- Name:

- Stella Maria Mylläri

- Title:

- Nordea Sustainable Finance Advisory

In just a few years, sustainability-linked bonds (SLBs) have carved out their place in the sustainable bond market, now representing 10% of total issuance for the year to date. As SLBs gain popularity, potential challenges with the format are beginning to emerge. In this article, we examine some of the difficulties relating to the application of the concepts of materiality and ambitiousness within SLBs and highlight some early research into SLB pricing.

In 2019 Enel issued the inaugural sustainability-linked bond (SLB), designed to make it possible to issue bonds for financing general corporate purposes that are tied to an issuer’s sustainability performance. The International Capital Markets Association (ICMA) provided input on the format 10 months later, in September 2020, with the publication of the Sustainability-Linked Bond Principles (SLBPs), which have fast become the market standard. In 2021, following a strong market debut, SLBs broke into general market parlance: the newcomer format saw the sharpest growth among the labelled formats (from 2% of total issuance in 2020 to 9% in 2021) and represented issuances across over 10 sectors. Within the first few months of 2022, SLBs have showed no signs of slowing down.

The publication of ICMA’s SLBPs came relatively swiftly compared to the Green Bond Principles (GBPs) in 2014. SLBPs were published only 10 months after Enel’s inaugural issuance, whereas 7 years passed between the first green bond issue and the publication of the GBPs. This accelerated response from ICMA demonstrates not only a maturing of the market since 2014, but also an increased recognition of the need for common attributes within the sustainable finance marketplace, specifically related to the materiality and ambitiousness of metrics and targets used within the facilities.

Academic research related to the sustainability-linked bond market is beginning to emerge. Despite the somewhat limited availability of data from the infant market, researchers from the University of Zurich, Köbel & Lambillon (2022), have published early research covering pricing of SLBs on the primary market. The results suggest that SLBs are issued at a statistically significant “sustainability premium” for issuers, both in terms of the yield differential and lower cost of capital even when not meeting the sustainability targets.

Firstly, the research shows an average yield differential among SLBs and non-sustainable counterfactuals[1] at issue of -29.2bps. It can be interpreted that this lower yield translates to investors being the counterparty paying for the sustainability improvement while the issuers benefit from a lower cost of capital. However, while the majority of issuances in the sample were issued within the European region, one should be cautious applying this finding across European markets. Based on comparisons with the green market, we would expect to see a much smaller premium for EUR investment grade issuers, for example.

