- Name:

- Jan Størup Nielsen

- Title:

- Nordea Chief Analyst, Denmark

Sivua ei ole saatavilla suomeksi

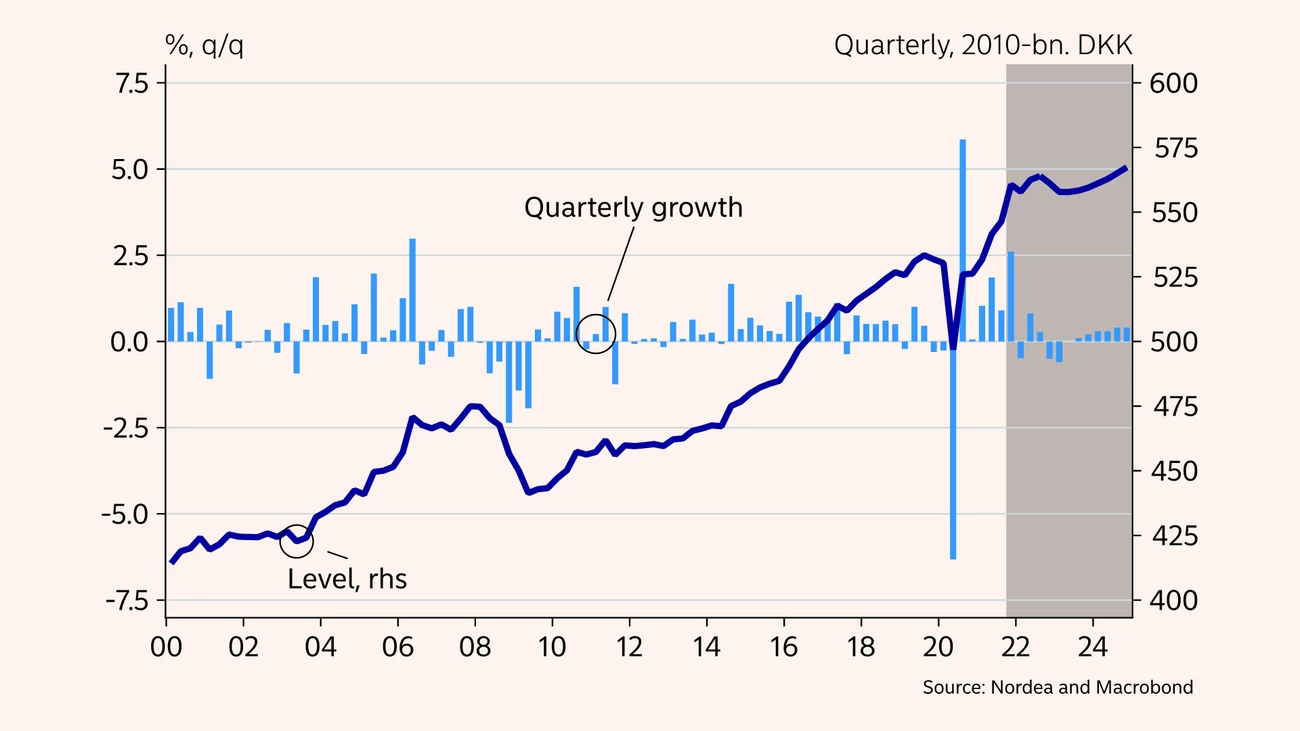

Pysy sivulla | Siirry aiheeseen liittyvälle suomenkieliselle sivulleAfter several years at full steam, the Danish economy is slowing down sharply now. The lower activity will especially hit household spending, which is under pressure from eroded purchasing power, rising interest rates and growing unemployment. The Danish economy is clearly positioned for a period with lower activity. However, there is a risk that the slowdown will be self-reinforcing – not least in the housing market where a significant correction of market prices is taking place.

After several years of high activity, the Danish economy is entering a new phase. Household spending is expected to go down, and at the same time companies’ investment activities will grind to a halt. Together with lower foreign demand, this will lead to an overall decline in Danish GDP of around 0.5% in 2023. However, towards year-end, economic activity is expected to start accelerating, thus paving the way for GDP growth of about 1% in 2024.

Compared to our forecast in September last year, this is a downward revision for both 2023 and 2024. It should be seen in the light of the upward revision for 2022, though. The actual activity level has thus remained basically unchanged during the forecast period, as the slowdown started later than previously expected.

