- Name:

- Jan Størup Nielsen

- Title:

- Chief Analyst

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaIn just a few months, sentiment about the Danish economy has changed markedly. Previously, there were fears of the economy overheating, but now focus has shifted to the negative effects of the war in Ukraine, the high inflation level and the rapidly rising interest rates. However, the good news is that the Danish economy is well positioned to ride out the new challenges. As the slowdown started while activity was high, it may at best prove to be a welcome cooling of the economy. But the uncertainty is high, and a major slowdown cannot be ruled out.

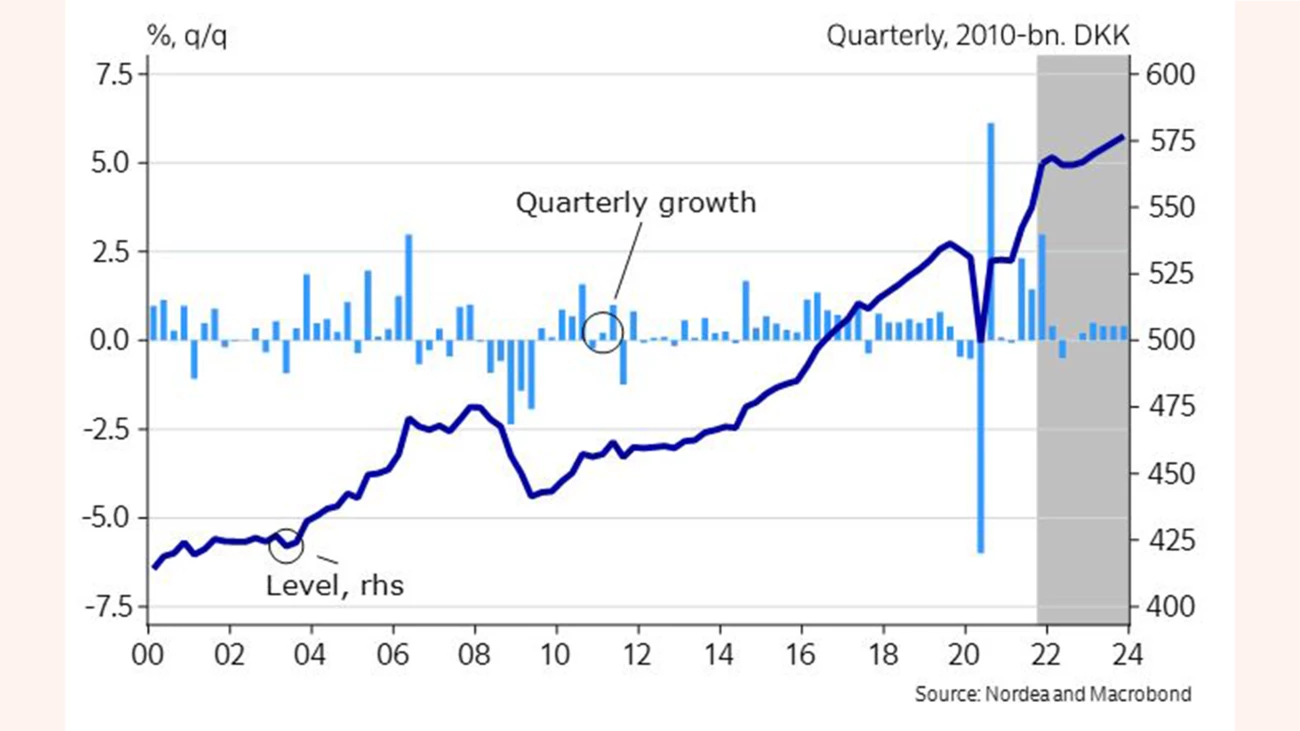

Last year, the Danish economy powered ahead. Overall activity rose by nearly 5%, which is the highest growth rate in more than 25 years. In Q4 2021 alone, economic growth in Denmark was a staggering 3%.

The high growth level towards the end of last year provides a good starting point for 2022. As a result, and seemingly paradoxically, we revise up our GDP growth forecast to 3.5% from 2.5% in January. However, it should be emphasised that the upward revision is solely due to the high growth level at the start of the year as the quarterly profile has been revised down to take into account the increased uncertainty caused by events in recent months. The negative effects will hit even harder in 2023 and we have therefore halved our growth estimate to around 1%.

