- Name:

- Torbjörn Isaksson

- Title:

- Nordea Chief Analyst

Sweden will see weak economic growth in the near term. Inflation will likely normalise and interest rates go down this year, which will provide support and lower the risks of a deep recession. However, the interest rate level will stay higher than before the pandemic. Many businesses and households thus still need to adjust to higher funding costs, which hampers the recovery. The SEK is on firmer ground and will strengthen in the forecast period.

The Swedish economy is currently in recession, with resource utilisation being lower than normal. Thanks to the exceptionally strong starting point, the current economic stagnation, which is expected to continue in 2024, will probably only lead to a relatively mild recession. GDP is close to the long-term growth trend and the number of people employed as a share of the population remains relatively high.

It is a mixed picture. The industries most affected by higher funding costs have serious problems – especially residential construction and durable goods sales. Also parts of the manufacturing industry are struggling, owing to weak global demand for goods. However, the private service sector has performed better.

Inflation will normalise this year, and the Riksbank will cut its policy rate in 2024. Coupled with stronger global demand, the economy will start growing again from mid-2024. Despite several rate cuts this year, the interest rate level will remain significantly higher than during the 2010s. The coming years will thus be characterised by a continued and necessary adjustment to the new interest rate level, resulting in a more gradual recovery.

The overall picture is that the Swedish economy will weather the recent years’ inflation and interest rate storm without sliding into a deeper crisis. Many risks will persist, though, and some will be linked to the rest of the world.

As for risks related to the domestic economy, it is still difficult to assess the consequences of recent years’ interest rate increases as they have not yet fully fed through to the economy. The risks will be higher if inflation, and thus interest rates, take hold at a higher level than expected.

At the same time, domestic demand may recover more than expected as households’ purchasing power strengthens and uncertainties decrease after interest rates have peaked. The risk picture is generally more balanced than previously.

The global industrial cycle is weak. Especially in our part of the world, the demand for goods has plummeted over the past year.

In spite of this, Swedish exports of goods were surprisingly resilient during 2023 and even increased towards year-end. Not least exports of cars and machinery have grown.

The outlook for the export industry is nevertheless subdued. Most export indicators are gloomy, and key export markets are weak. For example, euro-area growth – accounting for more than 40% of Sweden’s export market – is expected to come to a halt. Exports of goods are thus expected to fall in early 2024. The situation will later improve as the global economy recovers. As a consequence of the weak trend, industrial investments will decline this year.

