- Name:

- David Ray

- Title:

- Nordea Sustainable Finance Advisory

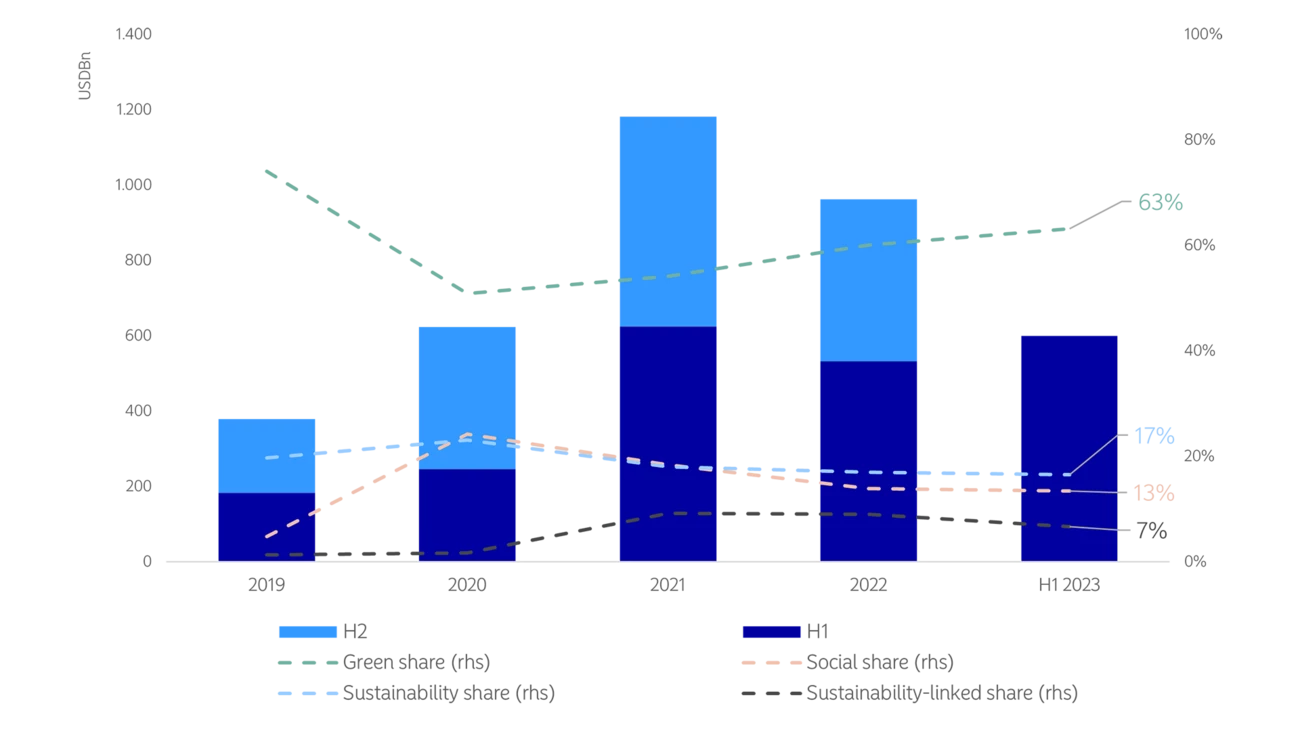

Sustainable bond markets are again showing positive signs, with both global and Nordic sustainable bond volumes beating previous years during the first half of 2023. First-half performance was supported by elevated Q1 volumes, which just beat out Q2 volumes across regions. We expect Q2 figures to be more indicative of what is to come as momentum appears positive, yet slightly challenged. Nordic sustainable loan markets struggled in the interest rate environment of H1 2023, although Finland and Norway showed strong performance.

2023’s global sustainable bond supply continued to outpace 2022’s performance through H1, with volumes from the first half of the year up 12% on H1 2022. Half-on-half performance was even more impressive, posting a 40% increase in total global volume from the macro-induced lows of H2 2022. Despite a clear bounce back from a tough 2022, quarterly performance revealed that challenges to momentum persist, with second quarter volume down 4% from an active Q1.

Source: BNEF, Nordea

Sustainability-linked bonds took a declining share for the first time, down from 9% to 7% of global sustainable volume from 2022 to H1 2023. Following an initial period of growth, the format maintained a 9% share of global volume from 2021 to Q1 2023, struggling to shake off scepticism in the market.