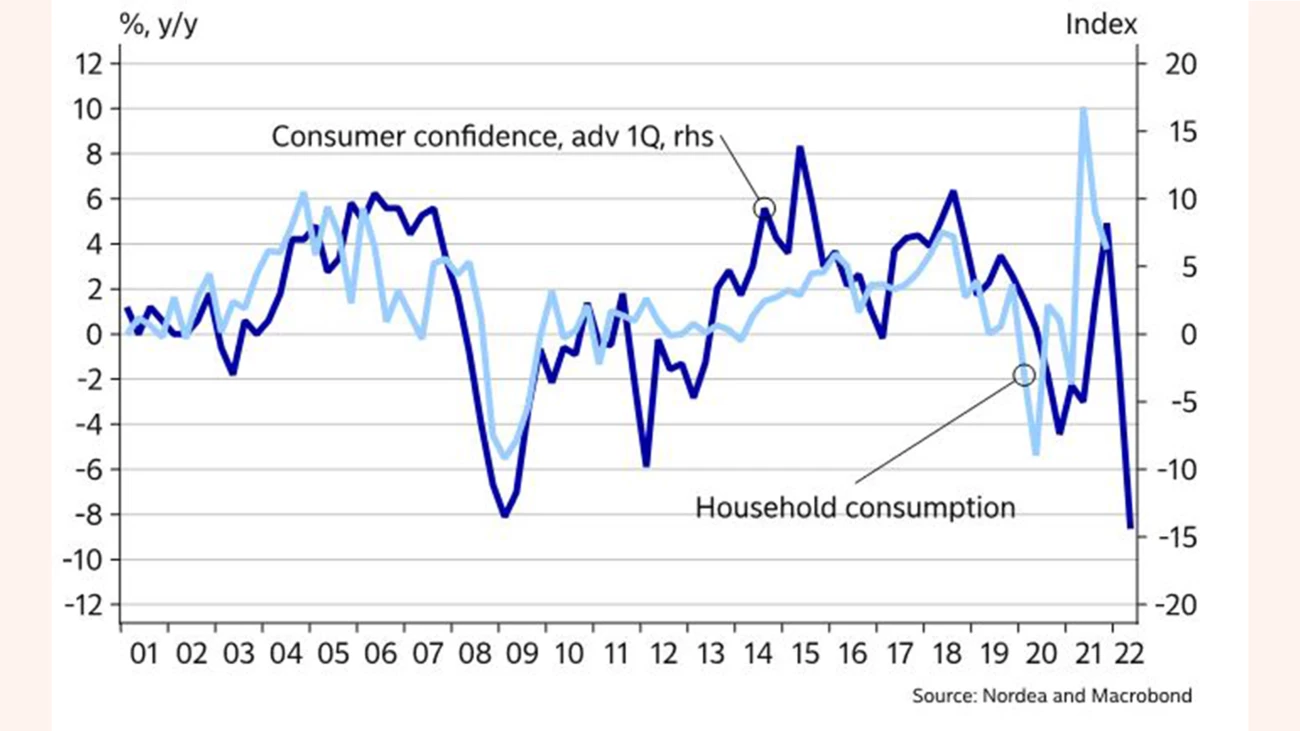

The toxic cocktail of higher interest rates, rising prices and the war in Ukraine has hit households hard. This also shows through in consumer confidence, which over the past months has dropped to the lowest level since the end-1980s. Especially households’ expectations for their own finances have plunged. As a result of this, most Danes now expect unemployment to pick up over the coming year.

Historically, the consumer confidence numbers have been a fairly good indicator of household consumption. So this could indicate a sharp decline in consumption as early as in the current quarter. However, we think that this time around consumer confidence and actual consumption deviate more than normally. The reason is mainly that the financial situation of households is extremely robust after a long period of positive real wage growth and large housing wealth gains. At the same time, employment was at a record-high level at the beginning of the year. Consequently, many households have strong buffers to withstand the current challenges.

Unlike Danish households, Danish businesses feel fairly confident about the future economic outlook. Overall industrial production has risen to an all-time high, also when excluding the rising production in the pharmaceutical industry. This means that capacity utilisation in industry during the first three months of the year was at the highest level in more than ten years.