| 2022 | 2023E | 2024E | 2025E | |

| Real GDP (calendar adjusted), % y/y | 2.9 | -0.3 | -0.5 | 2.2 |

| Underlying prices (CPIF), % y/y | 7.7 | 6.0 | 1.8 | 1.6 |

| Unemployment (LFS), % | 7.5 | 7.7 | 8.6 | 8.3 |

| Current account balance, % of GDP | 6.0 | 6.2 | 6.2 | 5.6 |

| General gov. budget balance, % of GDP | 1.3 | -0.1 | -1.7 | -1.3 |

| General gov. gross debt, % of GDP | 32.9 | 31.2 | 32.8 | 34.1 |

| Monetary policy rate (end of period) | 2.50 | 4.00 | 2.50 | 2.50 |

| EUR/SEK (end of period) | 11.12 | 11.10 | 10.80 | 10.70 |

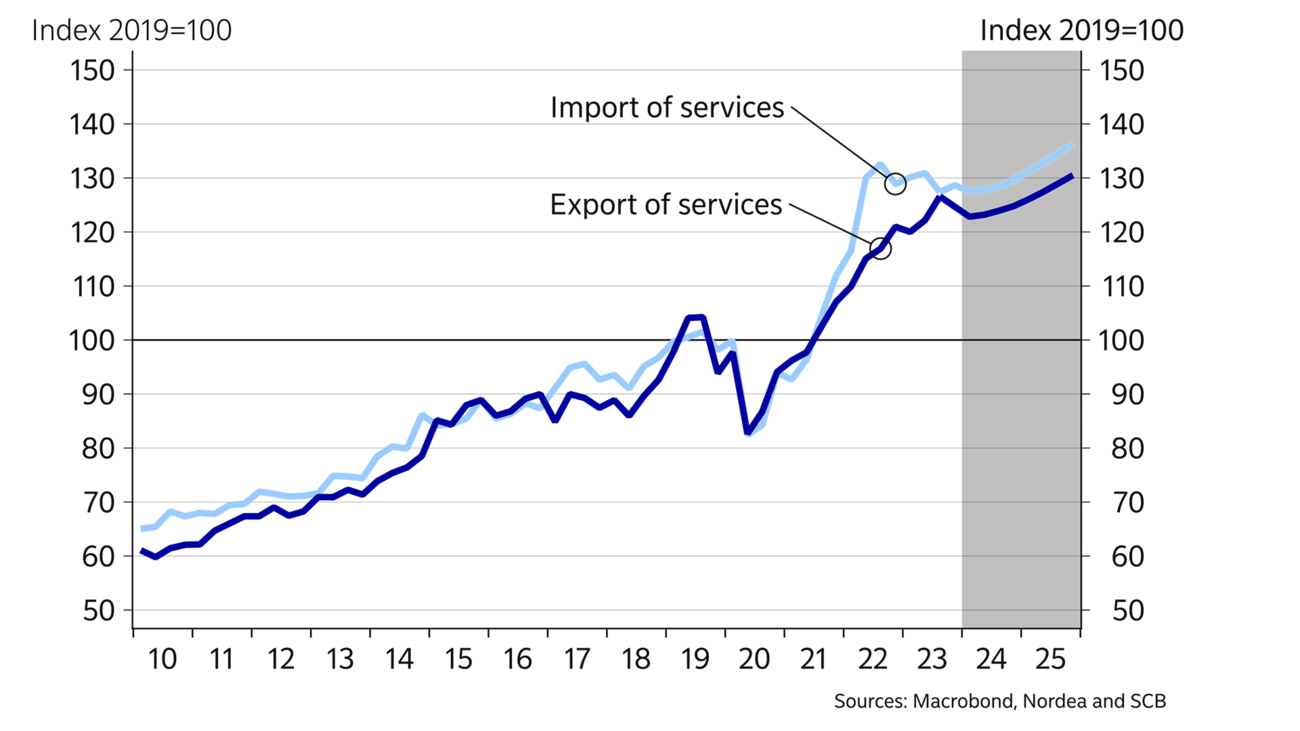

During Q3 2023, services exports were up 26% compared to 2019. This is a broad increase, with business services and services related to computers, head offices and R&D as the largest growth contributors.

Services exports now account for 17% of GDP and 32% of exports, and are an important reason for surprising GDP resilience in recent years. Although there are few signs of a slowdown, the best estimate is that the trend will break and services exports will flatten this year. Foreign trade in services seems to react to changes in global demand at a greater lag than goods, which could partly explain why the uptick in services exports was so strong up to and including Q3 2023.

For services imports the increase since 2019 is even bigger – a solid 30%. In other words, global trade continues to rise and globalisation seems to grow, at least in Sweden. Services are in any case an increasingly important part of the economy.

Last year, household consumption fell by 2.5%, according to our forecast. Besides the temporary standstill during the pandemic, this is the largest decline since the crisis of the 1990s. Falling household consumption is partly an effect of households’ adjustment to higher interest rates. As described in the theme article on page 27 about households’ finances, we expect debt relative to income to fall thanks to rising income and not because of debt repayments. If so, household consumption will be weaker than our forecast. The deteriorating labour market is another factor that could indicate a poorer-than-expected performance. It should be stressed that the development in interest rates is crucial to households.

However, we believe there is scope for household demand to stabilise later in 2024. Besides less uncertainty about the interest rate outlook and increased purchasing power, household financial wealth is robust. Overall, consumption is expected to decline somewhat in the near term, while a slow positive turnaround will start in mid-2024.

Foreign trade in services is an increasingly important part of the economy.

Housing prices flattened during 2023, but were 13% lower by year-end compared to the peak in early 2022. A large supply of homes and low turnover indicate a continued subdued near-term price trend. When the Riksbank lowers interest rates during the spring, a gradual recovery will begin. The total decline in housing prices will thus stop at 15%, according to our forecast.

Residential construction will also be supported by lower interest rates. The turnaround will take longer than for housing prices, though, and the upturn will also be slower. There is still a large discrepancy between the costs of building homes and what households are willing to pay. The number of housing starts will bottom at around 22,000 flats in 2024, which is only one third compared to the record-year 2021.

The decline in residential construction is the primary reason why total investments will fall during 2024. In addition to the industrial sector, the services sector is also experiencing a setback, albeit a mild one. Investments in the energy sector offset the downturn. Public investment and public spending are also on the rise. The increase reflects the rearmament of the defence force, among other things. On the other hand, local authorities are struggling with high costs and lower income. Fiscal policy continues to be disciplined and slightly expansive in 2024. The pressure on economic policy decision-makers to stimulate the economy will gradually mount, indicating a more expansionary fiscal policy in 2025. Still, public debt (Maastricht) is significantly below 40% relative to GDP by the end of the forecast period.

