- Name:

- Kjetil Olsen

- Title:

- Chief Economist, Norway

Activity in the Norwegian economy has flattened, unemployment has crept up slightly from a very low level and inflation is gradually on the way down. Coupled with a somewhat stronger NOK, this will pave the way for moderate rate cuts from Norges Bank after the summer. Good profitability in the manufacturing sector and a continued tight labour market will lead to high wage growth this year. Slightly lower interest rates, continued high wage growth and low unemployment will gradually improve households’ purchasing power. We therefore foresee better times ahead for both the Norwegian economy and the housing market. The NOK will likely perform better than last year thanks to lower inflation and lower interest rates abroad, but geopolitical challenges lurk.

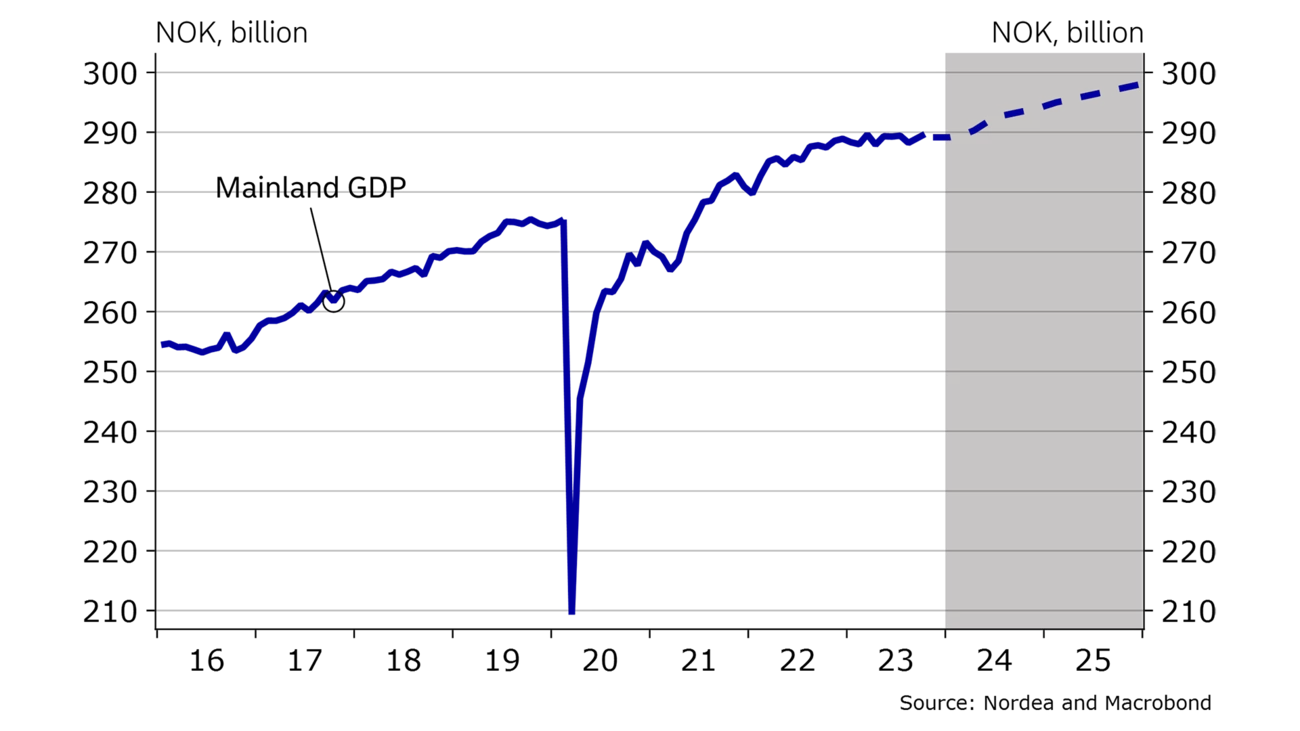

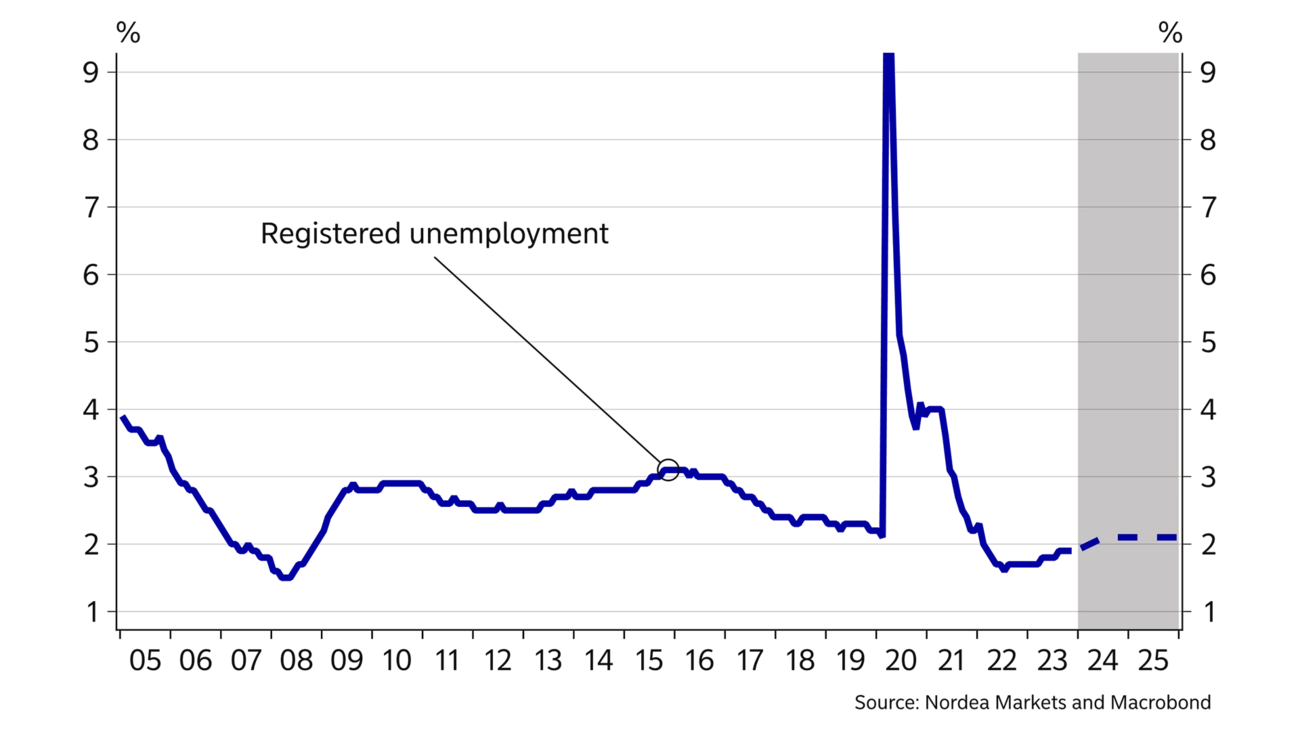

Last year, the Norwegian economy showed greater resilience to higher rates and inflation than widely expected. Economic activity measured by mainland GDP rose an estimated 1% in 2023. Registered unemployment rose slightly through last year from a low of 1.7% to 1.9%, mainly owing to higher unemployment in the construction sector. Unemployment is still lower than before the pandemic and overall employment has continued to rise. The NOK has also surprised. Higher than expected interest rates abroad and lower energy prices contributed to a sharp weakening of the NOK through much of the year. This is one of the reasons why inflation remains high. Overall consumer prices rose 5.5% from 2022 to 2023, in line with wage growth. Despite clearly higher wage growth than the year before, 2023 will likely be a year without wage growth in real terms. A solid policy rate increase from 2.75% in January to 4.5% in December weakened