As a starting point, we estimate that the upside and downside risks of the forecast are relatively balanced. Over the coming quarters, we do however see a risk that the slowdown may be sharper than expected, especially as personal spending could fall more than in our main scenario. On the other hand, towards the end of the forecast period, falling inflation and lower interest rates could boost activity more than expected.

Household spending fell throughout 2022 – particularly goods consumption, which took a nosedive from a very high level during the pandemic. We expect household spending to continue south this year. This is mostly due to the continued high inflation which has significantly eroded purchasing power. The uncertain situation has also fuelled fears of growing unemployment. This increases households’ propensity to save and, consequently, puts downward pressure on consumer spending.

But there is also some good news for the Danish consumers. First and foremost, the significant drop in electricity, natural gas and petrol prices. That trend is also supported by the electricity fee reduction for H1 2023 to the EU’s minimum rate of DKK 0.8 per kWh.

Moreover, it is worth emphasising that Danish households have solid buffers after a long period with higher disposable incomes, which among other things were used to reduce household debt. Thus, gross debt relative to disposable income has fallen to the lowest level in more than 20 years.

Danish exports grew significantly in both 2021 and 2022, and the current level is almost 10% higher than the peak seen before the pandemic.

|

|

2020 |

2021 |

2022E |

2023E |

2024E |

|

Real GDP, % y/y |

-2.0 |

4.9 |

3.0 |

-0.5 |

1.0 |

|

Consumer prices, % y/y |

0.4 |

1.9 |

7.7 |

5.0 |

2.4 |

|

Unemployment rate, % |

4.6 |

3.6 |

2.5 |

3.4 |

3.5 |

|

Current account balance, % of GDP |

8.2 |

8.1 |

12.6 |

10.3 |

7.9 |

|

General gov. budget balance, % of GDP |

0.2 |

3.6 |

1.2 |

-0.3 |

-0.4 |

|

General gov. gross debt, % of GDP |

42.2 |

36.6 |

29.6 |

27.7 |

25.8 |

|

Monetary policy rate (end of period) |

-0.60 |

-0.60 |

1.75 |

3.00 |

2.25 |

|

USD/DKK (end of period) |

6.08 |

6.54 |

6.97 |

6.48 |

6.37 |

The uptick in Danish exports has primarily been driven by increasing sales of goods, which has been broad-based across different industries.

Since the early autumn of 2022, the trend in the value of Danish exports has reversed. This is due to a drop in exports of goods and a large decline in freight rates, which have contributed to reducing the export value of services. We expect the downward pressure on Danish exports to take hold in the first half of 2023 in particular.

The lower demand is also expected to put downward pressure on companies’ investment activities. This will likely be the case for residential investments, which have grown rapidly in recent years. On the other hand, public investments are expected to continue to rise in the wake of the increased resource allocation to defence and the transition of the energy supply.

A / After a strong period, economic activity in Denmark will likely decline over the coming quarters, but then it should increase again.

