- Name:

- Jan Størup Nielsen

- Title:

- Chief Analyst

Jan Størup Nielsen

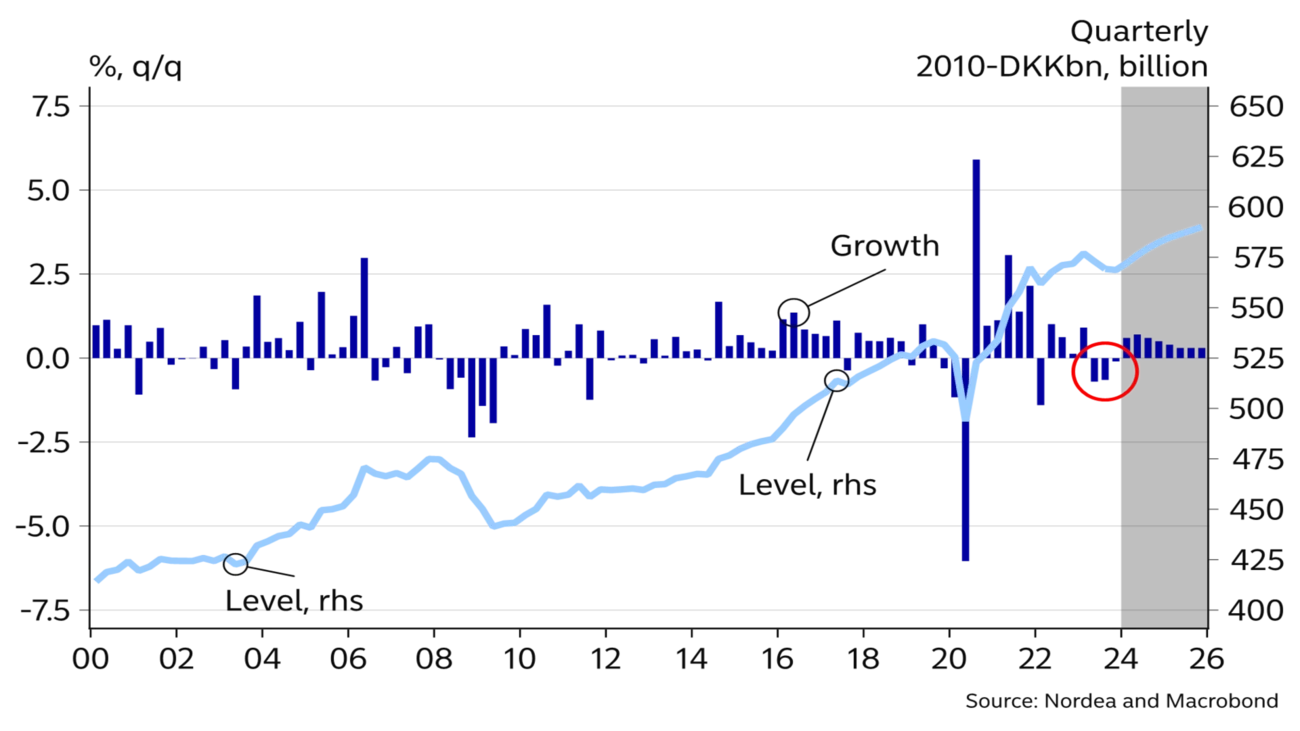

After several years of high growth, Danish economic activity has slowed down. Households are increasingly affected by rising interest expenses, and residential investment has nosedived. These were some of the factors that drove the Danish economy into a technical recession during 2023. Nonetheless, employment has risen to a historically high level. The dampening is expected to be relatively mild and soon to be replaced by renewed progress during this year. The renewed acceleration will primarily be achieved on the back of lower inflation, which will result in lower interest rates and help strengthen purchasing power. This could trigger renewed pressure in the tight labour market.

In 2023, the Danish economy suffered from several consecutive quarters of negative growth. It was the first technical recession since the COVID-19 pandemic hit in H1 2020. The slowdown will continue this year, in our view, as we expect GDP growth of 1.0%. This is slightly higher than in 2023, but well below average growth over the past decade. Next year, we expect the Danish economy to expand by 1.7%. For both years, the estimates are unchanged compared to our latest forecasts from September 2023.