the purchasing power of everyone with debt. Housing prices defied the rate hikes and ended the year almost where they started. All in all, housing prices have barely declined since the peak in the summer of 2021 despite one of the most rapid and aggressive rate hike cycles ever.

The central bank’s rate hikes may thus seem to have had little effect. But it takes time before the full effect of rate hikes feeds through, especially in the wake of the pandemic. The rate cuts in 2020 increased disposable incomes for everyone with debt, at the same time as spending was limited by the measures to contain the virus. Consequently, savings sky-rocketed. Rate hikes and high price growth have reduced purchasing power, but savings have declined again. For a long time, consumption was therefore not as negatively affected as many had expected. Savings will hardly fall as much going forward, and the effect of the latest rate hikes will thus be more pronounced until the summer. The financial situation of many households will get a bit worse before it gets better.

Many Norwegian households have experienced a sharp decline in purchasing power in recent years versus the pandemic period when the policy rate was zero. Given the latest rate hike in December, continued high inflation and slightly higher unemployment, households are likely to spend less in the coming months, adding to the somewhat weak overall trend in the Norwegian economy. But over the course of this year, many should benefit from gradually improving purchasing power. The vast majority will most likely experience that wages will rise more than prices this year and the next. Coupled with an exit from rate hikes, this will strengthen purchasing power. Also, most people will still be in work. This suggests stronger consumption after the wage increases in the summer.

