"Online retail sales growth should remain muted until we see easier comps in early 2023, after which the pre-COVID rising online penetration trend should resume."

Daniel Ovin, Senior analyst at Nordea Equity Research.

Sivua ei ole saatavilla suomeksi

Pysy sivulla | Siirry aiheeseen liittyvälle suomenkieliselle sivulleThe COVID pandemic helped online retail come of age in the Nordic region. Daniel Ovin from Nordea Equity Research discusses what to expect next in this interview from Nordea On Your Mind: E-commerce - The new normal.

Nordea Equity Research's Daniel Ovin (DO), who covers companies with online business models, says traditional retailers and investors now have more faith in the economics of online retail in the wake of the pandemic. While COVID's extra boost to online penetration has abated, the pre-pandemic trend of a rising online share of sales should resume from next year, he tells Nordea Thematics's Johan Trocmé (JT).

JT: The pandemic turbocharged the online migration of sales in the retail industry as consumers were unable to visit stores. Some of this boost has now subsided, albeit with higher online penetration than before. What do you think the trend will be going forward?

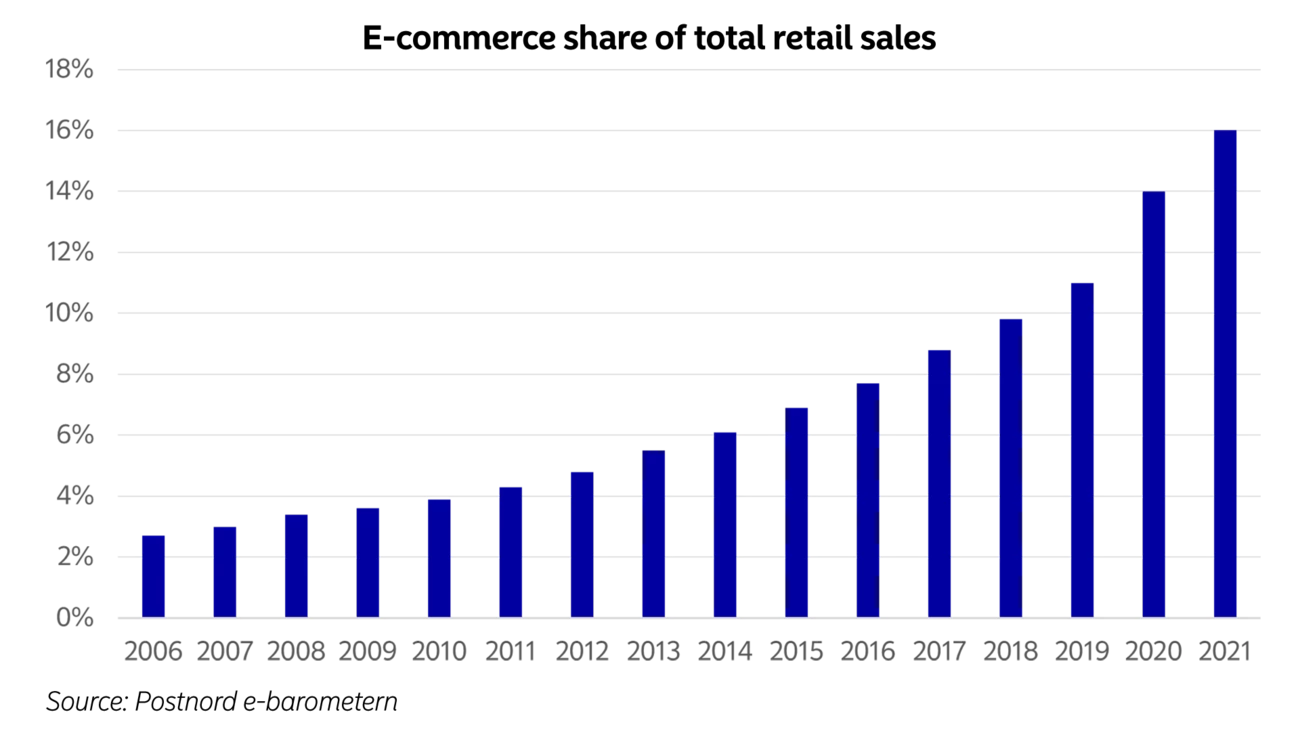

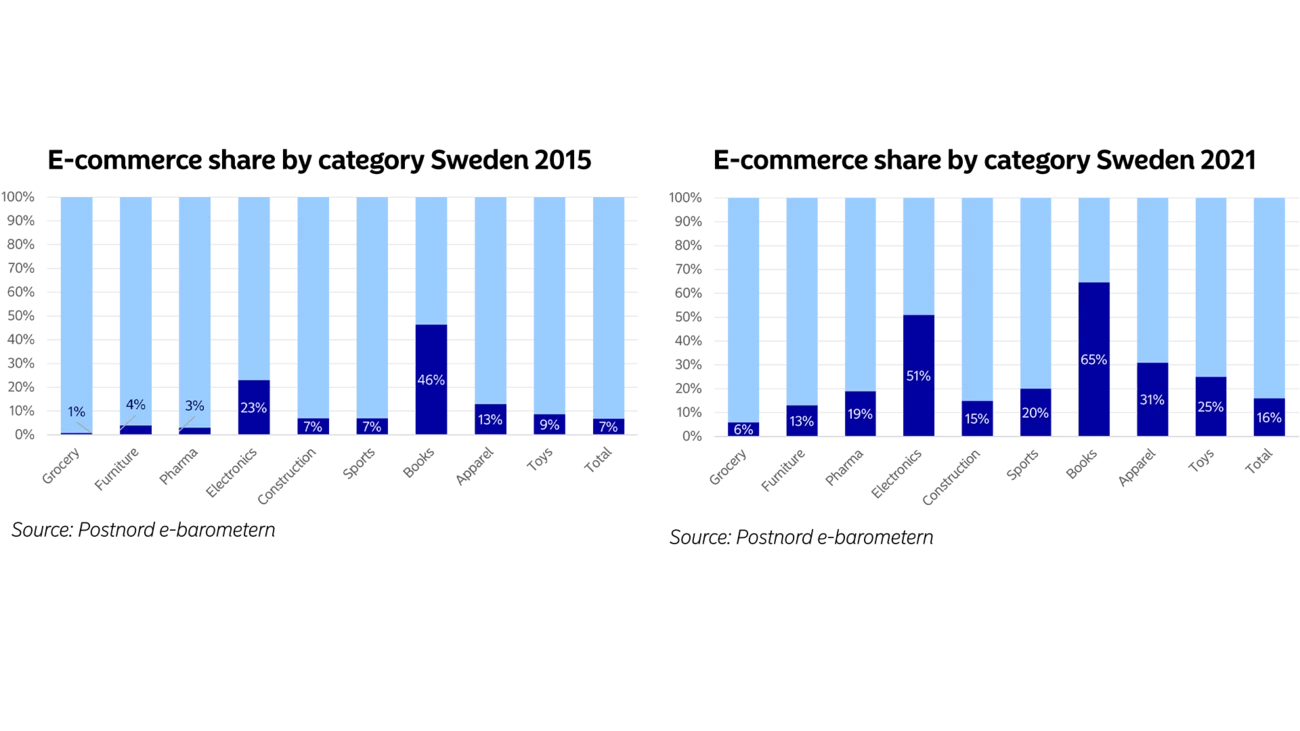

DO: Most physical retail sectors saw strong growth in e-commerce penetration during the pandemic, for obvious reasons, but some more than others. Overall, Swedish online penetration grew from 11% in 2019 up to 14% in 2020 and further up to 16% in 2021, according to PostNord’s e-barometer. Before the pandemic, overall online penetration only grew by around 1 percentage point annually, so there was a clear acceleration in conjunction with the pandemic. The largest relative growth can be found in the grocery space, where penetration increased from around 2-3% in 2019 to 5-6% in 2021 and even as high as 7.4% during Q2 2021. Even in sectors such as clothing, which was already operating at a relatively high level, online penetration grew from around 20% in 2019 up to 31% in 2021, according to PostNord’s e-barometer.

Daniel Ovin, Senior analyst at Nordea Equity Research.