Our expectation of renewed progress in the Danish economy from mid-2024 is mainly based on the prospect of lower interest rates, which will boost domestic demand, as well as demand in key export markets. As such, solid real wage increases could pave the way for higher household spending.

Industrial production in Denmark has risen nearly 50% over the past three years. This is a sharp acceleration compared to previously. However, the impressive growth is solely due to very significant progress in the pharmaceutical industry, which accounts for just over 20% of overall production. Non-pharmaceutical production has thus faced a setback since mid-2022.

The pharmaceutical industry is typically characterised by being highly productive, and at the same time, much of the activity takes place abroad. The substantial production abroad has been a decisive factor in maintaining a very large current account surplus, totalling more than DKK 300bn over the past year alone. This equals more than 10% of the country’s GDP.

Moreover, progress in the pharmaceutical industry has triggered a surge in companies’ investments in intellectual property rights, which have risen to an all-time high. On the other hand, the foreign-based production in the pharmaceutical sector contributes very little to developments in the Danish labour market. Therefore, industrial production has also increased significantly more than employment in recent years.

The rising financing costs and declining activity outside the pharmaceutical sector are clearly reflected in the number of bankruptcies, which rose to a decade-high in 2023. However, this increase follows several years with unusually few bankruptcies. Many of the bankrupt companies have had problems repaying the government loans from the pandemic. At the same time, many companies in the construction sector are feeling the consequences of sharp interest rate increases.