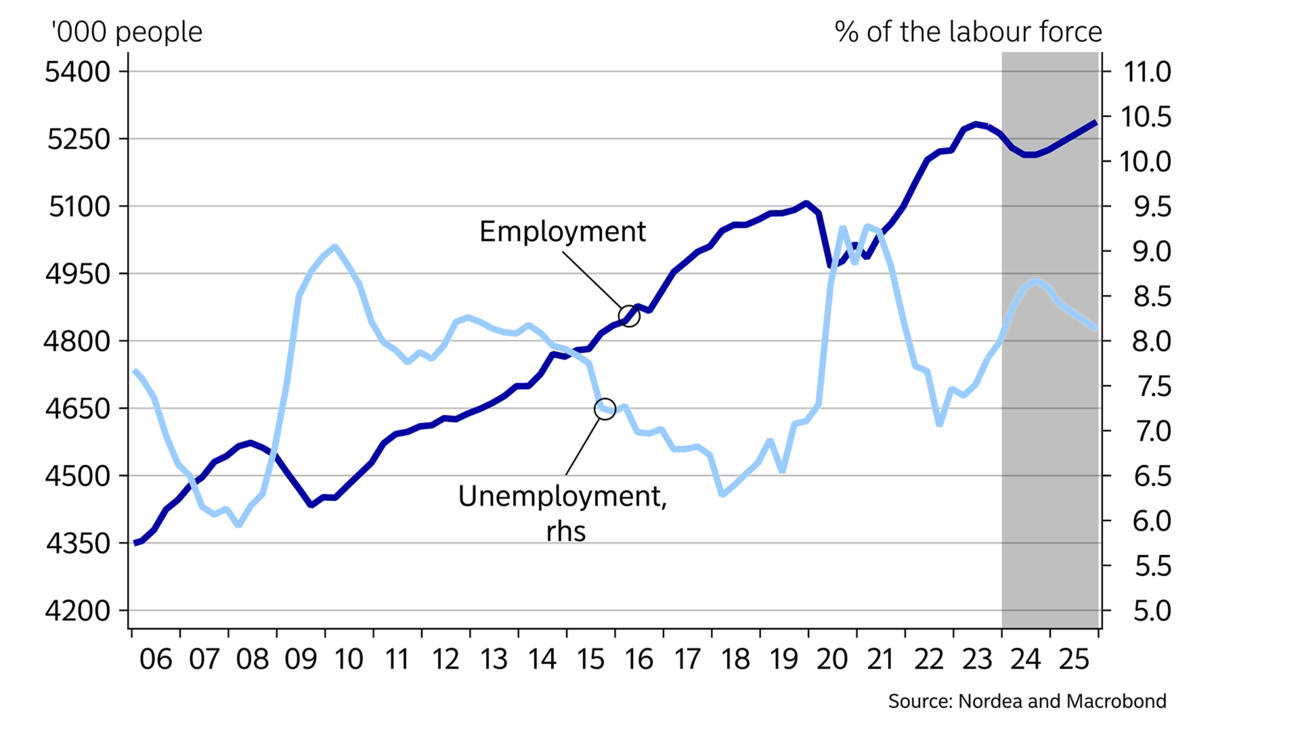

The economic slowdown will affect the labour market, but gradually. New job vacancies have fallen close to pre-pandemic levels. Also hiring plans are subdued. The number of layoff notices has gone up from the low 2022 levels and is somewhat higher than normal.

The labour market deteriorated especially after the summer. Notably, young people and temporary staff have experienced a decline in employment – they are often the first to be affected when demand for employment shifts. Employment is expected to continue to decline in early 2024, and unemployment will rise above 8.5% in the autumn.

Real wages will improve as inflation falls, and nominal wage increases have risen to around 4%, in line with the pay deals concluded last spring. Later in 2024, wage growth will slow when the second year of the deal starts with an agreed increase of 3.3%. When the new pay deals are concluded in the spring of 2025, we expect the outcome to be roughly within the same range. The overall pay rises will thus stabilise around 3.5% per year in the long term.