The overall business confidence indicator has risen throughout Q1 2022. This is in sharp contrast to the German equivalent, which reflects a far more negative view on the future economic outlook among German businesses. Many Danish businesses still point to labour shortages as a key production limiting factor. And about two-thirds of the supermarket chains expect to raise their prices in the coming three months. This suggests that many businesses are able to pass on the increased costs to their customers and thus maintain their earnings capacity.

3.5%Expected GDP growth in 2022

5.0%Expected average

+125,000Increase in employment after the coronavirus

|

|

Sources: Nordea estimates and Macrobond |

Denmark: Macroeconomic indicators, baseline scenario

|

|

2019 |

2020 |

2021 |

2022E |

2023E |

|

Real GDP, % y/y |

2.1 |

-2.1 |

4.7 |

3.5 |

1.0 |

|

Consumer prices, % y/y |

0.8 |

0.4 |

1.9 |

5.0 |

2.4 |

|

Unemployment rate, % |

3.6 |

4.6 |

3.6 |

2.8 |

3.2 |

|

Current account balance, % of GDP |

8.8 |

8.2 |

8.1 |

7.2 |

6.8 |

|

General gov. budget balance, % of GDP |

4.1 |

-0.2 |

2.3 |

0.4 |

0.5 |

|

General gov. gross debt, % of GDP |

33.6 |

42.1 |

36.7 |

34.2 |

33.5 |

|

Monetary policy rate, deposit (end of period) |

-0.75 |

-0.60 |

-0.60 |

0.15 |

1.15 |

|

USD/DKK (end of period) |

6.66 |

6.08 |

6.54 |

7.45 |

6.77 |

A / After a strong period, activity in the Danish economy is likely to fall over the coming quarters, but then it should increase again.

B / Consumer confidence indicators paint a bleak picture of the trend in household consumption. However, we do not expect the decline to be as big as the indicators suggest.

Danish exports ended the year 2021 at a record-high level. Especially exports of Danish goods to the European market contributed to the increase. This year, growth in Denmark’s key export markets looks set to drop markedly, and this will almost inevitably also hit Danish exports. However, the lower demand will to some extent be offset by a weaker trade-weighted DKK rate. The DKK has weakened especially versus the USD, and this contributes to making Danish goods cheaper in the US. Moreover, the DKK has weakened against the GBP and the NOK.

Unlike goods exports, exports of services are more than 10% below the pre-coronavirus crisis levels, even though income from sea transport has risen significantly due to sharply rising freight rates. But foreign tourism in Denmark is still markedly lower.

In the longer run, Danish businesses are well equipped to exploit future growth opportunities internationally. This applies especially in terms of the green transition as a large number of countries have scaled up investment in this area to become greener. These efforts have been further accelerated by the war in Ukraine, which has caused many western countries to bring forward investment plans to reduce their dependency on fossil fuels. Moreover, as a result of the coronavirus crisis, there is now a stronger focus on ensuring stable supply chains. This will lead to increased automation and could possibly also make some Danish businesses reshore production to Denmark.

The Danish economy faces headwinds from higher interest rates, rising inflation and the war in Europe.

