- Name:

- Jan von Gerich

- Title:

- Chief Analyst, Nordea

Jan von Gerich

An interesting US presidential election is drawing closer. While the result may not end up changing the medium-term outlook for the US economy significantly, the risks are real on many horizons.

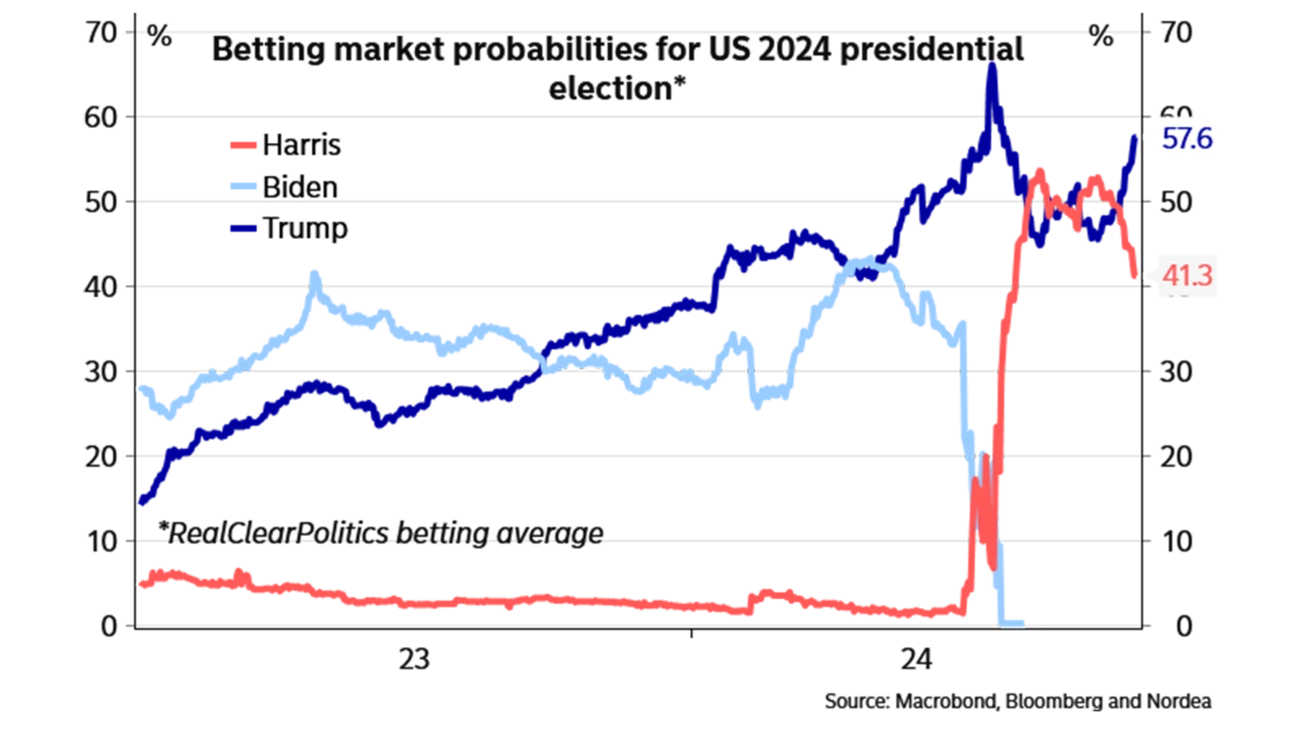

The US presidential election on 5 November is less than a month away, and while the topic has been closely followed in the media, financial markets have so far been preoccupied with other themes. Nevertheless, the uncertainty about the outcome is huge, with polls leaving the results too close to call, and the betting market favourite has changed many times in the past months.

