3

Number of years with stagnation in household consumption.

Torbjörn Isaksson

The conditions are in place for a recovery in domestic demand – the main drivers are lower interest rates and stronger household purchasing power. As a result, the labour market will likely improve. However, the effect of monetary policy occurs with a lag, and economic activity will be subdued in the near term. The recovery should gain further traction during 2025 and into 2026. Inflation remains low, and the Riksbank will likely cut its policy rate further.

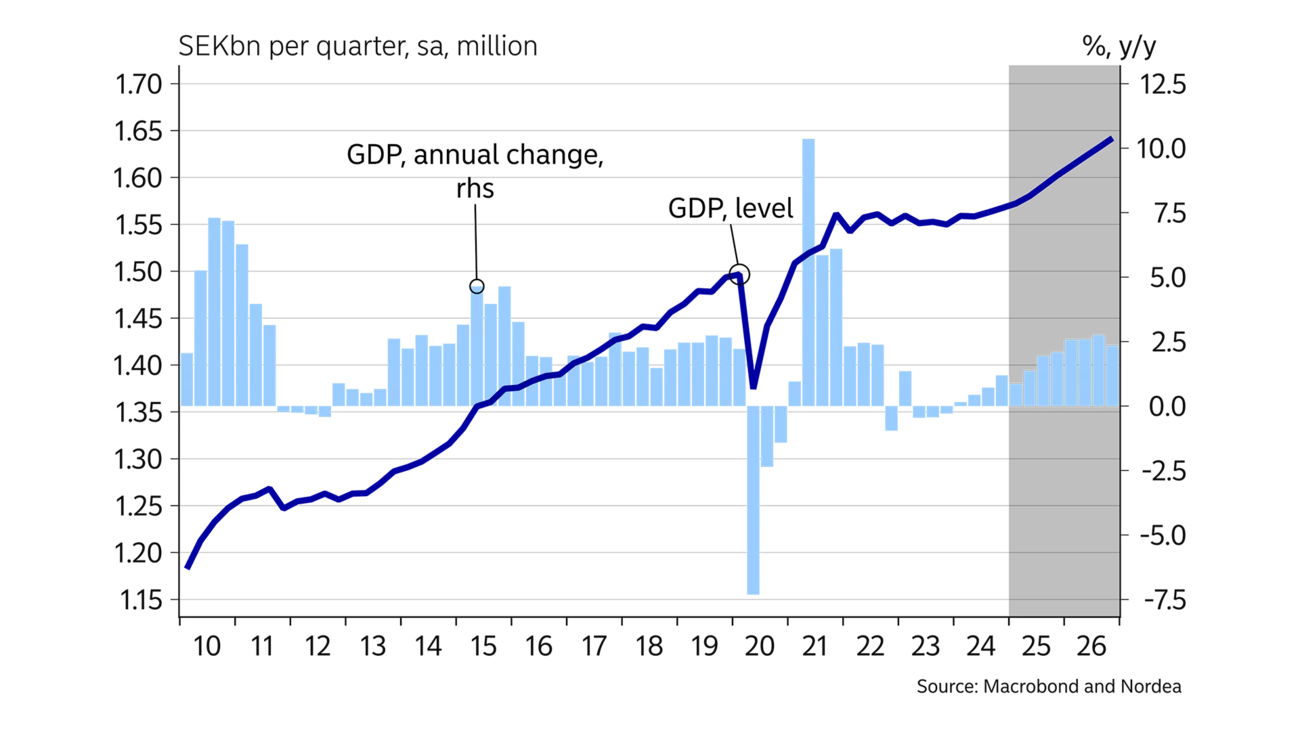

2024 was another lost year for the Swedish economy. GDP grew only slightly, and unemployment rose. Trends were also subdued around the turn of the year.

The Riksbank initiated a series of rate cuts in May 2024. However, not until the latter part of the year and the early months of 2025 have interest rates decreased more noticeably for households and businesses. In addition, the monetary policy affects the economy with a lag. Consequently, growth will be weak in the near term, and the recovery will not likely gain momentum until mid-2025.

Despite a series of rate cuts, the interest rate level will most likely remain higher than in the 2010s. The recovery will thus be slower than, for example, the rapid rebound after the pandemic. Neither unemployment nor housing prices will likely return to the peak levels of 2022 and 2023. In many respects, recent years’ inflation and interest rate shocks have had a greater negative impact on the economy than the pandemic.

