- Name:

- Jan Størup Nielsen

- Title:

- Nordea Chief Analyst

Sivua ei ole saatavilla suomeksi

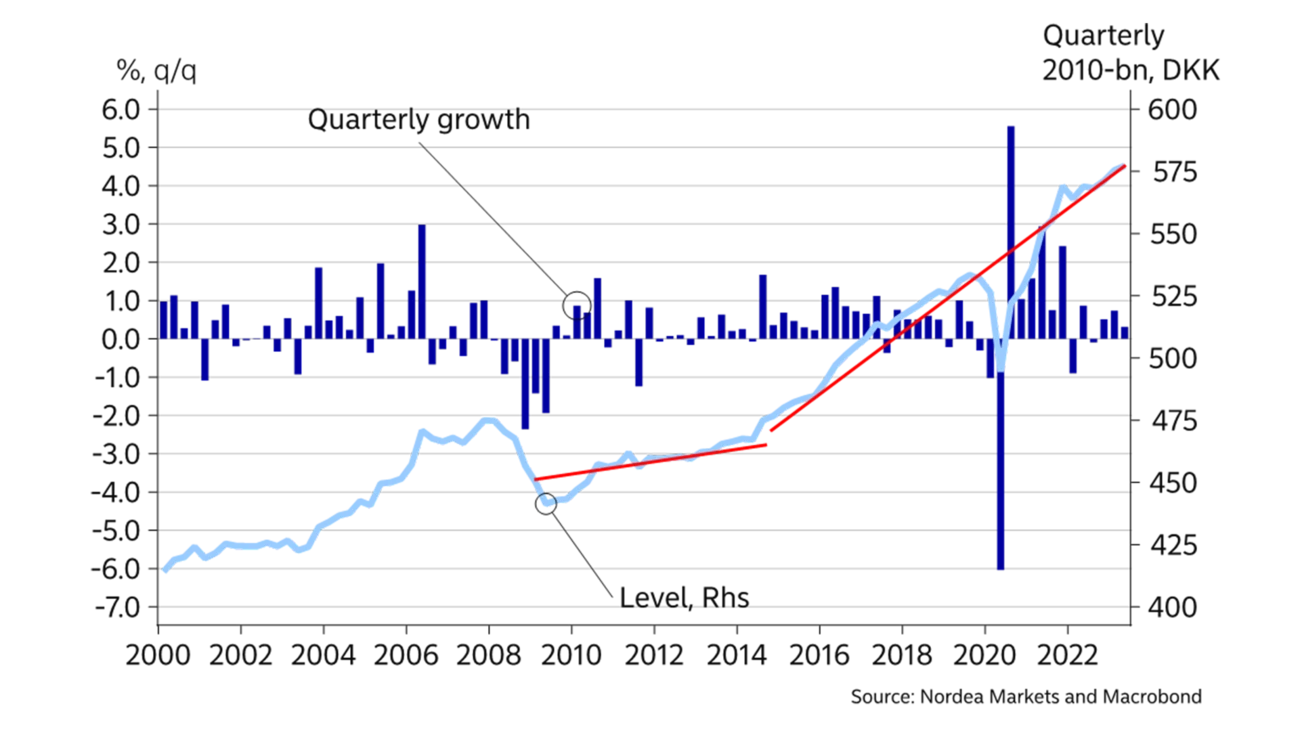

Pysy sivulla | Siirry aiheeseen liittyvälle suomenkieliselle sivulleThe Danish economy has been on a remarkable growth journey, which has boosted employment to the highest level ever. The current account surplus has thus risen sharply and public finances have been positive for six years running. However, signs of an impending slowdown are starting to show, not least through the higher interest rates and downturn in key export markets. This is expected to push the Danish economy into a new phase, with lower activity and growing unemployment. However, the dampening will be relatively mild and soon replaced by renewed progress during 2024.