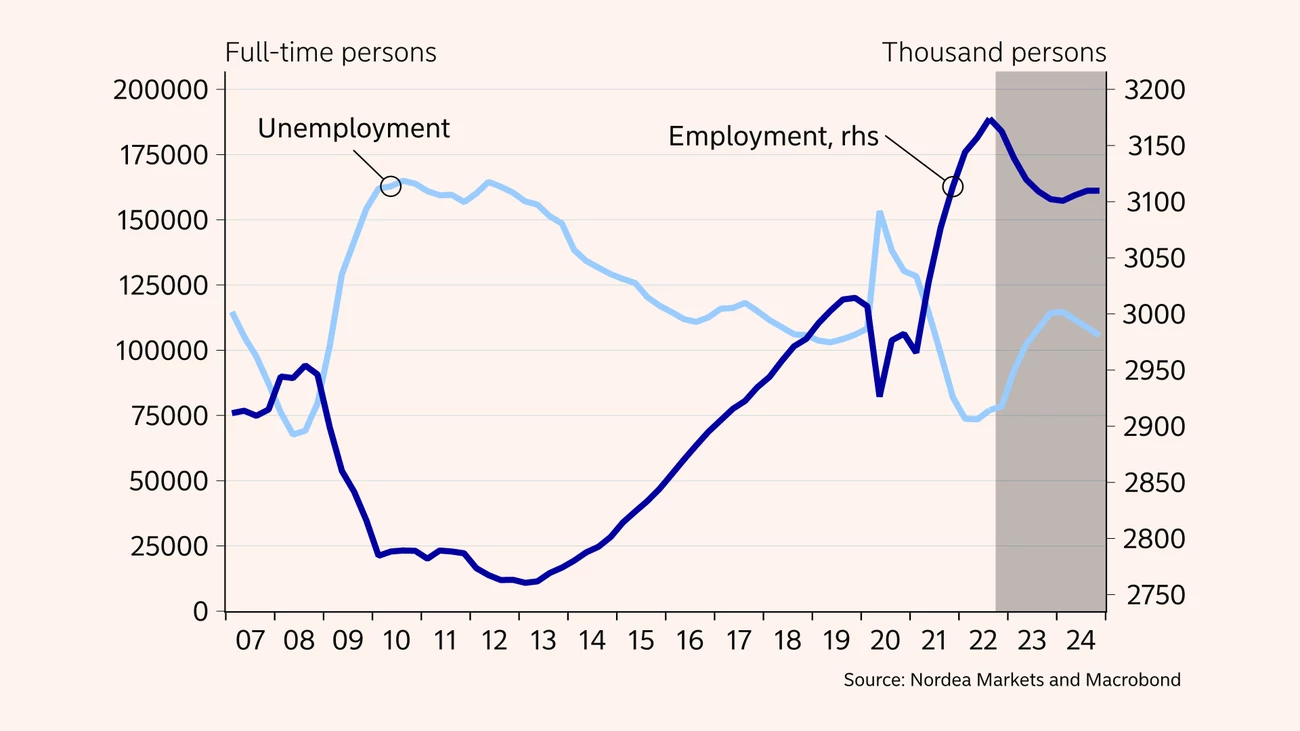

B / Decreasing economic activity in Denmark is expected to lead to growing unemployment and an even bigger fall in employment towards mid-2024.

The slowdown of the Danish economy is expected to lead to growing unemployment of around 40,000 full-time jobs by mid-2024. The expected increase will bring the unemployment rate back to basically the same level as before the pandemic. The balance between supply and demand of labour will thus improve after a period when many companies have cited labour shortage as a significant restraint on production.

Part of the labour market adjustment is expected to come from foreign labour which has risen considerably in recent years. Employment is thus also expected to decline more than the increasing unemployment seems to give rise to. In the slightly longer term, the influx of foreign labour is expected to continue, though.

The Danish economy is slowing down, but from a very high level.

