Our investment case

We are the leading financial services group in the Nordics with a 200-year history of supporting and growing the Nordic economies.

Nordea is listed at the stock exchanges in Helsinki, Stockholm and Copenhagen and we have around 580,000 private shareholders.

Below you can find some of the key reasons why you should consider being one of them.

- Nordea and its businesses are exposed to various risks and uncertainties.

- This information contain certain statements which are not historical facts, including, without limitation, statements communicating expectations regarding, among other things, the results of operations, the bank’s financial condition, liquidity, prospects, growth and strategies; and statements preceded by “believes”, “expects”, “anticipates”, “foresees” or similar expressions.

- Such statements are forward-looking statements that reflect management’s current views and best assumptions with respect to certain future events and potential financial performance. Although Nordea believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of various factors.

- Important factors that may cause such a difference for Nordea include but are not limited to: (i) the macroeconomic development, (ii) change in the competitive environment, (iii) change in the regulatory environment and other government actions and (iv) change in interest rate and foreign exchange rate levels.

- This presentation does not imply that Nordea and its directors have undertaken to publicly update or revise these forward-looking statements, beyond what is required by applicable law or applicable stock exchange regulations if and when circumstances arise that lead to changes compared with the date when these statements were provided.

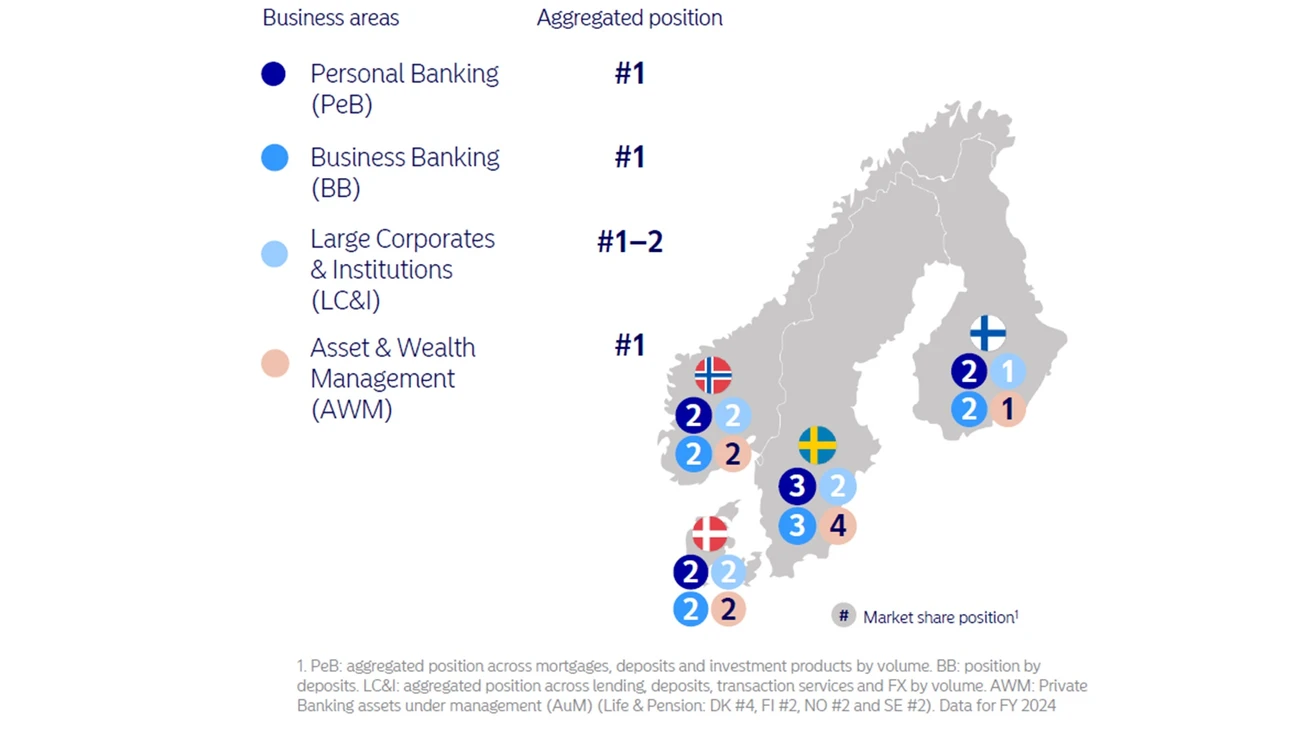

Market leading position in the Nordic area

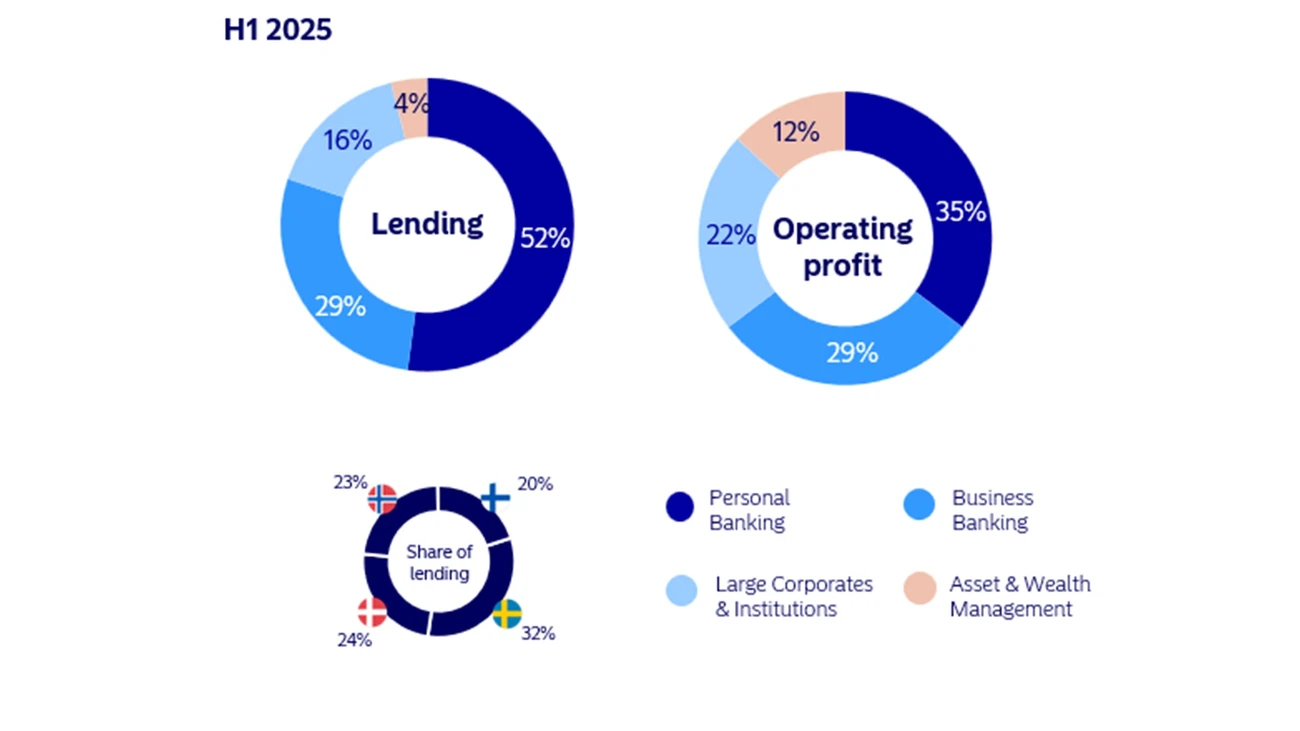

Diversified across business areas

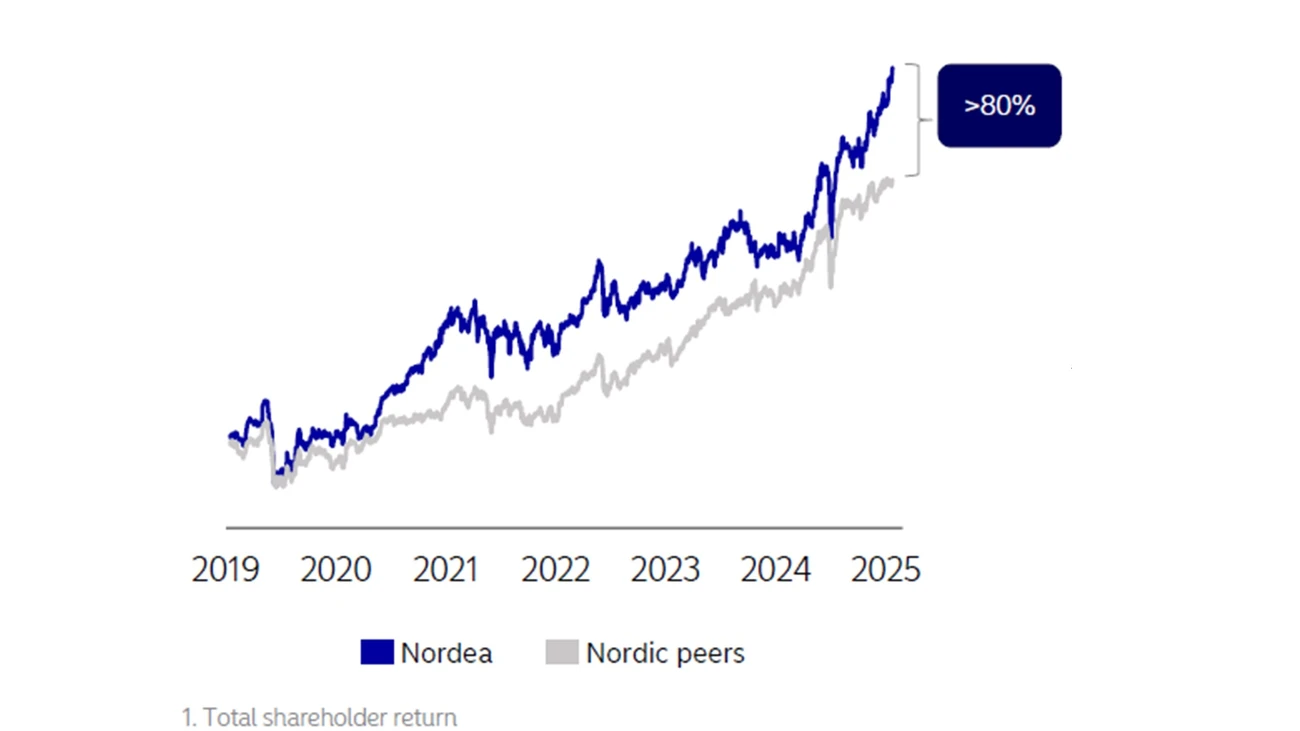

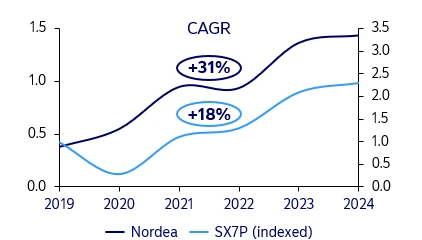

2. Market leading shareholder returns

+292%

Total shareholder return, September 2019 to October 2025

+25%

Annual total shareholder return, September 2019 to October 2025

