- Name:

- Torbjörn Isaksson

- Title:

- Nordea Chief Analyst

A cold wind is still blowing through the Swedish economy. Tight monetary policy will likely gradually impact the domestic economy and Sweden’s important trading partners. Some relief is expected once inflation falls and policy rates are lowered. Much of the forecast period is still characterised by subdued economic trends and rising unemployment, as households and businesses adjust to a permanently higher interest rate level.

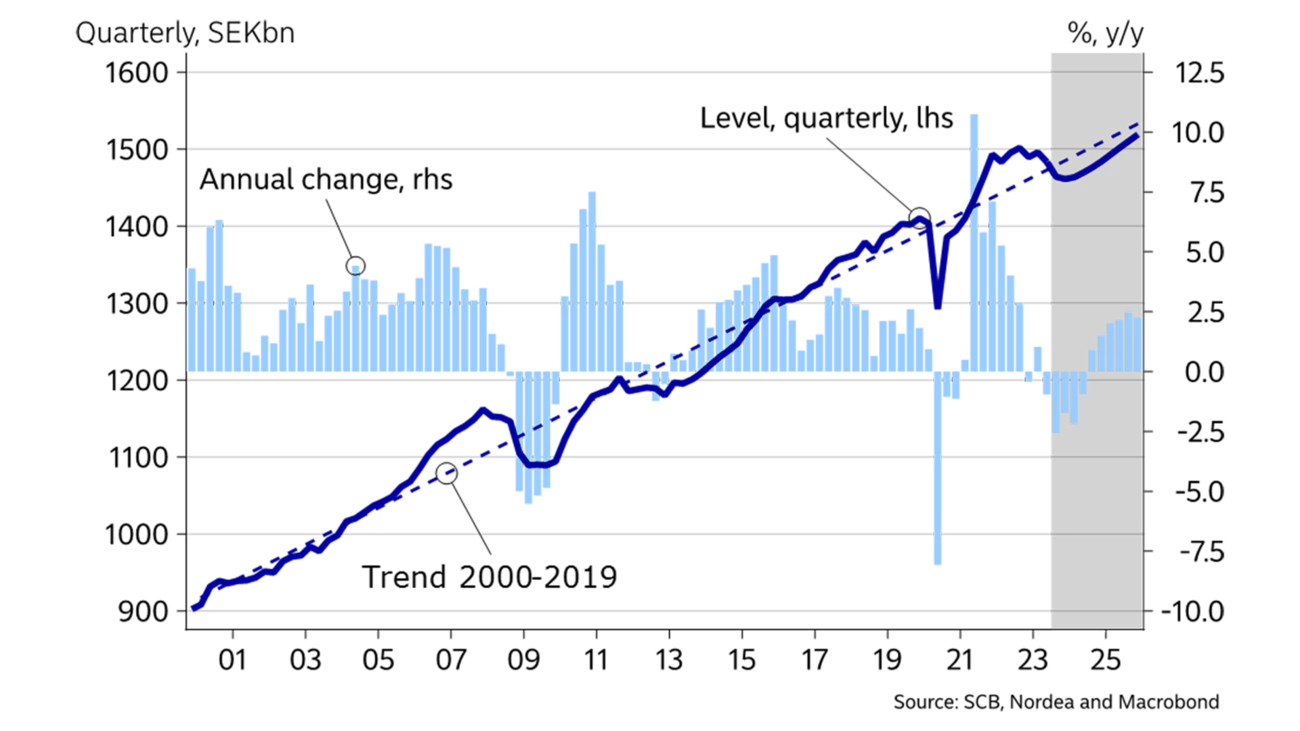

The Swedish economy started to lose momentum from an unusually strong level as early as the be-ginning of 2022. Then GDP stagnated and we expect the economy to shrink this year. Domestic demand is the main drawback, but the export industry is also facing tougher times. Monetary policy tightening has resulted in many challenges and GDP will also likely be weak in 2024, according to our forecast.