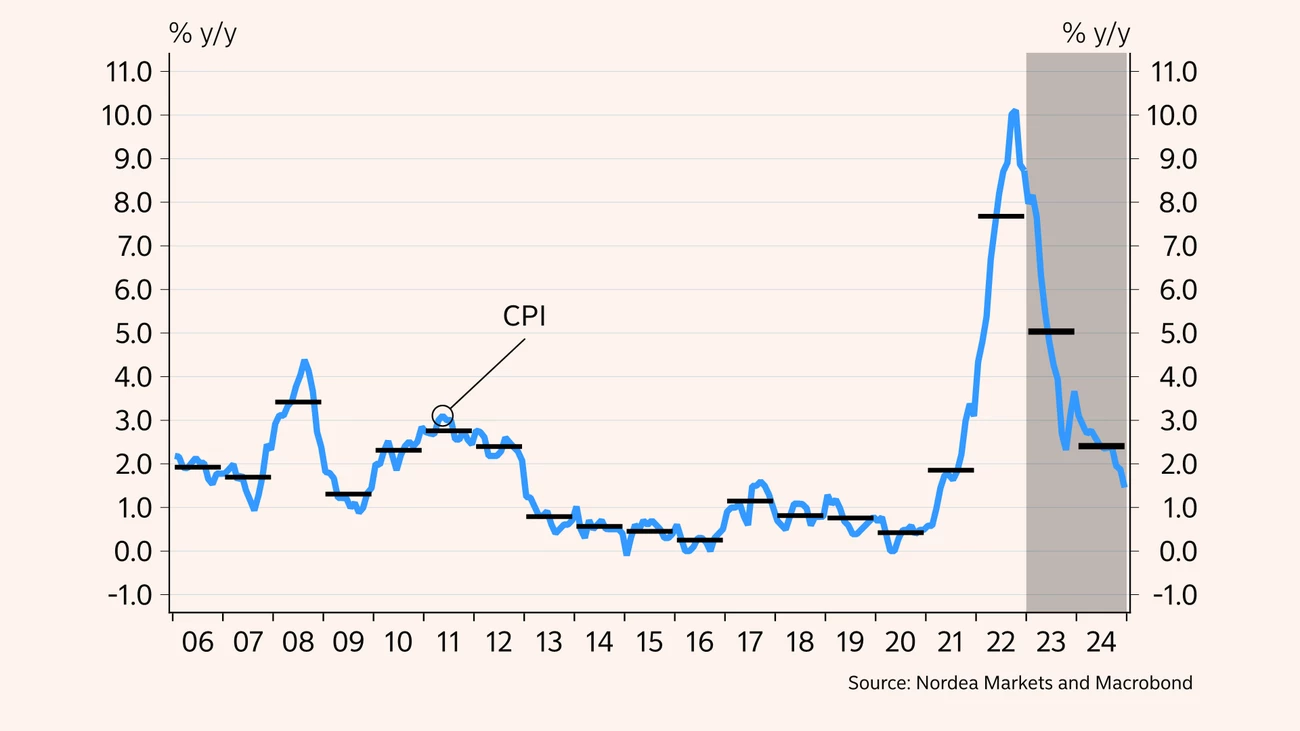

In 2022 the average inflation rate stood at 7.7%, which is the highest annual level since 1984. The rising inflation is first and foremost attributable to higher prices of goods. Not least food prices, which last year were 12% higher on average than in 2021. Also, electricity, natural gas and petrol were main inflation drivers in 2022. But here the trend has reversed in recent months, giving us good reason to believe that inflation will fall drastically going forward.

We expect the average inflation rate will be around 5% in 2023, falling to just above 2.0% in 2024, mainly because the contribution to the annual rate of increase from rising energy prices is getting smaller. On the other hand, the contribution from the service industries is expected to go up as many manufacturers will try to pass on rising wage costs to the consumers. So, even though inflation is expected to fall during 2023, the price level will remain significantly higher than in the years prior to the coronavirus crisis.

High inflation is eroding households’ purchasing power. The current collective agreements in the private sector will expire in the spring. Thus, the new collective agreements will likely have to be finalised in an environment with significantly higher inflation expectations than previously, and many companies are feeling the effects of weaker demand. The outcome of the collective bargaining is currently difficult to predict, and there is a higher probability of a large-scale conflict during the spring.

In our main scenario, we expect wages in the private sector to rise by around 4% this year – the highest annual rate of increase since 2008. Given our inflation forecast, real wage growth is also expected to become positive again towards year-end.

C / Inflation rose above 10% in the autumn of 2022. However, it has subsequently declined somewhat. Inflation is expected to continue to decline, reaching a level of about 2% by mid-2024.

