- Name:

- Kjetil Olsen

- Title:

- Chief Economist, Norway

Norwegian economic activity will pick up going forward, and unemployment will stay at a low level. Inflation will gradually decrease, but it will take years before it reaches the 2% target. Persistently excessive inflation, a weak NOK, high wage growth and better prospects for the Norwegian economy will put Norges Bank's planned rate cuts on hold until next year. Pay deals in the wage-leading sectors resulted in a 5.2% wage lift, which will boost household purchasing power and result in higher housing prices, even without rate cuts. The NOK is still affected by geopolitical challenges and the slower pace of rate cuts abroad.

A solid pay deal and falling inflation bode well for a brighter outlook for households’ personal finances and thus the Norwegian economy. After years of falling real wages, most consumers will experience stronger purchasing power this year, even if rate cuts are postponed. Since Norges Bank in December said that interest rates had likely peaked, consumer expectations have changed from very pessimistic to optimistic. This also spills over to the housing market, where prices of existing homes have risen nearly 6% so far this year. Stronger purchasing power will lift personal spending and improve sentiment among service companies, but also in the areas of the retail sector that have suffered since the pandemic.

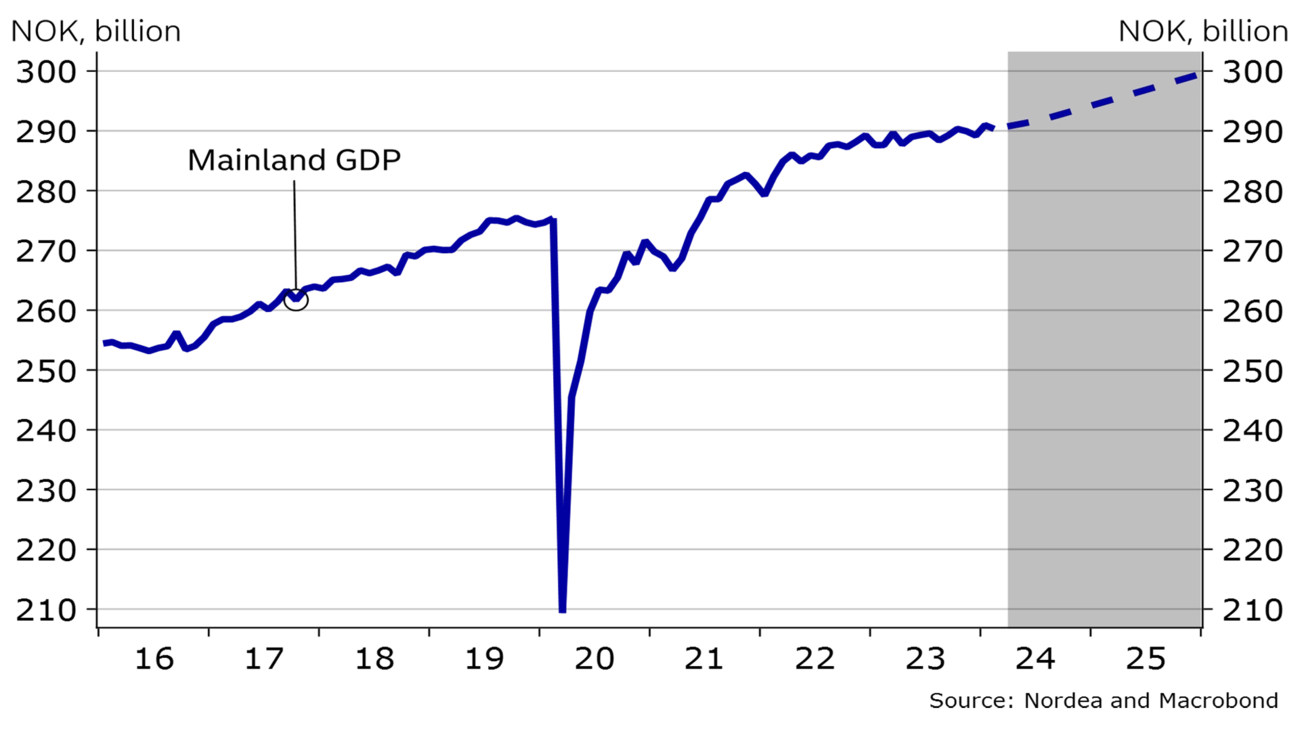

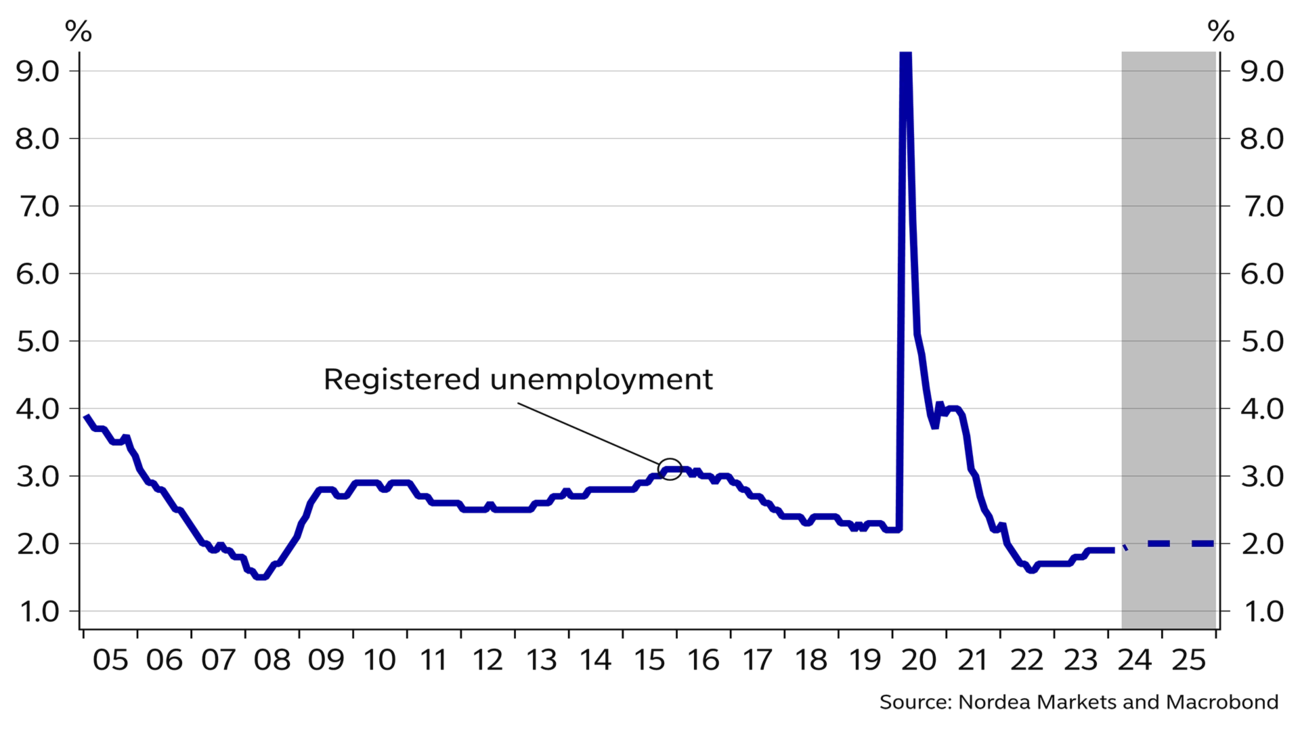

The weak construction industry and slow sales of new homes will likely continue for a while, but with increasing prices of existing homes and the interest rate peak behind us, this industry should start taking a less negative view on the future. Coupled with strong growth in the oil industry, good profitability in mainland exports and solid public sector demand, growth in the Norwegian economy will pick up going forward. We thus do not expect unemployment to rise significantly, but rather to stabilise around 2% going forward.