DENMARK: MACROECONOMIC INDICATORS

| 2022 | 2023E | 2024E | 2025E | |

| Real GDP. % y/y | 2.7 | 0.7 | 1.0 | 1.7 |

| Consumer prices. % y/y | 7.7 | 3.3 | 1.9 | 2.4 |

| Unemployment rate. % | 2.6 | 2.8 | 3.1 | 2.9 |

| Current account balance. % of GDP | 13.3 | 11.0 | 11.8 | 11.0 |

| General gov. budget balance. % of GDP | 3.3 | 3.1 | 2.2 | 1.5 |

| General gov. gross debt. % of GDP | 29.8 | 30.5 | 29.6 | 28.4 |

| Monetary policy rate (end of period) | 1.75 | 3.60 | 2.85 | 1.85 |

| USD/DKK (end of period) | 6.97 | 6.75 | 6.48 | 6.48 |

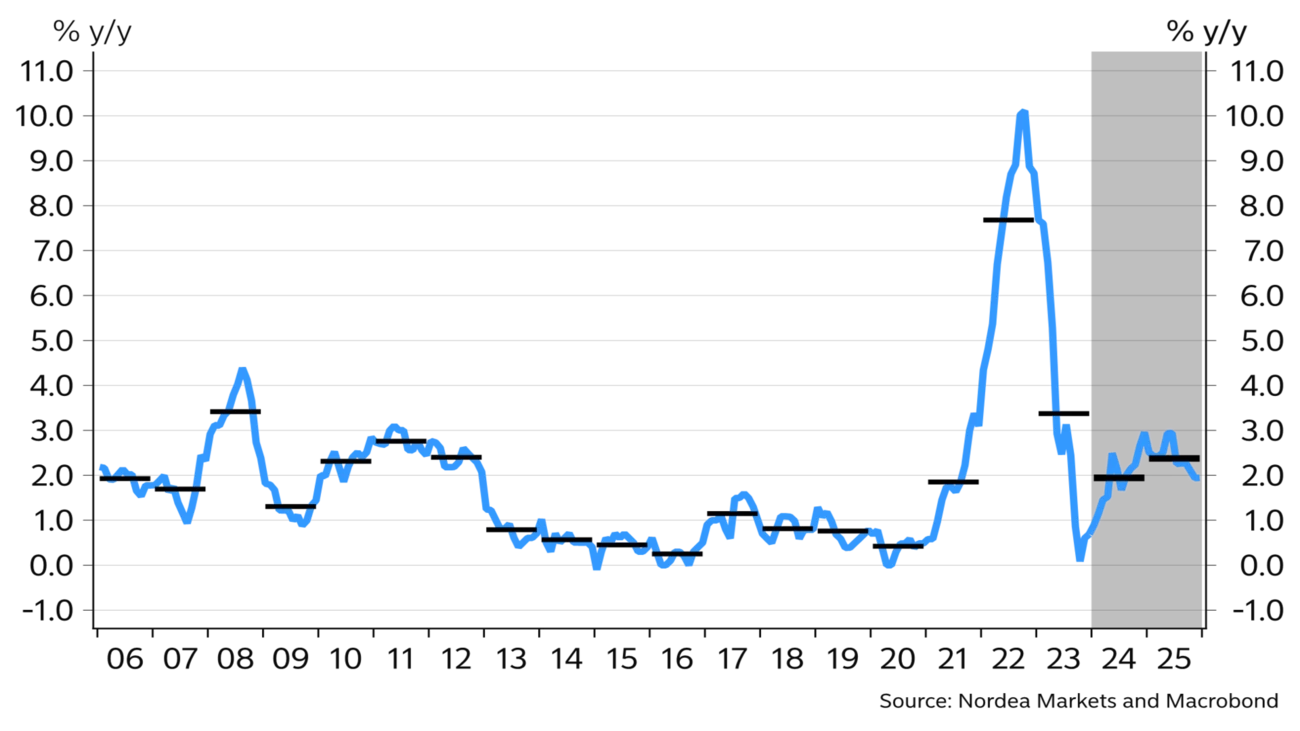

In October 2022, the annual rise in consumer prices reached 10.1%. It was the highest inflation rate on record since 1982. However, price growth has since dropped sharply, culminating in just 0.1% in October 2023. The sharp drop in inflation is mostly due to lower energy prices, as prices of both electricity and natural gas are currently much lower than one year ago.

Starting in mid-2023, food prices began to fall in Denmark in the wake of lower global commodity prices. Food prices in Denmark have fallen more and at a faster pace than in the euro area, which is one of the reasons why over the past six months, Denmark has had one of the lowest inflation rates in the EU.

We forecast average inflation this year to land just under 2%. However, during the year, inflation is expected to start edging higher again and will likely exceed 2% next year. Part of the explanation for the rising inflation is that the negative contribution from energy prices will gradually abate. At the same time, service prices will probably increase relatively steeply in response to the trend in companies’ wage costs.

The period of high inflation has eroded household purchasing power. However, during 2023, consumer confidence rose in step with declining inflation and growing wage increases. Moreover, record-high employment ensures that overall domestic purchasing power is strengthening. This has contributed to a renewed uptick in retail sales.

We expect consumer spending to rise further over the forecast horizon, mainly as a result of positive real wage growth. In addition, the refund of overpaid housing taxes could boost consumption. Lastly, the Danish Parliament adopted a broad-based new tax reform in December 2023. The reform is to be phased in over the coming years, but one of the measures – a higher employment allowance – will take effect starting in 2025. This should further stimulate household spending.

The Danish economy is seeing a slowdown after a long period of solid growth. Yet, the pause is likely to be short and should be replaced by renewed growth in 2024.

Since early 2020, the total number of wage earners in the Danish labour market has grown by more than 200,000. This is an increase of more than 7% in less than four years. Numbers have gone up in both the public and private sectors. As a result, the labour force participation rate, a measure of the portion of the working-age population at work, is back at the historically high level before the global financial crisis.

The surge in employment has only been possible because of a large influx of foreign nationals into the Danish labour market. At the same time, unemployment has remained at a very low level – albeit slightly higher than the lowest level in the spring of 2022.

In the ongoing economic surveys by Statistics Denmark, a majority of the respondent companies across the business sectors estimate that employment will decline in the first half of the year. This is well in line with our forecast, which also assumes a moderate decline from the historically high employment. Although this is expected to make unemployment rise further during 2024, the level will remain very low in a historical context.

