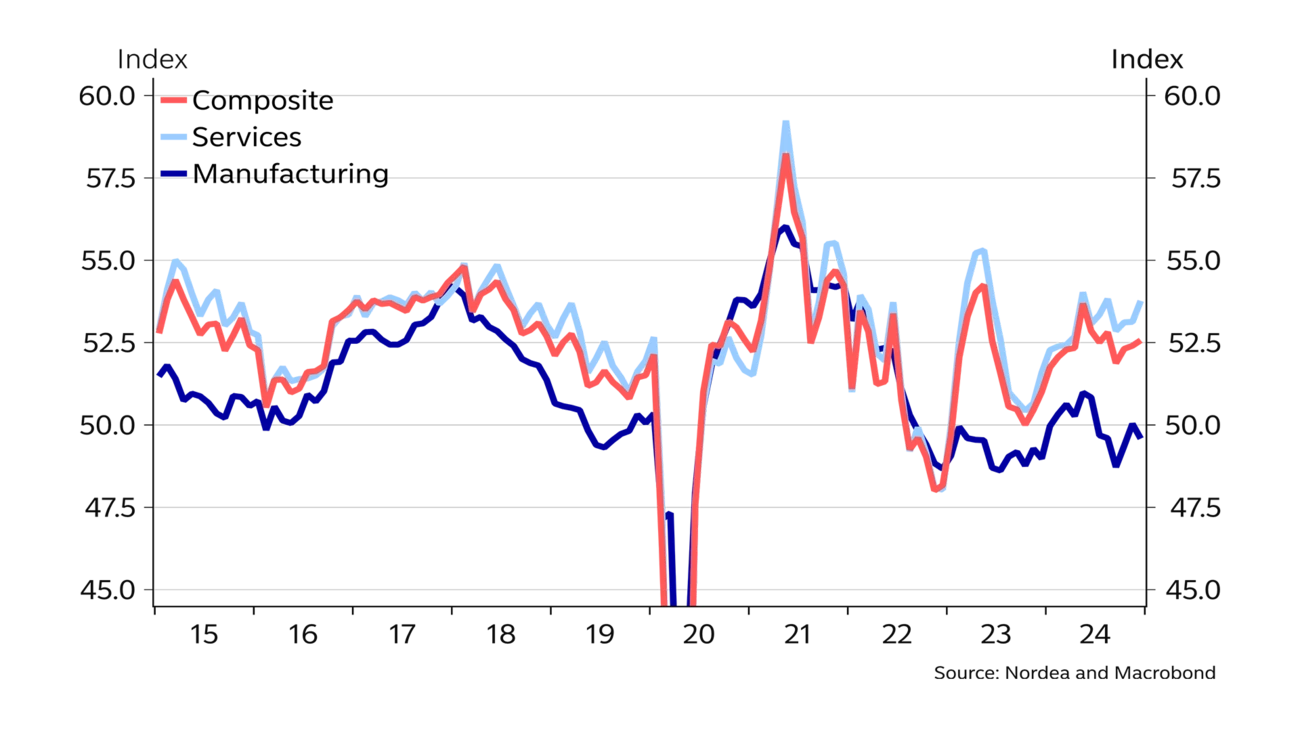

The global economic outlook has remained almost unchanged since our previous forecast. Global growth has relied on the service sector, while political uncertainty and earlier policy tightening are hampering growth especially within housing and manufacturing.

In our baseline forecast, consumers will be the main engine of economic growth in 2025 as they benefit from lower interest rates and rising real income. If they become more optimistic especially in China and the Euro area, the savings rate could decline and economic growth surprise to the upside. On the other hand, the political and geopolitical climate is very uncertain and it remains to be seen how consumers and corporates will react to the latest developments. We see major risks both ways.

At the time of writing, Trump is just about to start his second term as US president. He has presented many radical ideas during his election campaign and more recently, but it remains to be seen to which extent these will actually be implemented. So far, sentiment in the financial markets has remained optimistic, suggesting that market participants likely do not anticipate the most extreme proposals – such as those related to immigration and trade policies that could hinder growth while sharply driving up inflation – to materialise.