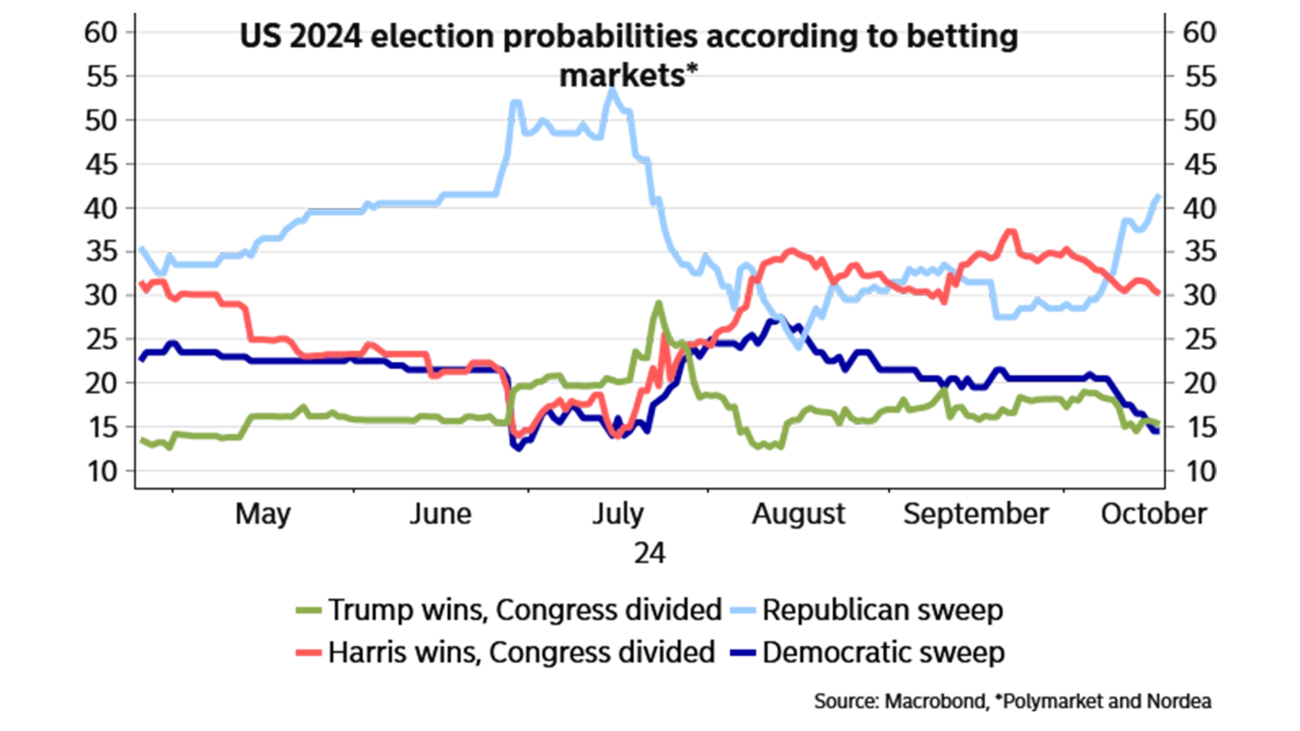

While most focus has been on the presidential vote, the results of the congressional elections matter a lot as well. Here we can say a bit more about the likely winner. The House of Representatives is likely to be controlled by the same party as the White House, but the Senate is different. Only around a third of Senate seats are contested every second year. Based on which seats are contested this time and which party is the favourite to win in those particular states, the Republicans are the clear favourites to take control of the chamber. As a result, if Donald Trump wins the presidency, the Republicans are likely to sweep, i.e. control both the White House and Congress. However, if Kamala Harris wins, she will likely face a divided Congress.

Harris would need congressional support for most of her agenda, whereas many of Trump’s initiatives can be furthered at least partly through presidential powers, suggesting policy changes are likely to be clearly bigger under a Trump victory than under a Harris presidency. Surprises are always possible, as for example in 2020, when the Democrats finally ended up controlling both houses of Congress as well as the White House despite unfavourable odds ahead of the election.

