- Name:

- Juho Kostiainen

- Title:

- Economist, Nordea

Juho Kostiainen

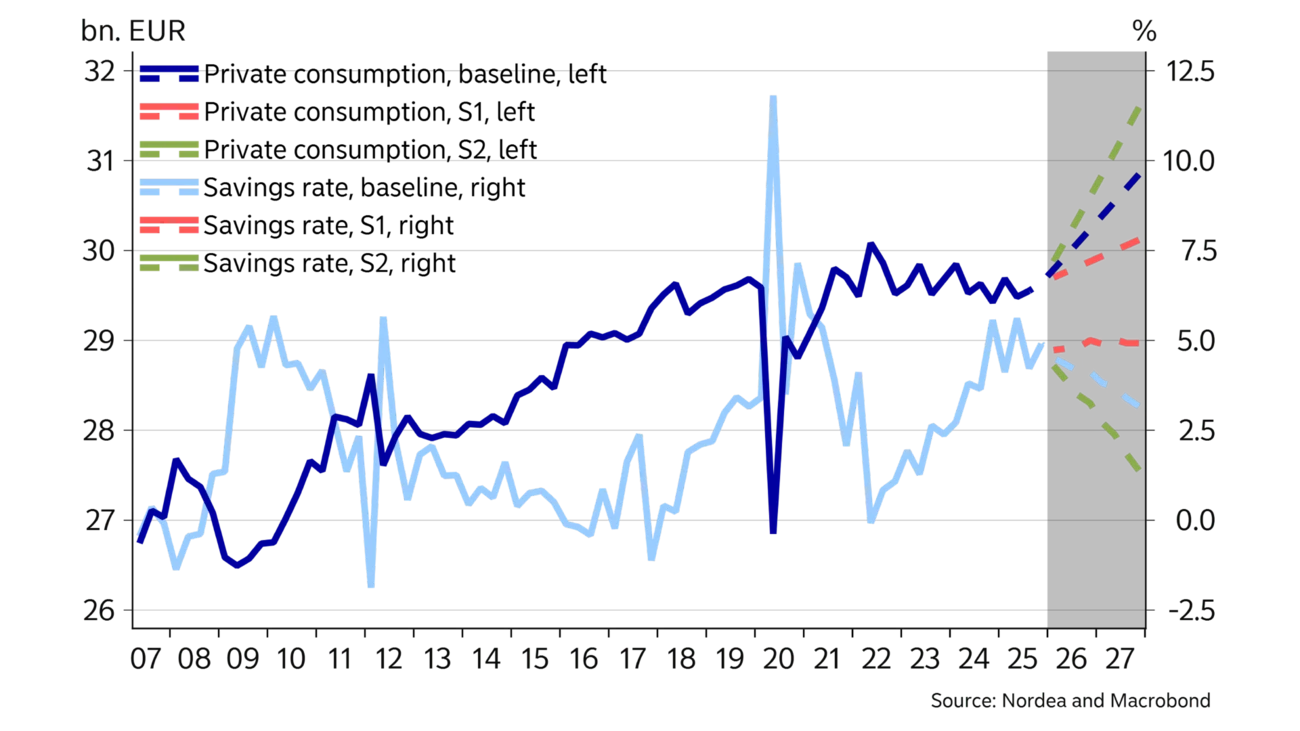

The increase in household saving has kept private consumption subdued in recent years. We examine how alternative assumptions about the savings ratio in the forecast years will affect consumption, employment and economic growth.

The weakness in private consumption has been the biggest drag on the economy in the past few years, alongside low construction activity. Private consumption has essentially not grown for three years.

The inflation and interest rate hikes that began in 2022 eroded consumers’ purchasing power, as prices rose faster than wages. In addition to purchasing power, consumer confidence was significantly weakened by Russia’s invasion of Ukraine in early 2022.

Over the past two years, purchasing power has improved, as inflation has slowed, interest rates have fallen and wage increases have clearly outpaced price rises. However, improved purchasing power has not been reflected in consumption at all; instead, it has been entirely directed towards saving. A weakened labour market, falling house prices, the ongoing war in Ukraine and generally poor economic prospects have kept consumer confidence low. The weak economic situation and the financial shocks faced by households have made consumers more cautious and underscored the importance of financial buffers.

The net household savings ratio in 2025 was just under 5% of disposable income. Such a high level of saving has been seen only during the pandemic years, when consumption opportunities were limited, and during the financial crisis of 2009-10. The savings ratio has averaged ~2%.

The savings ratio will play a crucial role in economic development this year and next. The savings ratio will almost certainly fall from its current high level, but the timing and speed of the turnaround are difficult to estimate. For this reason, we have prepared various scenarios for the performance of the economy under different savings ratio trajectories.

In our baseline forecast, we expect the savings ratio to fall from last year’s 4.6% to 4.4% this year and to 3.4% in 2027.

In the first alternative scenario (S1), we examine what consumption and economic growth would look like if the savings ratio remained at last year’s high level this year and next

Household savings will play a crucial role in economic growth in the coming years.

If the savings ratio remains stuck at its current level, it would cumulatively result in ~1pp weaker GDP growth over the next two years. At the same time, the increase in the employment rate projected in the baseline scenario would almost entirely fail to materialise. On the other hand, private consumption would still grow slightly this year and next, since consumption increases, as real incomes rise even if the savings ratio remains unchanged.

In the second scenario (S2), we look at economic growth in a situation in which the savings ratio falls faster than the baseline, dropping to the long-term average of ~2% in 2027. This would bring a total of 1pp more GDP growth than in the baseline. The GDP growth calculation takes into account that increased consumption boosts imports by a factor of 0.25 and that faster economic growth accelerates employment by a factor of 0.75, which is reflected in disposable income growing faster than in the baseline.

| Baseline | S1 | S2 | |

|---|---|---|---|

| 2025 | 0.0 % | 0.0 % | 0.0 % |

| 2026 | 1.0 % | 0.7 % | 1.3 % |

| 2027 | 2.0% | 1.5 % | 2.5 % |

This article first appeared in the Nordea Economic Outlook: Northern lights, published on 21 January 2026. Read more from the latest Nordea Economic Outlook .

Economic Outlook

The global economy was characterised by a high degree of resilience in a tumultuous 2025, with the prospect of renewed growth in 2026. However, there are significant risks are associated with the unpredictable geopolitical situation.

Read more

Economic Outlook

In a world of political uncertainty, the Danish economy is well positioned to handle future challenges. The foundation lies in the labour market, where record-high employment helps ensure robust public finances.

Read more

Economic Outlook

Finland’s economic growth has been slow to materialise. Weak consumer confidence and falling housing prices continue to hold back private consumption and construction investments. However, the fundamentals of the economy have improved, so the conditions for recovery are present. There are already signs of improvement in the manufacturing sector.

Read more