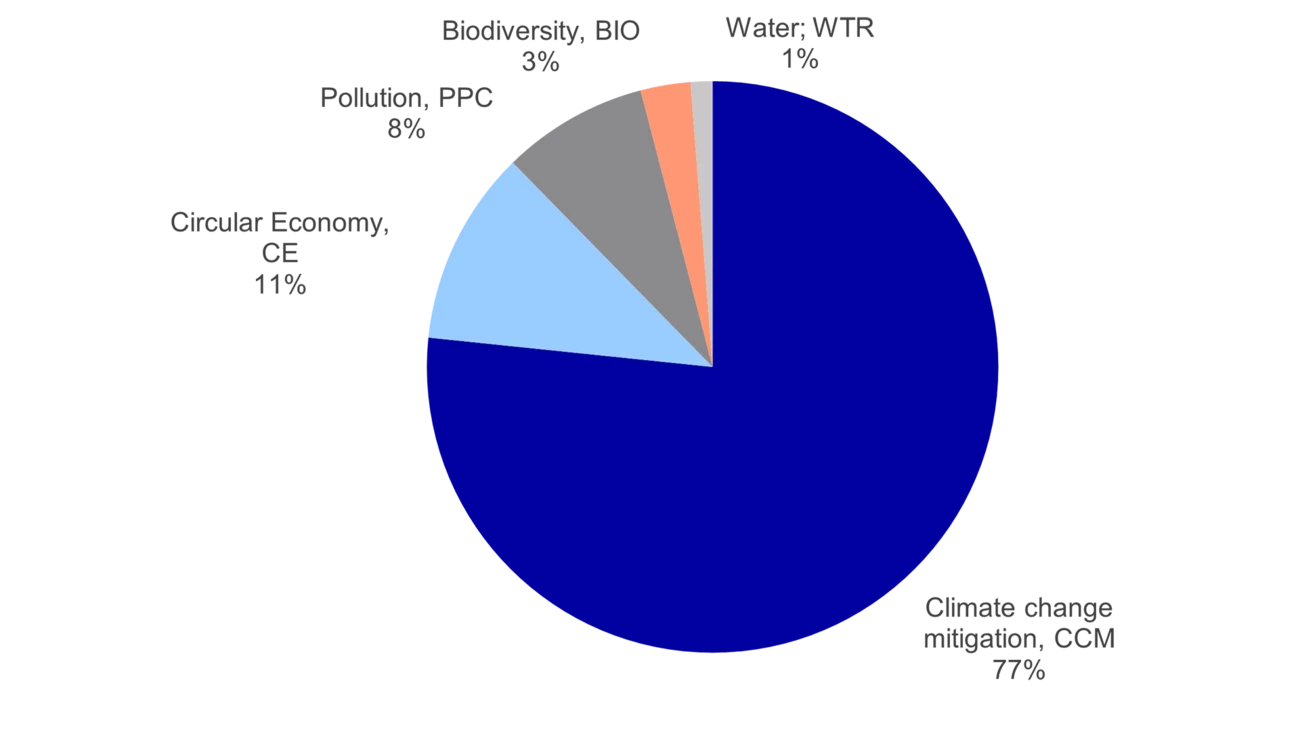

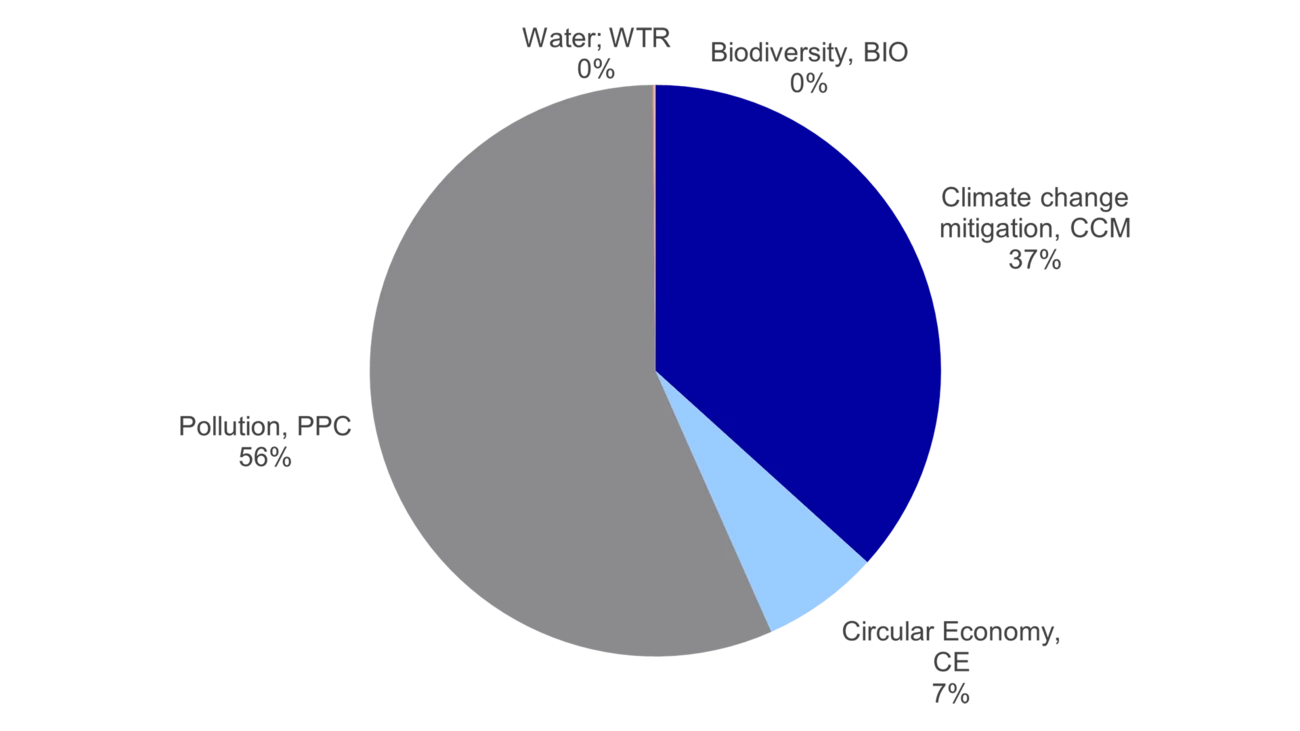

The EU Taxonomy's 6 environmental objectives

1) Climate change mitigation

2) Climate change adaptation

3) The sustainable use and protection of water and marine resources

4) The transition to a circular economy

5) Pollution prevention and control

6) The protection and restoration of biodiversity and ecosystems