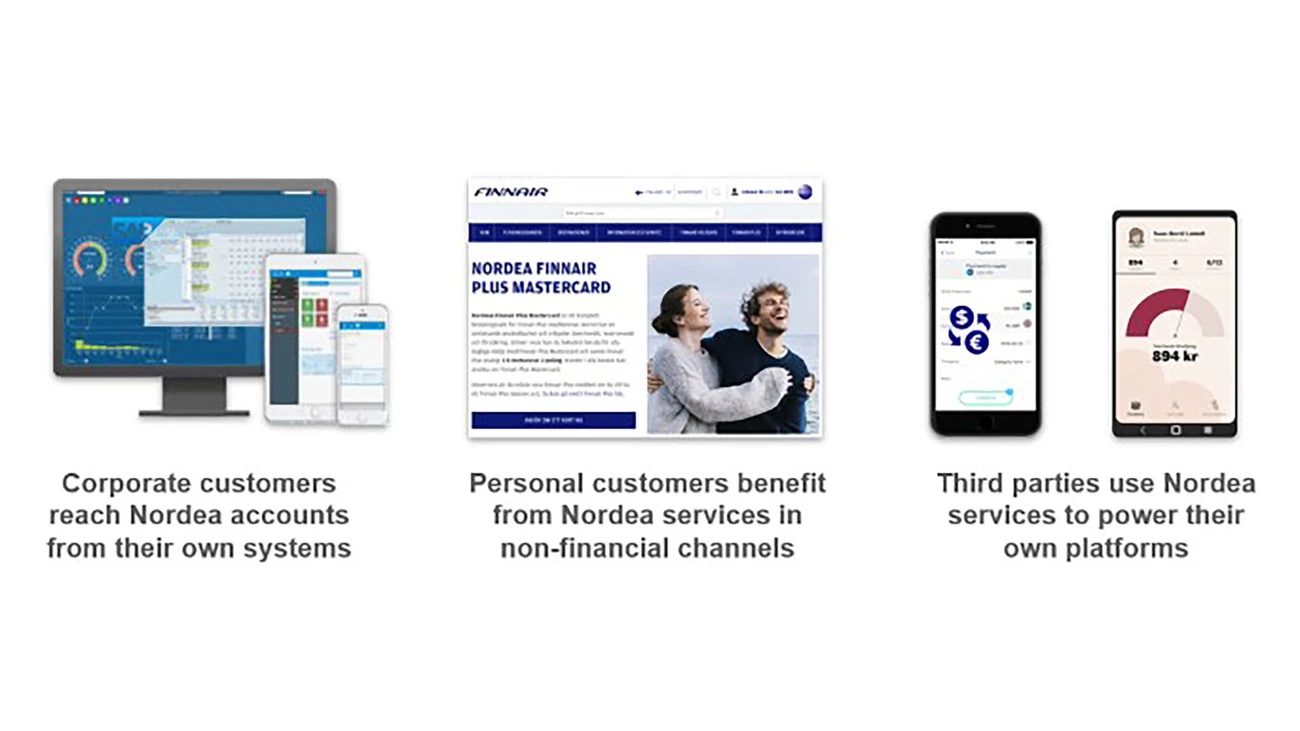

Embedded finance

Is defined as financial services that make up part of an offering from a non-financial service provider, but are provided in the background by a bank or another kind of financial service provider.

The user does not necessarily connect directly with the financial service provider, instead the financial service is embedded within an activity or process.