- Name:

- Richard Hayes

- Title:

- Head of Trade Solutions Denmark

- Email:

- [email protected]

Denne siden findes ikke på norsk

Bli værende på denne siden | Fortsett til en lignende side på norskAs the global economy slows, emerging market suppliers face the prospect of a hard landing. Richard Hayes, Head of Trade Solutions Denmark at Nordea, explains how companies can strengthen their supply chains and support their suppliers’ working capital through the use of traditional trade instruments.

The past three years have been characterised by a range of complex macroeconomic and geopolitical events that will continue to shape economies for years to come. The economic slowdown, high inflation and high interest rate environment have created challenges for importers and exporters alike. In this article, we explore some of the working capital challenges prevalent within the supply chain as a result of the ongoing macro and geopolitical “polycrisis” and the potential to use traditional trade instruments to provide much needed working capital financing.

The notable deceleration in major economies has reduced external demand for goods and services from many emerging and developing economies, which are an integral part of the global supply chain. Moreover, the slowdown is occurring just when governments in many of these economies are running out of policy space to respond to the emerging challenges. These include the COVID-19 recovery, persistent supply-chain bottlenecks and inflationary pressures, rapidly evolving sanctions regimes and heightened financial vulnerabilities in large parts of the world. The combination of these threats could increase the risk of a hard landing in these economies.

Smaller emerging market suppliers are a vital component of the global economy, contributing to the growth of many large multinational corporations. However, these suppliers often struggle with a lack of working capital, which can have a significant impact on their ability to operate and grow their business.

Here are some of the implications for suppliers:

- A lack of working capital can limit the ability to finance operations, purchase raw materials, manufacture product to fulfil orders, pay wages and cover other expenses associated with running a business.

- Suppliers may also struggle to keep up with demand or meet their contractual obligations. This can result in delays, production shutdowns and missed opportunities to fulfil orders, which can lead to reputational damage and loss of business.

- A lack of working capital can also limit investment in new technologies and innovation. These suppliers often operate in highly competitive industries, and it is critical to invest in new technologies and innovation to remain competitive. Without sufficient working capital and the associated technological and process investment, suppliers can lose their competitive edge and attractiveness to anchor buyers.