While green formats continued to show a steady increase in share through the first half of the year, representing 63% of total sustainable volume in H1 2023, we see a distinct opportunity set emerging for structures that combine elements of both the green and sustainability-linked formats.

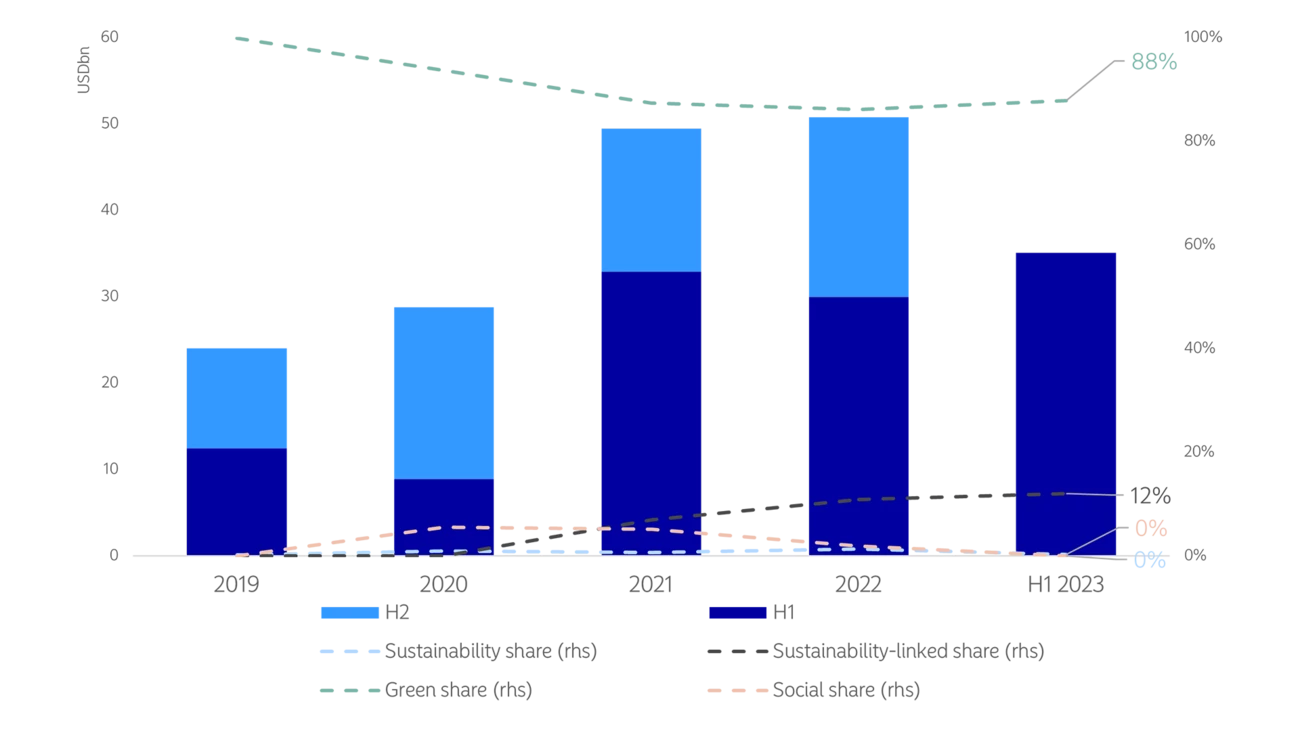

As observed during the first quarter, the Nordic sustainable bond market outperformed trends seen globally. The region saw its greatest ever volume of sustainable bond issuance during H1 2023, surpassing the previous high of H1 2021 by 7%.

Year-on-year figures also indicate that positive momentum is returning to the market as Nordic sustainable bond volumes for the first half of 2023 beat last year’s figures for the same period by 17%.

Source: BNEF, Nordea

Impressive half-year volume in the Nordics was strongly supported by bumper Q1 performance. With strained 2022 market conditions pushing some issuance into early 2023, Nordic sustainable bond volume dropped 5% from the first to the second quarter of 2023. As we look forward to the second half of 2023, Q2 performance may be a more accurate indicator of what lies ahead.

