- Name:

- Jan Størup Nielsen

- Title:

- Chief Analyst, Nordea

Den här sidan finns tyvärr inte på svenska.

Stanna kvar på sidan | Gå till en relaterad sida på svenskaLarge public budget surpluses and a declining debt ratio put Denmark in a good position to navigate the economy through an uncertain period. However, unexpectedly high tax payments have meant that excess liquidity in the money market has been lower than normal for some time. Financial market turmoil has meanwhile led to a weakening of the DKK.

According to preliminary figures, Denmark recorded a surplus on public finances of 4.5% of GDP in 2024 – the highest since 2007. The surplus is also the largest among the EU countries – a position Denmark has held since 2019.

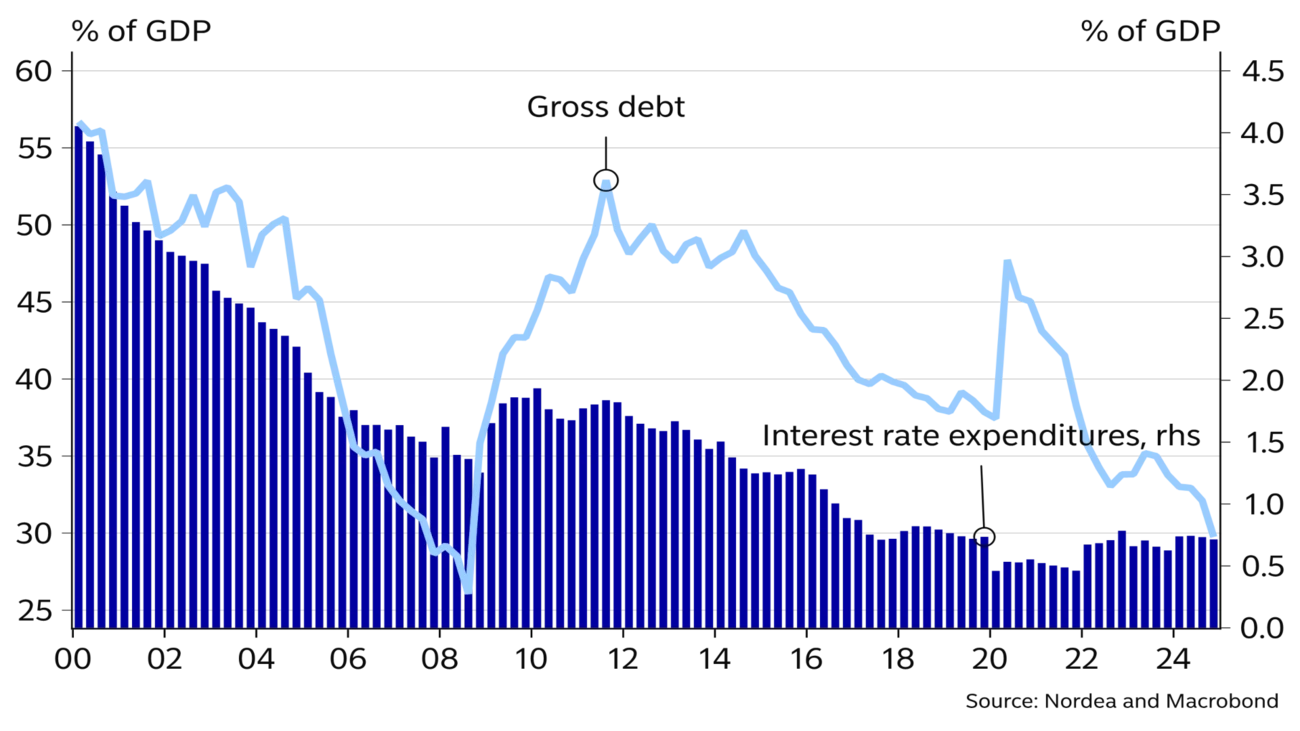

The long period of large surpluses has clearly affected the trend in gross public debt, which has dropped be-low 30% of GDP, despite a significant rise in the balances on the government’s account in recent years.

Combined, this provides great flexibility to be used, for example, for the government’s acquisition of the majority stake in Copenhagen Airports and for setting up a new fund to accelerate the build-up of the Armed Forces’ combat capability. This also applies to the financing reform that was agreed with KommuneKredit, the special-purpose credit institution, in March. Going forward, KommuneKredit’s lending activity will be financed by the issuance of government bonds. Despite this extra borrowing requirement, the Danish central bank has announced that it will maintain its strategy for central government borrowing in 2025.

In addition to the strong economy, the revenue from tax on pension returns plays an important role for the large surplus on public finances. At the start of 2025, the Danish Ministry of Finance expected these revenues to be just below DKK 10bn. However, the actual payments have subsequently proven to be more than four times as high. Thanks to the large, partly unexpected tax payments, the balance on the government’s account with the Danish central bank rose at the end of March to the highest level since 2011.

This, coupled with substantial corporate tax payments, has significantly reduced excess liquidity in the money market. This trend can be tracked in the daily net position figures, which at the end of Q1 dropped to the lowest level since the middle of 2022. This meant that during March the Danish central bank made its first monetary policy loans since 2022. Excess liquidity has subsequently increased again, but remains a good deal below the recent years’ average.

We expect the net position to increase towards year-end, thanks partly to a gradual reduction of the government’s very large balance with the Danish central bank.

Exceptionally strong public finances ensure great flexibility in economic policy. This is especially important in a country where monetary policy is locked in a fixed exchange rate regime.

During the financial market turmoil in the spring, the DKK weakened against the EUR. This trend culminated temporarily in mid-April when EUR/DKK briefly traded just below 7.47.

The DKK weakening is partly explained by the value loss experienced by the Danish insurance and pension sector in the US. In total, the sector has USD assets worth around DKK 1,600bn, corresponding to more than 50% of the Danish GDP. When the value of these assets falls (as it did during the sharp US stock market decline in March), this can lead to a sale of DKK by the sector as the need for currency hedging decreases.

This effect is partly offset by continued strong DKK demand from non-financial companies. With the historically large current account surplus, these companies are thus natural buyers of DKK. That is why the pressure on the DKK has not been so intense that the Danish central bank has intervened in the FX market. So the longest period without intervention since the introduction of the fixed exchange rate regime in 1982 continues. At the same time, this supports our view that the current monetary policy rate spread of -0.4% point versus the ECB will remain unchanged until the end of the forecast horizon.

This article first appeared in the Nordea Economic Outlook: Weathering the storm, published on 21 May 2025. Read more from the latest Nordea Economic Outlook .

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more