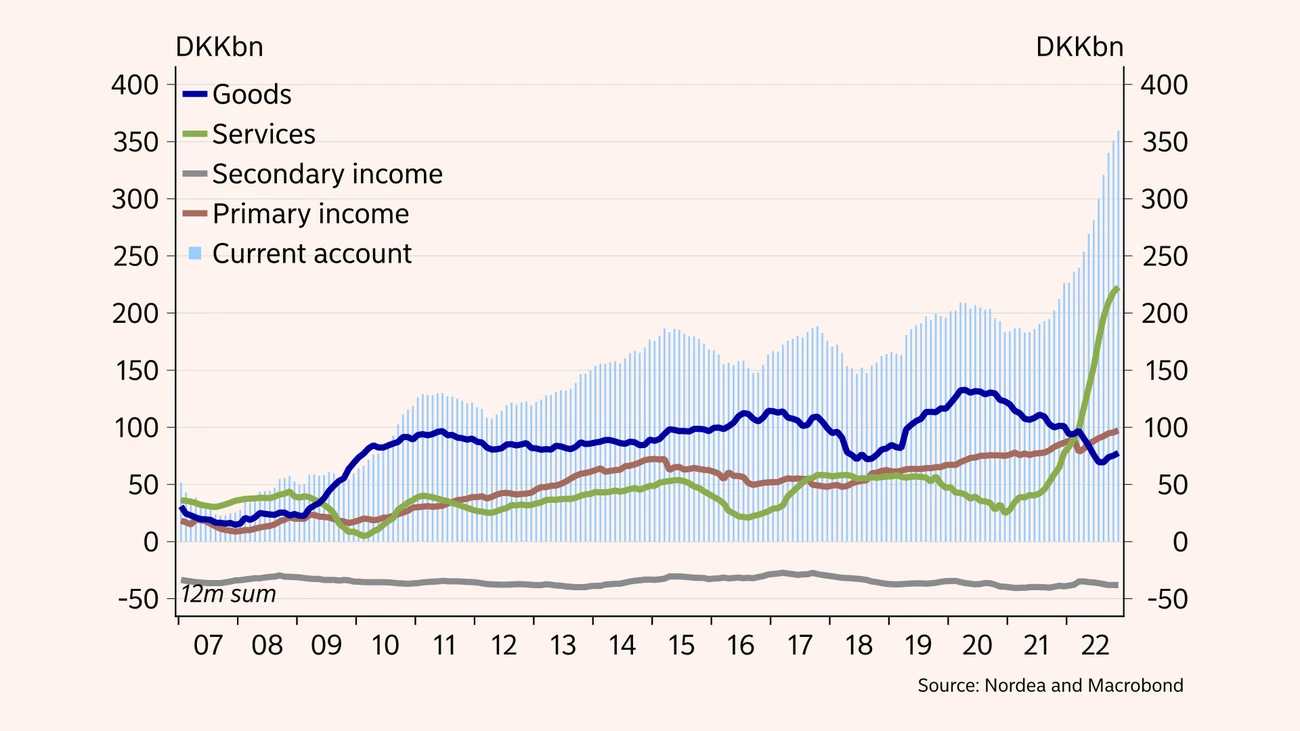

D / The current account balance has reached an all-time high. Especially high income from ex-ports of services has driven the surplus in recent years.

Public finances have again fared markedly better than expected. Thus, a public budget surplus of more than 1% is expected for 2022. If so, it will be the sixth year in a row with a surplus, and this has helped reduce public gross debt to around 30% of GDP. This is close to a historically low level – only surpassed during a brief period ahead of the financial crisis.

However, going forward, the public balance could go into negative territory again. Near term, this is especially because income from the pension return tax is expected to decline sharply. In addition, slower economic activity will lead to lower tax receipts. Also, longer term, public finances will likely come under increased pressure given the government’s ambition to lift its defence and security spending permanently to 2% of GDP by 2030. Further-more, substantial public funds are likely earmarked for the green transition, which has become more urgent as a consequence of the war in Ukraine.

Since mid-2021, the Danish current account surplus has risen markedly from an already high level, and as a result will amount to more than 12% of GDP for the full year of 2022. The latest increase was driven by a large increase in the surplus on the balance of service, which includes income from sea transport. The historically large current account surplus is also one of the reasons why Danish net assets against foreign countries are now approaching 80% of GDP. In comparison, it was 0% in 2009.

We expect the current account surplus to shrink in the coming years. This is mainly due to a normalisation of the extraordinarily high income from sea transport. The level of the current account surplus will, however, remain very high in a historical context, as the current return from the large net assets relative to other countries will ensure a steady inflow of substantial net income.

The European Central Bank (ECB) is expected to hike its policy rate further during the spring to 3.25% by mid-2023. Due to the fixed exchange rate regime, the Danish central bank will basically track the ECB’s interest rate movements. Since the spring of 2020, the DKK has traded on the strong side of its central parity versus the EUR. This has happened even though the Danish central bank has sold more than DKK 175bn on the FX market over the past two years to defend the fixed exchange rate regime. In continuation of this, the interest rate differential has widened so that the central bank’s current policy rate is 0.25% point below the ECB’s policy rate.

The persistent pressure for a stronger DKK against the EUR is due to the very high current account surplus and rapidly growing Danish net wealth relative to other countries. Thus, in our opinion, the Danish central bank needs to keep its policy rate lower than the ECB’s for a long time yet to ensure a sufficient flow of capital exports to counter the appreciation pressure on the DKK versus the EUR. In this light, the central bank’s deposit rate is expected to increase to 3% in mid-2023. It is estimated to stay at this level towards end-2024 when the ECB and the Danish central bank are expected to sanction their first rate cuts.

Danish long-term market rates are expected to rise slightly in the coming quarters. This is mainly due to additional monetary policy tightening and continued high inflation expectations. Danish long-term interest rates are expected to fall moderately. But the interest rate level will remain significantly higher than previously, as inflation has been lifted permanently and central banks are simultaneously trimming the very high balances created by the large-scale bond purchases during the pandemic.

This article first appeared in the Nordea Economic Outlook: The balancing act, published on 25 January 2023. Read more from the latest Nordea Economic Outlook.

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more