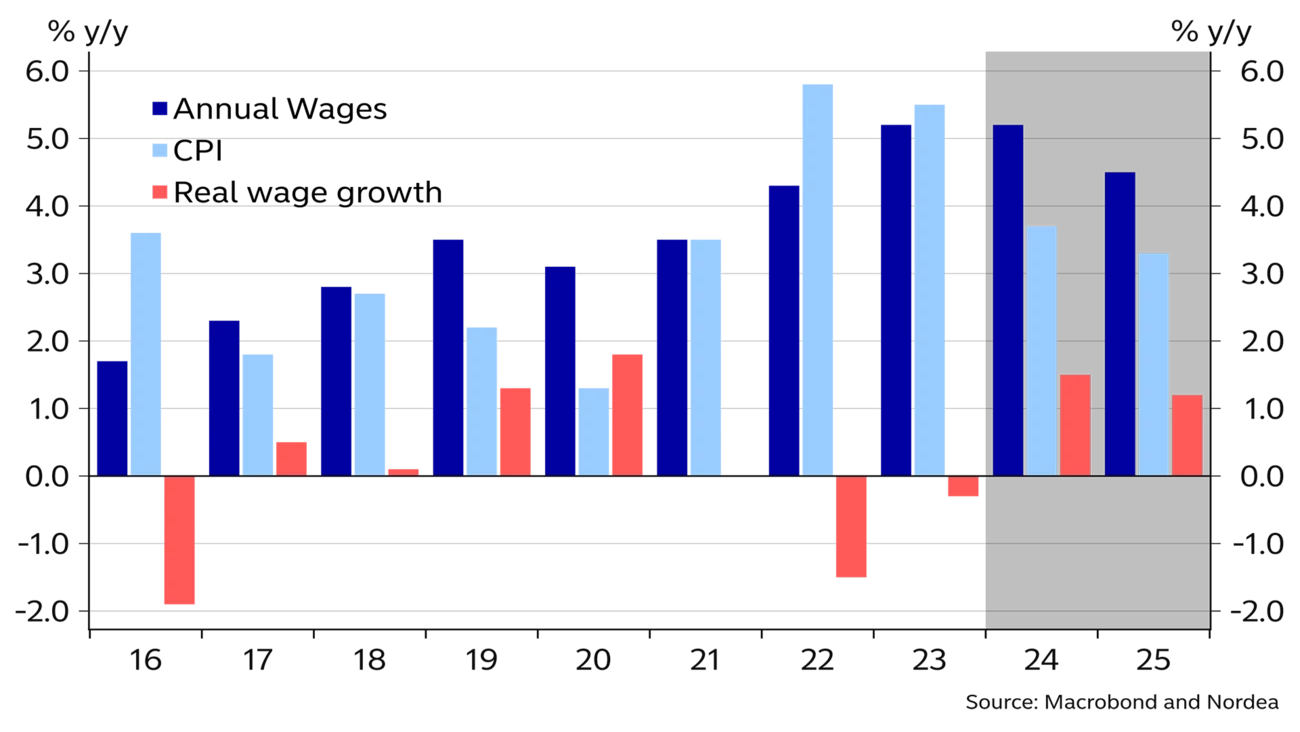

Many Norwegian households have experienced a sharp decline in purchasing power in recent years compared to the pandemic period, when the policy rate was zero. However, the situation will improve during 2024. We believe total wage growth will land close to the pay deals in the wage-leading sectors of 5.2% this year. We also believe overall consumer price growth will continue to fall to just below 4% on average for the year. As a result, households will enjoy gradually improving purchasing power from this summer, when wages start to increase. And, as interest expenses stop rising, households will have more money to spend. For an average-income family with a debt/income ratio of around 3½, purchasing power could rise by around 4% from January 2024 to January 2025, according to our estimates. Such a family spends around 35-40% of their income after tax on loan payments. These payments will be constant when the interest rate is unchanged. Thus, only 60-65% of income can be spent on consumption where prices increase in tandem with consumer prices. At the beginning of next year, total consumer price growth will likely have dropped to just over 3%. Overall, this means that in our example, the family would have around NOK 2,000 more to spend when the new year starts, taking price increases into account. This indicates increased spending during 2024. We have thus become more optimistic about the Norwegian economy.

Although nominal wage growth will be somewhat lower next year than this year, inflation will also be lower, resulting in positive real wage growth and further increasing purchasing power. We also expect Norges Bank to cut its policy rate slightly next year. This will further improve purchasing power for those with debt and add support to the economy.

| 2022 | 2023 | 2024E | 2025E | |

| Real GDP (mainland), % y/y | 3.7 | 0.7 | 1.0 | 1.7 |

| Household consumption | 6.2 | -0.7 | 1.4 | 2.5 |

| Core consumer prices, % y/y | 3.9 | 6.2 | 4.0 | 3.5 |

| Annual wage growth | 4.3 | 5.3 | 5.2 | 4.5 |

| Unemployment rate (registered), % | 1.8 | 1.8 | 2.0 | 2.0 |

| Monetary policy rate (end of period) | 2.75 | 4.50 | 4.50 | 4.00 |

| EUR/NOK (end of period) | 10.51 | 11.20 | 11.25 | 10.75 |

Mainland GDP, NOKbn

% of workforce

Overall inflation has fallen significantly since the start of the year and was 3.9% y/y in March. Lower price growth on food, lower energy prices and base effects will contribute to a further decline in inflation. With continued high wage growth, however, it will take time before inflation approaches 2%.

