- Name:

- Kjetil Olsen

- Title:

- Chief Economist

Kjetil Olsen

Economic growth in Norway picked up last year and is now back at normal levels. Unemployment has remained stable at a low level since last summer. Growth should increase further in the period ahead. Wage growth is clearly higher than inflation, and purchasing power is improving sharply. Rate cuts will further support consumption and strengthen the already strong growth in housing prices. Housing construction is set to pick up this year and increase sharply next year. Combined with continued strong fiscal stimulus and high activity in oil-related businesses, labour shortages may again become a challenge. Norges Bank will thus only cut its policy rate twice, to 4%. Inflation has plunged from its peak, but will not reach 2% for quite some time. Other countries’ rate cuts have not strengthened the NOK. The NOK will likely remain weak in the period ahead.

Housing investment continued to fall sharply during the first three quarters of last year. Still, economic growth in Norway picked up, mainly driven by higher public spending and oil investment. Although oil investment will likely level off at a high level this year before declining slightly in 2026, the Norwegian economy could grow even faster this year. Three factors will contribute to this, in our view.

First, fiscal stimulus continues unabated. For the second year running, an oil revenue spending increase of 1% of the mainland economy is planned for 2025. Oil revenue spending has only increased more during the financial crisis and the pandemic. Even during the oil crisis ten years ago, spending did not increase as much as now.

Second, housing construction will pick up this year and rise sharply in 2026. New home sales are already picking up again, and the decline in housing starts has stopped. The negative growth contribution from housing investment will thus soon be behind us. Housing prices rose more than 6% last year and will probably rise even more this year. This reduces the gap between prices of existing and new homes, so more people will likely buy new ones. Increased new home sales will lift housing investment, which will eventually more than offset lower oil investment.

Third, consumption is set to rise significantly going forward. Norwegian household purchasing power is now rising sharply. Consumer price inflation has fallen and was 2.2% in December. Given last year’s wage growth above 5%, most people’s purchasing power has already improved substantially. Purchasing power will increase further this year. Wage growth will likely be well above inflation this year too. At the same time, Norges Bank will cut rates. With two rate cuts on top of real wage growth, matters are starting to look good for everyone with debt. After the first rate cut, the reality may also become reflected in sentiment among average households. Then, consumption may pick up sharply.

Norges Bank estimates trend growth in the main-land economy at around 1.5%. In recent quarters, the pace of growth has been close to these levels. Over time, growth in line with trend growth will result in stable unemployment. So, it is not surprising that unemployment has remained at 2.1% since July; a level Norges Bank considers to reflect a balanced labour market. If growth rises above trend, labour shortages could again become a challenge. In recent quarters, businesses in Norges Bank’s regional network have reported incipient labour shortages. If all goes as expected, unemployment will slowly begin to decline again during 2025. The Norwegian economy may thus enter a new period of above-normal capacity utilisation. This is the main reason we expect fewer rate cuts than Norges Bank.

| 2023 | 2024E | 2025 | 2026 | |

| Real GDP (mainland), % y/y | 0.7 | 1.0 | 1.8 | 1.8 |

| Household consumption | -0.8 | 1.2 | 2.8 | 2.5 |

| Core consumer prices, % y/y | 6.2 | 3.7 | 2.7 | 2.6 |

| Annual wage growth | 5.3 | 5.2 | 4.2 | 3.8 |

| Unemployment rate (registered), % | 1.8 | 2.0 | 2.1 | 2.0 |

| Monetary policy rate (end of period) | 4.50 | 4.50 | 4.00 | 4.00 |

| EUR/NOK (end of period) | 11.20 | 11.79 | 11.75 | 11.50 |

Registered unemployment (% of labour force)

Consumer prices adjusted for energy and taxes (%)

Housing prices rose by as much as 6.4% last year, even without rate cuts. High wage growth has increased borrowing capacity, and housing prices rose only a bit more than wages. Housing price growth may intensify in the future. In 2025, housing prices may go up by some 10%.

