- Name:

- Juho Kostiainen

- Title:

- Nordea Economist

Export prices in Finland have kept up with rapidly rising import prices, keeping the country’s terms of trade unchanged. Zero-emission electricity generation is becoming a source of competitive advantage in manufacturing, which supports investment growth.

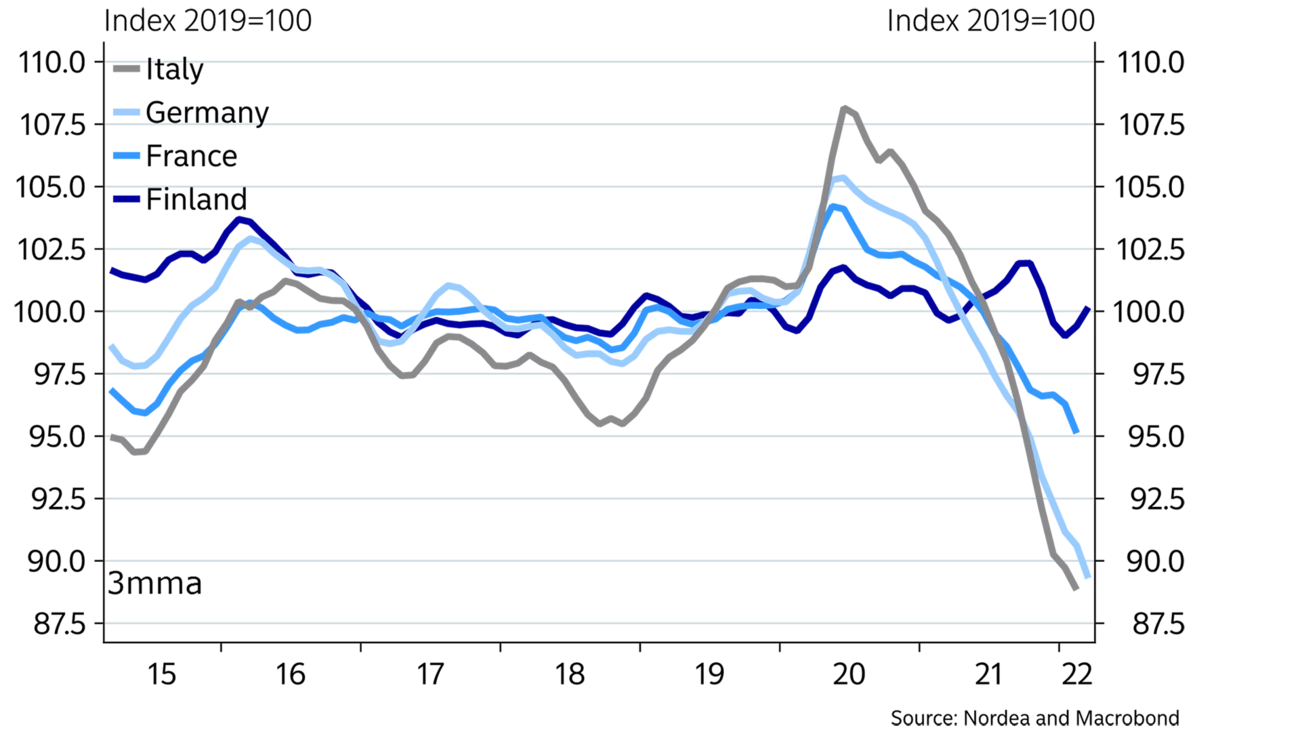

The global increase in prices of energy, commodities and materials has created cost pressures and chipped away at the profitability of many businesses. At the same time, commodity and material producers are on a record-breaking run. While import and export prices have risen in tandem in Finland, many other European countries have seen their terms of trade decrease significantly over the past six months. The eurozone goods trade surplus showed a hefty decrease during the same period.

The structure of Finnish exports has been somewhat favourable in terms of the rising global prices. Around half of Finland’s goods exports consist of commodities, fuels and manufactured materials, such as metals and paper. The export prices of metals are up by about 50% year-on-year, while the price of paper, too, has risen by 27%. Oil refining margins are also higher. Machinery and equipment manufacturing, one of the pillars of industry, has seen export prices rise moderately and is suffering from component shortage.

Zero-emission electricity is becoming a source of competitive advantage for Finland.

