- Name:

- Juho Kostiainen

- Title:

- Nordea Economist

Juho Kostiainen

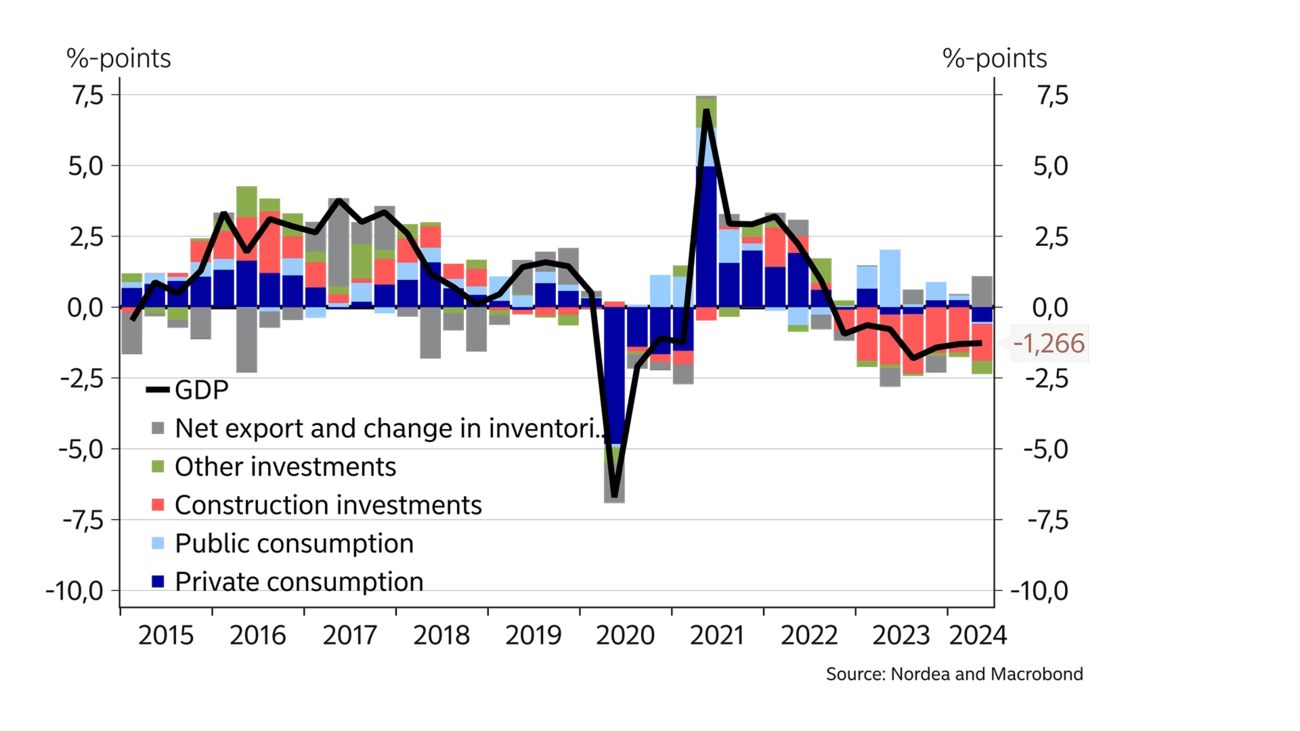

The Finnish economy has underperformed the rest of the eurozone over the past two years. Private consumption has gone down in Finland, as higher interest rates have hit households hard. However, most of the gap to the rest of the eurozone is due to the sharp decrease in residential construction in Finland. Falling interest rates are expected to enhance economic growth in Finland.

The Finnish economy has underperformed the rest of the eurozone over the past two years. The Finnish economy has contracted by 2% in the past two years, while the eurozone has experienced growth of more than 1% on average over the same period.

High inflation has weakened consumer purchasing power across the continent, due to which private consumption has been muted in Finland and the rest of Europe alike. Purchasing power in Finland has begun to recover, but the pace of recovery is lagging the rest of the eurozone, where many countries have introduced large wage increases or one-off payments to compensate for the loss of purchasing power. Moreover, unemployment in Finland has gone up to as much as 8.3%, compared to an average unemployment rate of 6.5% in the eurozone.

Higher interest rates have affected households in Finland, where most mortgages have a variable rate, to a much greater extent than in other countries, where fixed-rate mortgages are preferred. The average interest rate on household mortgages in Finland has gone up from less than 1% to 4% within two years, whereas the average mortgage rate in the eurozone is still less than 2.5%.

The rise in interest rates has dampened demand for housing, resulting in a strong negative impact on the Finnish construction sector, which has performed clearly worse than elsewhere in Europe and is mostly the reason for the weak GDP trend in Finland. The construction of new housing in Finland has been slashed by almost half in the past two years, as house sales virtually hit a wall once interest rates shot up. The construction of rental housing has also decreased significantly, because there are plenty of vacant rental dwellings on the market following the rapid construction boom seen in past years. The construction market overheated in Finland in the years of low interest rates, contrary to many other eurozone countries, which were still coping with the aftermath of the financial crisis.

The collapse in residential construction in Finland explains the weaker GDP trend compared to the rest of the eurozone in recent years.

In the eurozone, investment in construction has remained at more or less the same level for the past two years, whereas in Finland it has shrunk by as much as 26%. In Italy, for example, stimulus allocated to renovation has kept the construction sector busy. The healthier state of new construction in the rest of the eurozone reflects a stronger housing market. House prices in Finland have fallen by more than 10% from the peaks reached two years ago, while in the eurozone prices have come down just under 2% on average and many countries are already seeing strong price increases.

In Finland, public spending has been the only source of demand to support economic growth in the past few years. However, public stimulus can’t continue for very long, considering the persistent increase in public debt.

The dragging effect of residential construction on the Finnish economy is set to subside by the end of this year, as construction starts have begun to grow slowly from a low level, thanks to interest-subsidised production. Consumer purchasing power is also expected to continue improving next year.

The rapid rise in interest rates hurt the economy in Finland much more than elsewhere in the eurozone through both domestic consumption and construction. Now falling interest rates are expected to stimulate the Finnish economy more than the rest of the eurozone. Energy prices have also come back down faster than in other eurozone countries, thanks to growth in domestic energy generation and a low dependence on natural gas.

Based on all these factors, we forecast that the Finnish economy will grow more rapidly than the eurozone average in 2025 and 2026.

This article originally appeared in the Nordea Economic Outlook: Precision play, published on 4 September 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more