- Name:

- David Ray

- Title:

- Nordea Sustainable Finance Advisory

After a turbulent first half-year, the third quarter shows a market adapting to the new-normal: persistent inflation and rising interest rates. The energy crisis has not only resulted in a risk of recession in the Euro area but also created ambiguity for corporates’ sustainability ambitions, pushing the financial sector to the forefront of issuing sustainable debt.

While markets are starting to adapt to rising interest rates, sustainable debt markets continue to show a decline from the previous year’s record issuance levels. In the beginning of September, S&P revised its forecast to a 16% decline in overall bond issuance by the end of the year.

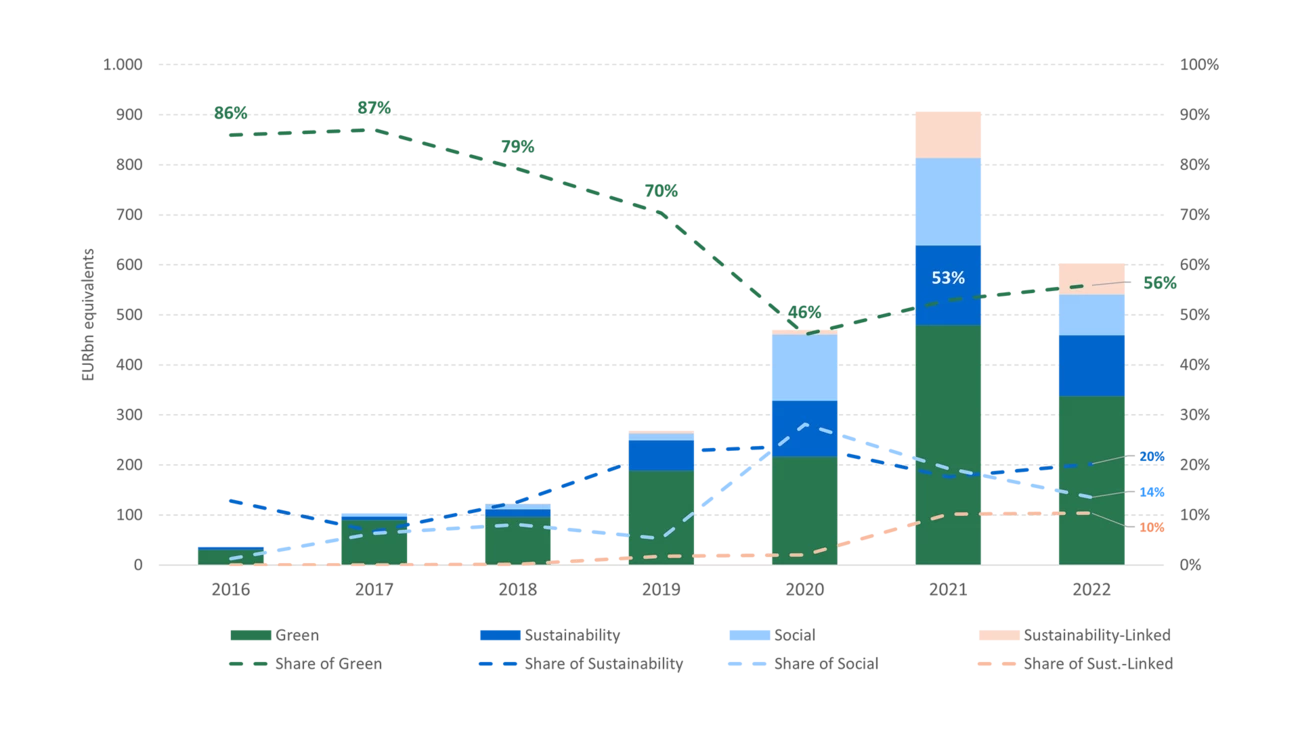

Looking across the different formats, the share of sustainability-linked bonds, which were expected to show the highest increase due to the format’s novelty and broader range of applications, instead remained relatively stable. The novelty of the format may have actually worked against its favour during the last quarter, with increasingly tight-pursed investors generally showing a preference for more established use-of-proceeds products. With high transparency in the allocation of proceeds, many investors have greater confidence in the ability of the use-of-proceeds formats to directly deliver the impacts sought.