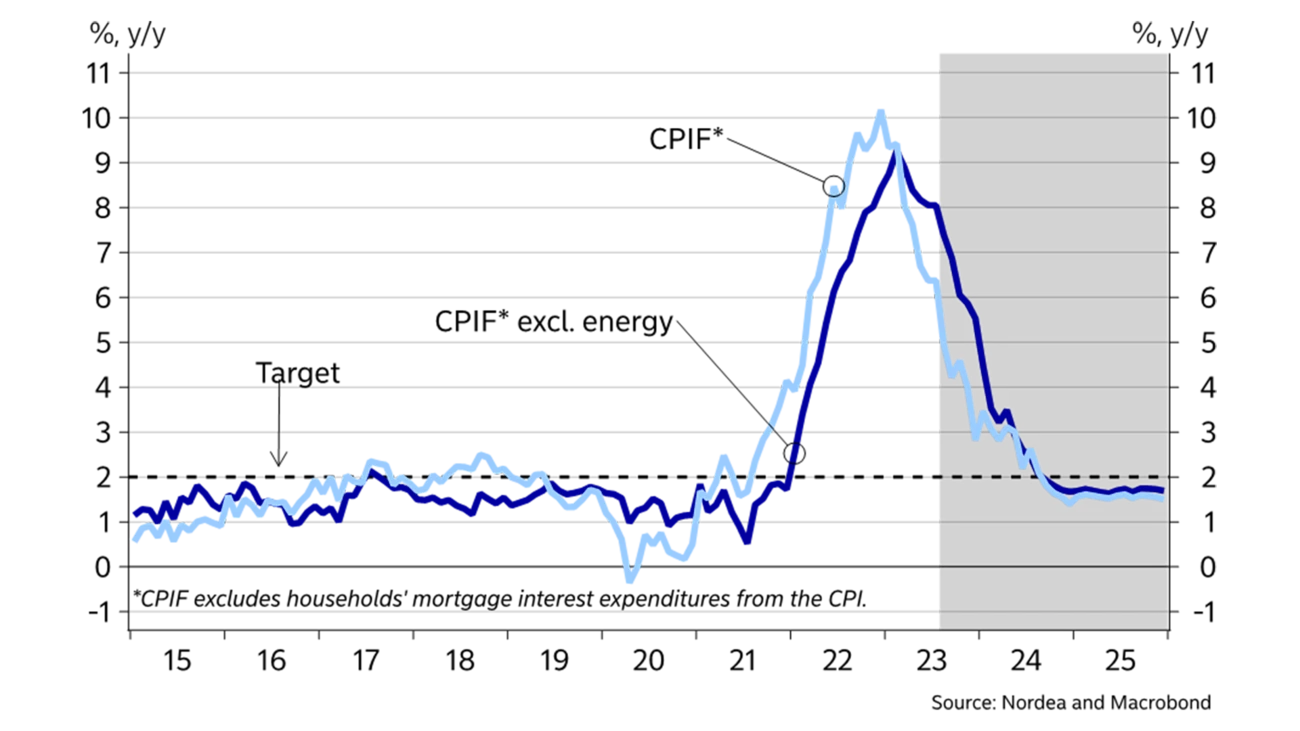

Inflation is falling, and the Riksbank looks set to cut interest rates next year, providing some relief for challenged households and businesses. A slow recovery could thus begin in 2025. However, resource utilisation will be lower than usual during the entire forecast period.