We take the stance that Trump wants the financial markets to remain optimistic and will mainly implement policies that are positive for US growth, for example via fiscal policy and deregulation. If so, inflationary pressures will continue to be strong but under the Fed’s control. For economies outside the US, the direct impact of Trump’s policies will probably be negative, as he aims to restrict other countries’ access to the growing US market. Especially China will be the target of high tariffs and other restrictions. In Europe, there is a lot of uncertainty about the so-called Trump effect. The direct effect on trade will be negative, but as we expect it to be rather small, it could be offset by domestic factors if Trump succeeds in either improving the European geopolitical landscape or encouraging EU countries to increase fixed asset investments in areas such as defence or shared debt. It remains to be seen how European consumers and corporates will react to the uncertain climate.

A high level of uncertainty typically supports the USD.

General measures of inflation continue to remain slightly above the targets set by central banks in the US and the Euro area. The most recent monthly observations in the US have pointed to another round of upside risks to inflation, which the robust economic growth outlook and Trump’s policies could increase this year. In the Euro area, slow economic growth is expected to gradually ease wage and price pressures and core inflation is expected to return to the ECB’s target in 2025. This downward trend is supported by weak global price pressures, which mainly stem from China. So far, China’s recipe for fixing the country’s economic challenges has been to boost the supply side. This has caused significant overcapacity and low or even negative inflation numbers as well as declining Chinese export prices.

Despite the consensus calling for an imminent recession many times, the US economy has grown clearly above potential since the autumn of 2022. The higher level of interest rates does not appear to have presented any large problems for the economy, suggesting that the neutral rate is clearly higher than previously thought. In addition, the added risk of higher inflation through tariffs and a reduction in immigration further reduce the Fed’s appetite for rate cuts. Hiring and investments that were put on hold in 2024 due to election-related uncertainty now appear to be resuming, backed by a large upswing in business sentiment.

3.3%

Global GDP growth in 2025.

2%

The ECB inflation target where Euro-area inflation is expected to return during 2025.

4.1%

The unemployment rate in the US in December 2024.

Despite the strong official GDP numbers, 2024 was a challenging year for many sectors in China. Especially the sectors close to Chinese consumers have suffered as a consequence of weak confidence. The Chinese leaders have recently emphasised the importance of growth, and we expect monetary as well as fiscal stimulus to continue in 2025. Although the easing measures will probably continue to focus on the supply side, we expect that some measures will be aimed at boosting consumption. However, given the already high level of public debt, our baseline scenario does not include a large fiscal stimulus package targeting consumers, and we expect the growth target for 2025 to be set at around 4.5% in March. Sectoral differences may continue to be large, as high-tech sectors are likely to benefit from the ambitious targets of self-sufficiency and green transition, while exports to the US will take a hit from Trump’s policies. The housing market could finally show signs of stabilisation.

In 2025 consumer spending in China as well as the Euro area could surprise both ways.

Euro-area growth continued to be sluggish in 2024 as the economy has been slow to react to lower interest rates. Consumers have remained cautious, using their stronger purchasing power to accumulate savings rather than spending more. In 2025, consumers could surprise either way. If the currently high level of domestic and geopolitical uncertainty abates, the expected positive real income growth could finally feed into consumption. On the other hand, consumers may continue to surprise to the downside if the labour market weakens or Trump’s trade policies hit European exports or fixed asset investments. In our baseline scenario, lower interest rates are expected to support fixed investments, and economic growth is expected to accelerate gradually towards the end of the year.

| Year | World New | World Old | US New | US Old | Euro area New | Euro area Old | China New | China Old |

|---|---|---|---|---|---|---|---|---|

| 2023 | 3.2 | 3.2 | 2.5 | 2.5 | 0.5 | 0.5 | 5.2 | 5.2 |

| 2024E | 3.2 | 3.2 | 2.7 | 2.5 | 0.7 | 0.7 | 5.0 | 5.0 |

| 2025E | 3.3 | 3.4 | 2.5 | 1.8 | 1.0 | 1.5 | 4.5 | 4.5 |

| 2026E | 3.2 | 3.3 | 2.0 | 2.0 | 1.5 | 1.5 | 4.0 | 4.0 |

| Year | EUR/USD | EUR/GBP | USD/JPY | EUR/SEK | ECB: Deposit rate | Fed: Fed funds target rate (upper end) | US: 10Y benchmark yield | Germany: 10Y benchmark yield |