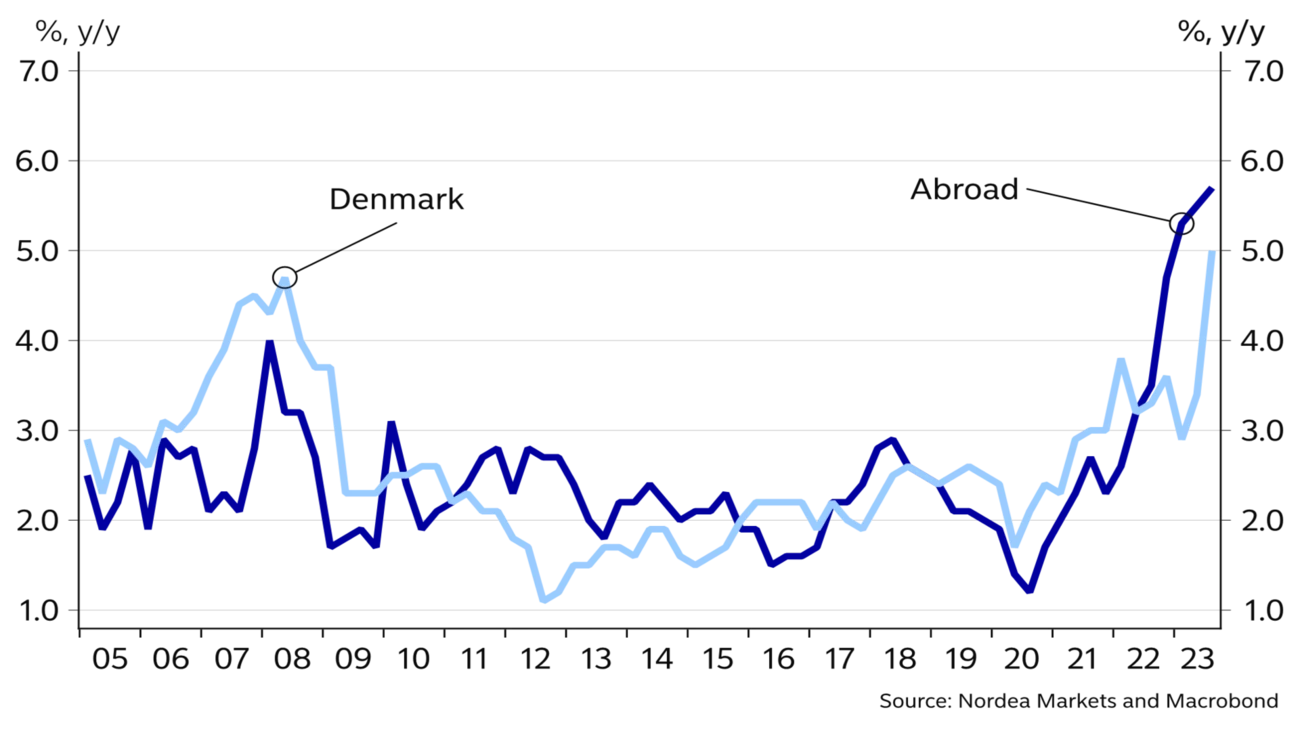

The period of very high inflation coupled with low unemployment has triggered upward pressure on wage increases. According to the latest official figures, this movement culminated in Q3 2023, when wages in the private sector rose by almost 5%. This is the highest rate of increase on record for more than 20 years.

However, unlike the years in the run-up to the financial crisis, wages in the Danish labour market have not risen faster than those of our most important trading partners. That is the reason why the current wage increas-es do not weaken Danish companies’ competitiveness.

We project wages in the private sector to increase by about 5% this year, declining to some 3.5% in 2025. Pay rounds are held in the public sector this year. In the Danish labour market, there is a longstanding tradition of pay agreements in the public sector largely mirroring the trend in the private sector.