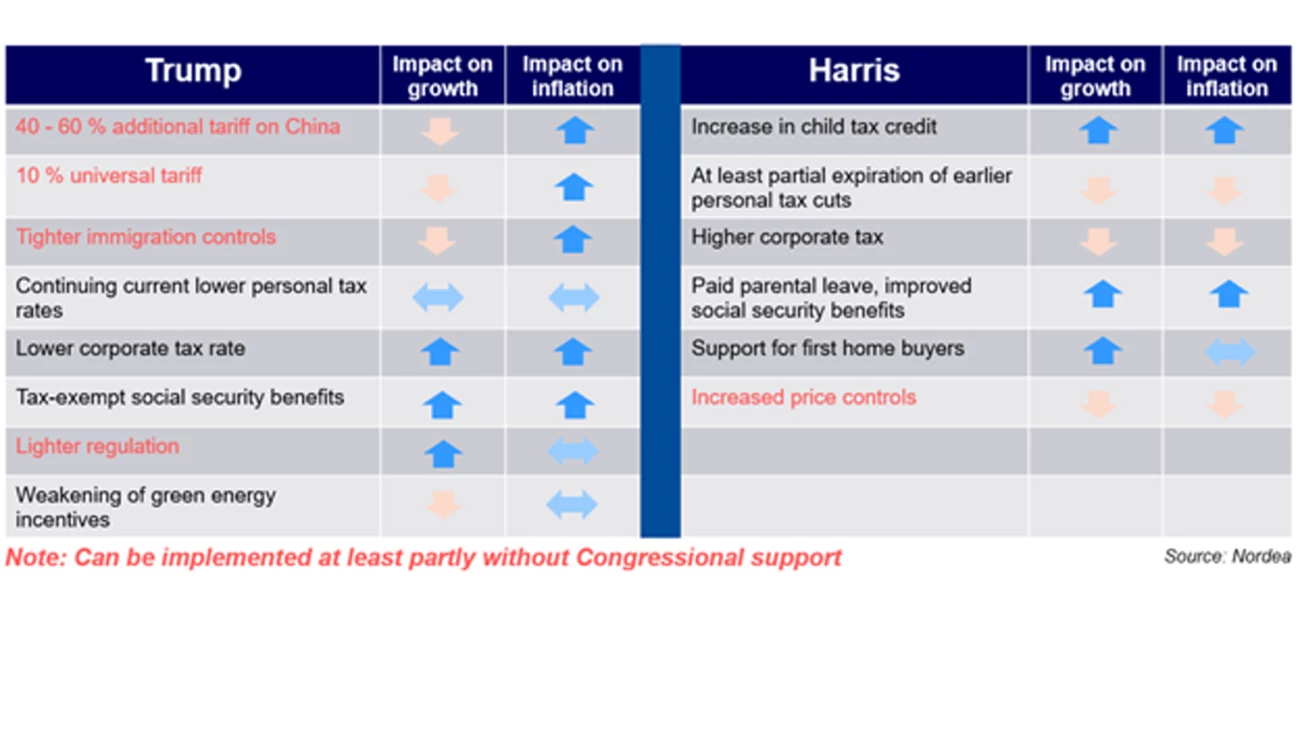

Regardless of which candidate wins, unless legislative action is taken, fiscal policy will tighten notably both in 2025 and 2026. This is because a big chunk of Trump’s previous tax cuts are scheduled to expire. Trump intends to continue these cuts in full and implement more cuts especially to corporate taxation, while Harris would also likely seek to continue a big part of these cuts.

While the two candidates have very different fiscal plans, fiscal policy is unlikely to become a larger driver of the economy in the comings years. Neither candidate plans to severely cut the deficit, while the already high starting point of the deficit would probably limit the willingness of Congress to support large-scale fiscal measures, even if one party controlled both chambers and the White House. In any case, high deficits are likely to continue.

In a Republican sweep, Trump would probably manage to push through some additional tax cuts, but these would pale in comparison to the cuts of his first term. In a Democratic sweep, Harris would likely manage to raise taxes and increase public spending, but these measures would at least partly offset each other in terms of the fiscal impulse and the economic impact. In a divided government scenario, Harris would struggle to implement any major parts of her agenda.

As described above, if Trump won, the Republicans would likely control Congress as well, and even in a divided government scenario Trump could do a lot. Yet even in a Republican sweep, it looks unlikely that Trump would implement his higher tariffs and tighter immigration policies in full. Nevertheless, given the still strong state of the US economy and a tight labour market, higher tariffs and tougher curbs on immigration would risk reigniting inflation and wage pressures, altering also the course for Fed’s rate cuts. We think such measures would have a negative impact on US growth, but the inflationary impact might still dominate.

Given his unpredictability, seemingly less willingness to compromise and less room for growth-supporting measures compared to his first term, the downside risks of a second Trump presidency appear clearly larger than those that prevailed during his first term. The geopolitical situation is already tense, and despite Trump’s promises, for example, to end the war between Ukraine and Russia in a day, his controversial stances could easily lead to a further escalation of global tensions. New tariffs would likely be met with counter-tariffs, which could lead to new trade wars. If he managed to ease fiscal policy, debt sustainability worries could surface. If he really tried to question the Fed’s independency, inflation worries might be reignited.