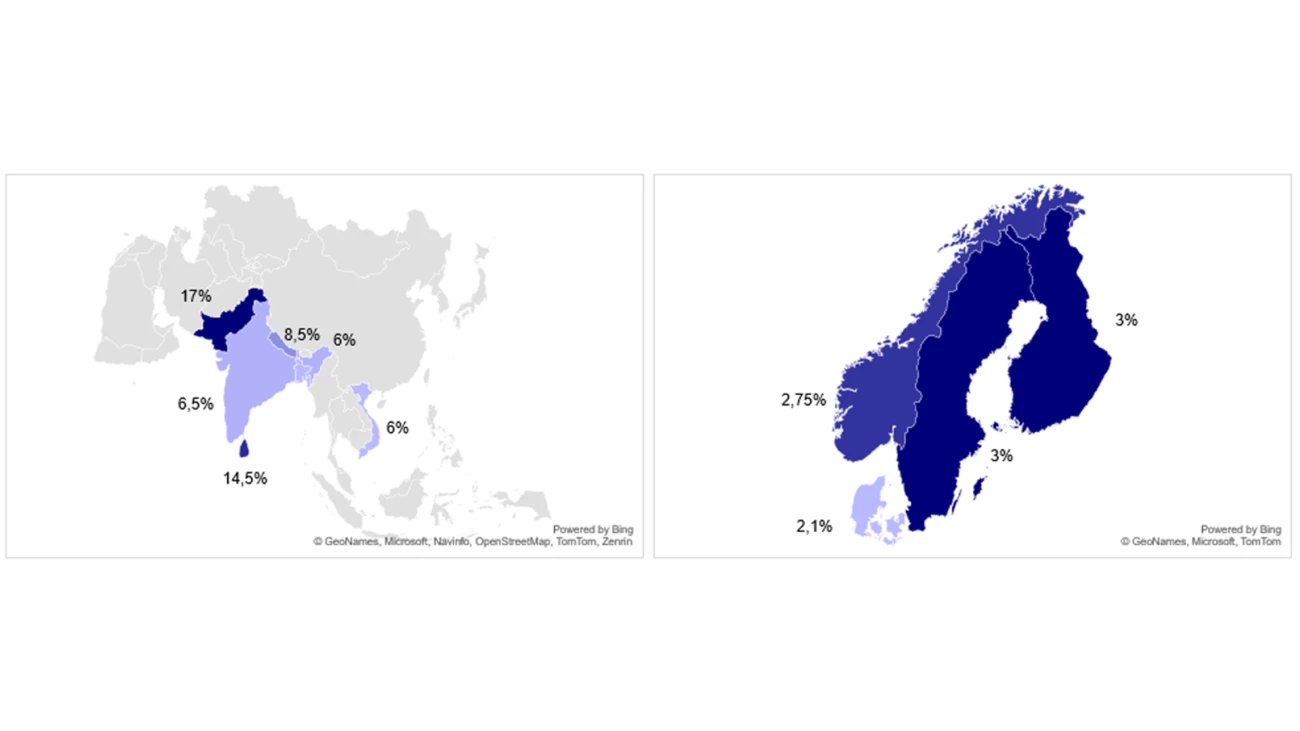

- Finally, there is a credit consideration. Many of the emerging and developing market suppliers rely on loans or credit facilities granted by local banks, often at much higher interest rates than seen in developed economies. Not only are financing costs high, but lenders are often reluctant to lend to suppliers without a solid financial track record. Without access to credit, suppliers may be unable to expand, grow their business or simply fulfil their ongoing obligations, which can further exacerbate their cash flow issues. The image below, which shows central bank base rates for key supplier markets and Nordic anchor buyer markets, illustrates the differential in financing costs that suppliers have to bear when raising financing locally.

Strategic supply chain management is an important area for treasury professionals, who can extend support to suppliers in multiple ways. A focus on strengthening relationships and demand forecasting is very important and can lead to increased trust, collaboration and communication, which can help improve overall performance and reduce risk in the supply chain. Risk reduction is another important tool. When suppliers are financially stable and able to meet their obligations, the risk of supply chain disruptions, quality issues and other problems is reduced.

During periods of economic contraction and stress, managing a financially healthy supply chain is a key priority.

Additionally, supporting a supplier’s working capital position can be seen as a socially responsible business practice. It can help ensure that suppliers are able to pay fair wages and meet other social and environmental responsibilities, which can help enhance the reputation of both the supplier and the large company. The focus of this article, however, is how to extend financing to key suppliers to support their working capital.

Through the use of an Import Letter of Credit (LC) with financing, the supplier can get easier access to much needed working capital and early financing as opposed to waiting for the maturity of a traditional trade instrument or waiting for the payment term of an open account settlement. This solution can also decrease potential hedging or FX costs due to the shorter exposure window, and there is no credit exposure during the deferred payment period. For the larger buyer, this is an excellent tool, which provides much needed financing to suppliers whilst allowing the buyer to potentially push out their own payment terms, further benefiting their working capital.

The process is much like a regular import LC until the seller (supplier) presents the documents to the advising bank, which checks them against the Documentary Credit (DC) and forwards them to Nordea. Nordea then checks the documents and forwards them to the large anchor buyer, who accepts them and instructs Nordea to pay at sight.

At this point, Nordea makes a payment to the advising bank according to their payment instruction. The payment to the advising bank is the invoice amount less the LC fee and the financing fee. The large anchor buyer then pays Nordea at maturity and the LC is closed, having provided its supplier with much needed working capital and extended its own payment terms.

To facilitate the structure, a simple adjustment to the wording of the LC must be made to incorporate specific terms relating to the financing.

As we have previously seen, there is a significant differential in the base rates for local financing in sourcing markets versus those in the Nordics. This working capital solution takes advantage of that arbitrage. The financing costs under this solution, whilst borne by the supplier, are usually substantially lower than they would pay if the financing were raised locally.

During periods of economic contraction and stress, managing a financially healthy supply chain is a key priority. It is well known that suppliers in emerging and developing economies are some of the first to feel the direct impacts of lower demand and consumption on their working capital. This solution helps mitigate some of that pressure for key relationships. As a solution to support strategic suppliers, this is a relatively easy structure to put in place and can be deployed today with Nordea.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more