- Name:

- Joel Lundh

- Title:

- Analyst, Nordea

Sweden's public finances are stable, which is and has been a strength – especially during the recent turbulent years with the pandemic, war and high inflation. Ahead of the next framework period, low government debt and an increased investment requirement open the door for a more expansionary fiscal policy.

Sweden's public finances have been stable, with an annual budget surplus of around 0.4% from the end of the 1990s up to the pandemic. It can be compared to the EU average, where the median annual deficit was -2.4% of GDP in the same period. Solid public finances are a strength, paving the way for a more expansionary fiscal policy going forward.

The surplus target (fiscal target) is pivotal in the Swedish fiscal policy framework and refers to the average net lending over an economic cycle. The target has varied over time, but, during the current framework period running until 2026, it has been set at 1/3 of a percent of GDP.

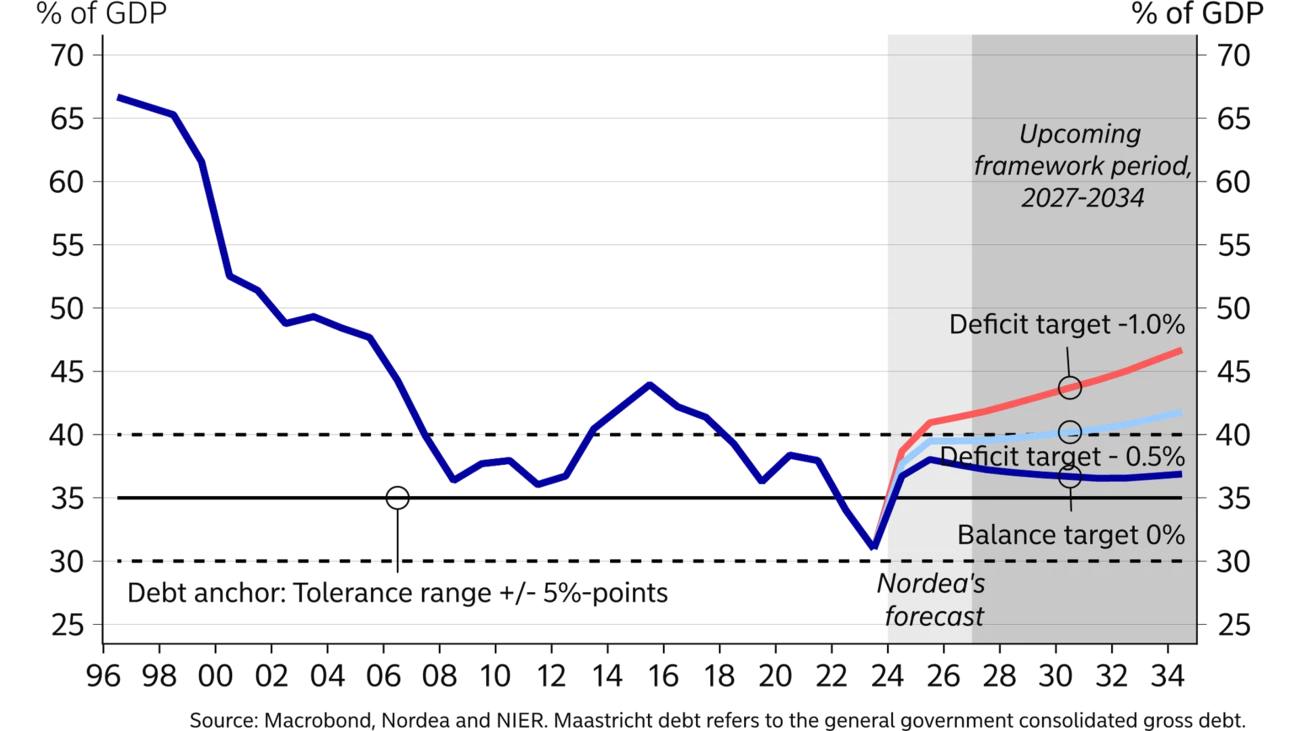

The Maastricht debt supports the fiscal target – the debt anchor is 35% of GDP, with a tolerance range of plus/minus 5 percentage points. The Maastricht debt refers to general government consolidated gross public debt as a share of GDP. The public sector comprises the government, the municipal sector (municipalities and regions) and the retirement pension system. In addition, Sweden is bound by the EU's Stability and Growth Pact, meaning that the Maastricht debt must not exceed 60% and the budget deficit must not exceed 3% of GDP in a single year. Sweden is far from these levels, with a Maastricht debt of 31.6% compared to the EU average of 81.7%.

The Swedish fiscal policy framework must be reviewed every eighth year. Ahead of the upcoming 2027-2034 framework period, a balance target is the most likely outcome, even though a deficit target has been discussed. A parliamentary committee must provide the basis for proposals for the next fiscal target level by 15 November 2024 at the latest.

A transition to a balance target would result in a downward revision of the fiscal target by 1/3 of a percentage point. According to our calculations based on the National Institute of Economic Research's forecasts from June, this implies increased room for reforms of around SEK 220bn during the coming framework period and a Maastricht debt of around 37% by end-2034. A similar estimation with a deficit target of -0.5% (-1) suggests increased room for reforms of SEK 550bn (880) and a Maastricht debt of 39% (42).

The 2023 Long-Term Survey presented scenarios for the public debt development based on a permanent change of the fiscal target level. The survey estimation suggests that a balance and deficit target of -0.5% would entail debt in the tolerance range in the coming framework period. However, debt is still expected to increase, with the deficit target to exceed the range towards 2050 (42%). The main difference between the survey and our calculations are the revisions made to public debt and GDP.

A change of the fiscal target will also require a discussion about the future Maastricht debt level. The Long-Term Survey considers that public finances, with a debt anchor of 40-50%, can be characterised as "very strong" and consistent, with a fiscal target of -0.5% of GDP.

The Long-Term Survey and the Swedish Fiscal Policy Council also point out that temporary increases in expenses financed by funding rather than temporary tax increases may be justified to finance investments.

Low government debt opens the door for a more expansionary fiscal policy.

Risks related to a lower fiscal target and higher public debt are, all else equal, less solid public finances. Additionally, it may be difficult politically to reverse the fiscal target once it has been reduced.

Based on the normalised inflation level, the government has signalled a more expansionary fiscal policy in the 2025 budget proposal. A lower fiscal target indicates a more expansionary fiscal policy also going for-ward. All else equal, it should lead to higher interest rates via an increased borrowing requirement and high-er GDP growth. If it affects inflation, it will likely be upwards. It is reasonable to expect a higher policy rate as a result, which can be around 3% in the long term.

This article first appeared in the Nordea Economic Outlook: Precision Play, published on 4 September 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more