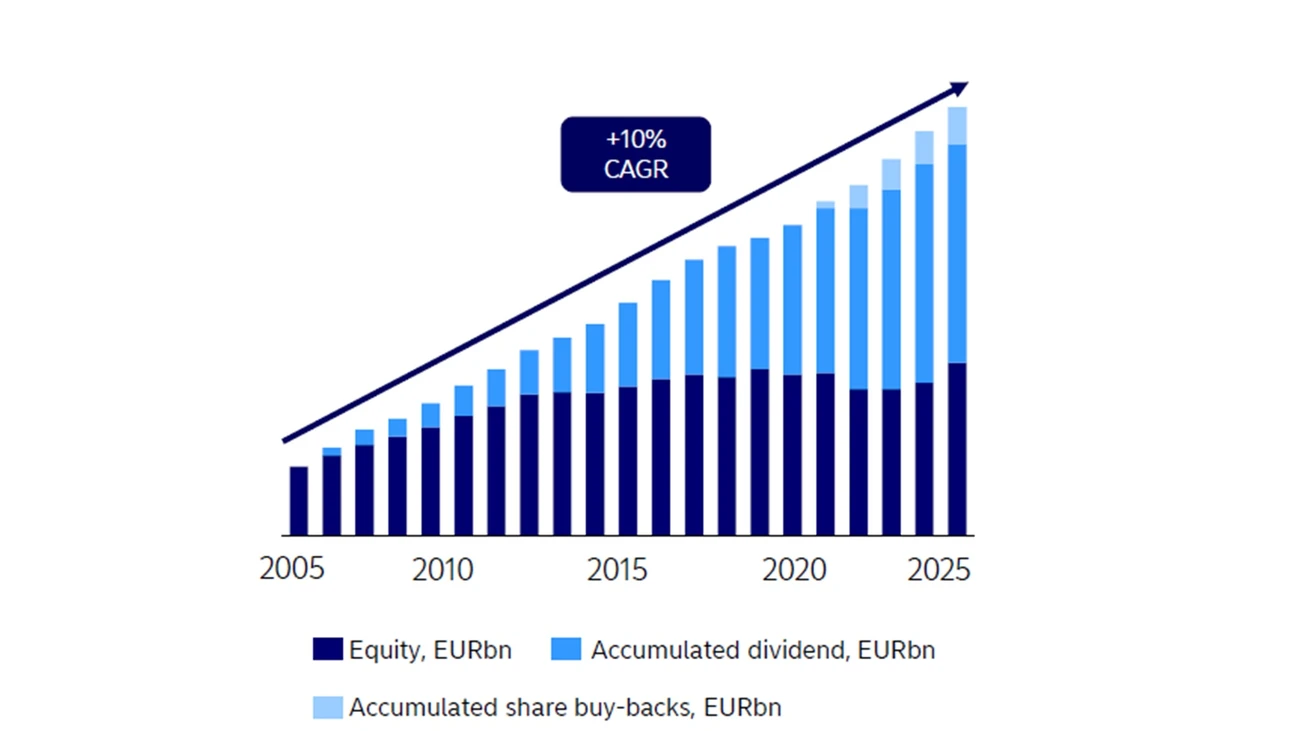

Consistent, strong capital generation

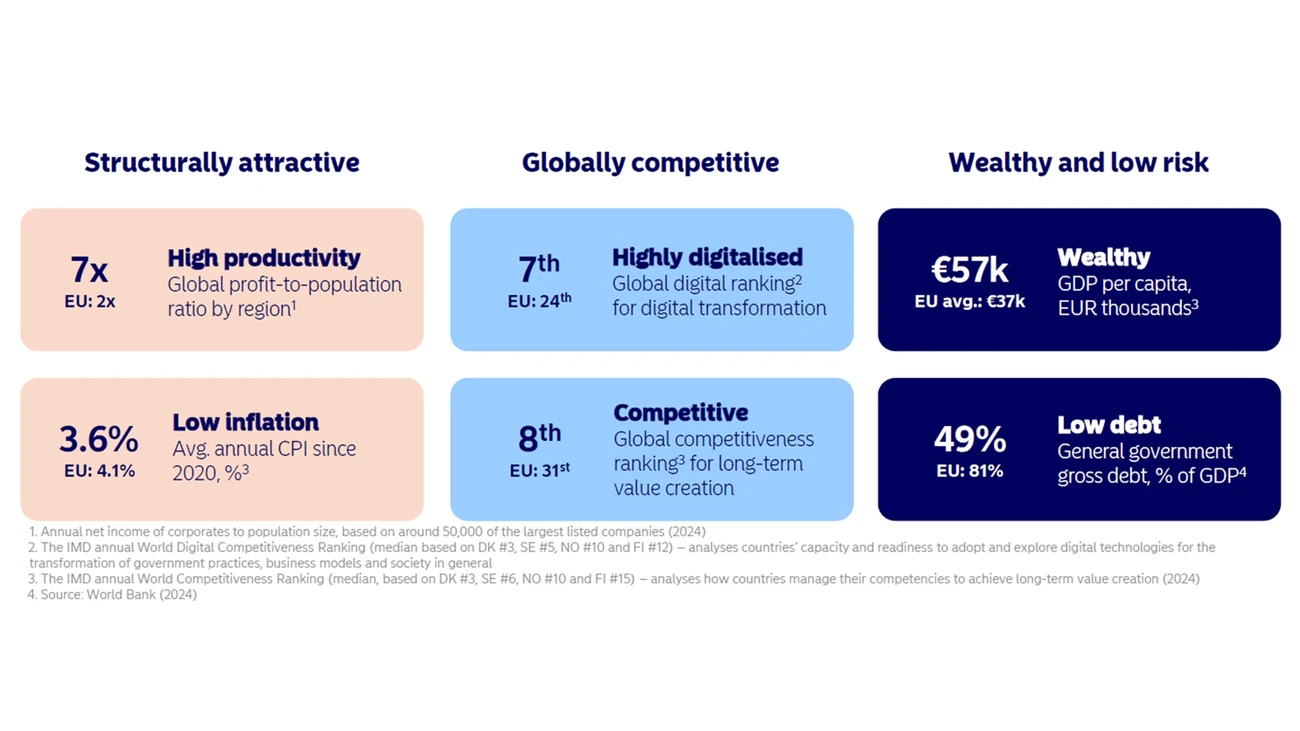

3. Structurally attractive Nordic banking environment

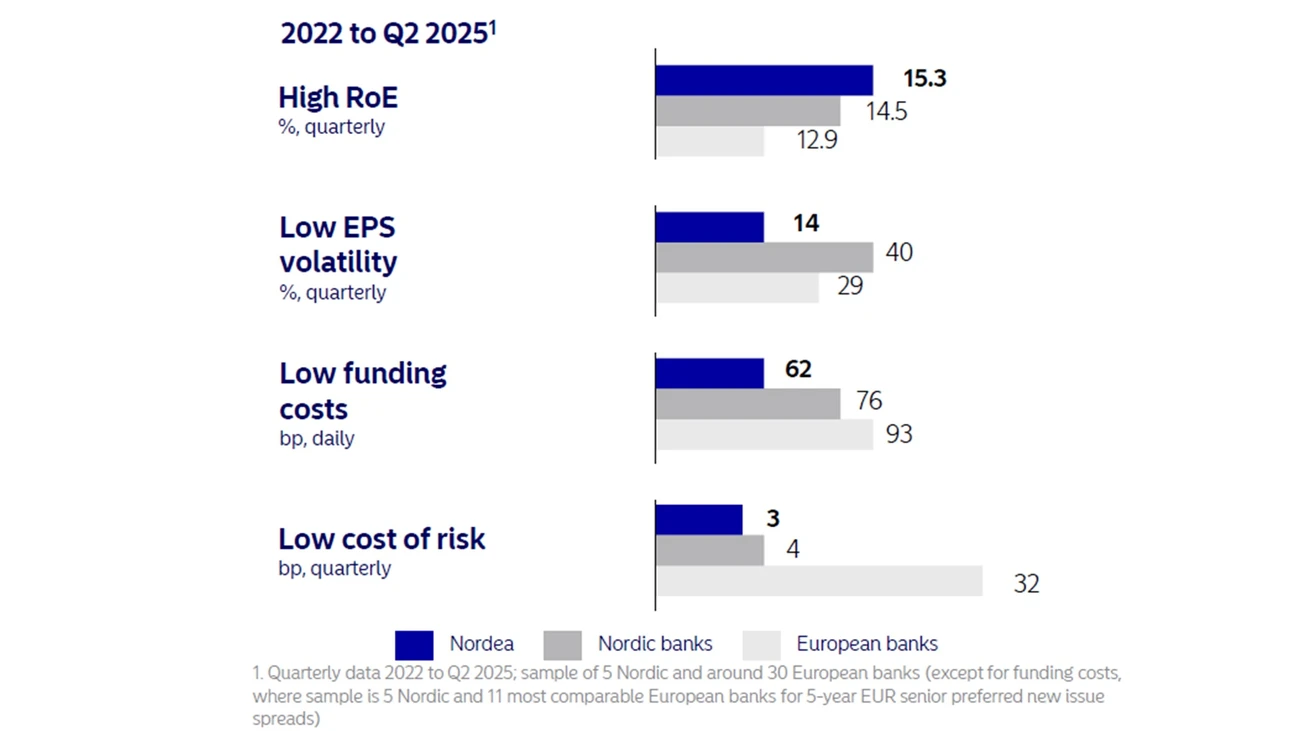

4. Superior earnings growth and market-leading profitability

Superior EPS growth, driven by positive jaws

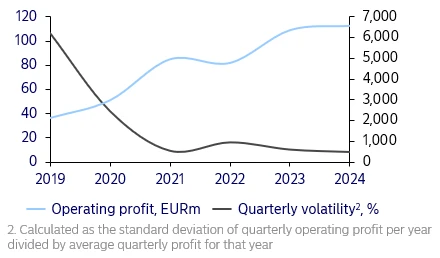

Resilient earning power with low volatility

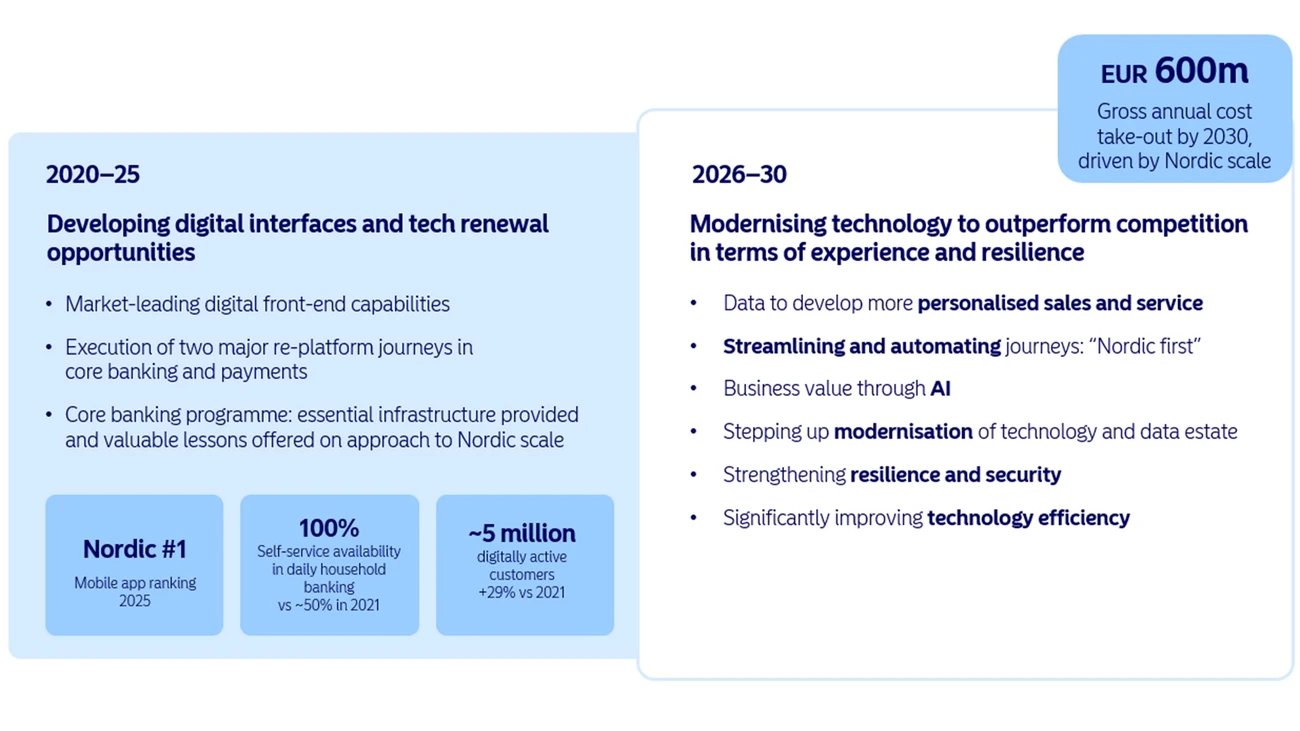

5. Nordic Scale and modernising technology to outperform competition

Want to know more about being a Nordea shareholder?

Contact Investor RelationsOur sustainability objectives:

Net-zero

emissions by 2050 at latest

40–50%

