A new common front-end system for integrating external partners was introduced over the past 12 months

Erik Sønsterud, CEO at Elkjop Nordic AS

Siden findes desværre ikke på dansk

Bliv på siden | Fortsæt til en relateret side på danskThe COVID-19 pandemic accelerated the omnichannel strategy of Nordic consumer electronics retailer Elkjøp. CEO Erik Sønsterud discusses the company's approach to creating a seamless online and in-store customer journey.

The omnichannel strategy of consumer electronics retailer Elkjøp has been in high gear ever since the pandemic sent footfall in its stores falling. Elkjøp CEO Erik Sønsterud (ES) explains why consumers' behavioural changes and the additional shift to online purchases during the pandemic will be permanent and how Elkjøp is responding. He also discusses what will be the critical differentiators for tomorrow's successful retailers in this interview with Nordea Thematics's Johan Trocmé (JT) in the latest Nordea On Your Mind: E-commerce - The new normal.

JT: Being the leading consumer electronics retailer in the Nordic region, how would you briefly describe your omnichannel strategy?

ES: We are very aware that the customer journey starts online. This makes the online experience critical both for driving online sales and footfall in our stores, and it needs to be integrated into a seamless customer journey. It should be very convenient for the customer to make a purchase with click-and-collect, and in the store we should offer advice and any accessories or consumables the customer did not think of ordering when making the online purchase.