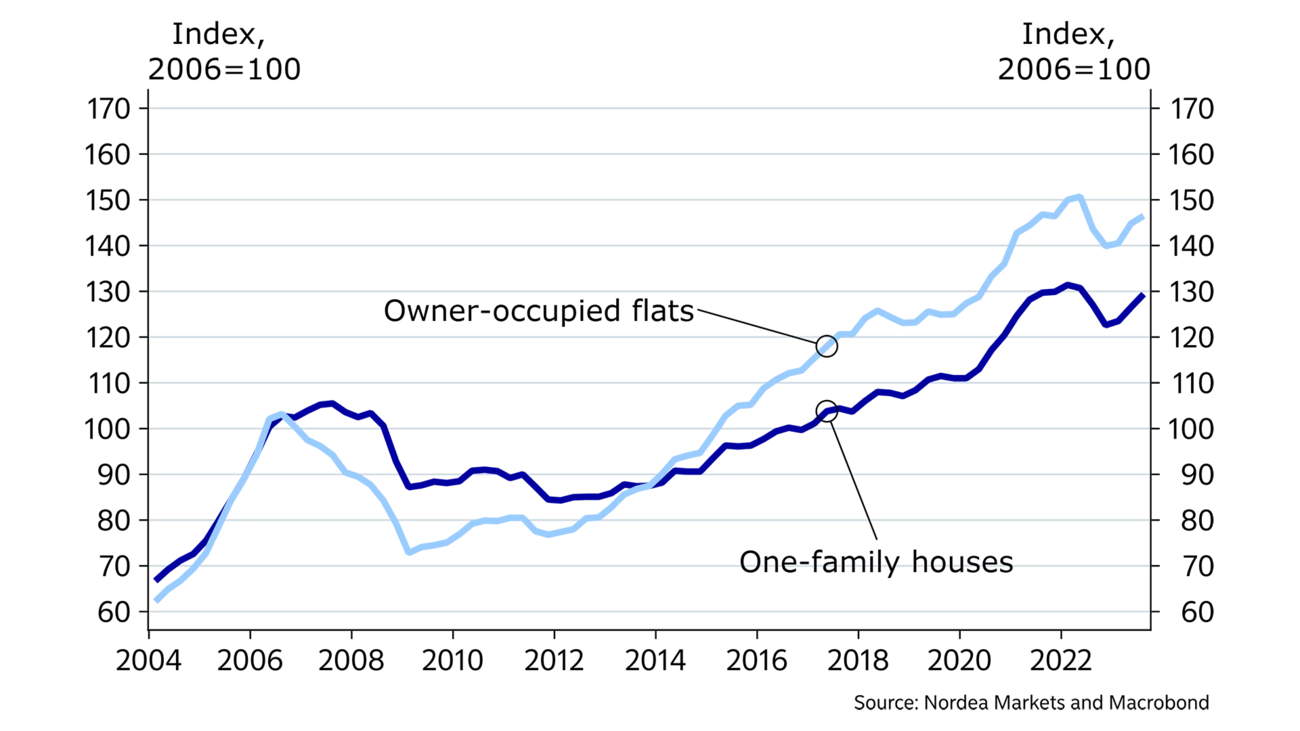

According to Statistics Denmark, sales prices of houses have gone up by just over 6% since the start of 2023. This surprising increase is taking place in the wake of the new tax reform, which took effect at the year-end. This has probably meant that many home buyers, particularly of expensive owner-occupied flats, landed their deals before the cut-off date to obtain a tax rebate. Moreover, the housing market is supported by record-high employment, which firmly underpins home buyers’ finances. Lastly, the supply of homes for sale has been comparatively low for several years. In combination with a low number of forced sales, this has tipped the scales in favour of the sellers.

We expect an increased supply of homes for sale and continued high financing costs to result in a largely sideways trend in home prices throughout most of 2024. Consequently, home prices will probably “only” be 1.6% higher at the end of the year than in the beginning. In early 2025, prices are likely to start edging higher again as lower interest rates and renewed growth in the Danish economy will boost optimism in the housing market.

During 2023, the Danish krone gradually weakened against the euro. This trend culminated in the autumn, when the krone briefly traded above the central parity against the euro. However, the weakening was not significant enough for the Danish central bank to intervene in the currency market.

The krone has subsequently strengthened slightly again, and at this point. it seems likely that the Danish key policy will remain 0.4% point lower than in the euro area. The need for a lower interest rate in Denmark to defend the fixed exchange rate regime is due, among other things, to the very large current account surplus.

From mid-2024, the European Central Bank is expected to gradually start lowering the key policy rate in the euro area. The Danish Central Bank is generally expected to track these rate cuts. Against this background, the central bank’s deposit rate will likely be reduced from the current 3.60% to 1.85% at year-end 2025.

This article first appeared in the Nordea Economic Outlook: Past the peak, published on 24 January 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more