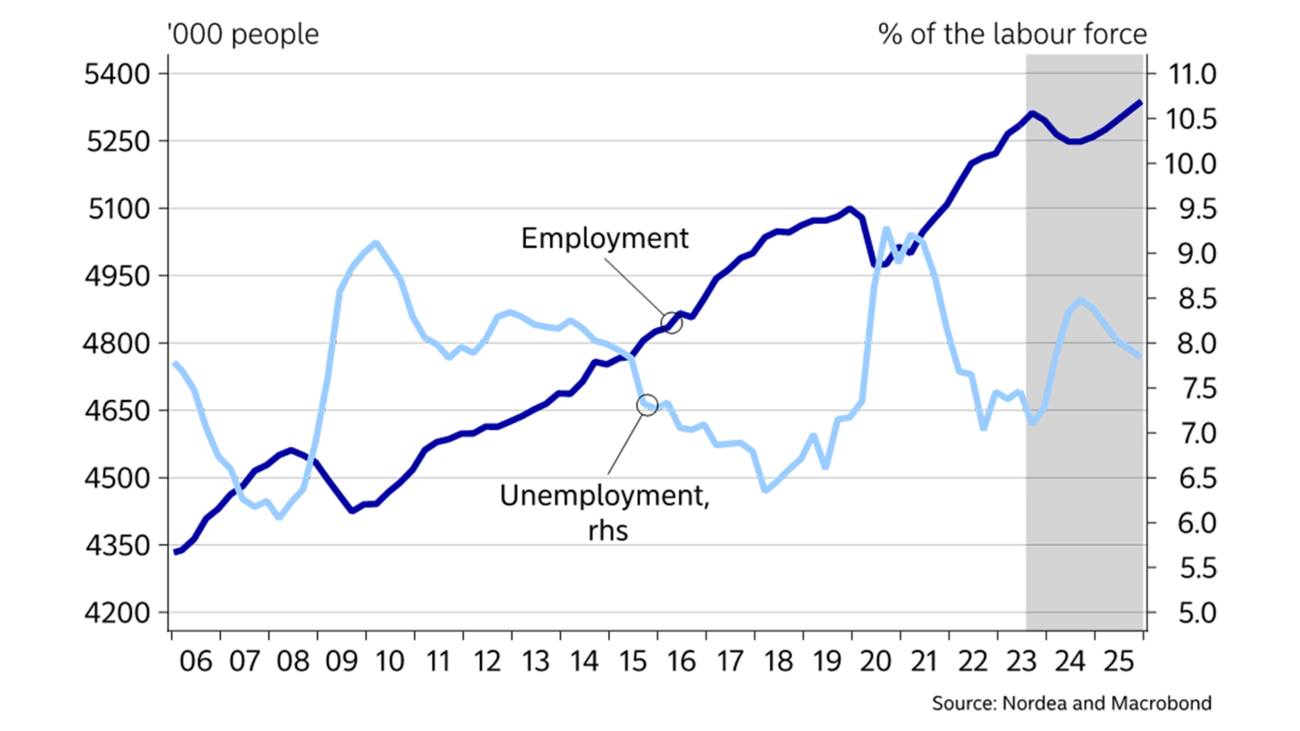

But there are also positive signs. The labour market has been surprisingly strong so far this year, and the downturn in employment is relatively modest compared to expectations. In addition, GDP has been strong in nominal terms; that is, in current prices. This applies to household spending and income, among other things. This may have contributed to fewer bankruptcies, higher employment and general economic resilience this year. Central banks’ rate hikes and reduced balance sheets are weighing on household finances and business results. Consequently, nominal growth will slow too. This should help drive inflation lower, but also weaken demand and production. We believe that policy rates will be lowered during 2024 and 2025, but the interest rate level at the end of the forecast period will still be significantly higher than before the pandemic.

During the pandemic, global demand shifted to goods as financially strong households were prevented from buying services. The pandemic is basically over and consumers’ spending patterns have normalised in most countries. Coupled with central banks’ tightening measures, this has lowered glob-al demand for goods this year, which is reflected in an unusually sharp decline in world trade.

The global industrial cycle has thus cooled – and that also affects Swedish exporters. Near term, the transport industry will likely deliver a stable performance, though, as the past few years’ full order books are still being processed. Defence equipment manufacturers are also experiencing a positive trend, which is important at a regional level, but this does not make up for the otherwise lower demand for goods.

The overall picture is thus of most exporting companies and gradually also the transport industry, seeing subdued demand for goods during the coming year, with a likely recovery only in 2025. The weak development will also lead to a drop in industrial investments, both this year and the next, before the level stabilises.