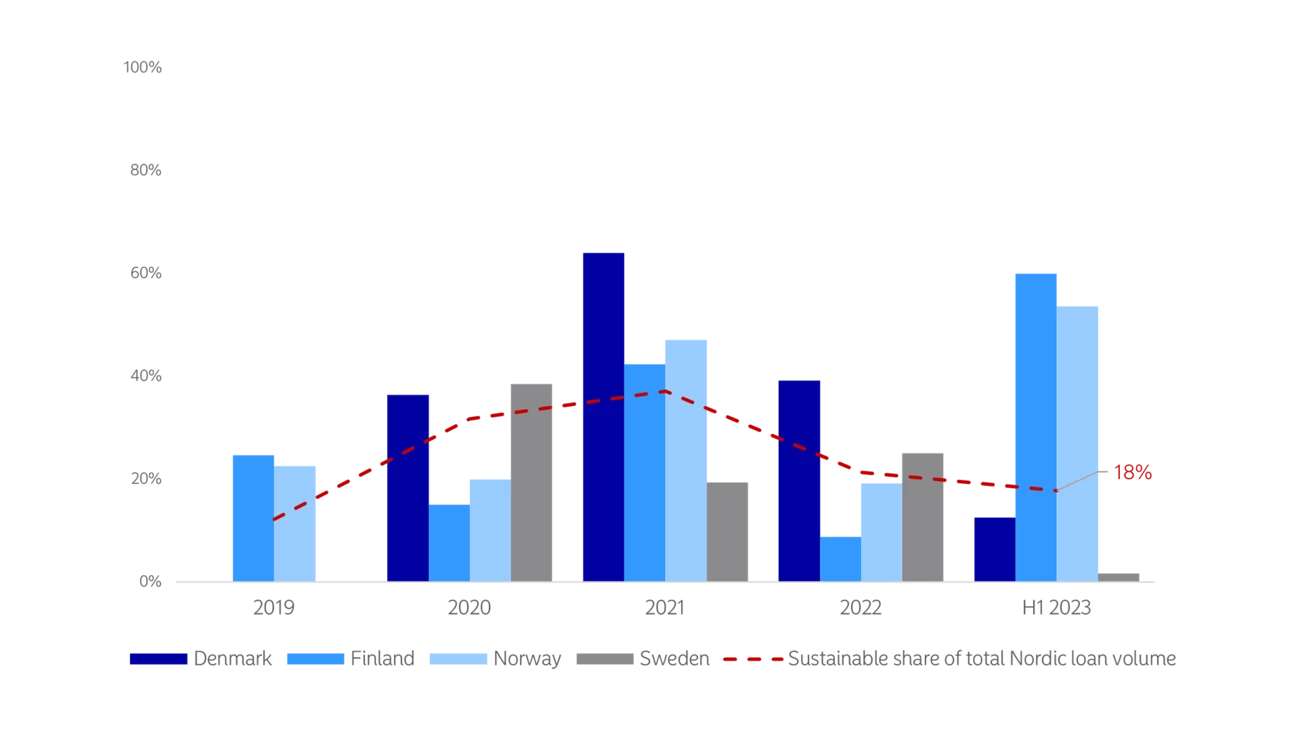

The interest rate environment of 2023 proved to create particularly harsh conditions for sustainability-linked loans during the first half of the year. While there was evidence of this in late 2022, H1 2023 performance reveals the extent of the impact, as Nordic sustainable loan volumes sank by 50% year-on-year and 22% half-on-half.

The sustainable share of all Nordic loans is at its lowest level since 2019, having steadily fallen to 18% from a 2021 high of 37%. This can be viewed as a result of market conditions rather than waning enthusiasm for sustainable formats. Due to the application of sustainability criteria, such as KPIs with set yearly target levels, the majority of sustainable loans are best suited to loans with multiple year terms. Longer term lengths provide opportunity for the borrower to demonstrate an improvement in sustainability performance while also providing confidence to the lender that improvements were additional and not a continuation of business as usual. With the interest rate environment pushing corporates towards shorter-term financing, sustainability formats became less widely applicable than in previous years.

Source: Dealogic, Nordea

Despite challenges in the broader market, Finland and Norway each showed record shares of sustainable loans in H1 2023. Sustainable formats made up 60% and 54% of each country’s total loan market, respectively, during the first half of the year. Denmark and Sweden have seen significant drops in sustainable share of total activity during 2023. This is the first time Denmark has not had the greatest sustainable share in the Nordics since entering the market in 2020.

Stay on top of the latest developments in the fast-moving world of sustainable finance. Receive a curated monthly digest and occasional flash updates with the latest news, insights and data from our Sustainable Finance Advisory team.

Register here

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more