The NOK is still a wild card for the pace of inflation. It usually takes 3-9 months before changes in the NOK exchange rate impact imported inflation. Many importers are likely uncertain and hesitant to cut prices, even if the NOK should strengthen to make up for last year's margin losses after the exceptional and surprising NOK weakening. This suggests that it could take longer before we see the benefits of lower prices abroad and possibly a stronger NOK. However, commodity prices have headed higher recently and the decline in goods prices abroad seems to have slowed. Also, the NOK is still under pressure. This indicates only a moderate decline in imported inflation going forward.

Continued high growth in rents will also slow the decline in inflation. Rents make up about one-fifth of the consumer price index. According to Statistics Norway, rents rose by around 8% from March 2022 to March 2024, while Real Estate Norway’s rent statistics show price growth of an impressive 15.6% in the same period. Statistics Norway’s rent figures measure the trend in rents with a time lag. This may indicate that rent growth in the CPI will accelerate further and thus curb the decrease in overall inflation going forward.

High nominal wage growth and zero productivity growth in the mainland economy overall indicate continued price pressure on Norwegian goods and services going forward. It will therefore likely take a long time before underlying inflation returns to Norges Bank’s target of about 2%. At 4.5%, Norway is now the country with the highest underlying inflation among the ten large developed economies. With a vulnerable currency and wage formation not only linked to inflation, but also to profitability in industry – with both elements affected by a weak NOK – it may be more challenging to curb inflation compared to many other countries. Underlying inflation is not likely to drop below 3% y/y before year-end 2025.

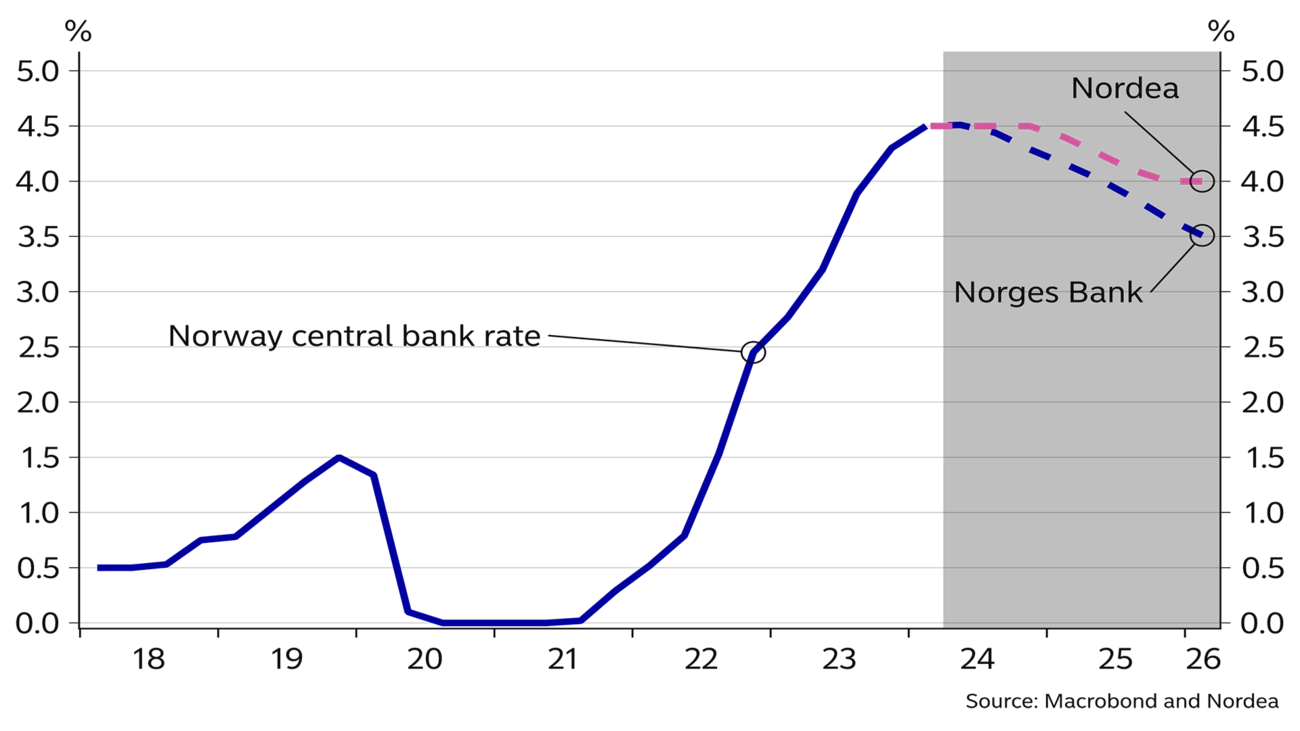

Norges Bank hiked its policy rate to 4.5% in December and signalled in March that it will most likely be cut in September. Norges Bank's latest interest rate forecast indicates a rate cut every six months or so and a policy rate around 3.5% by year-end 2025.

