- Name:

- David Ray

- Title:

- Nordea Sustainable Finance Advisory

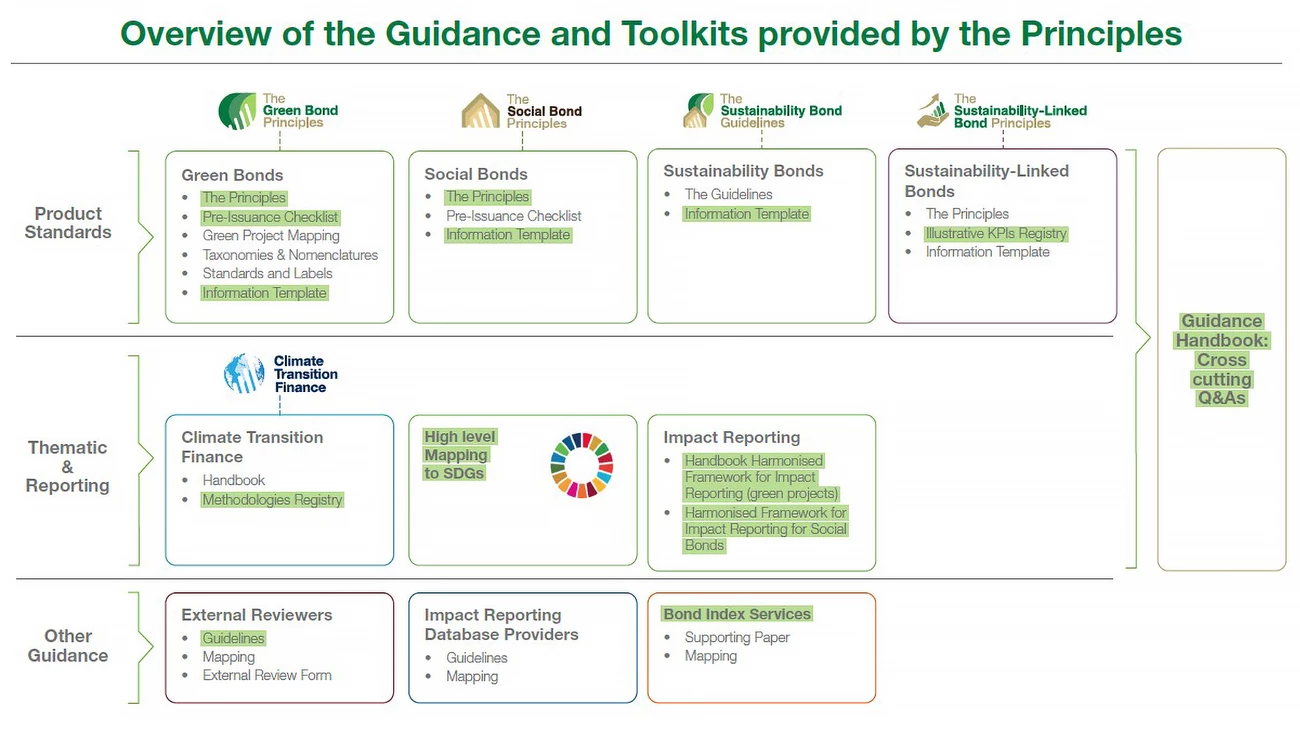

The eighth annual general meeting of the ICMA “Principles” – the Green Bond Principles (GBP), Social Bond Principles (SBP), Sustainability Bond Guidelines (SBG) and Sustainability-Linked Bond Principles (SLBP) – saw the publication of additional guidance to support market transparency and development, with key announcements relating to green securitisation, sustainability-linked bonds, and climate transition finance.

The International Capital Market Association (ICMA) hosted its eighth consecutive Annual General Meeting (AGM) of the “Principles” on 28th June, announcing the publication of a wealth of additional resources with relevance across the market. Nicholas Pfaff, Deputy Chief Executive and Head of Sustainable Finance at ICMA, stated that “the 2022 announcements of the Principles represent critical support for market integrity and development […] The Principles provide market participants and stakeholders with an essential reference for product standards, agreed terminology and technical consistency, as well as a resource to benchmark ambition.”

With the common objective of increasing market integrity and transparency, the headline announcements following the AGM include:

Comprising 28 organisations, the Sustainable Securitisation Taskforce kicked off in January 2022 with the initial objectives of assessing existing market practices, inclusive of both green and social assets, to review the relevant section of the Principles and to provide amendments and additional guidance if necessary.

Following the work of the Taskforce, new definitions have been embedded in Appendix 1 of the Green Bond Principles. The scope of the definitions includes covered bonds, securitisations, asset-backed commercial paper, secured notes and other secured structures.

New definitions include:

Representing the fastest growing segment of the sustainable bond market, sustainability-linked bonds have sparked ongoing debate among market participants over materiality and ambitiousness, among other KPI characteristics. The sustainability-linked bonds working group aims to promote transparency and integrity through increasing understanding of KPI materiality and the application of best practice calculation methodologies.

Integrating input from over 90 organisations, the working group has published a registry of approximately 300 key performance indicators (KPIs) for sustainability-linked bonds. This registry, published with a Q&A, provides collated suggestions on how to identify, select and apply KPIs for the purpose of structuring SLBs. The combined documents provide guidance relating to topics such as KPI materiality, target observation dates (and call dates), adjustments to bond financial characteristics, KPI or SPT amendments, and the use of multiple KPIs.

The published registry provides the following detail with relation to illustrative KPIs where relevant:

The updated KPI registry and climate transition methodologies stand to aid issuers to fundamentally and rapidly advance the transition to a low-carbon economy via the bond market and beyond.

The need for credible and science-based decarbonisation targets that follow ambitious yet realistic trajectories is clearer now than ever. As the sophistication of the market’s understanding of the subject has increased, so has the volume and complexity of guidance available. In recognition of the importance that methodologies are both grounded in science and reasonably applied, the Climate Transition Finance Working Group has published a registry of Climate Transition Finance (CTF) Methodologies.

While the publication does not act as a comprehensive source for all tools that issuers, investors and financial intermediaries may use, the registry aims to guide these parties in the appropriate use of tools covered, specifically in the context of Element 3 of the Climate Transition Handbook (CTFH). The registry provides categorisations, including target institution type and sector and sub-sector applications. The publication is viewed as “live” and is expected to evolve as requirements relating to the validation of specific emission reduction pathways, as well as scientific understanding of the underlying issues, change over time.

Additional publications announced at the AGM include: new metrics for impact reporting (Green Projects relating to environmentally sustainable management of living natural resources and land use, and Social Projects including an enhanced list of social indicators and impact confirmation on target population), updated high-level mapping to the UNSDGs, a recommendations paper proposed information template for providers of Green, Social and Sustainability Bond index services, and a Pre-issuance Checklist for Green Bonds/Green Bond Programmes.

All new or updated documents released following the AGM:

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more