SWEDEN: MACROECONOMIC INDICATORS

| 2022 | 2023E | 2024E | 2025E | |

| Real GDP (calendar adjusted), % y/y | 2.8 | -1.0 | -0.2 | 2.2 |

| Underlying prices (CPIF), % y/y | 7.7 | 6.1 | 2.4 | 1.6 |

| Unemployment (LFS), % | 7.5 | 7.3 | 8.3 | 8.0 |

| Current account balance, % of GDP | 5.0 | 5.7 | 5.6 | 4.0 |

| General gov. budget balance, % of GDP | 1.1 | -0.7 | -1.5 | -0.4 |

| General gov. gross debt, % of GDP | 32.8 | 32.2 | 34.0 | 34.4 |

| Monetary policy rate (end of period) | 2.50 | 4.25 | 3.75 | 2.50 |

| EUR/SEK (end of period) | 11.12 | 12.00 | 11.20 | 10.70 |

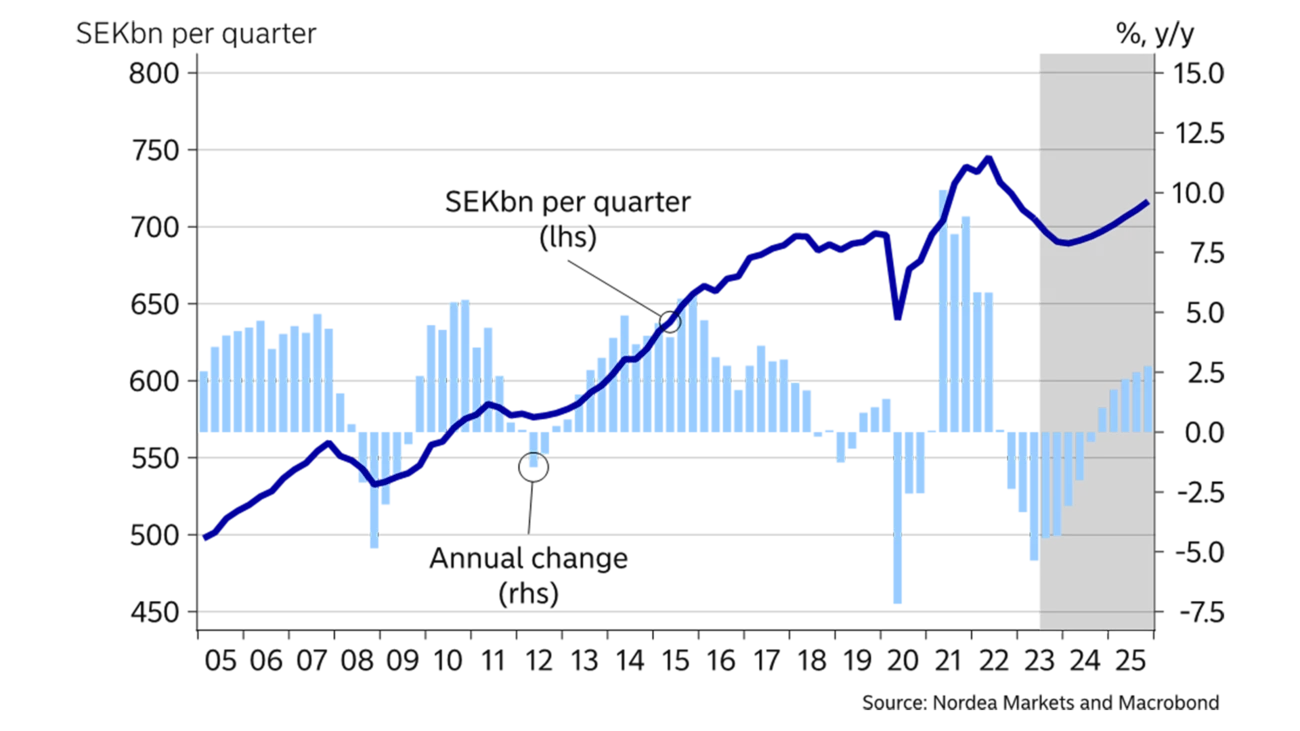

The demand for services has been strong in several areas of the economy during the past year. Production has been resilient and investments have gone up in the services sector. Foreign trade in services has risen especially rapidly over a long period. During Q2 this year, services exports were up 20% on 2019, and imports have seen an even steeper increase of as much as 30%. The increases are mostly driven by various types of business services and services related to in-formation and telecommunications. In other words, foreign trade continues to increase and, at least in this respect, globalisation seems to increase for Sweden. The longer-term trend in services is thus strong, but will also be affected by a cyclical downturn in global demand in the coming year.

In a bid to maintain their spending level, households have set aside more money than ever before for pur-chasing goods and services this year. It has not been enough, though. High inflation has eroded households’ purchasing power, resulting in reduced consumption volumes. Rising interest expenses are also eroding purchasing power and are weighing on home prices too. Home prices have recovered somewhat over the summer after the previous fall, but we fear that prices will drop further going forward, although more gradually than the previously sharp decline. This is important in several respects. For example, the trend in home prices usually affects households’ propensity to spend.