In the shorter term, if the polls are anywhere near correct, we might have to wait for an election result for days or weeks due to recounts in many states. And if the counts were really close, the losing candidate, especially Trump, would probably use any means possible to question and change the result. It would not even be the first time that the Supreme Court would have to take a stance. And it is also possible that neither candidate would receive the necessary 270 votes, and the House of Representatives would have to elect the president. The longer the uncertainties over the election result prevailed, the more market worries could escalate.

In short then, significant risks lie behind a baseline of more limited policy changes.

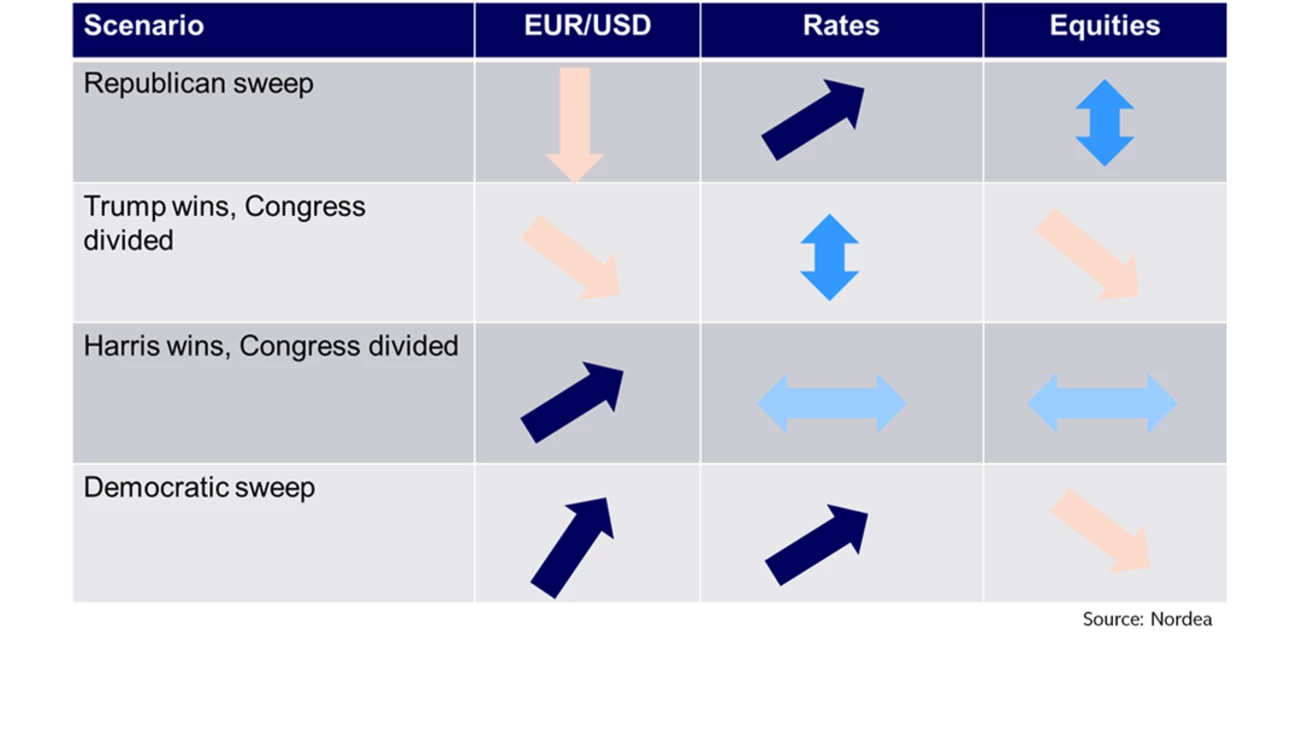

Given the uncertainties, trying to estimate the likely market reaction is fraught with uncertainties. Our strongest conviction on likely market reaction relates to the dollar, which is likely to perform better, if Trump wins. No matter whether the focus would be on tariffs, Trump’s growth-enhancing plans or increase in geopolitical tensions, the dollar should perform. The Chinese yuan would also likely face pressure under a Trump presidency.

Harris, in turn, would be seen as the candidate for continuity, which should limit global risks to some extent and thus support a higher EUR/USD.