|---|---|---|---|---|---|---|---|---|

| 2023 | 1.10 | 0.86 | 141.02 | 11.10 | 4.00 | 5.50 | 3.88 | 2.02 |

| 2024 | 1.04 | 0.83 | 157.00 | 11.48 | 3.00 | 4.50 | 4.58 | 2.36 |

| 2025E | 1.03 | 0.88 | 155.00 | 11.40 | 2.25 | 4.50 | 5.00 | 2.60 |

| 2026E | 1.06 | 0.88 | 145.00 | 11.00 | 2.25 | 4.50 | 5.00 | 2.75 |

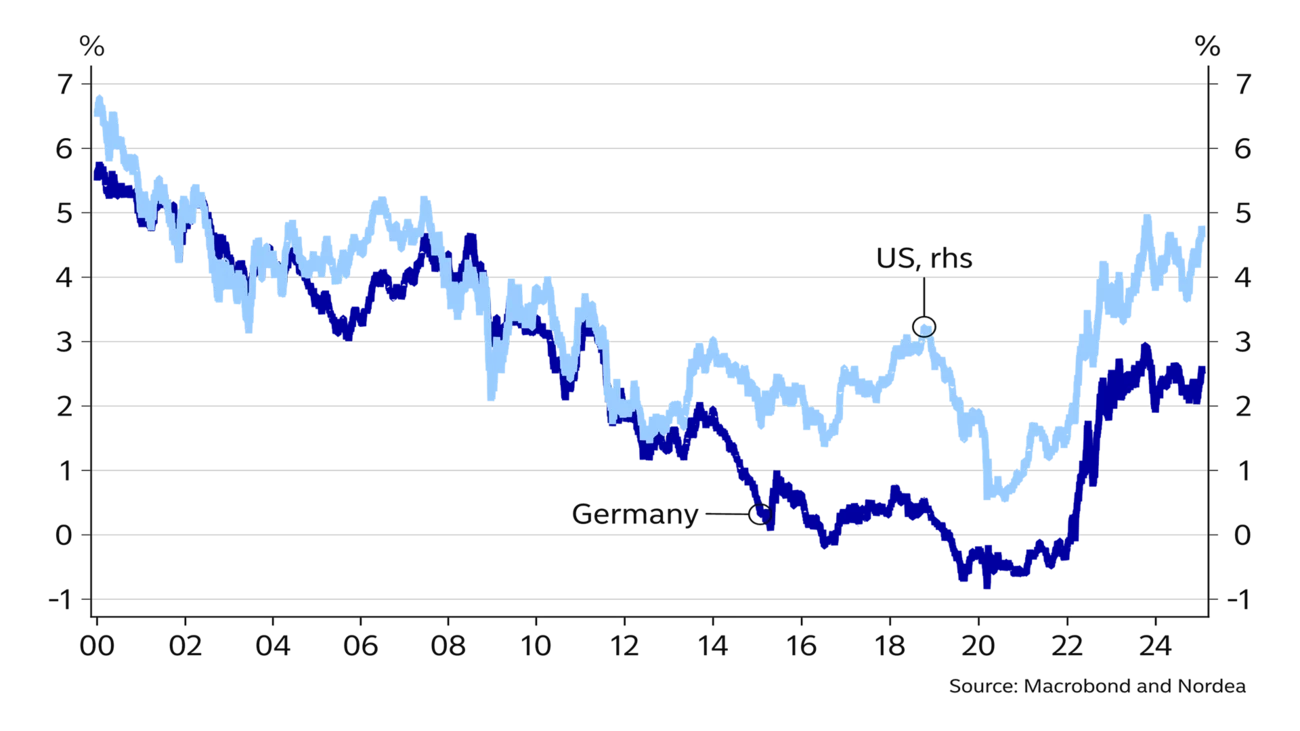

The ECB started its rate cuts before the Fed in this cycle, and it now looks like it will continue cutting rates also longer than the Fed. The Fed signalled a pause in its rate cuts at the December meeting, and we expect this pause to be maintained, as we do not see any more rate cuts from the Fed within our forecast horizon.

Even before the election of Donald Trump, the US economy was exhibiting signs of strength, while core inflation was showing renewed upward momentum. With activity picking up from already brisk levels and renewed upside risks to inflation, we see little reason for the Fed to cut rates any further.