Even if wage growth will be a bit lower this year, it will likely end above 4%. Experience suggests a close correlation between growth in income and housing prices over time. Moreover, empirical evidence suggests that a 1 %-point lower interest rate would lift housing prices nationwide by about 10%. With two rate cuts from Norges Bank totalling ½ %-point, this would imply a further increase in housing prices of about 5%. Add to this the effect of the easing of the equity capital requirement from 15% to 10%. For those who were only limited by the equity capital requirement, purchasing power in the housing market will increase by a hefty 50%. Far fewer homes than population trends would indicate may be put on the market in the next few years. A tight supply side could drive housing prices even higher. It is not inconceivable that growth in housing prices will beat our 10% estimate this year.

The surging housing prices will lift housing construction. Yet, it will take time before these newbuilds are ready for occupancy. Moreover, labour shortages could limit the number of homes that it will actually be possible to build in the years ahead (see more details in our Norway theme article). So, it could be some time before the supply of new homes matches the underlying population trends.

We expect very strong house price growth, even without many rate cuts.

Core inflation adjusted for energy prices and taxes has fallen sharply from its peak 18 months ago. In December, 12-month growth was 2.7%, versus 7% in June 2023. Yet, it will still be a slow decline down to 2%. Core inflation will probably remain close to today’s level for some time before only gradually falling further.

The main contributor to the drop in inflation so far is lower international price impulses, both directly through lower inflation for imported consumer goods but also indirectly through lower inflation for input goods used in domestic production. In the future, we cannot expect international conditions to contribute to further drops in domestic inflation. Experience shows that it takes up to a year before changes in international prices impact goods prices in Norway. International commodity prices plummeted until the summer of 2023, but have since remained fairly stable. The effect on Norwegian goods prices should thus be behind us now. In the future, it will thus mainly be domestic conditions that determine whether inflation will fall further.

While growth in the prices of imported consumer goods was down to 0.4% in December, growth in the prices of goods and services produced in Norway was 4%. For businesses, strong wage growth, combined with very low productivity growth, results in underlying cost increases, which are passed on to end users. Over time, there is thus a close correlation between wage growth and price growth for domestically-produced goods and services.

After two years of wage growth in excess of 5%, there are prospects that wage growth will gradually abate, but remain fairly high. Low unemployment and large profits in export-oriented wage-leading sectors give employees good bargaining power. Expectations surveys point to wage growth of 4-4.5% this year. At the same time, stronger household purchasing power may make it easier to pass on cost inflation to prices. Corporate margins declined to a relatively low level in Q3 overall. Many businesses will probably try to increase margins in step with stronger demand. As such, it could take time before inflation for domestically-produced goods and services slows down, even with slightly lower wage growth.