The Danish economy has expanded by an annual average of 2.5% per year since 2013. That is a markedly higher growth pace than the years following the financial crisis, when the Danish economy almost ground to a halt for several years. This was achieved despite the major setbacks caused by the COVID-19 lockdowns.

This long stint of solid progress has brought the Danish economy closer to the capacity limit, making it increasingly difficult to keep moving forward based on existing resources. This challenge has been partly offset by a strong influx of foreign labour. Still, the latest data indicate a gradually slowing growth pace. This is particularly the case in the construction sector, which is traditionally very sensitive to interest rate increases.

Against this background, we expect economic growth of around 1.3% this year. Compared with our May forecast, this is an upward revision from 0.5%. This is mainly due to a surprisingly strong performance in the first half of the year, while we expect a mild contraction in the remainder of the year. The weakness is expected to be carried over into next year with a drop in GDP growth to 1.0%. Lastly, we include a forecast for 2025, with a growth rate of 1.7%.

Since early 2020, overall industrial production in Denmark has increased by more than 50%. That is a sharp acceleration compared to previously. Moreover, it is an entirely different trend than in for instance Germany and Sweden where industrial production has moved sideways in recent years. The key explanation for this strong growth is the pharmaceutical industry, which represents just over 20% of total production. Here, production has roughly tripled since the beginning of 2020. On the other hand, production in other sectors that do not include the pharmaceutical industry has declined since last summer. This is also the case for the large mechanical engineering industry in Denmark, which has contracted more than 10% over the past year alone.

The calculation of industrial production includes sales of goods produced both in and outside Denmark. The pharmaceutical industry is typically characterised by being highly productive and at the same time much of the activity takes place abroad. Therefore, industrial production has also increased significantly more than employment in recent years.

Correspondingly, the strong growth in the pharmaceutical industry is a crucial precondition for the current account performance. Over the past few years, the current account surplus has totalled almost DKK 400bn, or more than 13% of GDP.

|

|

2022 |

2023E |

2024E |

2025E |

|

Real GDP, % y/y |

2.7 |

1.3 |

1.0 |

1.7 |

|

Consumer prices, % y/y |

7.7 |

4.0 |

2.3 |

2.0 |

|

Unemployment rate, % |

2.6 |

2.9 |

3.3 |

3.1 |

|

Current account balance, % of GDP |

13.5 |

12.4 |

11.1 |

10.4 |

|

General gov. budget balance, % of GDP |

3.4 |

2.3 |

1.4 |

0.5 |

|

General gov. gross debt, % of GDP |

29.7 |

29.8 |

29.5 |

28.7 |

|

Monetary policy rate (end of period) |

1.75 |

3.35 |

2.60 |

1.60 |

|

USD/DKK (end of period) |

6.97 |

6.96 |

6.65 |

6.48 |

The Danish economy has been on a remarkable growth journey. A slow-down is looming, but it will likely be relatively mild.

Tighter credit conditions and an uncertain demand situation in several key export markets have pushed investment activity lower. Especially notable is housing investment, where the number of housing starts has plunged. On the other hand, companies’ investments in intellectual property rights have risen to an all-time high – again mostly driven by the pharmaceutical industry. The divergent trend clearly underlines that it is mainly higher interest rates that currently constrain investment in the most cyclically sensitive sectors.

Last year, the erosion of purchasing power was one of the reasons why overall household spending declined by more than 2%. However, during 2023 consumer sentiment reversed in step with falling inflation and higher wage growth. Also, record-high employment has reinforced overall domestic purchasing power – triggering a renewed rise in retail sales. We expect consumer spending to rise further over the forecast horizon, mainly as a result of the positive real wage growth. In addition, the refund of overpaid housing taxes could boost consumption.

Despite the slowdown in construction activity, lower industrial production outside the pharmaceutical sector and the waning investment activity, the labour market continues to surprise on the upside. Since early 2020 overall employment has thus grown by almost 200,000 people or some 7%. In June the number of wage earners was very close to three million.