Overall, households are experiencing a soft landing.

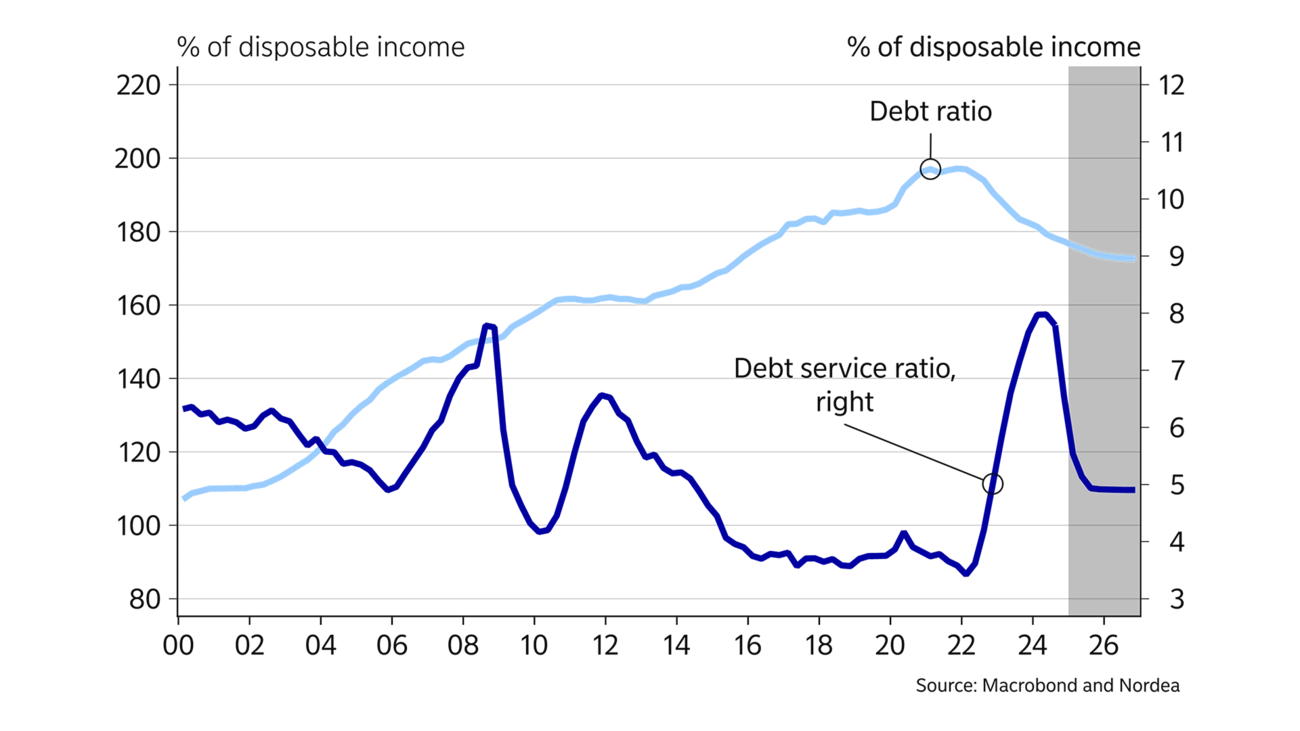

Households have had some tough years. Rising inflation has taken a toll on purchasing power. At the same time, high interest rates have not only driven expenses higher but also eroded real wealth, owing to falling housing prices. Households have increased their buffer savings with the heightened uncertainty.

There are early signs that households are recovering. The most obvious sign is that housing prices are on the rise again. In line with the historical pattern, housing prices rose when the Riksbank made its first rate cut in the spring of 2024. Changes in housing prices are usually a good indicator of household demand, and last year’s increase in housing prices suggests that consumption will also soon pick up again.

Another positive signal is that households expect the Swedish economy and their own finances to normalise following particularly gloomy sentiment in recent years. This, in turn, suggests that buffer savings may decrease, freeing up money for consumption. Inflation has stabilised and growth in household real disposable income should pick up in 2025, supporting the recovery.

Overall, households are experiencing a soft landing, which is very unusual. Households have managed to consolidate their financial position and cope with the higher interest rates without it causing a crisis in the Swedish economy.

The process has affected households and companies that depend on household demand. However, resilience has been better than feared. Household debt has remained unchanged during the past few years.