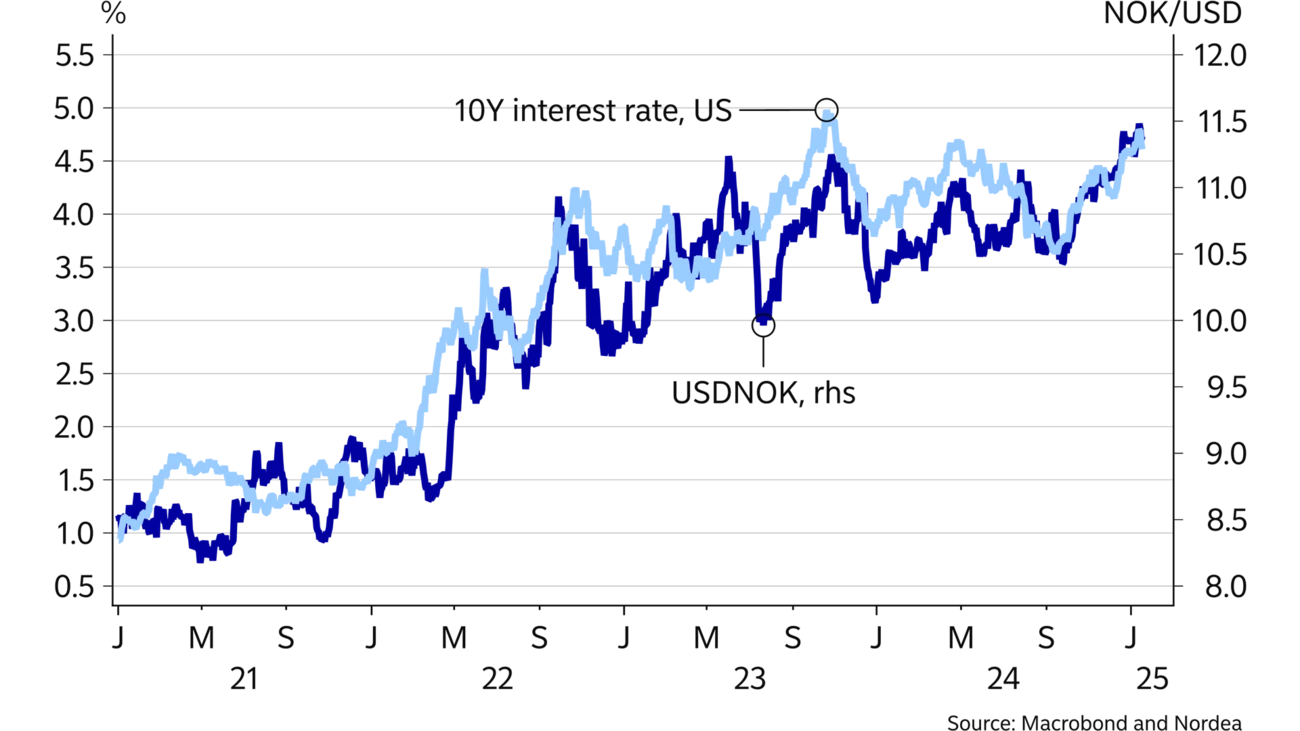

10y US government bond yields (%) and USDNOKY

Nordea, interest rate forecasts, %

The list of countries that have already cut interest rates is growing long. So far, lower rates abroad have not led to a stronger NOK. If anything, we have seen the NOK weakening in line with expectations of fewer rate cuts from the US Federal Reserve. It is worth recalling that the US policy rate has been higher than Norway’s policy rate. Although the Fed has cut rates by 1 %-point, policy rates have not reached the same level as in Norway until now. Moreover, the Fed is uncertain as to whether more rate cuts are needed. Growth in the US economy is strong, income growth is solid, consumption is growing sharply and inflation is not quite under control there either. When Norges Bank starts cutting rates, US rates may therefore gain the upper hand again. The NOK thus looks set to stay weak in the period ahead.

The USD has strengthened across the board in line with higher interest rate expectations in the US. Since September, the USD/NOK has risen from 10.40 to around 11.40. In the same period, the EUR/NOK has been fairly stable, at around 11.75. In the short term, the risk is on the upside in both currency pairs. If President-elect Donald Trump does what he has said – increasing tariffs and sending back undocumented immigrants – inflation could rise and further drive up US interest rate expectations. This would strengthen the USD further. In addition, the market is now very pessimistic about Euro area growth prospects, and a number of further ECB rate cuts have been priced in. If matters go a little less badly than the market expects, it will not take much for the EUR to strengthen as well.

Norges Bank has not announced rate cuts in the future because it fears that inflation will be too low. Without being aided by a stronger NOK, the high wage growth in Norway means that further reductions in inflation will likely be sluggish. We share Norges Bank’s view on this. Inflation is likely to remain above the 2% target throughout the forecast period through 2026.