NORWAY: MACROECONOMIC INDICATORS

| 2022 | 2023E | 2024E | 2025E | |

| Real GDP (mainland), % y/y | 3.8 | 1.1 | 1.0 | 1.5 |

| Household consumption | 6.2 | -0.5 | 1.5 | 1.7 |

| Core consumer prices, % y/y | 3.9 | 6.2 | 4.2 | 3.4 |

| Annual wage growth | 4.3 | 5.6 | 4.8 | 4.0 |

| Unemployment rate (registered). % | 1.8 | 1.8 | 2.1 | 2.1 |

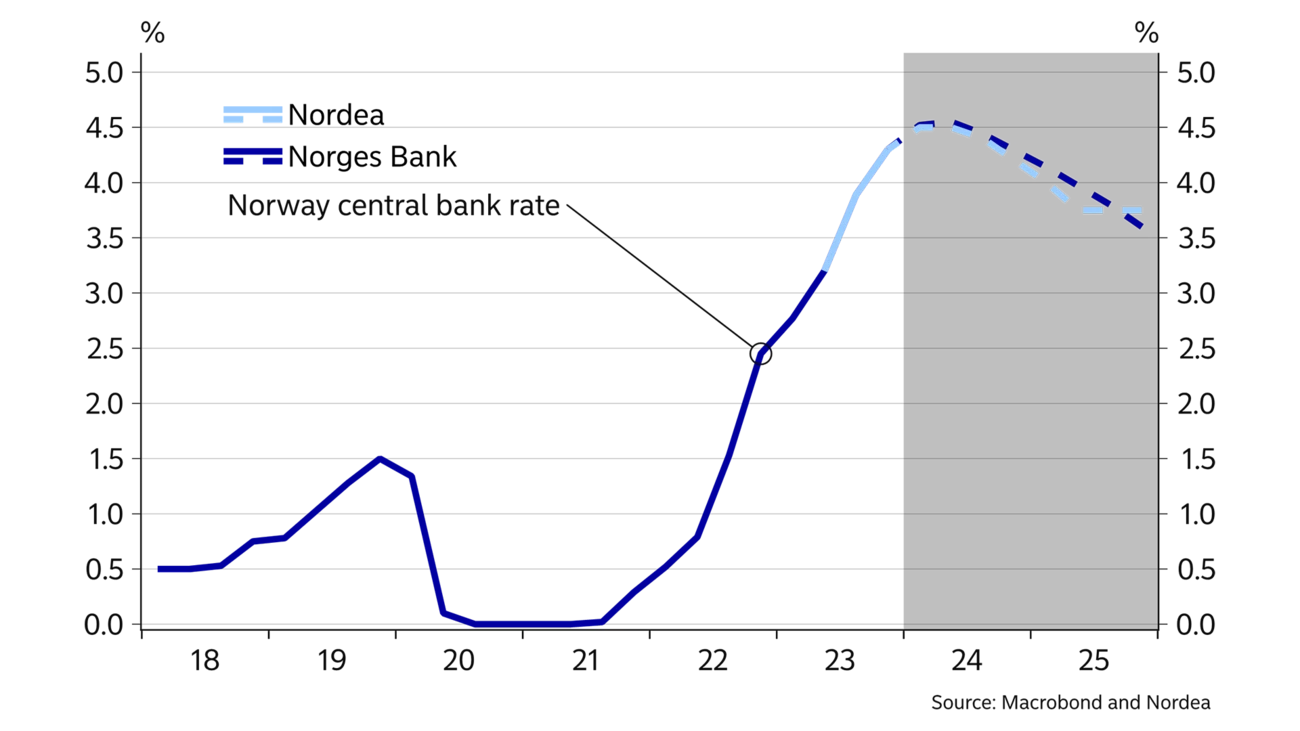

| Monetary policy rate (end of period) | 2.75 | 4.50 | 4.00 | 3.75 |

| EUR/NOK (end of period) | 10.00 | 11.20 | 11.00 | 10.50 |

Demand for higher real wages will dominate this year’s pay talks.

We expect Norges Bank to cautiously start lowering its policy rate after the summer. This will boost purchasing power further towards the end of 2024 and in early 2025. Given households’ improved finances, both the service sector and retailers should enjoy better times. Coupled with high oil investments and strong growth in petroleum-related businesses, we are thus cautiously optimistic about the Norwegian economy.