Global GSSS issuance by format

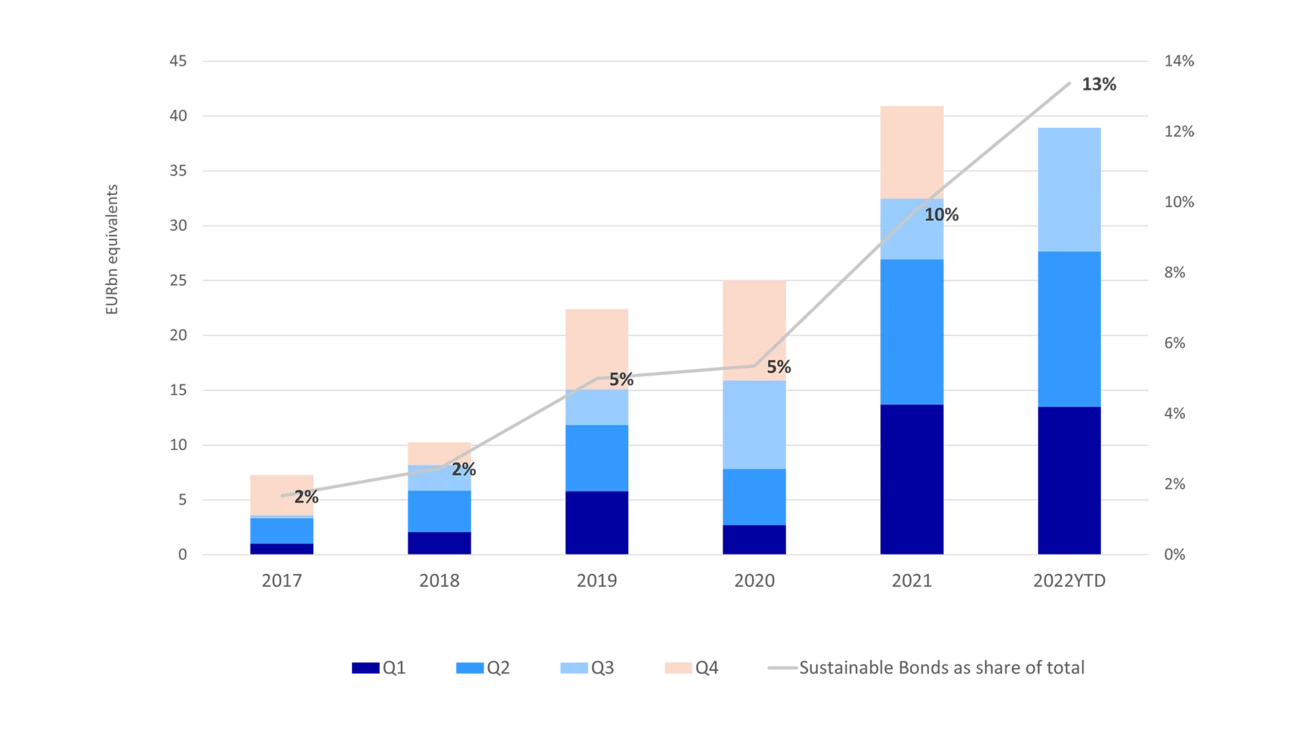

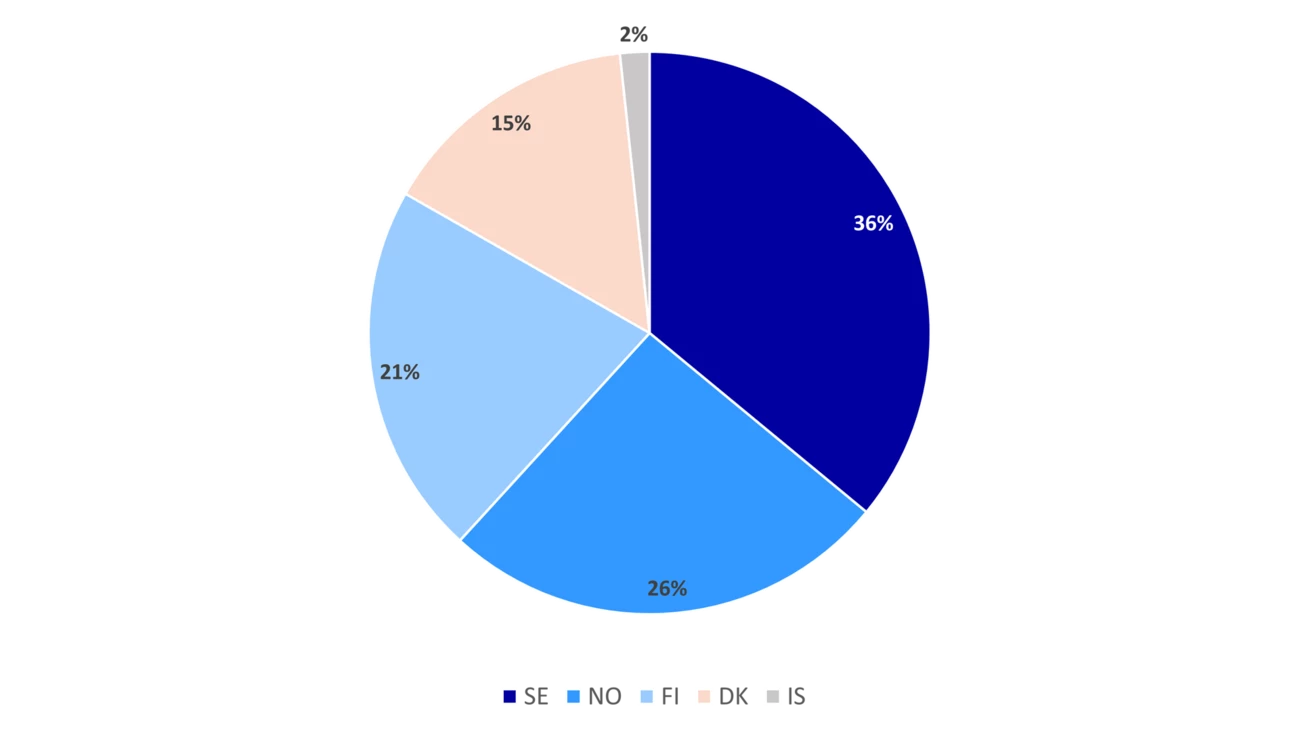

The Nordics seem to have weathered the global turmoil better than global sustainable debt markets, with total GSSS quarterly issuance in Q3 2022 nearly double of that in Q3 2021. Sustainable debt now constitutes around 12% of the Nordic bond market, with the majority in 2022 issued in Sweden followed by Norway.

Nordic quarterly GSSS issuance

Country distribution of GSSS issuance 2022

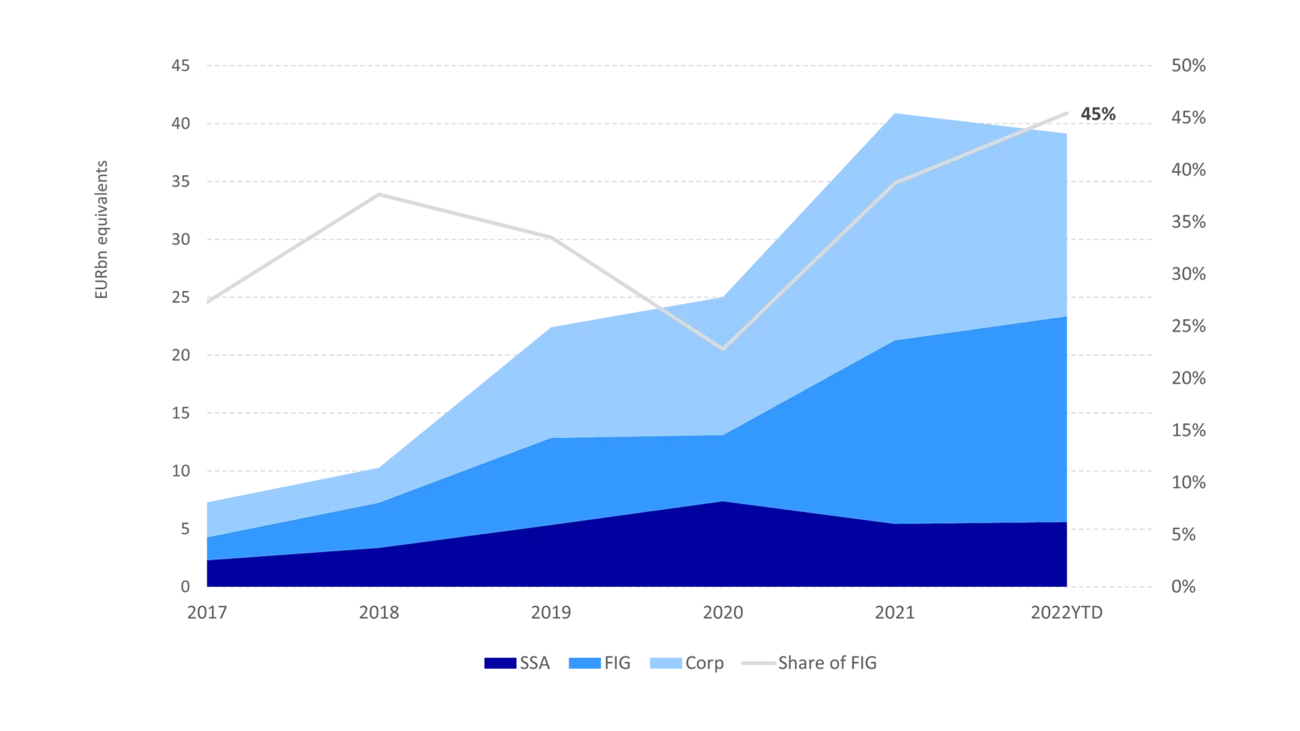

Increasing energy prices and scarcity of renewable energy, coupled with continued geopolitical uncertainty, cast some short-term doubt over companies’ sustainability targets. Combined with a stormy real estate sector, a core component of the Nordic bond market, this has led to the first decrease in corporate issuance since the inception of sustainable bonds. The financial sector, including banks and insurers, has been the only sector to add growth throughout 2022 so far, making up nearly half of the Nordic sustainable bond market by Q3 2023.

Nordic GSSS issuance by sector

Nordea's Sustainable Finance Advisory team helps clients navigate fundamental changes in the financial markets as the global economy shifts towards becoming sustainable and low-carbon. Find out more about our sustainable product offerings and holistic advisory services.

Learn more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more