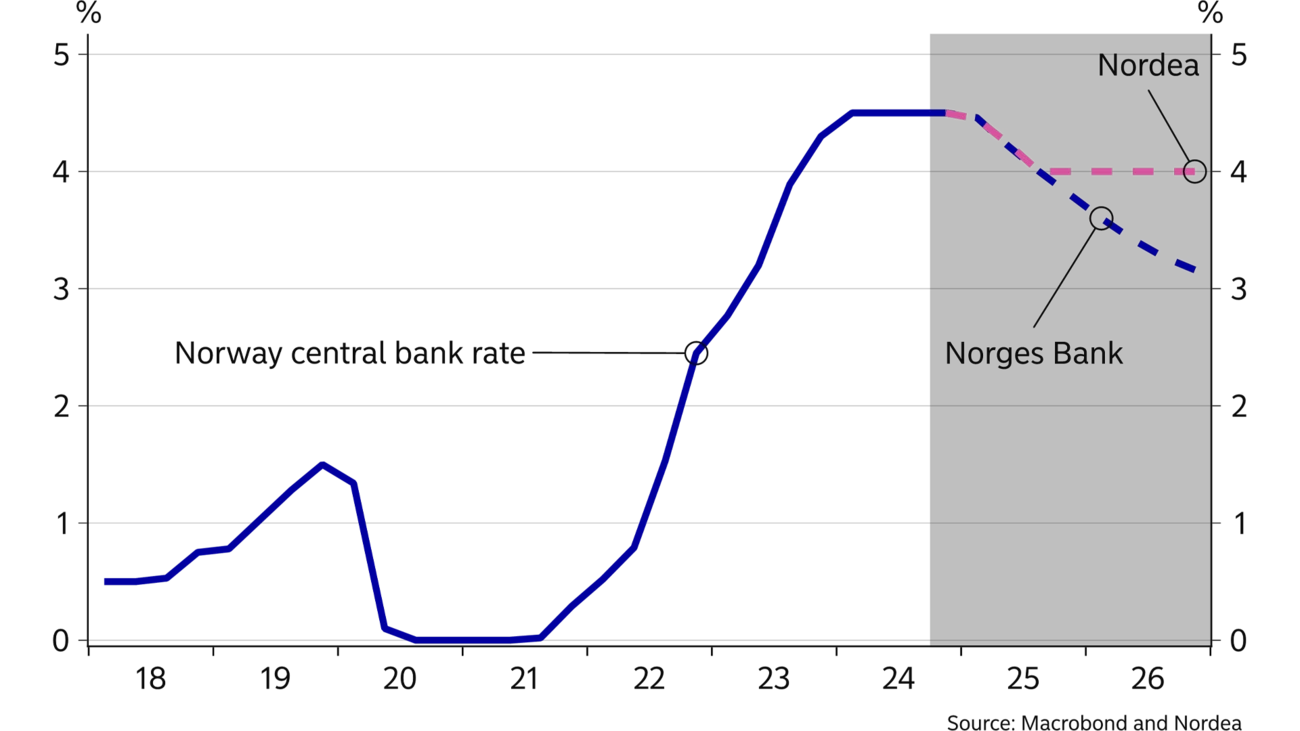

Norges Bank has announced six rate cuts over the next two years, to 3%, because it fears that unemployment will otherwise rise sharply. In our view, the question is then: how many rate cuts are needed to keep unemployment low? Here, we have a different view than Norges Bank and many others. We believe Norges Bank will cut interest rates in March, but only deliver one more cut. By autumn, the policy rate will likely have fallen to 4% and will help lift growth in the Norwegian economy above the trend level, so that unemployment will come down slightly during 2025.

We have been strengthened in our belief that there will not be many interest rate cuts.

We now expect one fewer rate cut over the forecast horizon than in our September report. Growth in the Norwegian economy has been stronger than we had assumed, and fiscal policy is far more stimulatory than previously assumed. In addition, there are prospects that the money market premium, that is, the difference between Nibor and the policy rate, will be structurally lower than before. Norges Bank is changing its liquidity management method from 2025 onwards, implying that banks' liquidity will be much higher in the period ahead. As a result, banks will have less of a need to borrow in the money market, resulting in lower money market rates. We expect that the Nibor will only be around 10bp above the policy rate, versus some 30bp previously. This alone means that almost one less interest rate cut is needed, all else equal. It is market rates, not the policy rate, that determine lending rates to businesses and households. We have thus grown stronger in our conviction that there will not be very many interest rate cuts.

This article first appeared in the Nordea Economic Outlook: Consumer comeback, published on 22 January 2025. Read more from the latest Nordea Economic Outlook

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more