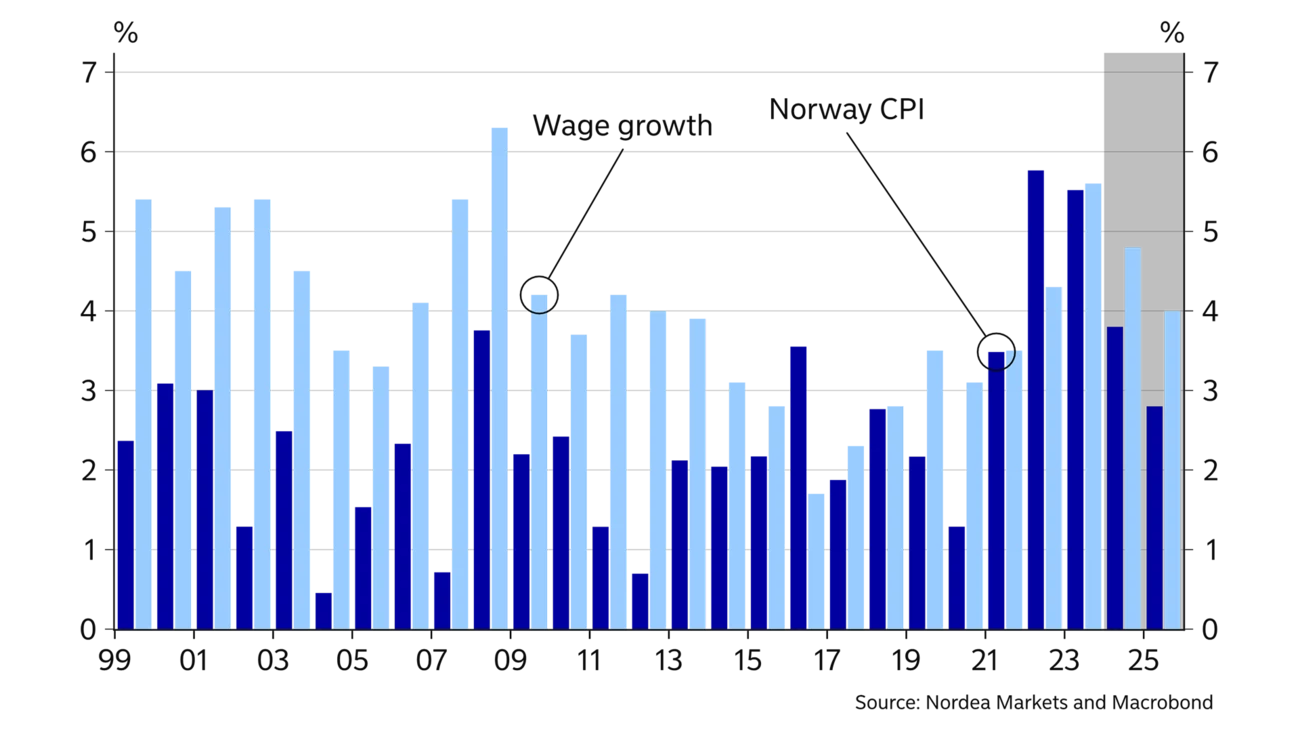

Annual wage growth will likely be close to 5% this year – clearly higher than our price growth estimate of close to 4%. Last year, price growth was higher than assumed during the pay talks. The majority therefore also missed out on the anticipated real wage increases last year as well. This is likely to impact this year’s pay talks.

This year's pay round is a main settlement where all themes are in principle open for negotiation. We expect wages to be this year’s main focus area, with the trade unions having clear expectations of a sharp real wage increase after many years where inflation has eroded wage growth. Also, some of the key wage-leading sectors have experienced sharply improved profitability, mainly because the NOK weakening has boosted the profitability of export-oriented businesses. In manufacturing, the wage share (wages expressed as a share of value creation) is at its lowest in decades. In line with the Norwegian model for wage settlements, wage earners should have their rightful share of profits – indicating higher nominal wage growth for a given price growth level this year than previously. Although nominal wage growth should be lower in 2024 and 2025 than in 2023, a faster price growth drop will indicate positive real wage growth and improved finances for Norwegian wage earners in the years ahead.

In 2023, overall inflation slowed to 5.5% from 5.8% in 2022. This year, the slowdown will likely be faster. Lower food and energy prices and base effects will contribute to a further decline in inflation. With continued high wage growth, however, it will take time before inflation approaches 2%.