Harris’s victory with a divided Congress should not lead to large changes in policy, which should also limit the market reaction. In a Democratic sweep, we tend to think the increase in fiscal spending might be larger than rising taxes, which could raise interest rates to some extent, while the equity market could still worry about higher corporate taxes.

Trump’s unpredictability would no doubt increase volatility, which could be seen especially if lack of congressional support forced him to take action on fronts where he can do so with solely presidential authority. We tend to think that in a Republican sweep, market focus would be on the prospect of some further fiscal stimulus as well as upside inflation risks, which would put upward pressure on rates.

Many of the market moves could take place already ahead of the election, depending on which scenario seems to be the most likely one. The magnitude of the market moves will naturally depend also on the scale of the surprises the election result brings. Market volatility could be high, especially as the vote count proceeds, if the race ends up being as close at the polls currently suggest.

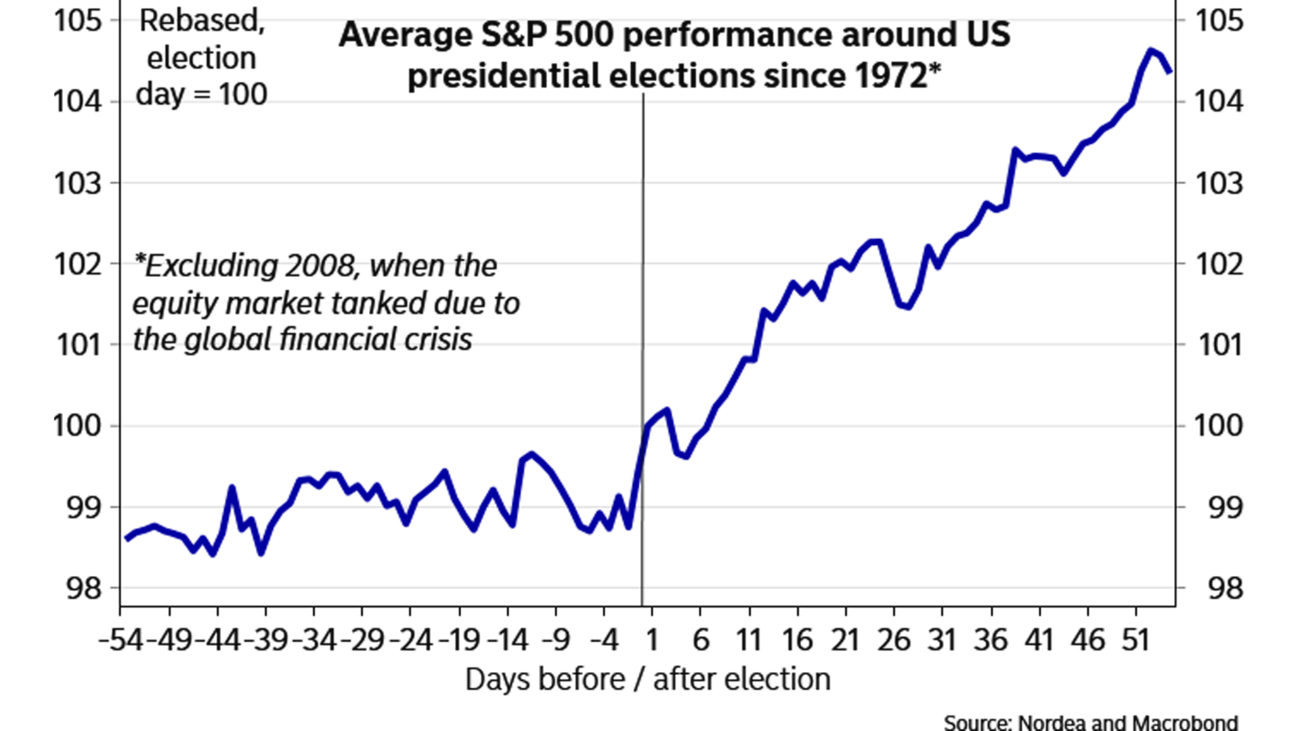

In the medium term, our baseline is that the election will not materially alter the course for the US economy and financial markets, but as discussed above, especially another Trump presidency would entail significant risks to this view. And almost regardless of the election result, assuming we do get a clear result, the removal of uncertainty relating to the election could boost economic confidence and risk appetite.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more