- Name:

- Kjetil Olsen

- Title:

- Nordea Chief Economist, Norway

Siden findes desværre ikke på dansk

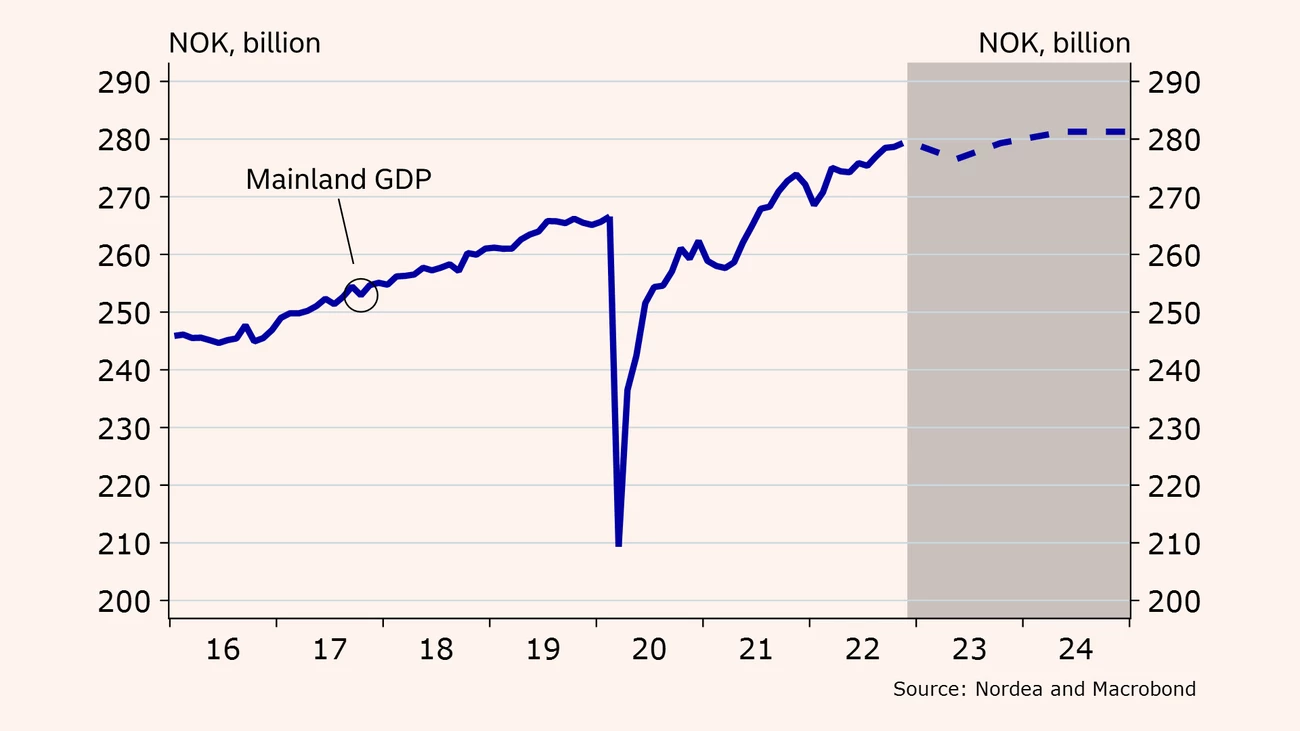

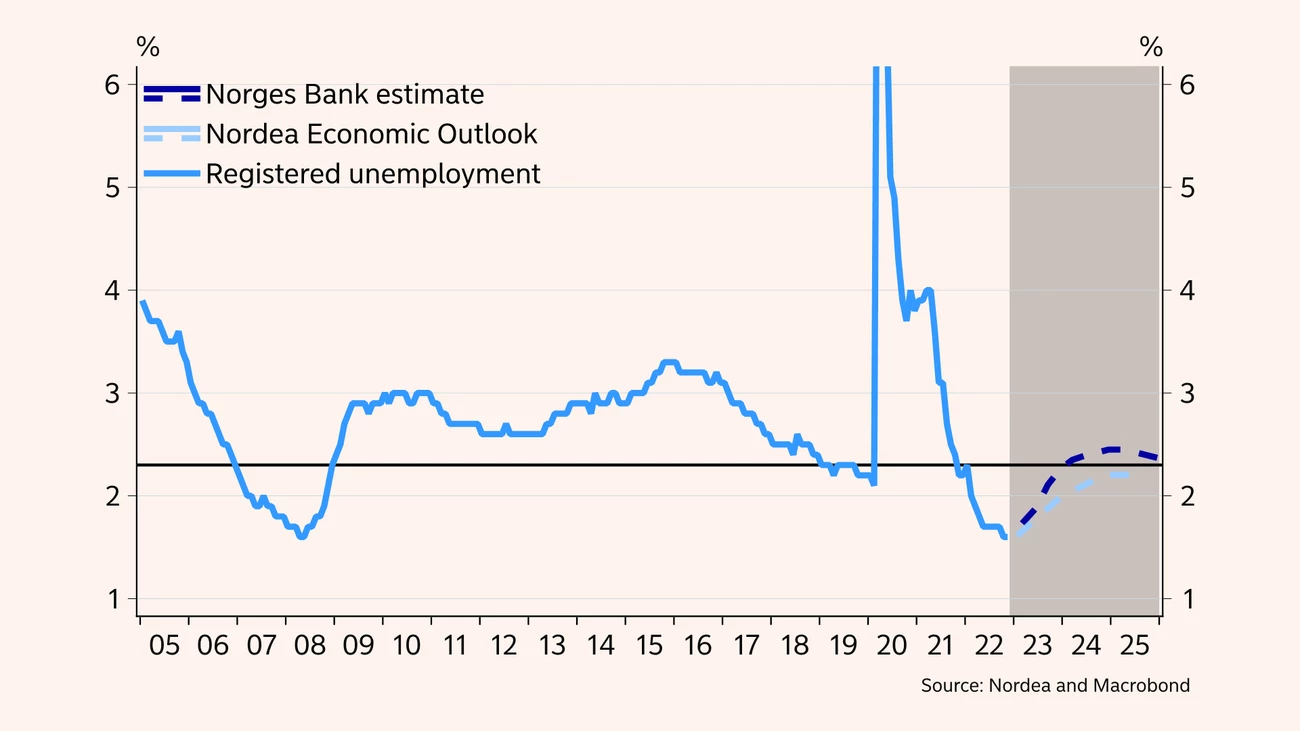

Bliv på siden | Fortsæt til en relateret side på danskThe Norwegian economy can look back on a year with high activity and historically low unemployment but also higher prices and interest rates. Overall, the coming year will probably be characterised by stagnation. Weaker purchasing power will dampen consumer spending and unemployment may rise from a very low level. But we think the Norwegian economy will fare better than many other countries, one reason being sharply higher activity in the petroleum sector. High price growth and a continued tight labour market will increase wage earners’ wage claims after years of weak real wage growth. The policy rate could reach 3.25% by the summer and home prices will continue to fall. Higher oil prices and oil investments could gradually strengthen the NOK.

The Norwegian economy can look back on an unusual year. After a subdued start to 2022 due to infection control measures, demand and activity quickly recovered. But businesses soon faced major problems due to capacity restraints and labour shortages. At the same time, the war in Ukraine led to record-high energy prices and further price increases of many input goods. Businesses have to a large extent passed costs on to consumer prices. Much higher inflation and stronger-than-expected trends in the Norwegian economy made Norges Bank hike the policy rate faster and more aggressively than forecast in early 2022 – from 0.50% in January to 2.75% in December.

Households’ purchasing power has eroded sharply since 2021, which was a year when many had far larger buffers than usual and savings were unusually high. High price growth in most products and services and markedly higher interest rates have impacted everybody but have been particularly challenging for low-income families and highly indebted households. Expectation surveys show that households have never before been more pessimistic about their own financial situation over the coming year. Consumption has been resilient so far, though. Some of the factors behind the higher-than-expected spending growth are more people in work, a desire to resume more normal spending patterns and, in turn, lower savings as well as ample savings left over after the pandemic.

We project a clear dampening of growth in the Norwegian economy and most likely a year with close to stagnation and somewhat higher unemployment. Although consumer spending has held up well so far, we are quite sure that eroding purchasing power will make many households tighten their belts in the period ahead. This will in turn dampen growth in the Norwegian economy. At the same time, lower growth in both domestic and global demand could weaken the investment outlook among mainland businesses. Also, higher interest rates will mean less residential construction and fewer new commercial property projects. Nor do we expect public demand to be a strong growth driver this year.

