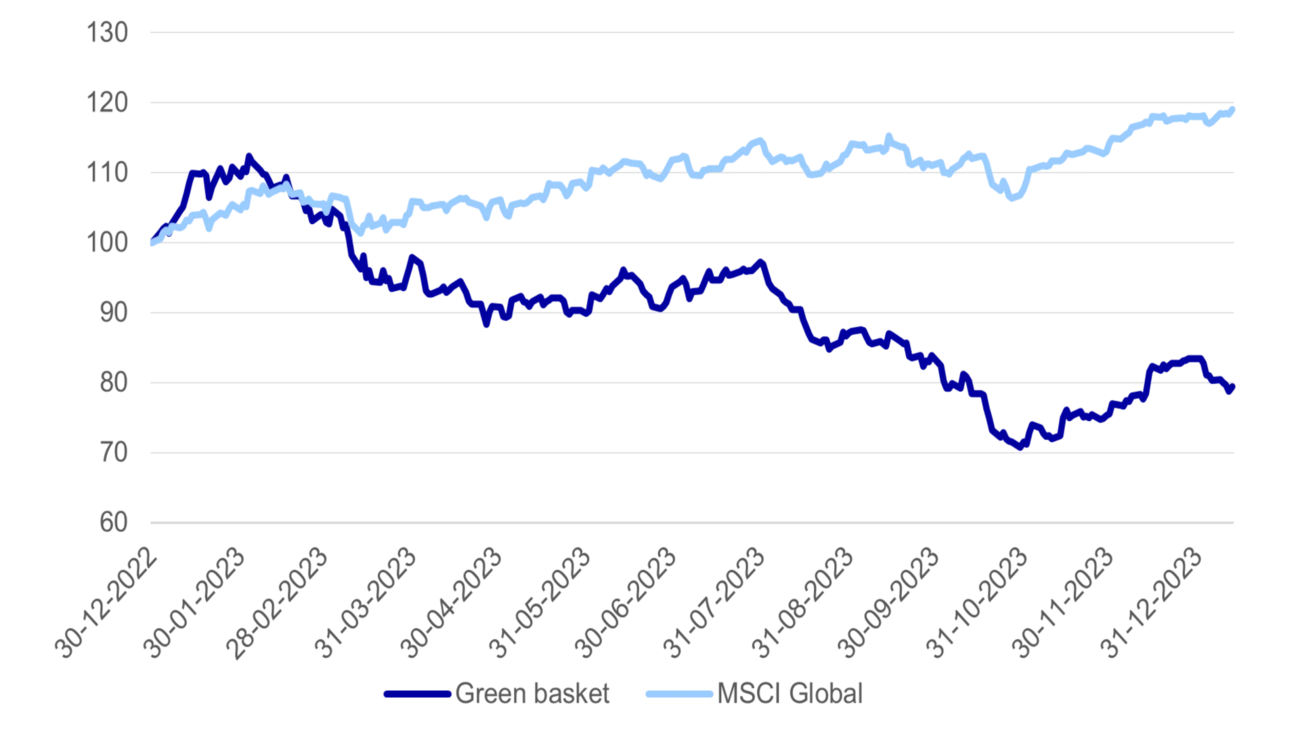

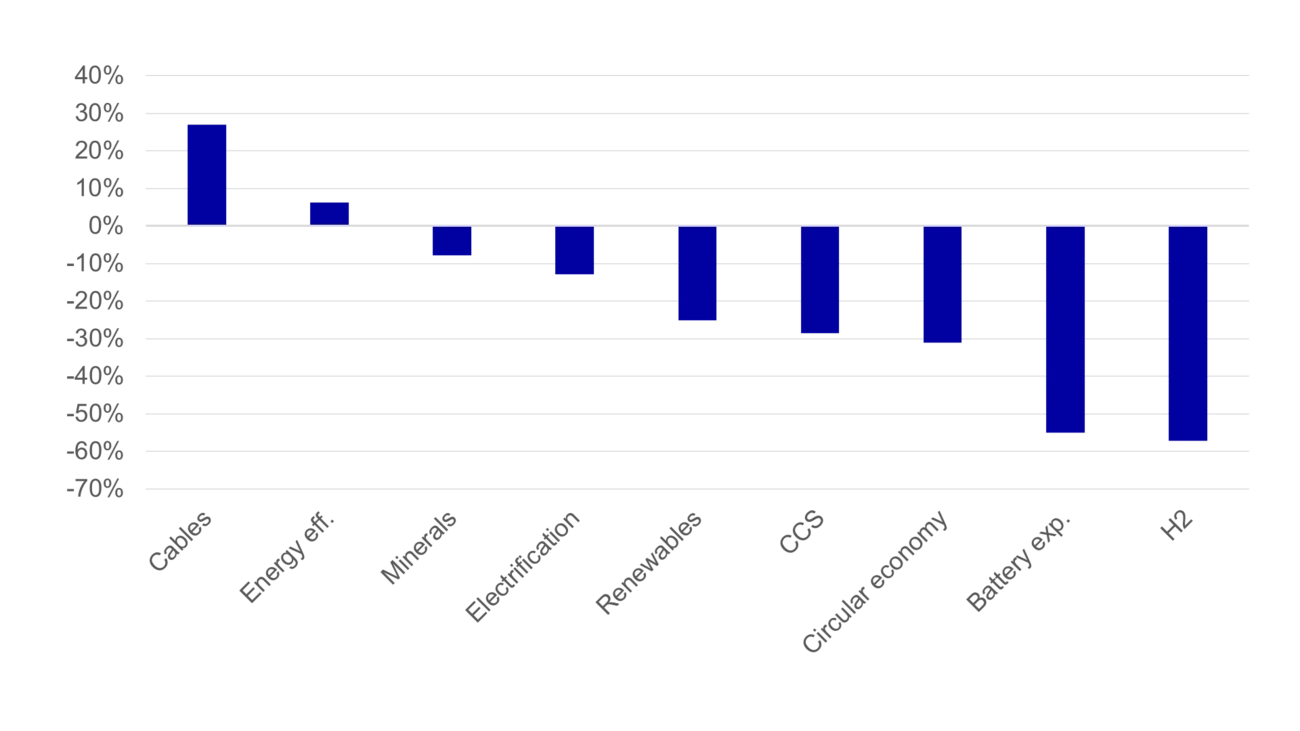

However, the difficult years are behind us, according to Kisic. He sees four main reasons for past underperformance in the space and argues that these headwinds are now receding or turning.

1. Interest rates

Cleantechs are extra sensitive to changes in interest rates, due to their cash flow and growth profiles. With central banks raising interest rates rapidly to fight inflation, cleantechs have felt the pain. The normalisation of interest rates should be especially powerful for this group of companies.

The ESG team assesses the interest rate sensitivity of these companies based on their cash flow duration, in other words how long it will take for future cash flow to materialise. Nordic cleantechs have a duration around 20% longer than the market. In general, stocks with a long cash flow duration should outperform in an environment of falling interest rates, Kisic says.

2. Inflation

Cleantechs have suffered from higher inflation, due to higher input costs, for example, for materials for the wind industry. What’s more, against an inflationary backdrop, consumers have been less inclined to choose premium products. Falling inflation should bring some relief.

3. Policy uncertainty

In addition to higher rates, cleantechs have also faced policy headwinds. Kisic argues that several policy “mistakes” in 2023 left the market questioning policymakers’ commitment to the transition. He cites the UK’s fifth offshore wind auction, in which the price of the contract was not adjusted to reflect inflation, resulting in no bids. He also points to the debacle around Germany’s gas boiler ban.

With some policy U-turns in the right direction, the ESG team sees positive policy momentum in certain segments, such as wind power.

4. Operational risk

Operational issues have also hampered cleantech companies, especially in the wind industry. These issues have included equipment issues, delays and quality concerns. While such problems are quite idiosyncratic and company specific, Kisic argues that these operational risks should diminish as the technologies mature.

“We expect to see some normalisation in 2024,” says Kisic.