By contrast, the debt ratio, or debt-to-income ratio, has decreased significantly, driven by growing income. Most factors will likely improve going forward, suggesting that the favourable process will continue and that the rise in consumption will gradually accelerate in 2025 and continue in 2026.

| 2023 | 2024E | 2025E | 2026E | |

|---|---|---|---|---|

| Real GDP (calendar adjusted), % y/y | 0.0 | 0.6 | 1.6 | 2.6 |

| Underlying prices (CPIF), % y/y | 6.0 | 1.9 | 1.8 | 1.6 |

| Unemployment rate (LFS), % | 7.7 | 8.4 | 8.4 | 7.9 |

| Current account balance, % of GDP | 6.7 | 6.9 | 6.0 | 5.8 |

| General gov. budget balance, % of GDP | -0.8 | -1.7 | -1.5 | -1.4 |

| General gov. gross debt, % of GDP | 31.4 | 33.7 | 34.5 | 35.0 |

| Monetary policy rate (end of period) | 4.00 | 2.75 | 2.00 | 2.00 |

| EUR/SEK (end of period) | 11.10 | 11.48 | 11.40 | 11.00 |

3

Number of years with stagnation in household consumption.

1.5

%-points, rise in unemployment from 2023 to 2024.

18

%-points, share of exports of services of GDP in 2024.

Lower taxes are one of the reasons why household incomes will improve this year. More resources will also be allocated to defence, regions and infrastructure. In total, discretionary fiscal policy corresponds to ~1% of GDP for 2025, which is expected to be largely the same in the election year of 2026. The budget deficit will be ~2% of GDP in 2025, while improving slightly in 2026.

Public debt (Maastricht) is rising but still close to the debt anchor of 35% of GDP during the forecast period. This is low in a historical perspective and significantly lower than in many other countries. Confidence in public finances thus remains intact, which strengthens the impact of fiscal policy on GDP growth.

The expansionary fiscal policy is reflected in increased public investment during the forecast period, not least under the auspices of the central government. Conversely, the slowdown within the industry sector in 2024, with reduced production and capacity utilisation, led to a decline in industrial sector investment in 2024, indicating an unchanged level in 2025, according to our view. The same applies to the private service sector, which has been under pressure from reduced household demand in recent years. The outlook for many service providers is improving, as interest rates decline and household demand improves.

Otherwise, the biggest drag on investment is housing construction. The decline is largely structural as population growth has stagnated. Furthermore, there is a gap between construction costs and households’ financing options. Although the gap is narrowing due to lower interest rates over the forecast period, it will continue to impede housing construction, which is estimated to be ~25,000 housing starts per year in 2025 and 2026.

Foreign trade has experienced remarkable growth after the pandemic. Services account for most of the export growth; read more on page 28.

While exports of goods have remained basically unchanged over the past two years, this performance is still relatively strong, given the muted demand from key trading partners. Certain sectors have been particularly resilient, especially exports of cars and trucks, which have increased, and exports of pharmaceuticals have also grown.

It is difficult to assess the effect of the exchange rate on exports. It is also often challenging to find short-term correlations between fluctuations in the SEK and the development in exports. However, the prolonged weakening of the SEK could affect companies’ long-term view of the SEK and thus their allocation of production. Thus, there could be a positive effect of the SEK weakening – especially on the exports of goods.

The outlook is uncertain. Indicators are mixed; a trade war cannot be ruled out and questions hover over the demand from Sweden’s most important trading partner, the Euro area. We expect the exports of goods to continue to develop modestly in the near term and that exports of services will also level out before global demand recovers again later in 2025.

The direct effects of a possible increase in import tariffs in the US, which accounts for 9% of Swedish goods exports, are likely to be felt by certain industries but still limited in terms of GDP. However, the big risk is if the trade war expands to more countries and regions.

