Treasury and finance professionals are working in a challenging new era of stubborn inflation, higher interest rates and elevated geopolitical tension. They acknowledge the risks that come with this new reality, but there does not seem to have been widespread action on that awareness yet.

That’s according to the latest findings from Nordea’s 2023 Treasury Survey: Brave new world.

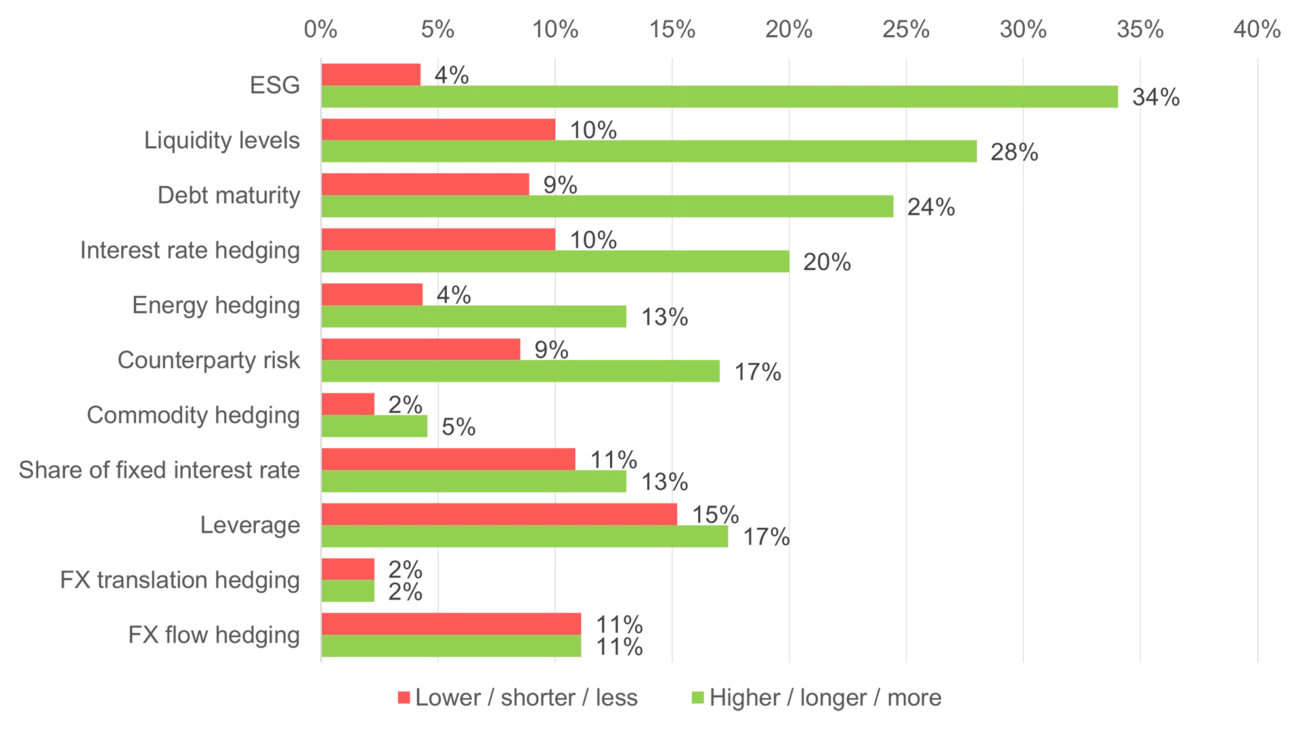

“We see a clear pattern that treasurers perceive the need to be more mindful of interest rate risk and leverage, but they haven’t done that much yet in terms of taking action,” says Johan Trocmé, Head of Nordea Thematics and co-author of the study.

Each year, the survey takes the temperature of Nordic treasury professionals on a wide range of issues. This year’s study drew in record participation from 176 Nordic and international large corporates from a broad spectrum of industries. The authors set out to examine whether the new, uncertain environment with higher interest rates and geopolitical risk is reshaping treasury priorities and behaviour.

“The inflation comeback has led to higher interest rates. No one knows how far it will go or how long it will last. We also have the geopolitical risk from the war in Ukraine and simmering tensions between the US and China,” says Trocmé.

He goes on to explain that more than 10 years ago, the treasury function was more oriented towards managing financial risks. Then, over the past decade or so, it entered a period of optimisation, centred around streamlining processes, boosting efficiency and turning the treasury into a well-oiled machine. Now, with the new economic environment, has the treasury reprised its role as risk manager?