The NOK is a wild card for the pace of inflation. It usually takes 6-12 months before changes in the NOK exchange rate impact imported inflation. Many importers are likely to be uncertain and hesitant to cut prices even if the NOK firms to make up for last year's margin losses after the strong and surprising NOK weakening. This suggests that it could take longer before we see the benefits of lower inflation abroad and a stronger NOK.

Continued high growth in rents will also slow the decline in inflation. Rents make up about one-fifth of the consumer price index. According to Statistics Norway, rents rose 4% from 2022 to 2023, after having risen just 2% the year earlier. Many rents are CPI-adjusted every year in line with the Norwegian Tenancy Act. By comparison, overall inflation has been well above 5% in recent years. Statistics Norway’s rent figures measure rents at a time lag; the figures from Real Estate Norway show growth of 7.7% y/y in the large cities in 2023. This may indicate that rent growth in the CPI will accelerate further and thus curb the decrease in overall inflation going forward.

With the addition of continued high wage growth, it could therefore take a long time before core inflation again approaches Norges Bank’s target of close to 2%. Inflation will likely not drop below 3% until the end of 2025.

Norges Bank hiked its policy rate to 4.5% in December and signalled that it will stay unchanged for quite some time. According to the central bank, the first rate cut is not likely until the end of 2024. Norges Bank still worries that inflation and wage growth could take hold at an elevated level, although economic pressures have eased.

Norges Bank is particularly worried about the NOK, and the weakening ahead of last year’s December meeting was a main reason why the central bank went against the tide and hiked its policy rate once more. However, this time the interest rates hike had an effect on the NOK, which is now somewhat stronger than assumed in Norges Bank’s analyses. If the NOK stays at current levels, we believe that Norges Bank may start to reduce its policy rate cautiously as early as in September. Further weakening of the NOK is the main risk that could postpone the first rate cut beyond the time estimated in this report.

Once the rate cuts are imposed, they will most likely not be very sizeable. We expect only three rate cuts in 2024 and 2025 in total. Too many domestic rate cuts could lead to renewed economic pressure. It will not take many rate cuts to refuel households’ demand for goods and services and drive up housing prices. Also, the NOK strengthened after the December rate hike, because Norges Bank increased its policy rate, while other central banks started to talk about rate cuts. With the same number of rate cuts in Norway as in other countries, the NOK could soon weaken again. This suggests that Norges Bank will be cautious about cutting rates – pos-sibly trailing other central banks.

Housing prices have been surprisingly resilient in recent years given Norges Bank’s rate hikes. Seasonally adjusted, housing prices have basically been unchanged since the peak in the summer of 2022. Housing prices will likely flatten towards the summer or fall a bit before rising again. Higher wage growth indicates higher price growth, but the current housing price level still does not reflect Norges Bank’s most recent rate hike. However, a stabilisation of the interest rate level could ease some of the uncertainties rooted in the housing market. It would not take many rate cuts to boost sentiment in the housing market. Probably not least in Oslo, where very few new homes have been built lately. Housing prices could thus rise again once the rate cuts are finally sanctioned, with better times ahead for construction companies.

We are more optimistic about the NOK this year, but it faces multiple risks.

The NOK performance was a nightmare in much of 2023. Lower energy prices and a clearly narrower interest rate gap between Norway and other countries were some of the main drivers of the NOK weakening. It has been questioned whether interest rate decisions really affect the NOK. However, the last weeks of 2023 showed how much the interest rate gap impacts the NOK exchange rate. Norges Bank's somewhat surprising rate hike coupled with the Fed’s rate cut talks boosted the NOK at year-end.

As usual, future NOK trends are uncertain, but we are more optimistic this year than previously. A further decline in inflation abroad will pave the way for rate cuts in the US as well as in Europe. Coupled with increased oil investments, which lead to increased demand for the NOK, an improved interest rate differential could result in a slightly stronger NOK longer out. The best outcome for the NOK would be a dream scenario where abating inflation leads to lower interest rates while economic activity picks up globally and energy prices are high. The biggest risk to the NOK would be price growth abroad surging again, with expected rate cuts in other countries being cancelled. Near term, the heightened geopolitical tensions, not least in the Middle East, are a major risk factor. If the conflict in the Middle East spreads, we could soon see a new energy price shock. In a low-inflation world, higher energy prices would likely be good for the NOK. But with high inflation from the outset, the situation could be different. Central banks may encounter higher energy prices and in-creased inflation with persistently high interest rates. Recent years have shown that the NOK does not al-ways benefit from a sharp rise in energy prices.

Find out more about the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more