As consumers started to feel secure enough to visit stores towards the end of 2021, some of the pandemic-related online migration reversed again, but not all of it did so. During Q1 2022, Swedish online sales declined by 8% y/y overall, according to e-barometer, while the overall online retail market grew by 2.7%, according to Statistics Sweden. This implies that overall online penetration fell back from 16% during 2021 to around 14.5% during Q1 2022, which still suggests an acceleration during 2020 and 2021, up from the 11% in 2019. During Q2 this year, the overall retail market has been weak and the monthly numbers from Statistics Sweden suggest a slowdown into negative territory. Looking at guidance and communication from Nordic e-commerce companies, it seems as though overall online growth during the quarter has not improved in Q2 from Q1.

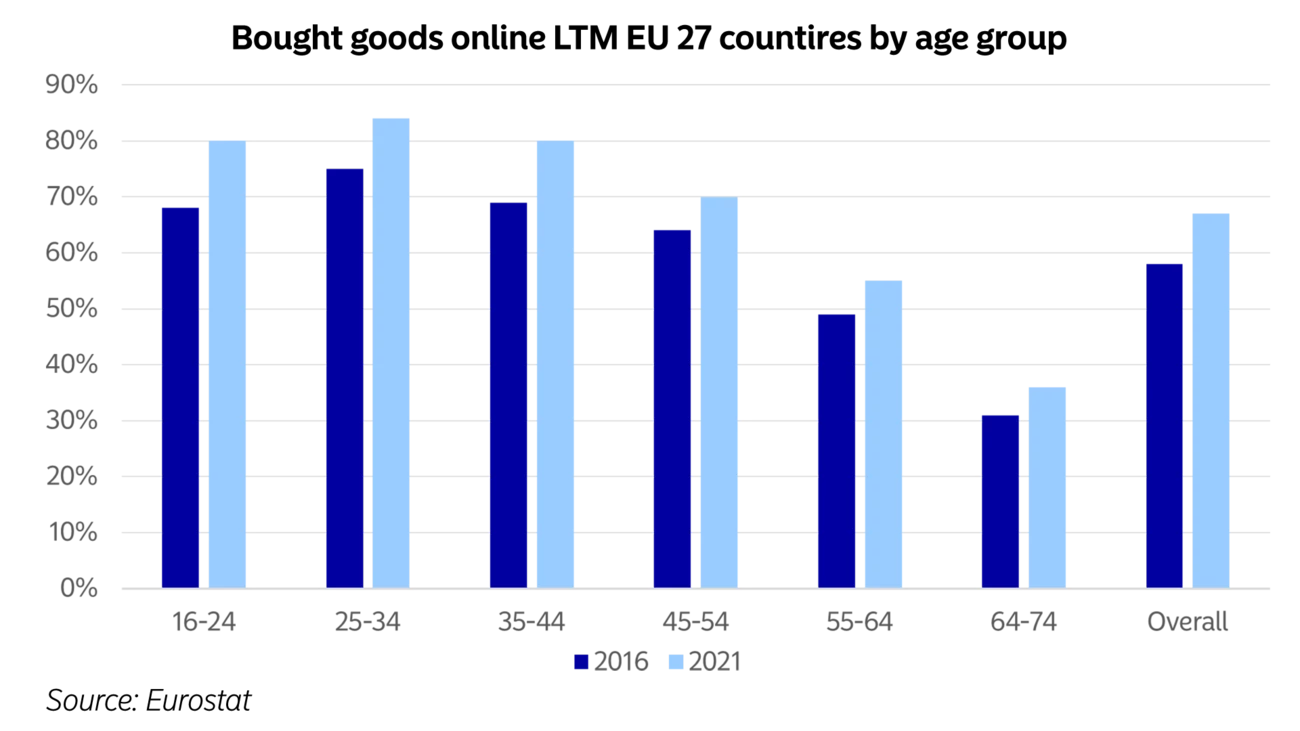

Looking ahead, we think that overall y/y online market growth is likely to stay muted also for the rest of 2022, until the y/y comparison become significantly easier in the beginning of 2023. From this point on, we argue that there are strong reasons to believe that the online market will continue to grow in line with the growth rate we saw prior to the pandemic. According to data from Eurostat, during 2021 only 55% of consumers in the 55-64 age group bought something online and 36% in the 65-74 age group, versus 84% in for 25-34 year olds. It is hence likely that longer-term demographic changes will support further online migration and we have also seen that there is still an ongoing migration in various age groups. In the 25-34 group, the percent that bought something online in 2011 was 65%, growing to 84% in 2021 for example. This is also confirmed by online companies such as Asos, which stated that online clothing penetration in the UK for 20-somethings is higher than 50% versus mid-30% for the overall UK population.