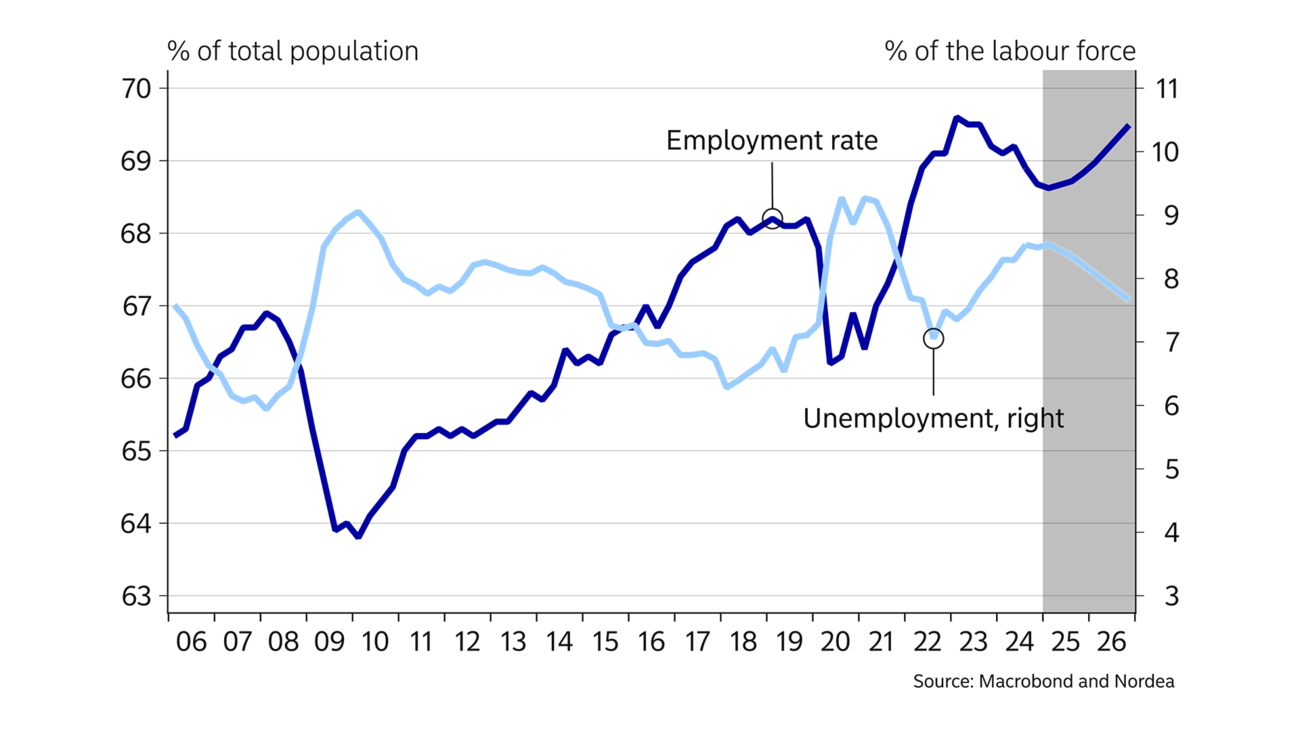

The labour market continued to weaken during the autumn. Consequently, the employment rate – the number of employed persons relative to the working-age population – has decreased by ~1 %-point since the peak in 2023. Also, unemployment has risen by almost 1.5 %-point – even though many have left the labour force, as some job seekers seem to have simply given up. At the end of 2024, both the number and the share of discouraged workers were at the highest level since 2020.

The outlook for employment is muted in the near term, but the labour market will most likely start to recover in 2025 when the domestic economy improves more significantly. There are early signs of stabilisation in the labour market. For example, layoff notices have fallen to more normal levels. As demand for labour picks up, more job seekers are likely to join the labour market again, contributing to a slow decline in unemployment to just below 8% at the end of the forecast period.

Wage growth was unusually high in 2024. In the business sector, wage growth was ~4%, while the current wage agreement stipulates wage growth of 3.3%. At the end of March 2025, the labour market parties will agree on a new wage agreement, probably spanning several years. Lower inflation and dampened labour demand tip the scales towards lower wage growth. On the other hand, relatively high wage expectations, which have historically been a good indicator, suggest that wage growth will stay at a high level. We expect the new wage agreements to be largely at the same level as in 2024 and that wage drift will decrease. Total wage growth will thus likely stabilise at ~3.5% annually, which is somewhat lower than in 2024.