The surge in employment has only been possible because of a large influx of foreign nationals to the Danish labour market during the same period. As a result, foreigners now make up more than 12% of the overall labour force.

Thanks to the strong employment growth, unemployment has been maintained at a very low level. In fact, many businesses, particularly in the service industry, still cite labour shortages as a constraint. However, in our view, unemployment will rise moderately towards the end of 2024 in response to generally lower economic activity. But even taking into account the expected rise in unemployment of about 3.3%, the level will remain very low in a historical perspective.

After peaking at just over 10% in October, 2020 inflation has steadily decreased to a level of 3.1% in July this year. The main reason is the sharp drop in energy prices, not least for electricity and gas, which are down about 30% than a year ago. Prices of several products have also stopped rising as a result of cheaper commodities and freight costs as well as weaker demand. In July, product prices were thus marginally lower compared to July 2022. This was the first time since 2020 that product inflation was negative.

On the other hand, service prices continue to rise quite steeply. One of the main reasons is since the service industry is traditionally very labour-intensive and therefore also very sensitive to the higher rate of wage increases. At the same time, consumer demand for services is still strong, which is also one of the factors driving inflation higher.

We expect average inflation to land on 4.0% this year, mainly due to the high levels at the beginning of the year. Next year we expect a decline to 2.3%, as goods prices are likely to notably drive the overall rate of inflation lower. However, it should be stressed that the fore-cast is very uncertain, as it is highly dependent on future developments, particularly in energy prices.

The decline in inflation coincides with rising wage increases. With the collective agreements in the spring, salaries in the private sector are expected to rise by around 3.7% this year and around 4.5% next year. That is also the case for employees in the public sector, for which collective bargaining will start next year. However, in the Danish labour market there is a long-standing tradition of pay rises in the public sector largely mirroring the trend in the private sector. The wage trend in the public sector is thus generally expected to follow the private sector – albeit with a slight delay given the different collective agreement periods.

The combination of record-high employment and low supply of homes for sale has somewhat surprisingly led to a renewed rise in home prices. The low number of homes for sale follows several years of very high trading activity. We forecast that prices of single-family houses will rise a bit further over the summer. But not enough to prevent average sales prices this year being at least 2% lower year-on-year.

We expect that normalisation of the supply of homes for sale and continued high financing costs will mean that sales prices will move sideways throughout 2024. But we see quite a significant risk that prices will start falling again as more and more homeowners will feel the pinch of the markedly higher interest rates. Into 2025, prices should start to climb a bit higher, to reach the same level as in early 2022. Adjusted for inflation, real home prices should still be around 15% lower than at the beginning of 2022.

In 2022, the public budget surplus was 3% of GDP. It was the sixth year running with positive public finances, and since 2019 Denmark has been the EU country with the largest surplus relative to GDP. Government gross debt has thus fallen below 30% of GDP thanks to the current surplus. This is a historically low level, except for a short period up to the financial crisis in 2007-08.

Public finances are expected to continue to record a surplus in coming years. However, it will most likely be smaller compared to previous years, as, for example, pension return tax receipts will likely be significantly reduced. Moreover, in 2023 and 2024, public budgets will be affected by the refund of more than DKK 13bn to homeowners, who paid too much in housing taxes from 2011 to 2020.

Since the summer of 2022, the ECB has raised its policy rate by a total of 4.25% points. The Danish central bank has only partly mirrored this aggressive monetary policy tightening. One of the reasons is the historically large current account surplus, which has increased Danish companies’ demand for Danish kroner. To counter the pressure on the DKK, the Danish central bank has several times had to widen the interest rate differential, so the policy rate is now 0.4 percentage points lower than in the Euro area. This has eased the pressure for a stronger DKK and the Danish central bank has not intervened in the currency market since the beginning of 2023.

In our baseline scenario we do not expect more rate hikes from the ECB or the Danish central bank this time around. The first rate cuts are not projected until around mid-2024, though. This should maintain short Danish rates at around the current level until the turn of the year.

Get the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more