Taxonomy basics

The EU Taxonomy is the classification framework to determine whether an economic activity is considered environmentally sustainable in the context of the European Green Deal. It covers environmental objectives related to six themes:

- Climate mitigation

- Climate adaptation

- Water

- Waste and circularity

- Pollution

- Biodiversity

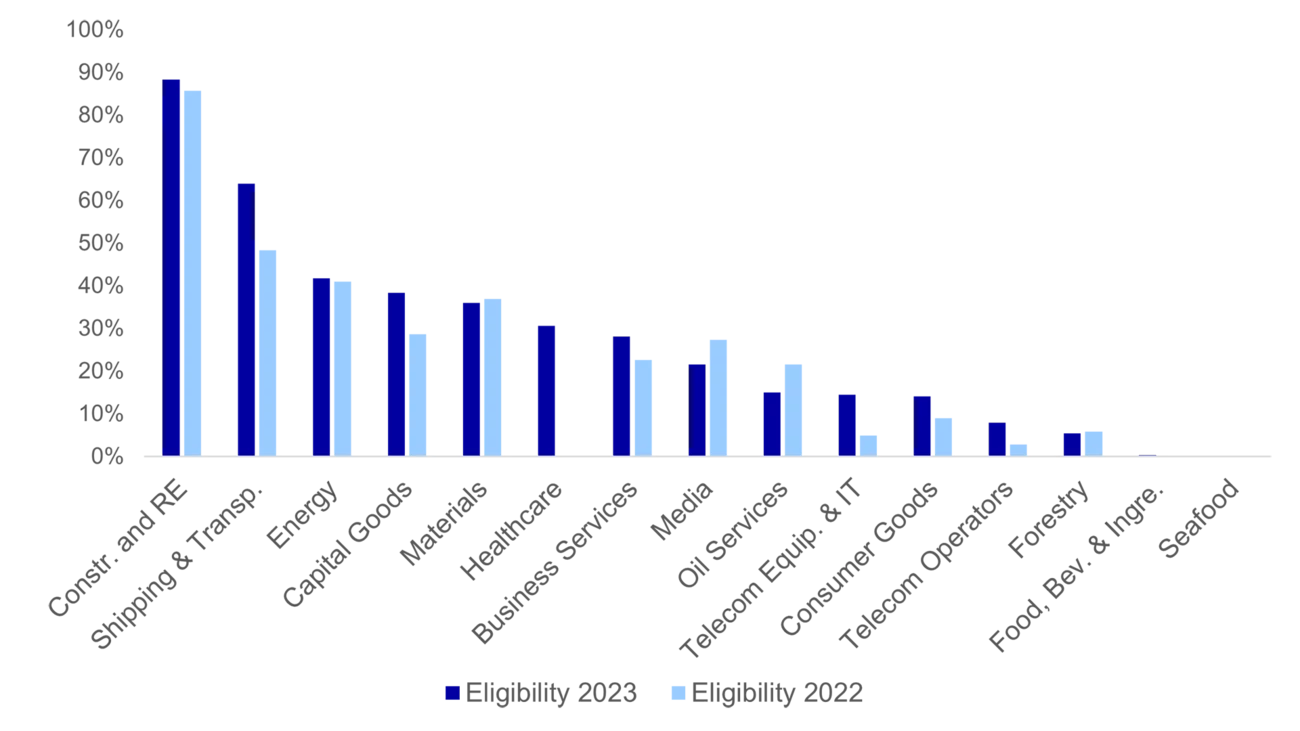

Companies should disclose what share of their revenues, capex and opex are eligible and aligned with these six objectives. Eligibility refers to whether an activity is within the scope of the Taxonomy.

Alignment indicates that, in addition to being within scope, the activity also meets the technical thresholds defined by the Taxonomy, does no significant harm (DNSH) to the other environmental objectives and does not infringe on human rights (Minimum Safeguards).