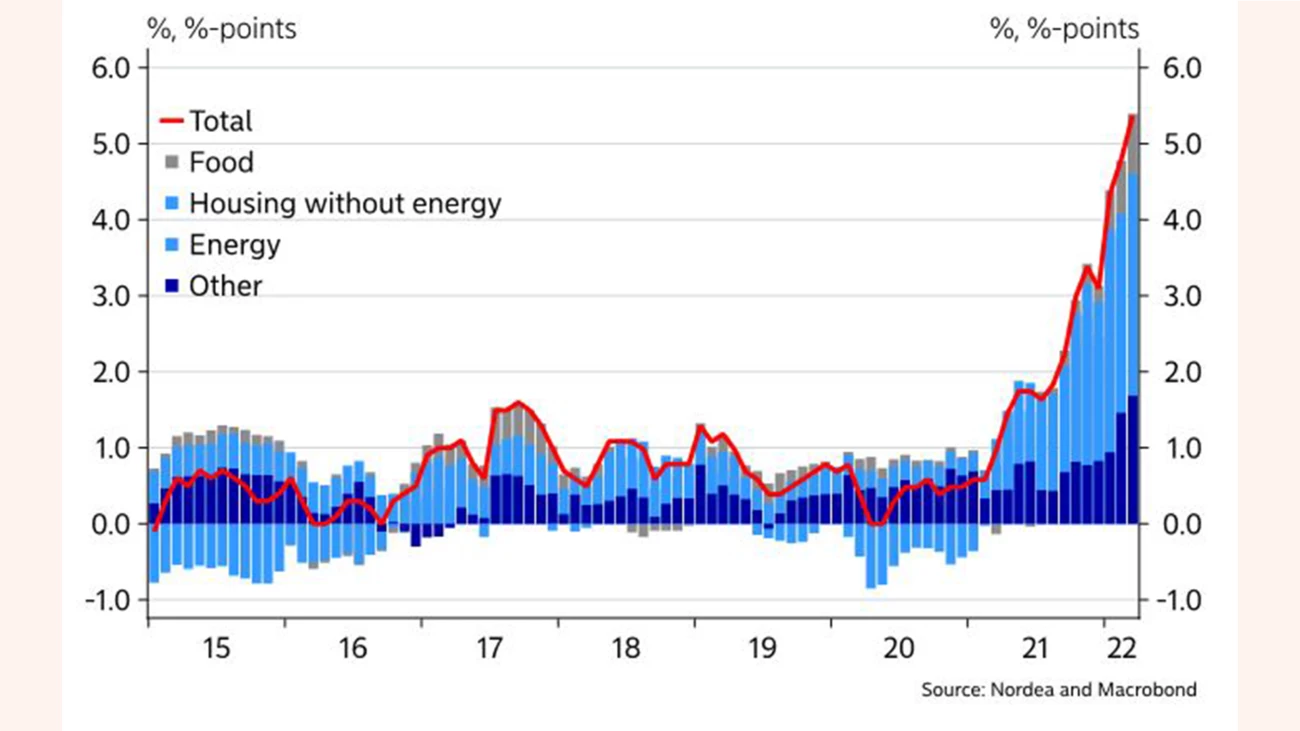

Like the rest of the world, Denmark is currently experiencing the largest surge in consumer prices in many years. More than half of the pick-up in Danish inflation is driven by huge increases in prices of petrol, electricity and natural gas. Over the past few months especially food prices have started to rise much faster than previously.

We believe that at the current levels inflation is about to peak mainly because the contribution to the annual rate of increase from rising energy prices is getting smaller. On the other hand, the contribution from other goods categories is expected to go up as many manufacturers will try to pass on the rising energy costs to consumers. So even though inflation is expected to fall back over the year, the level will still be significantly higher than in the years prior to the coronavirus crisis.

The sharp increase in consumer prices erodes households’ purchasing power despite record-high employment and an unemployment rate that is close to the bottom levels seen ahead of the financial crisis.

We expect employment to decline over the summer in response to the general economic slowdown. However, part of the drop in demand for labour is likely to be absorbed by the large number of vacancies reported by businesses at the beginning of the year.

The current collective agreements in the private sector are valid until the spring of 2023. Thus, the new collective agreements will likely have to be finalised in an environment where inflation expectations are significantly higher than previously and where many companies feel the effects of weaker demand. It is extremely difficult to predict the outcome of the next collective bargaining round at this point in time. We expect real wage growth to be negative this year, but to be positive again as early as next year.

C / Inflation has risen to an all-time high since the mid-1980s. Higher energy prices have been the main culprit, but food prices have also started to rise much faster.