We believe Norges Bank will wait even longer to cut rates, and we do not expect a first cut until 2025. Our forecast assumes a policy rate of 4% by year-end 2025. With a growing Norwegian economy, continued low unemployment and high cost pressure, it is worth considering whether the Norwegian economy really needs several rate cuts, especially as inflation will likely stay well above 2% in the coming years. In addition, the NOK is vulnerable to geopolitical factors and not least the interest rate trends abroad. In the US, later-than-expected rate cuts will also reduce Norges Bank's possibilities to cut rates.

We believe Norges Bank will put rate cuts on hold and do not expect the first cut until 2025.

Fears of a newfound substantial NOK deterioration still exist. Thus, we cannot totally rule out another rate hike although it is not our baseline scenario. If USD/NOK again trades well above 11 and EUR/NOK above 12, speculation about a new rate hike may start. A weaker NOK not only dampens the fall in inflation, it also increases profitability in industry, which is important for pay deals in the wage-leading sectors. A weaker NOK thus has a direct effect on price growth via import prices and an indirect effect via wage formation. If the NOK continues to weaken, it will become even more demanding to bring inflation down towards 2% and Norges Bank will likely have to react – initially by postponing rate cuts further.

CPI and annual wage growth, y/y %

Policy rate, Nordea’s and Norges Bank’s forecasts, %

Housing prices have stayed surprisingly high in recent years, given Norges Bank’s rate hikes. Seasonally adjusted, housing prices are basically unchanged since the peak in the summer of 2022. Unadjusted housing prices rose by 5.9% in Q1 this year. Norges Bank’s signals that interest rates have peaked have likely eased uncertainties about interest rates and fuelled housing market psychology. We expect continued price growth. Higher wage growth will result in higher borrowing capacity, in turn indicating stronger price growth. Newbuild activity is also low, and more and more people want to live in or close to large cities. We expect price growth in the housing market around the nominal wage growth this year, and likely stronger price growth than wage growth next year when the policy rate will probably be lowered slightly. The construction sector will continue to struggle this year, but pessimism will decrease, and activity will go up in line with increasing prices of existing homes and expectations of lower interest rates.

The NOK gained a better foothold early this year after Norges Bank went against the flow and hiked rates in December while central banks in other countries stayed on the sidelines and began talking about rate cuts. Early this year, players in the interest market anticipated six Fed rate cuts this year, starting in March. After three months with higher inflation data than expected, the market is only pricing in about two rate cuts in the US this year. There is a risk that the Fed will not cut rates at all this year. The NOK has been punished, depreciating especially against the USD but also the EUR, even though oil prices and stock markets have risen so far this year. This illustrates that the NOK needs outside help in the form of lower inflation and lower interest rates to recover.

The NOK performance will as usual also be uncertain going forward. In the short term, we fear the NOK may weaken even further, especially given the risk of volatile financial markets as a result of weaker liquidity in the US banking system and postponed rate cuts from the Fed. Gradual ECB rate cuts starting in June will, all else equal, be good for the NOK. But if the NOK is to stabilise at a stronger level over time, the policy rate in the US likely also needs to be lowered.

We still haven’t given up hopes of a gradually stronger NOK.

The biggest risk for the NOK would be price growth abroad surging again, causing the expected rate cuts from the Fed and the ECB to be cancelled. In the near term, heightened geopolitical tensions, not least the situation in the Middle East, are a major risk factor. If the conflict in the Middle East spreads, we could soon see a new energy price shock. In a low inflation world, higher energy prices would likely be good for the NOK. But when inflation is initially too high, the situation could be different. Central banks may counter higher energy prices and increased inflation with persistently high interest rates. Recent years have shown that the NOK does not necessarily emerge stronger from a sharp rise in energy prices.

The dream scenario for the NOK is still that lower inflation results in lower interest rates abroad, while the world economy starts to grow again and energy prices are high, but this scenario has probably become less likely recently. However, we expect inflation abroad will slow down, although it will take some time, and central banks in other countries will have room to cut rates gradually. This is the main reason why we are not giving up hopes of a gradually stronger NOK.

Find out more about the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more