Much of the forecast period is characterised by households’ adjustment to the higher interest rate level. Further, employment looks set to fall and unemployment increase going forward, weighing on income trends and creating uncertainties for households.

Lower inflation and somewhat lower interest rates during 2024 should provide some support for spending and home prices. At the end of 2025, home prices will still likely be significantly below the 2022 top level, at the same time as consumption volumes remain basically unchanged since 2021.

Much of the forecast period is characterised by the adjustment to a higher interest rate level.

As a result of households’ tighter financial position and falling home prices, residential construction has plummeted. We expect the number of new housing starts will fall to an annual rate of around 22,000 flats, equivalent to just one third of the record year of 2021. Slight pickup is expected in 2025. The fall in residential construction is the key reason why investments will fall both this year and the next. Besides the industrial sector, the services sector is also expected to experience a setback back this year, while investment in the energy sector is increasing.

Also, government investment and public consumption are rising. The increase reflects the rearmament of the defence forces, among other things. In spite of this, public sector spending and investments are not large cyclical buffers this year. Local authorities are poised to struggle with high costs and, further ahead, lower tax revenues as employment declines.

The pressure on economic policy decision makers to support the economy is gradually mounting. This indicates that local authorities will be allocated public funds next year, resulting in increased spending and investment. Nevertheless, the public budget is close to balancing in the forecast years and public debt (Maastricht) remains below 40% of GDP.

The weak trend in GDP is eventually feeding through to the labour market. Things took a turn for the worse over the summer, and unemployment will likely rise to around 8.5% during the forecast period. Read more about the labour market on page 15. The wage agreement is fixed for the coming two years with a negotiated increase of 3.5% per year, and a weaker labour market will likely reduce the probability of accelerating wage drift. We believe that total wage increases will land just below 4%.

The inflation outlook is still uncertain, although it now seems to be slowing. The trend is largely the opposite of the increase in early 2021. Energy prices, other commodity prices and global transport costs will be the first to reverse, followed by changes in consumer prices, mainly of goods.

Many services industries also benefit from the sharp price drop in the mentioned input goods over the past year; for example via costs for heating, transport, travel and material related to certain services. Moreover, the weak domestic demand makes it more difficult for companies to pass on cost increases, which reinforces the picture of lower services inflation. Wage increases pull in the other direction, as the increase generates price impulses. However, the expected wage increases are not likely to reach levels high enough to jeopardise the inflation target.

The weakening of the SEK is the main reason why the Riksbank will hike rates in the autumn.

The weak exchange rate of the SEK poses an inflation risk. Partly because of some uncertainty about how the exchange rate will develop and partly because it is difficult to estimate how much it will affect consumer prices. We believe the SEK will continue to trade at weak levels in the near term, as subdued global growth creates an environment that rarely favours the SEK. The weaker SEK will not prevent inflation from falling, but it will slow down the decline. Overall, lower prices of input goods, reduced demand and a stable exchange rate will lead to a fall in inflation to around 2% next year, according to our forecast.

The weak SEK is the main reason why the Riksbank will hike interest rates in the autumn. Continued depreciation may lead to higher imported inflation, and the plan is to prevent this through a higher policy rate that supports the SEK. The SEK is the focal point, while there are few domestic reasons to tighten monetary policy further.

Inflation hovering around the 2% target coupled with the weak economy will prompt the Riksbank to follow other central banks and lower its policy rate from next year. At the end of the forecast period, central banks’ policy rate will still be several percentage points higher than before they started hiking rates in 2022.

Monetary policy feeds through with a lag, and it is difficult to estimate the full effects of the past years’ unexpected and sharp rate hikes. If inflation becomes unexpectedly high, central banks will probably continue to tighten their monetary policies, which will result in weaker economic conditions. In this context, the SEK is a particular worry for Sweden. The trends suggesting a more favourable development going forward include high nominal growth of household income and spending. Such trends may mitigate some of the negative effects on, for example, labour markets that are otherwise often triggered by lower consumption and production volumes.

This article first appeared in the Nordea Economic Outlook: Not there yet, published on 6 September 2023. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more