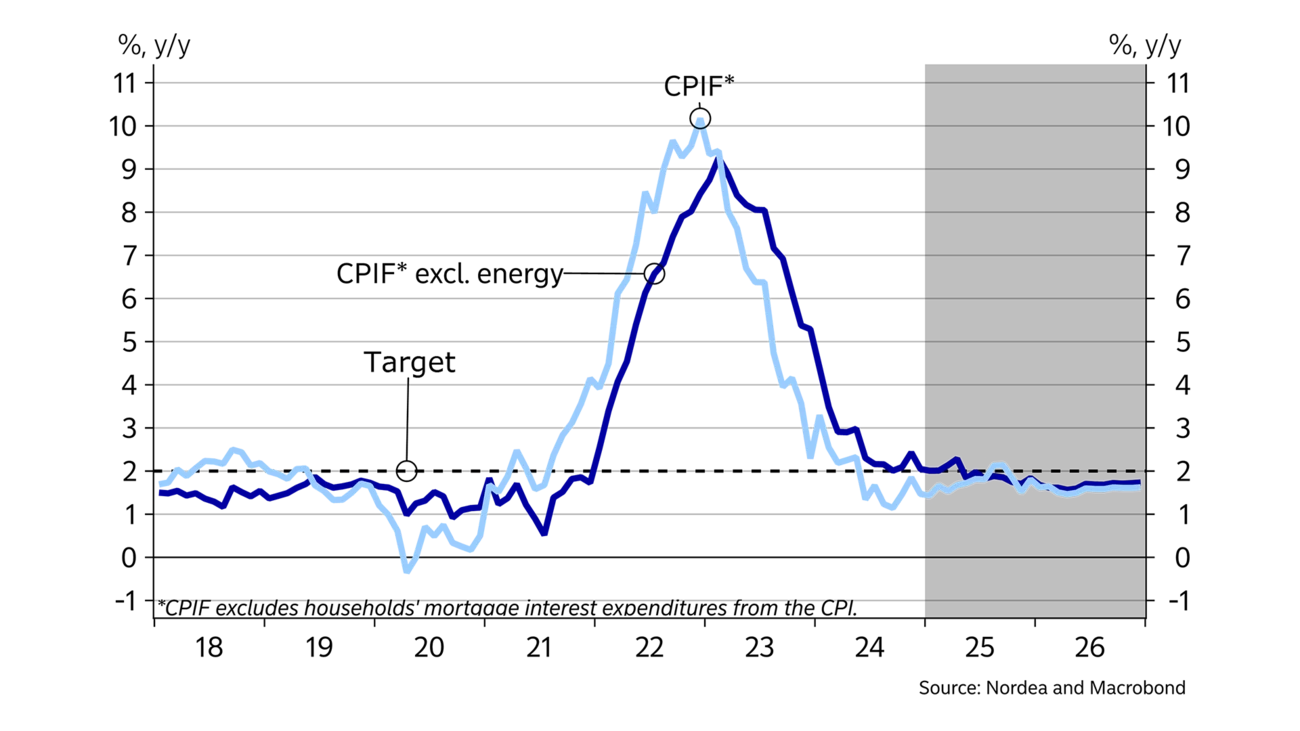

Despite higher wage increases, consumer prices have remained relatively steady over the past year. By the end of 2023, the monthly changes began to normalise. Consequently, the 12-month figures also fell to 2% in 2024 despite the higher wage increases.

In the autumn of 2024, there were small signs of rising inflation, partly as a result of higher food prices. Exchange rate fluctuations also seem to have contributed to slightly higher consumer prices. The effects will most likely linger in 2025. Subsequently, inflation will likely fall, as lower input prices, such as the normalisation of energy and commodity prices, will dampen inflation.

Against the background of moderate inflationary pressures, a weak labour market and low resource utilisation, the Riksbank will continue to cut its policy rate in the near term. However, the Riksbank will leave the policy rate at higher levels than before the pandemic. One reason is the vulnerable SEK exchange rate and that the Riksbank is expected to take into account that other central banks seem reluctant to cut rates quickly and to low levels. Rate cuts in Sweden should also boost growth, and improved economic conditions reduce the need for rate cuts later on.

The Riksbank's policy rate will remain higher than before the pandemic.

The trade-weighted exchange rate has strengthened over the past year, albeit gradually and with large fluctuations. Basically, the conditions are in place for a continued strengthening of the SEK exchange rate later this year. Households have weathered the interest rate and inflation shocks, and, with falling interest rates and stable inflation, Sweden’s growth prospects now appear more favourable than those of many other countries. In addition, the business sector is competitive and fiscal policy is expansionary. However, a more pronounced strengthening of the SEK is not likely until late 2025.

This article first appeared in the Nordea Economic Outlook: Consumer comeback, published on 22 January 2025. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more