- Name:

- Jan Størup Nielsen

- Title:

- Nordea Chief Analyst

After tough negotiations the labour market parties have managed to reach a new collective agreement for the private sector – calling off the risk of a long and costly conflict. Moreover, the agreement will likely make it possible for wage earners to regain lost purchasing power.

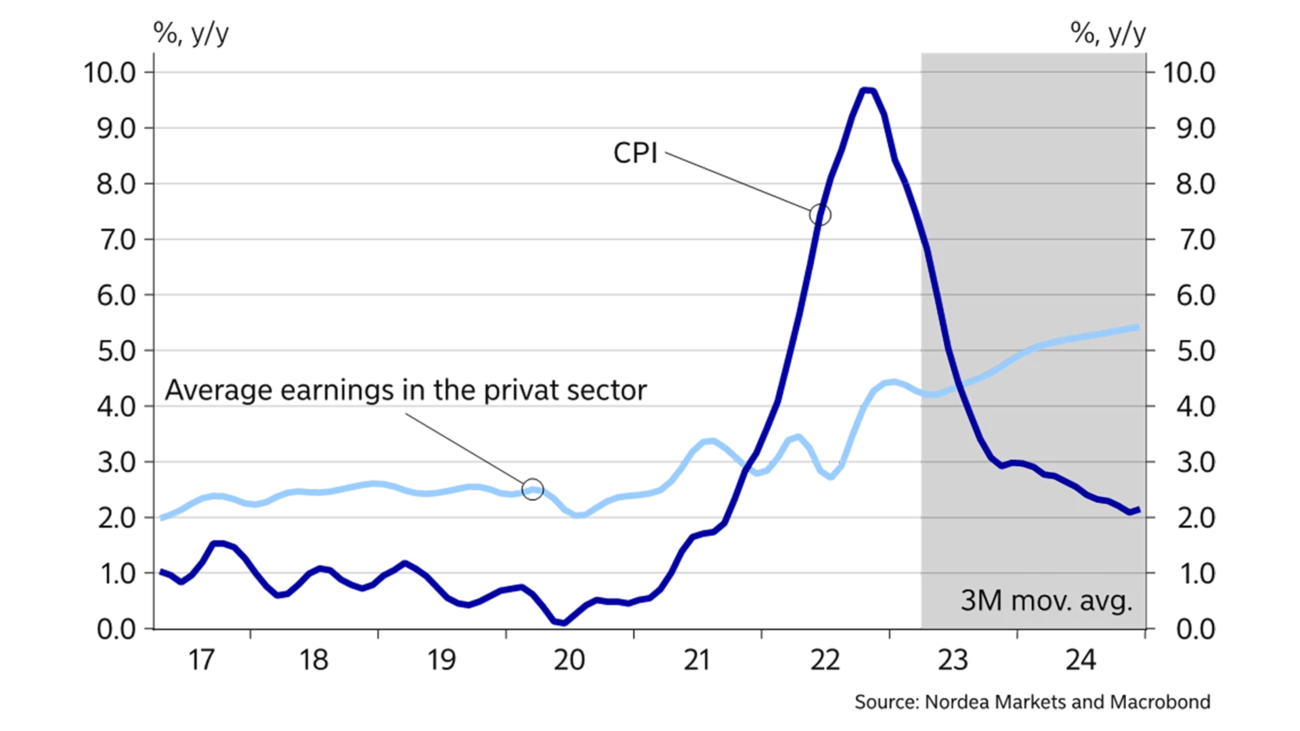

A drama was set to unfold when collective bargaining for nearly 700,000 employees in the private sector started in early January. Together with record-high employment, the significant erosion of wage earners’ purchasing power in 2022 due to sky-high inflation gave reason to expect very tough negotiations between employers and employees. But there was no drama. On 19 February the parties of the industrial sector announced that they had reached a new collective agreement and on 3 March the transport sector followed suit.

The two agreements work as a main settlement for the minimum and standard wage areas, and thus paved the way for a relatively easy bargaining period for the rest of the many collective wage agreements to be renewed this year.

The outcome was historically high salary increases, which will likely be in the region of 9-10% over the coming two years. The reason why the actual wage trend is uncertain is that some 80% of wage earners are employed on minimum wage agreements, but hardly any of them receive that rate, and salaries are agreed through local bargaining at company level. Only 20% are employed on terms of the standard wage which can be found in the collective agreement.

However, the risk of a long and costly general strike could soon be called off. A strike had been widely expected in light of the government’s decision to abolish Great Prayer Day from and including 2024. However, already at an early stage the parties agreed that this was a political decision that should not impact the collective bargaining.

In this way the Danish model has proven its strength. And the fact that the labour market parties solve their own issues is perhaps one of the key reasons why Denmark is one of the countries in the world with fewest labour market conflicts. In 2022, only 16,000 working days were lost because of conflicts. Most of them were related to the pilot strike at SAS with industrial actions among cabin crew and aircraft mechanics.

With the new collective agreements, salaries in the private sector are expected to rise by around 4.5% this year and just over 5% next year. That is roughly the same wage trend level as that of our most important trading partners. So although these are the largest wage increases since the financial crisis, we do not expect that they will significantly weaken Danish companies’ salary competitiveness.

For wage earners the collective agreement means that they can look forward to recovering the purchasing power lost because of last year’s rapidly increasing inflation. That is also the case for employees in the public sector where collective bargaining will start next year. However, in the Danish labour market there is a long-standing tradition of pay rises in the public sector largely mirroring the trend in the private sector. The wage trend in the public sector is thus largely expected to follow the private sector – albeit with a slight delay given the different collective agreement periods.

The collective agreement shows the strength of the Danish labour market model – and also paves the way for higher consumption in 2024.

The recovery of positive real wage growth is crucial for household consumption to pick up again. This is expected to happen because positive real wage growth will lift households’ disposable income, and at the same time it is an important psychological effect when wage earners get relatively high pay increases paid out. According to our forecast, this will happen next year when total consumer spending is expected to grow by nearly 2%.

This article originally appeared in the Nordea Economic Outlook: The Inflation Standoff, published on 9 May 2023. Get the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more