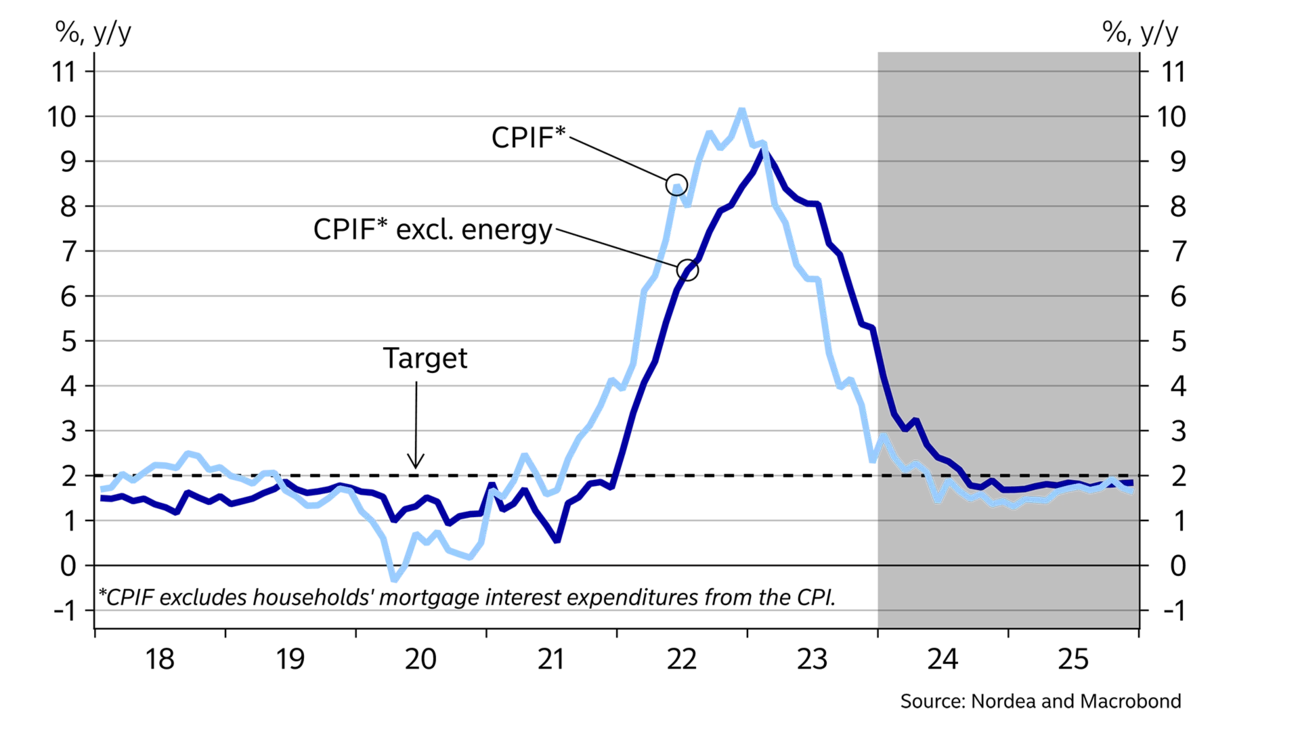

During the forecast period, wage growth is around 1% point higher than in the 2010s, but will not challenge the inflation target. The domestic cost pressure is modest also in other respects. In addition, energy prices have come down, other global costs have decreased and the SEK has stabilised. The weak domestic demand also makes it more difficult for businesses to pass through cost increases. Inflation (CPIF) is thus expected to stabilise close to 2% during the first half of the year and drop below the target in mid-2024.

Inflation is expected to stabilise close to 2% during H1 2024 and fall below the target as from the middle of the year.

With lower inflation, the Riksbank can start to normalise its monetary policy. Domestic costs are modest and long-term inflation expectations are anchored close to the inflation target. The policy rate is initially high, and, despite expected rate cuts, monetary policy will be tight during much of 2024. Inflation below target in H2 2024 and lower resource utilisation than usual are other reasons to ease monetary policy. On the other hand, the recession is relatively mild and inflation will be close to target longer out, so the Riksbank could consequently keep its policy rate on hold in 2025.

Over the past few months, the SEK exchange rate has benefitted from falling bond yields in the rest of the world. When both the Fed and the ECB lower their policy rates this year, it will support the SEK. The relative growth outlook has improved for Sweden. The interest-sensitive Swedish economy has tackled rising interest rates better than feared, and over time it will become even more evident that foreign economies and regions are also affected by higher interest rates. This speaks in favour of a stronger SEK, which is expected to strengthen both against the EUR and the USD longer out.

This article first appeared in the Nordea Economic Outlook: Past the peak, published on 24 January 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more