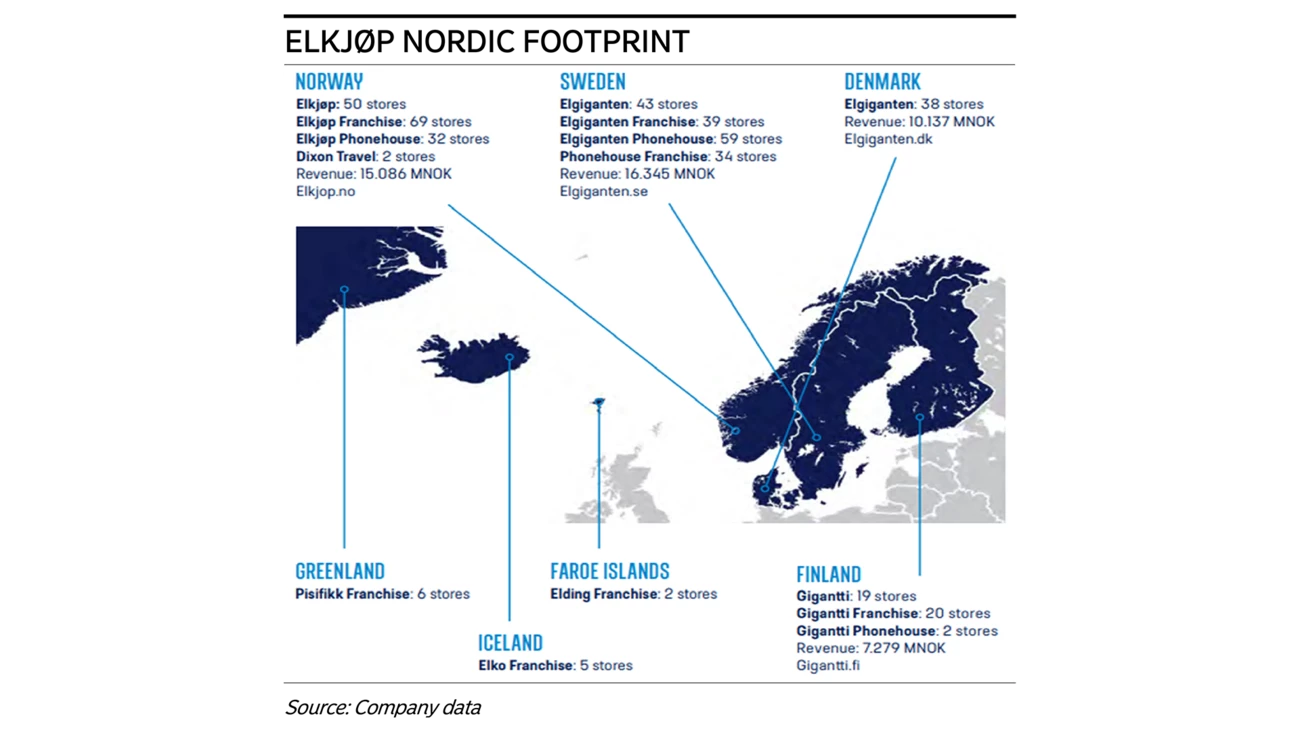

We want to make the best possible use of our stores and our 11,000 employees to help customers find the right products and services to meet their specific needs. And the customer should be able to buy them in the store or online, whichever they prefer. With our presence in some 400 cities in the Nordic region, we are able to offer click-and-collect within 30 minutes for online purchases throughout the Nordic region. This is made possible by optimising the use of our stores and our centralised warehouse in Jönköping, Sweden, with a view to consider additional distribution centres in major cities to free up space in our stores for inspiration and showcasing. We have a broader assortment online than in our stores, and our advisors are available to help customers in the online store as well.

To make this possible, we have over the past 12 months replaced the front-end system for all our salespeople and modernised all national e-commerce platforms and integrated them into this common platform in which we see all our inventory and customer data. Our financial service providers, such as banks, and our delivery partners are also plugged into the same system. It all blends into one omnichannel for the total customer journey, from exploratory browsing to installation and user support. Live shopping and ship-from-store are two very important elements of this setup.

Erik Sønsterud, CEO at Elkjop Nordic AS

JT: How did the COVID-19 pandemic affect your business, and how did you respond?

ES: The pandemic has accelerated our omnichannel strategy. The earliest steps we took included improving and expanding click-and-collect, allowing customers to purchase online and pick goods up safely in the parking lots outside our stores. Contactless payments was another quick measure, as was live shopping, giving customers access to human advisors when shopping online.

Although the Nordic countries lagged behind Europe in forcing stores to close during the pandemic, our online sales saw growth of 80% during the pandemic, as customers to a great extent opted to avoid stores anyway. Footfall in our stores fell sharply, but conversion rose. Customers browsed online, and turned up at our stores only to pick up what they had ordered. Online sales growth has come back down from those extreme levels now, but from a higher established level after the pandemic. From a starting online share of sales of some 15% prior to COVID-19, we saw the share rise to 30%, and now running around 25%.

The online share of sales was 15% pre-pandemic, 30% during the pandemic, and is now 25%

Customers have migrated more online, but now also have higher expectations for the online experience which have to be met.

JT: Do you think behavioural changes by consumers during the pandemic will be permanent? Have you changed your online approach and priorities after the pandemic?

ES: We believe the additional shift to online purchases by consumers is permanent. We expect customers to continue to increasingly start their journey by browsing online, and that this will in many cases lead to a store visit and an in-store experience. We and other retailers need to offer a strong customer experience in the browsing stage through our front end, and then use customer data and insights to customise and optimise the subsequent in-store experience.

As consumers have embraced online shopping even more strongly during the pandemic, their expectations have also risen for their online experience and fulfilment of purchases, across the entire chain from browsing through to payment and delivery. And sustainability has at the same time grown to be very much top of mind for the customer. This applies to products, which should be possible to repair and recycle, and be manufactured from responsibly sourced materials and components. And it applies equally to retailers, who screen their assortment and provide a platform for repairs and recycling.

Before the pandemic, the consensus among consultants was that the death of the physical store was imminent, with developments in the US and the UK offered as pointers for what was to come. And we did indeed see that online shares of retail sales are around 50% in these markets, which we believe will reach similar levels in the Nordic region over time. But having said that, our belief that the physical stores have an important role to play also going forward has been reinforced further during the pandemic. They add value in several ways, including the showroom and inspiration aspect, as well as logistical support for quick delivery. They are also an enabler for local language interaction with customers, which is a differentiator against global e-tailers such as Amazon. We are still opening stores in new areas which are 'white spots' for us, and we see both our offline and online market shares grow when we do.