On the other hand, we expect energy and petroleum investments to continue to rise sharply in the wake of the global challenges in energy markets, environmental considerations and new legislation. But first and foremost, the tax package for the petroleum industry has accelerated a number of investments and made more projects profitable. Higher energy and oil investments will be a key driver of economic growth in Norway in coming years and is unlikely to be much affected by interest rate changes, lower global growth or the prevailing economic uncertainties. This makes us more optimistic about the Norwegian economy than many other economies.

|

|

2020 |

2021 |

2022E |

2023E |

2024E |

|

Real GDP (mainland), % y/y |

-2.8 |

4.1 |

3.8 |

1.0 |

1.0 |

|

Household consumption |

-6.2 |

4.5 |

7.5 |

3.0 |

0.5 |

|

Core consumer prices, % y/y |

3.0 |

1.7 |

3.9 |

5.0 |

3.5 |

|

Annual wage growth |

3.1 |

3.5 |

4.2 |

5.0 |

4.5 |

|

Unemployment rate (registered), av. % |

5.0 |

3.1 |

1.8 |

1.8 |

2.1 |

|

Monetary policy rate, deposit (end of period) |

0.00 |

0.50 |

2.75 |

3.25 |

3.25 |

|

EUR/NOK (end of period) |

10.47 |

10.03 |

10.51 |

10.00 |

9.80 |

Norges Bank’s regional network survey shows that businesses experienced somewhat less labour shortage towards end-2022 than during the summer and autumn. But the demand for labour is still strong. Registered unemployment has remained at a record-low level with more than two vacant positions for each registered unemployed. At the same time, price growth has reached a 30-year high. Against this background, we expect this year’s pay talks to be very demanding.

Wage earners have had some disappointing years with meagre real wage growth. Last year, real wages fell sharply due to markedly higher price growth than expected. At the same time profitability in many business sectors has been good, also in the wage-leading sectors most exposed to foreign competition. It is probably fair to assume that wage earners expect decent real wage increases this year. Employers, for their part, call for restraint due to prospects of weaker profitability. The agreed benchmark in the wage-leading industries very rarely ends up below the expected price growth. The last time was in 2016 during the oil crisis, but at that time unemployment was twice as high as today. See our Norway theme article on page 23.

Based on our estimate of overall CPI growth in 2023 around 4¼%, the starting point for the pay talks is higher than it has been for a long time. At the same time, wage growth among European trading partners is rising. This will also place the bar for the pay talks higher than what we are used to. Moreover, the NOK is still weak from a historical perspective. Even though unemployment could rise somewhat from a record-low level, wage earners should still hold a strong hand in this year’s pay talks. We expect overall wage growth of some 5% this year – surpassing the likely price growth and last year’s wage growth. If so, real wage growth will help maintain household spending despite additional interest rate hikes.

A / Activity in the mainland economy will likely stagnate in 2023.

B / Unemployment will rise slightly from a very low level.