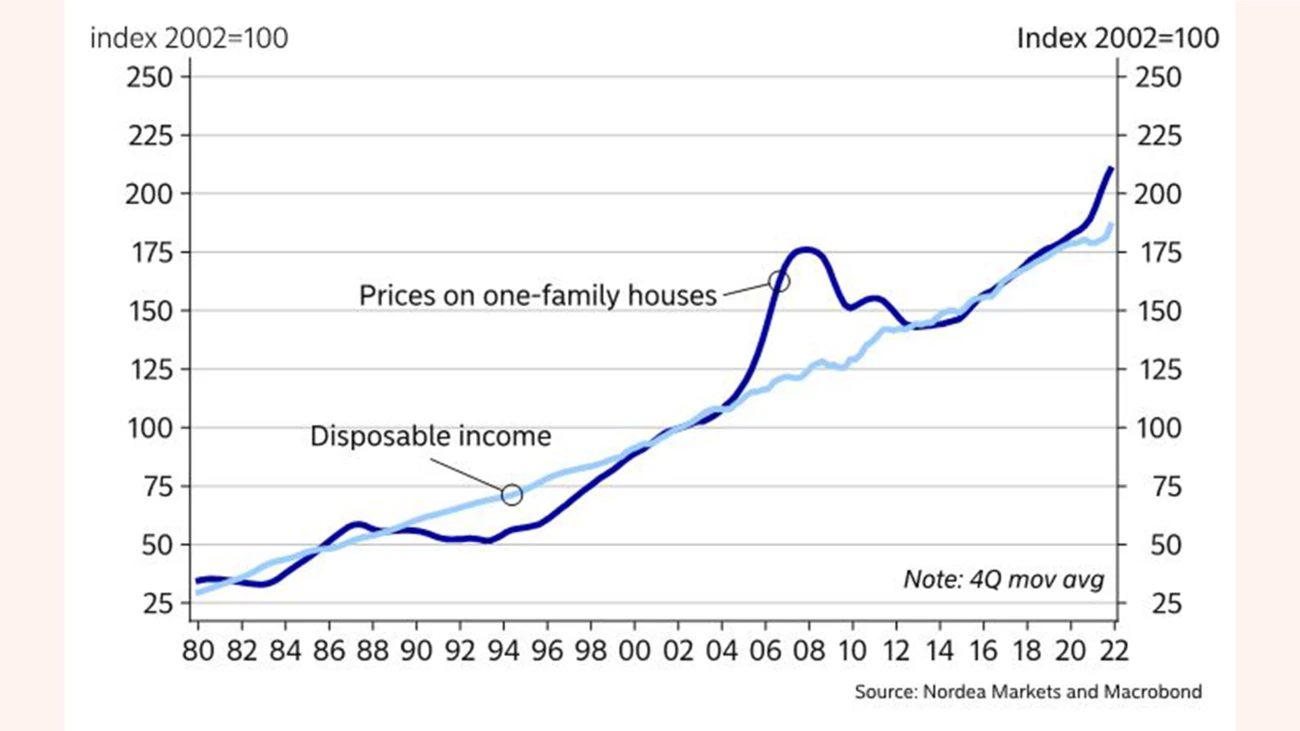

D / In recent years, housing prices have risen much faster than disposable incomes. This may add downward pressure on prices now that interest rates have risen.

One of the big unanswered questions in the Danish economy is how resilient the housing market is. In 2021, prices of single-family houses rose by more than 11%, which is the highest annual rate of increase measured since the financial crisis. Even larger increases were measured in the market for holiday homes, where prices surged by nearly 16% last year. The pick-up in prices was driven by a very low supply of homes for sale, relatively low financing costs and households’ increased purchasing power as a result of rising employment. However, the sharp increases mean that housing prices have risen much faster in recent years than households’ disposable incomes.

Since the end of last year the very favourable conditions for the housing market have been challenged by large interest rate increases, which since the turn of the year alone have doubled long mortgage rates. Also the interest rate on adjustable-rate loans has risen sharply. In our baseline scenario, we expect housing prices to rise only slightly this year, primarily as a result of the price increases at the beginning of the year. In 2023, nominal prices are expected to remain unchanged on average. However, there may be large local differences. The most expensive part of the Danish housing market is expected to be especially affected by the rising financing costs as well as property tax reform, which will come into force at the beginning of 2024.

The European Central Bank has clearly signalled that it intends to hike its policy rate during H2 2022. This has caused the financial markets to price in expectations of further rate hikes up to the turn of the year. If market expectations are realised, it will mean that the time with negative deposit rates at the central bank is coming to an end.

After a large sell-off of DKK towards the end of the year to defend the fixed exchange rate regime, the Danish central bank has seen no need to intervene so far this year. However, the DKK is still strong against the EUR, so a further need to sell DKK cannot be ruled out. In our baseline scenario, we expect the spread between the deposit rates of the ECB and the Danish central bank to remain at the current level until end-2023.

This article originally appeared in the Nordea Economic Outlook: Under Pressure, published on 11 May 2022. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more