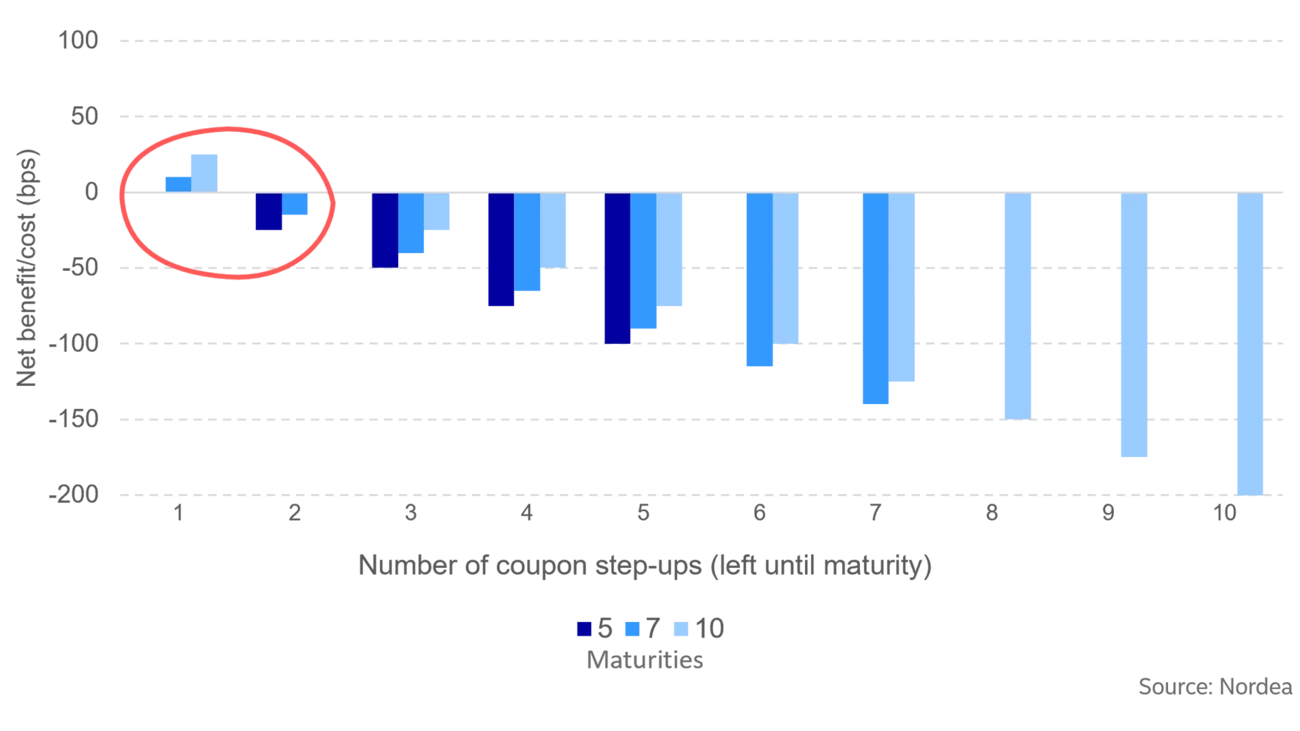

Secondly, the research revealed that some issuers failing to meet their sustainability performance targets were also benefiting from a lower cost of capital due to the average coupon step-up being lower than the sustainability premium and a time lag until the coupon step-up applies. This finding signals the potential for a “free lunch” for issuers of SLBs as the average sustainability premium was recorded at 29.2 bps, with the average coupon step-up being 26.6 bps, translating to a total “free lunch” of USD 14.5m by the end of 2021. This suggests that SLBs’ current penalty structures may not be sufficient.

To further illustrate this latter point we have outlined a simple break-even analysis below. The chart highlights, for three different maturities (5y, 7y, and 10y), the projected benefit/cost when assuming a 5bp lower credit spread. The net gain or cost (in bps) is shown via the y-axis and the number of step-ups assumed is shown via the x-axis. As demonstrated, assuming a 10-year bond with 5bp savings running every year (that is, 50bps in total over the life of the bond), break-even is reached if structuring bonds with a 25bp step-up and only two years of possible step-ups (that is, 50bps in total over the life of the bond).

This situation is a potential concern for the market as it would allow issuers to have their cake and eat it too. It remains too early to predict where the market consensus will land on this. Nonetheless, this is something that we need to be mindful of in the coming months, and it will likely feed into discussions relating to the calibration of targets set within SLBs.

Given that the sustainability-linked format is available to a wider range of sectors compared to the green and social labelled formats, we anticipate that SLBs will to continue to drive growth in the market in 2022. As the use of SLBs expands, particularly across issuers with different levels of maturity in their approaches to sustainability, harmonisation will be crucial to maintaining the integrity of the market. A shared understanding of how to assess the materiality of KPIs and the ambitiousness of targets must exist for investors to retain confidence that the incentives behind these labelled bonds will provide the desired impact over time.

The SLBPs lay a common foundation, outlining that “first and foremost, the KPIs should be material to the issuer’s core sustainability and business strategy and address relevant environmental, social and/or governance challenges of the industry sector and be under management’s control.” However, challenges in the practical implementation of this guidance exist, as highlighted by the absence of a unanimous view of materiality taken by second-party opinion (SPO) providers.

Perhaps more challenging is the assessment of the ambitiousness of targets. Each assessment must be company-specific in order to provide an appropriate incentive for improvement, meaning that unique data and forward-looking projections are used in the assessment of each SLB. Although there are no doubts about the integrity of the target setting process, there is currently no common approach for incorporating updates to the projections used during target setting. Until now, there have only been a handful of cases of companies reaching sustainability performance targets significantly early. As the market continues to scale, this issue is more likely to arise due to the company-specific nature of target setting. This is a subject that will need to be addressed with a common approach as the market continues to evolve.

[1] Köbel and Lambillon’s (2022) research method consisted of the matching method. The authors matched a sample of 102 bond pairs, one SLB and one non-sustainable counterfactual.

SPOs are a core element of sustainable bond formats as they are intended to provide pre-issuance assurance on a framework’s alignment with relevant market principles. In connection to SLBs the SLBPs recommend appointing an SPO to confirm the framework’s alignment with the principles’ five core components.

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more