- Name:

- Kjetil Olsen

- Title:

- Chief Economist

How many rate cuts will we get over the next two to three years? Forecasts vary more than usual, mainly because of varying estimates of the normal interest rate. We expect fewer rate cuts and a higher normal interest rate than most.

When will the first rate cut be made, and how low will interest rates end up? The answers and the reason why forecasts differ a lot probably have to do with the very different views on what the normal interest rate is.

The normal interest rate, or the neutral rate in technical terms, is the interest rate level that neither stimulates nor curbs the economy, and it may change over time. Norges Bank and the Fed believe the neutral rate is roughly 2.5% and that the current monetary policy is slowing down the economy substantially. When inflation is tamed, both central banks therefore expect to cut rates significantly from the current levels to reach the estimated neutral level.

Thanks to capital mobility, it is fair to assume that the neutral rate in Norway is closely linked to the global rate. Globally, the US sets the standard, and Norges Bank’s estimates of the neutral rate have over time approximated those of the Fed for the US. From our perspective, little seems to indicate that US monetary policy is dampening growth very much. Economic growth is above trend, and unemployment is low. In Norway, economic activity has also been stronger than expected. Unemployment is low, and housing prices are rising again despite interest rates at a 15-year high. Given this, it seems worth considering whether the neutral rate is higher than many think.

Since the financial crisis we have become accustomed to very low interest rates. This likely affects the common perception of what a normal interest level actually is. But perhaps it was the post-crisis years that were unusual. Globally, unemployment soared, and housing prices plunged. Households in the US and Europe suddenly had much more debt than home equity. They were “forced” to save to reduce their LTV ratios again and continued with this for almost ten years with consequent strong headwinds for the economies. The neutral rate probably fell as a consequence. Despite large rate cuts, monetary policy was not very stimulating, and growth remained low. Low interest rates abroad also resulted in low interest rates in Norway.

We expect fewer rate cuts and a higher normal interest rate than most.

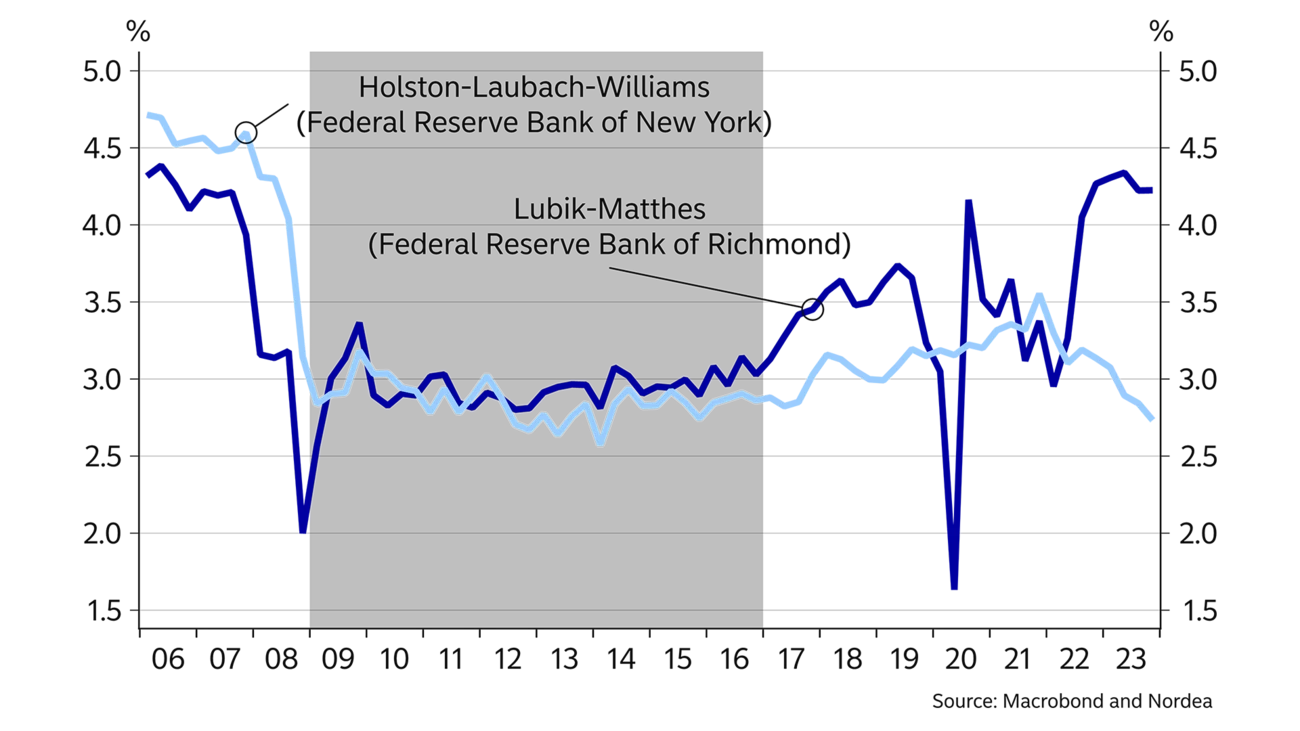

The balance sheet adjustment after the financial crisis has been completed for a long time, so it is not strange if the neutral rate has moved back to “old” levels around 4%, corresponding to the sum of the economic growth potential of about 2% and the 2% inflation target. However, the neutral rate cannot be observed and has to be estimated. Uncertainty is high. Different models for the neutral rate in the US all show that it declined after the financial crisis, but they now produce very different results (see chart A). In a BIS review of the different models, it is clear that the model which the Fed has given most weight (Holstein-Laubach-Williams) stands out with very low estimates of the neutral rate. Other models estimate a much higher neutral rate than in the years after the financial crisis. Market expectations of the interest level over the longer horizon have also risen. If the neutral rate is closer to 4% than 2.5%, one should perhaps not expect too many rate cuts either globally or domestically.

This article first appeared in the Nordea Economic Outlook: Falling into place, published on 24 April 2024. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more