Obviously, a number of scenarios could materialise under President Trump, and while we are far from certain of his ability to boost real growth in earnest, we see his policy plans as adding to upside inflation risks. As far as longer yields are concerned, the term premia in longer yields have started to increase again, and we see more upside potential, as Trump’s fiscal plans will keep government borrowing requirements huge and public debt on an upward trajectory.

In the Euro area, even if market rates have moved in tandem with US moves lately, we do not think the ECB outlook has changed materially recently. We continue to look for three more 25bp rate cuts from the ECB and a subsequent deposit rate of 2.25%. We still see risks tilted towards lower rates than our baseline suggests. At the longer end of the curve, large government bond issuance requirements, coupled with the ECB reducing its bond holdings, suggest rising term premia in the Euro area as well. Also higher US yields should exert some upward pressure on EUR bond yields.

1.00

The level we expect EUR/USD to hit by mid-2025.

O

The number of expected Fed rate cuts in 2025.

3

The number of expected ECB rate cuts in 2025.

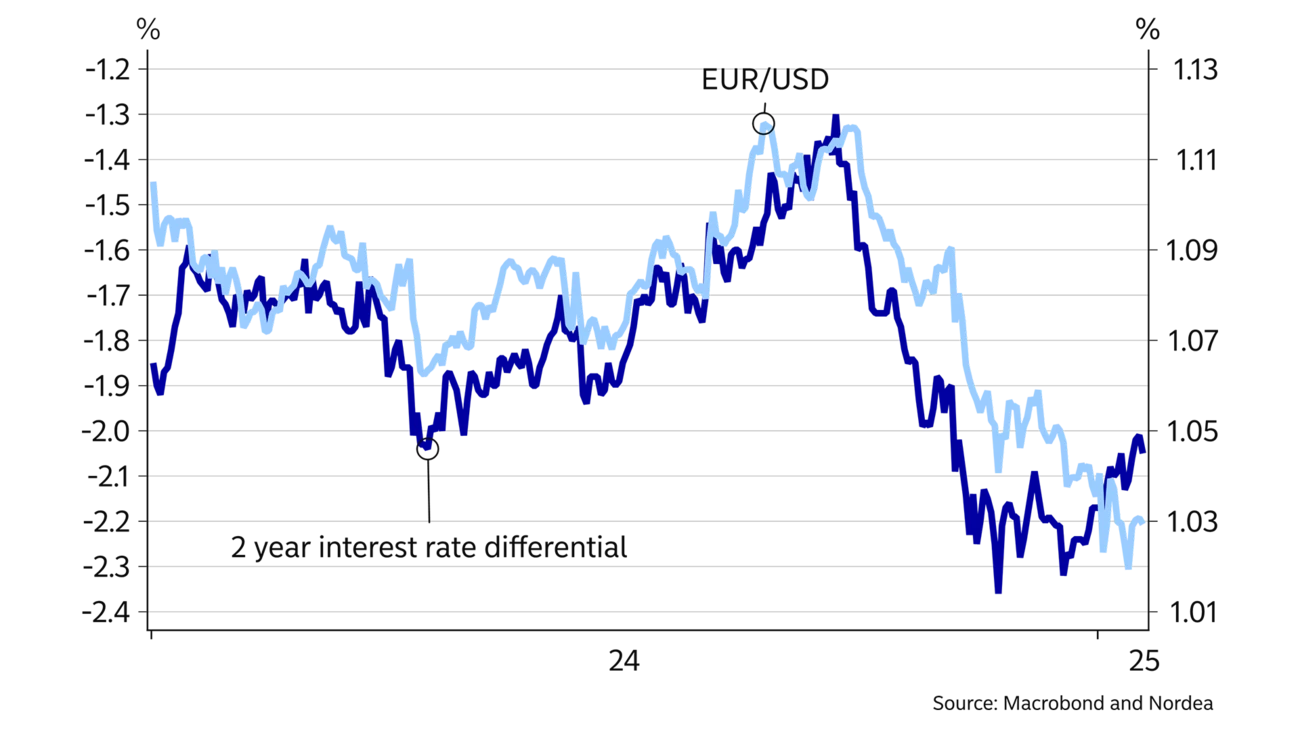

We expect the economic divergence between the US and the rest of the world to remain a source of strength for the USD this year and the balance of risks to point towards further divergence, which could fuel the USD even more than our baseline.