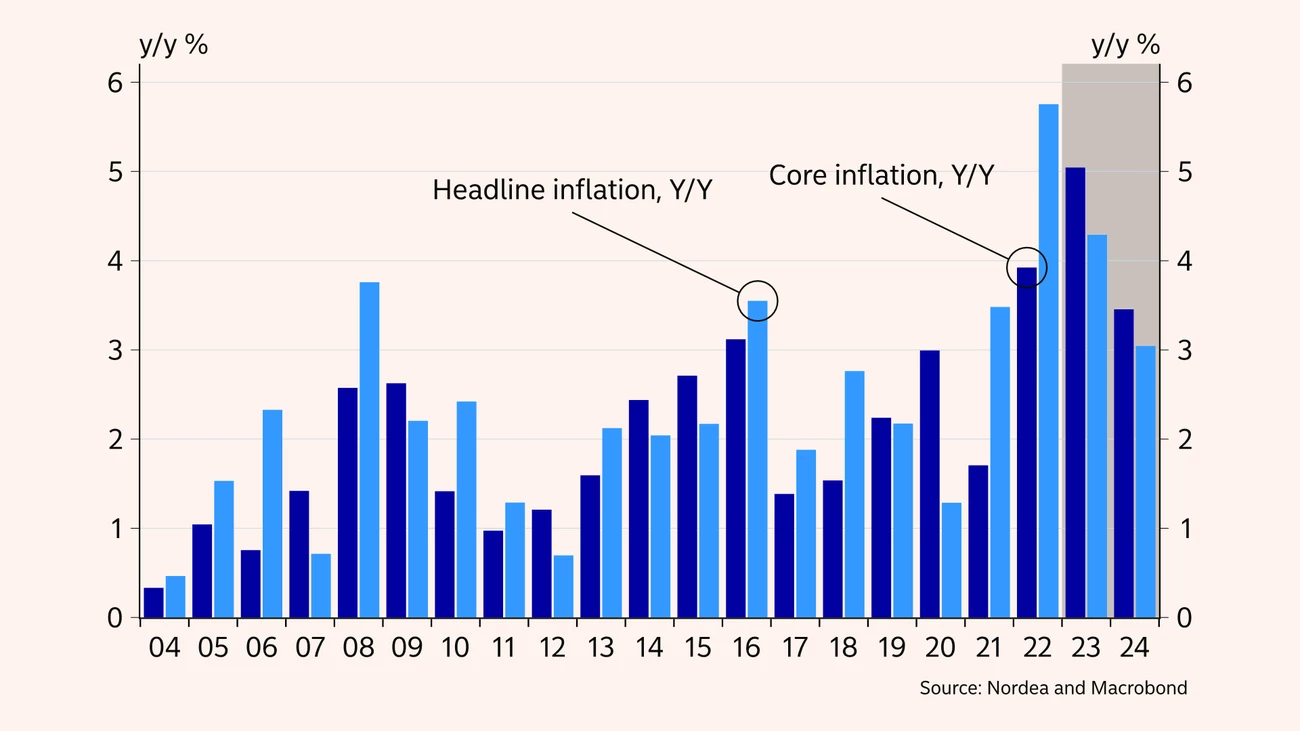

On average, consumer prices rose 5.8% in 2022 compared to 2021 – mainly driven by sharply higher energy and food prices, but also broad-based increases in prices of other products and services. Forward electricity prices could indicate that the worst price impulses are behind us and that 12-month headline CPI price growth will abate going forward as a result of base effects.

Adjusted for energy prices and duties, core inflation reached a new high in October 2022, increasing 5.9% versus the year-earlier month. We expect core inflation to remain close to 6% towards the summer before slowly abating due to base effects, but most likely also because of businesses’ lower margins. With lower demand it could become more difficult to pass on costs to consumer prices. At the same time, it will likely take a long time before core inflation returns to Norges Bank’s target of around 2%. Higher wage costs and rents, of which the latter closely tracks last year’s price growth, will contribute to keeping core inflation well above 2% in both 2023 and 2024.

Wage growth will rise further this year.

Last year’s high inflation made Norges Bank hike its policy rate at a historically fast pace from 0.5% to 2.75%. We are probably near the peak this time around and Norges Bank is now in fine-tuning mode. But despite the prospects of a clear downturn in growth and easing of pressures in the Norwegian economy, the central bank is still worried that growth in prices and wages will take hold at excessive levels. Another focal point is the risk that a narrower interest differential versus other countries will trigger uncertainty around the exchange rate and affect imported price growth. It will take time and probably somewhat higher interest rates than today to reduce core inflation to the 2% target. We look for a policy rate of 3.25 % by end-2023.

We consider the risk related to the estimated interest rate peak to be balanced. It cannot be ruled out that Norges Bank will have to hike rates further if economic growth proves more resilient than widely expected and growth in wages and prices overshoots current projections. So far economic growth has been stronger and price growth higher than most had expected. Conversely, the economy may slow down more and faster than we expect at present and price pressures could ease sooner. If so, interest rates could peak at lower than 3.25%. In any case, we think it will take time before Norges Bank starts to consider rate cuts. Although rising, unemployment will remain at low levels. At the same time, inflation will stay well above 2%. It is far from certain that rates will be cut in 2024.

C / We expect that core inflation will remain well above the overall price increase this year and next year.