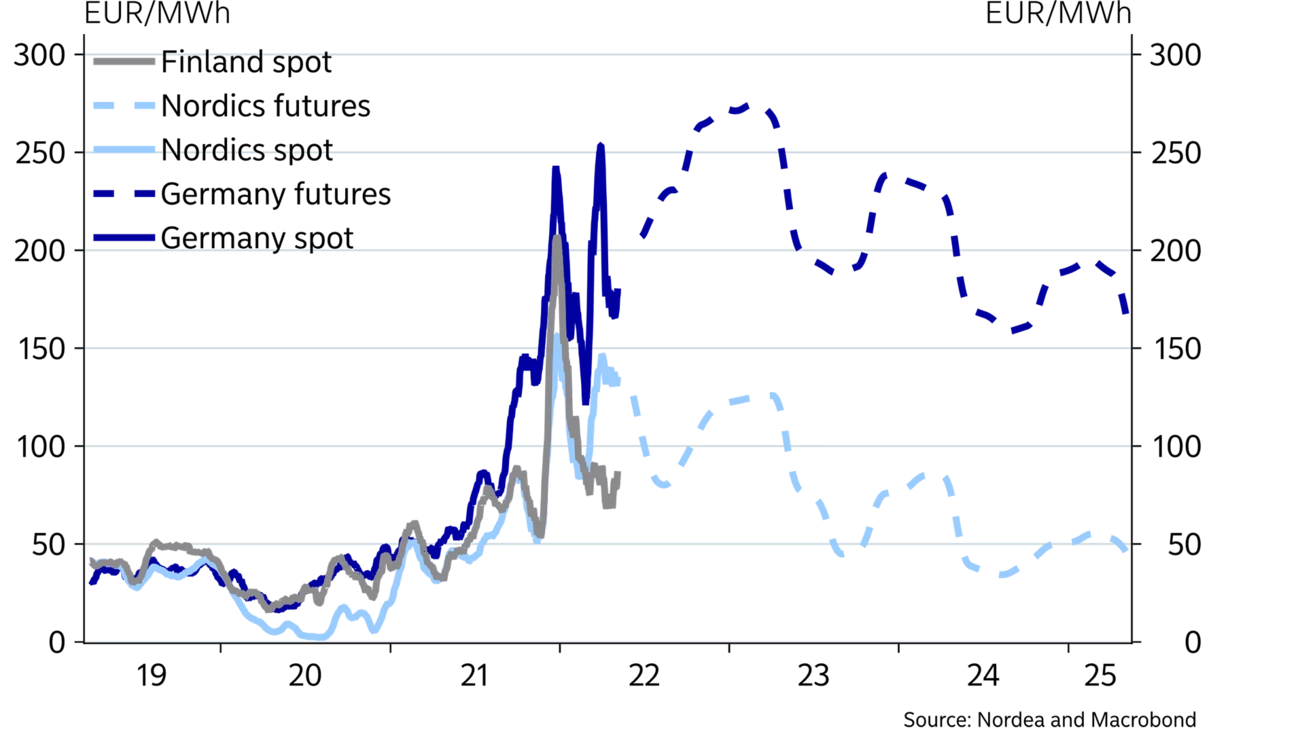

Electricity prices hit record-highs in both Finland and Central Europe due to several simultaneous factors. In Finland, the price of electricity has now clearly declined, and the Nordic power futures indicate that it will continue to fall below 50 euros per megawatt-hour.

In Germany, the price of electricity has remained elevated due to the high cost of fossil power production as a result of the war in Ukraine. Moreover, the high prices of emission allowances raise the cost of electricity from fossil fuel-powered plants.

Finland will become self-sufficient in electricity, and power generation will be entirely fossil-free in the next couple of years once the new nuclear reactor becomes operational and the country’s wind power capacity doubles. Onshore wind power generated in Finland is, in fact, one of the cheapest ways to increase zero-emission power in Europe and get rid of Russian energy imports. Clean electricity will enable investment in profitable and environmentally-friendly manufacturing in Finland in the future.

Moderate wage growth over the past few years has, together with higher profitability growth, enhanced Finland’s cost competitiveness. This is reflected in the current account balance, which is now positive, and in labour’s lower share of the national income – in other words, a decrease in real unit labour costs. In recent months, terms of trade-adjusted unit labour costs have been trending very positively in relation to competitors, and the current wage deals further reinforce Finland’s competitiveness.

With regard to cost competitiveness, it is, however, good to keep in mind that the rise in export prices may turn out to be temporary if the balance between commodities demand and supply is restored. Wage increases should therefore not be based on a short-term rise in prices. For some companies, higher prices reduce their ability to pay wages, as production costs increase. This means that payroll capacity varies highly from sector to sector.

This article originally appeared in the Nordea Economic Outlook: Under Pressure, published on 11 May 2022. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more