- Name:

- Jan Størup Nielsen

- Title:

- Chief Analyst, Nordea

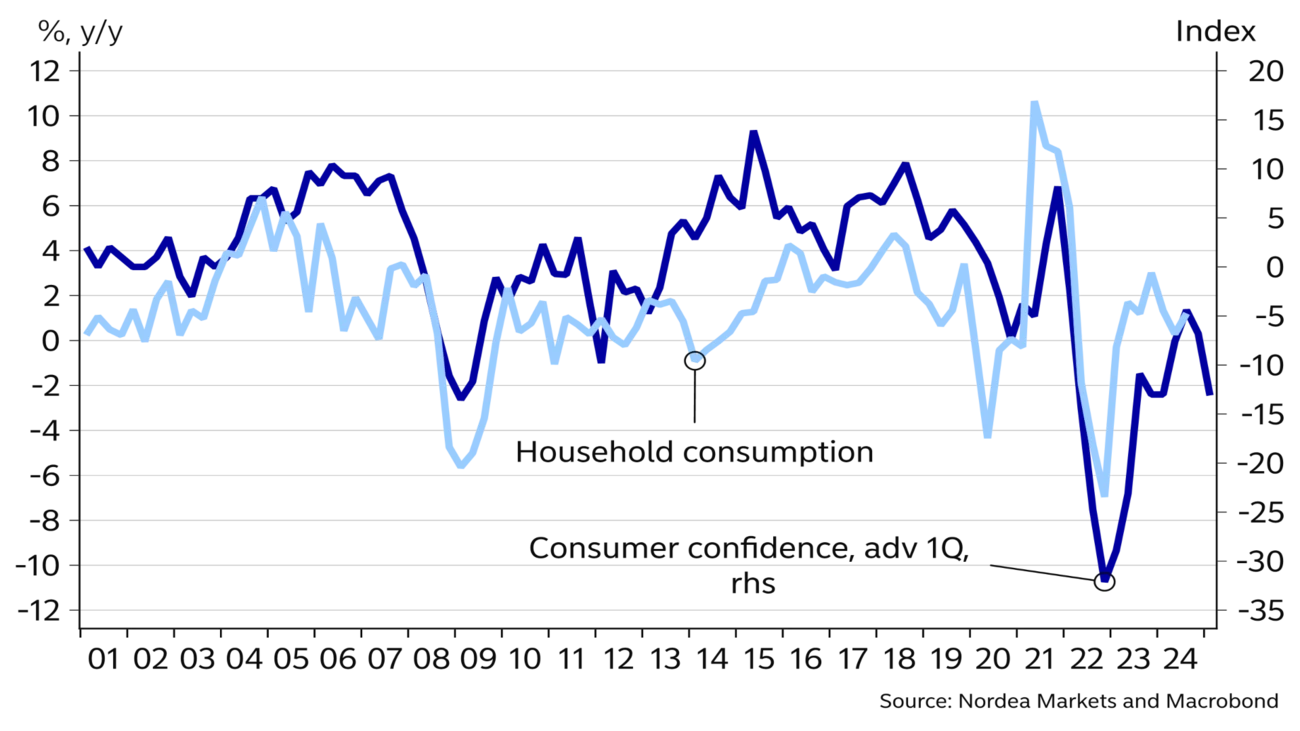

Over the past four years, the Danish economy has been in a solid recovery phase. During that period, employment has risen to a historically high level, and purchasing power has improved significantly. Despite this recovery, consumer confidence is at a low level, as households are increasingly worried about Denmark’s economic situation going forward. The question is whether this will put a spanner in the works for the expected consumption-driven recovery in 2025.

Every month, Statistics Denmark conducts a sample survey of about 1,500 people. This provides a measure of consumer expectations that sheds light on households’ views of the current and future economic situation. During the COVID-19 pandemic, the overall indicator of consumer confidence fell to the lowest level since the survey started in 1975. In step with the subsequent reopening of society, it rose rapidly, and, by mid-2024, it was close to the historical average. Subsequently, however, it has declined again, and, in the December 2024 survey, confidence hit the lowest level since mid-2023.

The decrease in consumer confidence is mainly due to a significant drop in respondents’ expectations of Denmark’s economic situation in one year compared to today. That sub-index has declined steadily since mid-2023 and is approaching levels last measured during the COVID-19 pandemic. This naturally raises the question of whether the growing worries will trigger households to have a higher propensity to save – ultimately slowing down the expected growth in private consumption for 2025.

In a survey from 2022, Statistics Denmark shows that “the consumer confidence indicator has a significant information value about the following quarter’s consumption.” However, the survey also finds that the best correlation to actual consumption is found by combining questions about consumers’ personal finances with their assessment of Denmark’s current economic situation. Common to these indicators is that they have developed relatively steadily throughout the year – and thus have not shown the same decline as the overall index for consumer expectations. This could indicate that households are also worried by other factors than purely economic ones. Here it seems obvious to point to the uncertain geopolitical situation, which is widely covered in the media, as well as the political debate.

At the same time, many households in Denmark are also feeling the consequences of the large price hikes from 2022. Even though rising wages (on average) have offset the loss of purchasing power, food prices, for example, are today about 25% higher than three years ago. In continuation of this, the index of expected price trends in the consumer confidence survey has also risen to the highest level since mid-2022. It should be emphasised that the index has historically not been a particularly good indicator of actual inflation developments. However, the numbers show that the fear of rising prices is simmering among consumers.

Lastly, many households are also feeling the consequences of higher interest rates. Even though almost half of Danish home owners have a fixed-rate mortgage, households’ total interest payments have tripled over the past two years.

Despite a solid improvement in the Danish economy, consumer confidence is at a low level. This reflects considerable uncertainty about consumption going forward.

The gloomy expectations among households are in stark contrast to the business confidence survey, which has risen considerably in recent years. At the same time, it is worth noting that households’ assessment of whether it is advantageous to acquire large consumer goods has not fallen nearly as much. With the prospect of additional interest rate cuts from central banks, continued very high employment and further growth in purchasing power, we also estimate that household consumption will increase throughout the year. The strength of the recovery, however, will largely depend on the geopolitical situation – a factor that may be crucial for private consumption trends.

This article first appeared in the Nordea Economic Outlook: Consumer comeback, published on 22 January 2025. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more