The COVID pandemic created a greater sense of urgency for traditional retailers to have an online offering.

JT: Have you seen any changes in attitudes towards e-commerce among retailers during and after the pandemic? Has the case for online retail altered, and if so, how?

DO: We have the sense that even before the pandemic, most retailers accepted that online was here to stay and is also likely to continue to grow for many more years. As many brick-and-mortar retailers had no route to reach customers during the pandemic, the case to establish a reliable and strong online presence has become even stronger. With growing online penetration and higher density, it has also become easier to operate with similar margins to brick-and-mortar retailers, thanks to scale benefits. Some consumer brands have also chosen to sell on platforms such as Amazon or Zalando to speed up the online route to market, whereas others have also invested in their own online capabilities.

JT: How would you describe equity investors’ view of online retail? How has it evolved since 2019, and what are the key opportunities and challenges today?

DO: Before the pandemic, many Nordic equity investors remained sceptical about online retail, considering it as an inherently low-margin business with low entry barriers. During the pandemic, however, very few new competitors emerged and the established players took the vast majority of the additional pandemic-related online volumes, revealing that sizable barriers to entry had already been established through scale benefits in sourcing, logistics, marketing and consumer data. In addition, established online companies demonstrated that they have the ability to operate with reasonable margins as capacity utilisation grew and marketing expenses fell during the pandemic at the same time as brick-and-mortar players held back on online marketing.

At the moment, investors are again avoiding e-commerce companies, but now mostly for other reasons. Interest rates are moving up, which is not of benefit to growth-driven companies with a significant share of their value lying far out in time. Consumers' consumption in general is also under pressure from a sharp rise in inflation and consumer spending is also migrating from buying goods to services, such as travel and restaurant visits. We believe this trend is likely to continue at least into 2023, but at some point not too far out in time, inflation is likely to have faded and interest rates stabilised, leading to consumer consumption patterns reverting to a more normal mix between services and goods. We believe this is likely to turn investors' attention back to high-growth online retail companies.

Nordic equity investors were wary of online retail before the pandemic, but they have now seen it prove itself commercially.

JT: How do you think macroeconomic uncertainty and concerns about reduced disposable household income from higher interest rates and energy and food price inflation could affect online retail? Any different from general retail?

DO: Higher fuel and transportation costs currently pose a more severe challenge to online retailers, but compensating for this somewhat is that overall online penetration is higher now versus prior the pandemic. This means larger volumes, better scale effects and higher consumer density, which allows for lower transportation costs.

JT: How far do you think the online penetration of retail sales could go? How should retailers think about e-commerce now?

DO: As already discussed, there is a big variability between sectors in terms of the current online penetration, with groceries at around 4-5% versus the clothing space around 30%. But with demographic changes favouring a continued migration online in virtually all sectors, overall online penetration will likely continue to come up. In segments such as clothing, we believe that online penetration will reach above 50% over time, a level we already see in the consumer electronics space. For groceries, with increasing automation and higher consumer penetration, reaching levels of more than 20% is likely in areas that are reasonably well populated, in our view. For most other sectors, an online penetration rate somewhere between groceries and apparel is probably likely in the not-too-distant future.

Ultimate online penetration will vary by category, but could reach 50% for apparel and 20% for groceries, with most other categories somewhere between the two.

Did the Covid-19 pandemic have a lasting impact on the growth of e-commerce and the online migration of retail sales? Will the trend continue? Below you find all the latest publications from the Nordea On Your Mind report "E-commerce - The new normal".

Explore all publications from Nordea On Your Mind here.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more