reduction in emissions across investment and lending portfolios by 2030.

50%

reduction in emissions from internal operations by 2030.

Strong progress since 2019

Reducing the bad

Progress | Target |

|---|---|

-36% reduction in emissions in our lending portfolio | 2030: 40-50% |

-43% reduction in emissions in Life & Pension | 2029: 40-50% |

-44% reduction in emissions in our Asset & Wealth Mgmt | 2030: 50% |

-53% reduction in emissions from internal operations | 2030: 50% |

Increasing the good

Progress | Target |

|---|---|

EUR 185bn sustainable financing facilitation | 2025: >EUR 200bn |

40% of each gender representation at the top three leadership levels: 41%/59% | 2025: 40% |

86% of exposure to large corporates in climate-vulnerable sectors covered by transition plans | 2025: 90% |

Double the net-zero-committed AuM - on track | by 2025 |

Explore more

Inside information: Nordea announces updated strategy and new financial targets for 2030

Nordea

Nordea has updated its strategy and set new financial targets for the period 2026–30. Nordea’s strategy is aimed at delivering superior earnings per share growth, driven by profitable, faster-than-market income growth and significant improvements in cost efficiency.

Read more

Latest interim results

Nordea’s latest interim results, reports, presentations, webcasts and more.

Read more

Latest annual report

Here you can see the highlights and key figures from the latest annual report.

Read more