Last-mile delivery, assembly and installation are not core competencies, and are sourced externally from partners.

JT: What is your thinking with regard to e-commerce fulfilment? In-house development and capability for systems, platforms, logistics and delivery, or partnerships or outsourcing to third parties?

ES: We have developed our new front-end platform inhouse, but with help from consultants. With this platform, we have linked up external partners. We run the core of our logistics in-house, including the flows from our central warehouse to our stores and to our distribution hubs. But for final deliveries to customers from hubs and from stores, we rely to a great extent on partners. There is now a number of good players in this space, who are able to hook up and integrate with our platform. From the customer's point of view, they should only need to interact with Elkjøp in a simple and convenient way. But last-mile delivery, assembly and installation will in most cases be executed by our partners. We know the products and their use, but our core competencies do not include the skillsets of plumbers or electricians. And then it is better for us and for the customers if we outsource these parts of the customer experience.

Most retailers should be able to afford to develop or buy in a front-end online sales platform, but a distribution footprint can be a barrier to entry where scale helps. In Nordic countries with low population density you need to achieve reasonable economics for nationwide delivery. The distance between Oslo and northern Norway is roughly similar to the distance from Oslo to Rome, which is a logistical challenge. You either have the resources to build that distribution infrastructure yourself, or you rely on a logistics partner. Just as an example, Amazon has not built an in-house footprint in Sweden, but relies on PostNord as one of its partners.

Price will be a hygiene factor, not a differentiator.

JT: What do you think will be key differentiators for retailers going forward? Price? Brand? Scale? User experience/fulfilment? Other factors?

ES: I think it is hard to pinpoint just one, because several will be very important. I would not say price, because that is very transparent already today, particularly for consumer electronics. It is a hygiene factor that simply has to be competitive. Being relevant will mostly be about being able to help your customer. A strong brand can help you be perceived as a sustainable and a responsible player that customers want to buy from. A simple and seamless customer journey will be crucial, which requires a good front-end solution and logistics.

And this could grow even further in importance from a continued evolution towards subscription-based business models, where customers pay for their actual use, instead of buying the equipment in the traditional way. We have started to see the first steps in this direction for mobile phones, with swap and switch schemes, and subscription packages containing call and data charges, the phone, insurance and upgrade options in one monthly fee. This will likely grow to include other product categories, not least through the continued evolution of smart homes with connected appliances and other devices. With rapid technological development, there could be an even greater need to get access to the latest products, and to receive support for connection and installation. And for subscription-based solutions, access to the end customer and insights about usage patterns and preferences will be crucial.

For a simple product such as a toaster, there may not be a huge need for much more than to offer it competitively on display. But I think for more complex products and solutions, a user-friendly seamless customer journey comprising both online and in-store browsing, advice, delivery and support will be key for a consumer electronics retailer to be successful going forward.

A seamless online and in-store customer journey will be even more important as subscription-based models for usage evolve as an alternative to traditional purchases.

Human connectivity has soared over the past decade, offering new online solutions for our private and work lives. In the report E-commerce and Corona from Nordea On Your Mind, we explore the COVID-19 pandemic's disruption of business models and turbocharging effect on e-commerce.

Nordea On Your Mind is the flagship publication of Nordea Investment Banking’s Thematics team, which produces research for large corporate and institutional clients. The research does not contain investment advice and typically covers topics of a strategic and long-term nature, which can affect corporate financial performance.

Top decision makers at Nordea’s large clients across the Nordic region receive Nordea On Your Mind around eight times per year. The publication’s themes vary widely, and many are selected from suggestions by clients. Examples of covered topics include artificial intelligence, wage inflation, M&A, e-commerce, income inequality, ESG, cybersecurity and corporate leverage.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more