The US economy is strong and likely to be supported by Trump, who is focused on boosting the economy and productivity. In the Euro area, the economy is sluggish and hampered by low confidence among businesses and consumers alike, which could take another blow this year if the political turmoil in France and Germany is not resolved.

Reflecting that economic gap, we think the balance of risks is tilted towards even more interest rate cuts from the ECB and the dollar being strengthened by a growing interest rate differential.

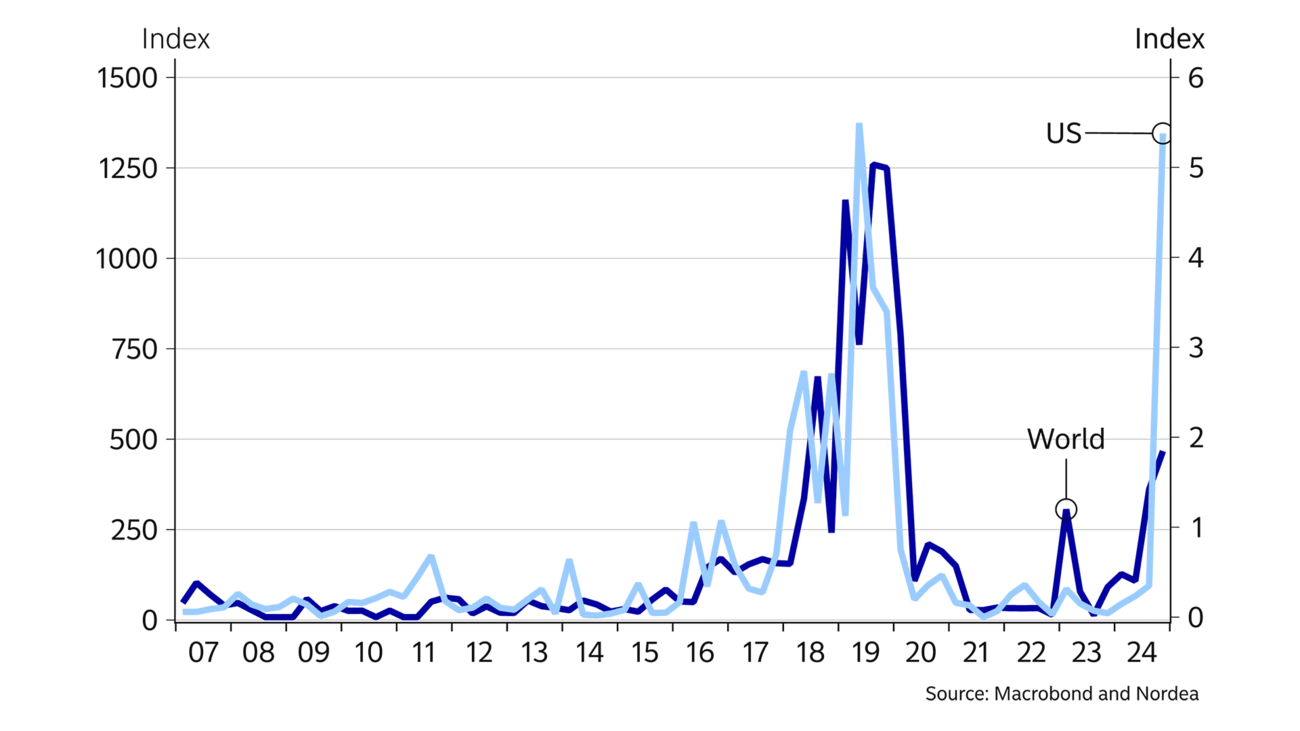

Tariffs could also potentially widen the gap between the US and the rest of the world and fuel the USD. The trade war between the US and China in 2018-2019 strengthened the dollar about 15 % versus the renminbi in anticipation of tariffs lowering US imports and hurting the Chinese export sector. There is a lot of uncertainty in terms of which trade policies will actually be implemented, but we think there is a significant risk of tariffs against China and an elevated risk of universal tariffs, which would reinforce the dominant position of the USD.

Our outlook for continued USD strength and high US interest rates spells bad news for risk-sensitive currencies. The SEK and NOK are particularly vulnerable to a strong dollar and high interest rates. Therefore, we think both currencies will remain weak in the coming year, with risks tilted to the downside.

This article first appeared in the Nordea Economic Outlook: Consumer comeback, published on 22 January 2025. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more