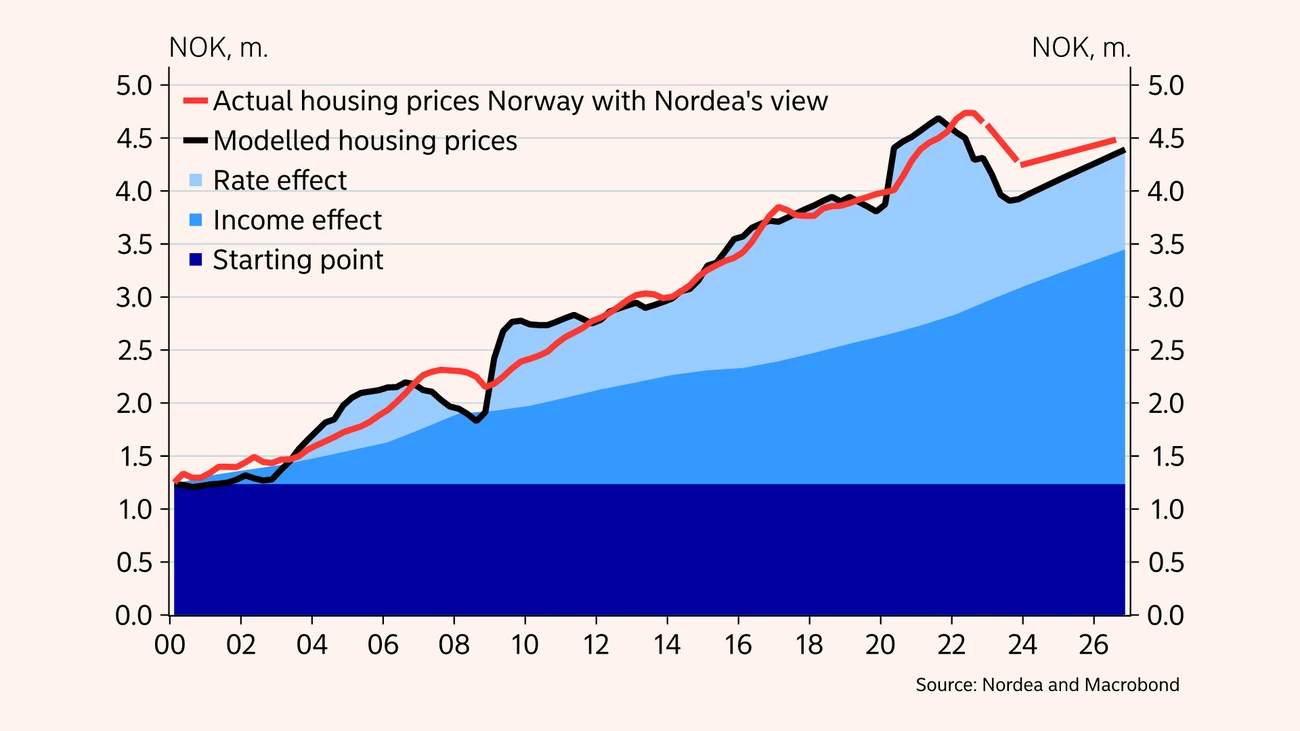

D / Higher interest rates will reduce purchasing power in the housing market, and contribute to lower housing prices going forward.

After a sharp rise in H1 2022, we saw home prices starting to correct down after the summer following Norges Bank’s rate hikes. Since the summer, home prices have fallen some 2.5%, seasonally adjusted, in line with our long-held view of a decline of up to 10% from the peak in August 2022. We expect home prices to fall about 5% more from today’s level, partly because Norges Bank’s latest rate hikes are not reflected and partly because we think interest rates will increase a bit more.

The changes in home loan regulations, which took effect from the new year, could mean a smaller decline in home prices than would otherwise have been the case. Borrowers must now be able to sustain a rate increase of 3% points instead of 5% points (but in any case a rate of 7%), which means that banks can lend more to more borrowers than under the old rules. However, changes in The Norwegian Financial Contracts Act pull in the other direction, as it could become harder for sellers to obtain bridge financing, which usually means they have to sell their old home before buying a new one. Historically, such a change in housing market dynamics has reinforced the decline in home prices.

But we do not think the housing market will melt down completely. Although unemployment could rise somewhat, it will remain at a low level. Most people will still have jobs. At the same time, wages will rise in nominal terms. The decline in housing prices will also be dampened by higher construction costs and a slowdown in housing supply.

We must expect home prices to fall further.

The NOK exchange rate remained weak during the autumn and winter, largely tracking developments in global stock markets. Lately, lower oil prices have also weighed on the value of the NOK. We do not think the NOK will recover much in the near term. Further rate hikes by central banks worldwide and a weaker global economic outlook could drive stock markets lower again. That would weaken the NOK, as evidenced by recent developments.

However, longer out we are more optimistic about the NOK. The global interest rate increase will gradually stop, slightly easing uncertainties in the financial markets. That could suggest NOK strengthening. The reopening of China could also trigger a rise in oil prices. Also, Norwegian oil investment looks set to increase sharply ahead, and this will force the oil and gas companies to buy more NOK to pay their Norwegian suppliers and employees. This also points to a stronger NOK over time.

This article first appeared in the Nordea Economic Outlook: The balancing act, published on 25 January 2023. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more