- Name:

- Jan Størup Nielsen

- Title:

- Chief Analyst, Nordea

After some hectic years, the Danish economy is moving into a calmer period. Inflation is under control in both Denmark and the Euro area, boosting household purchasing power. It has also paved the way for a looser monetary policy, which will further stimulate economic activity – and also con-tribute to higher home prices. Activity is also lifted by significant growth in the pharmaceutical industry, which increases employment and helps ensure a large current account surplus.

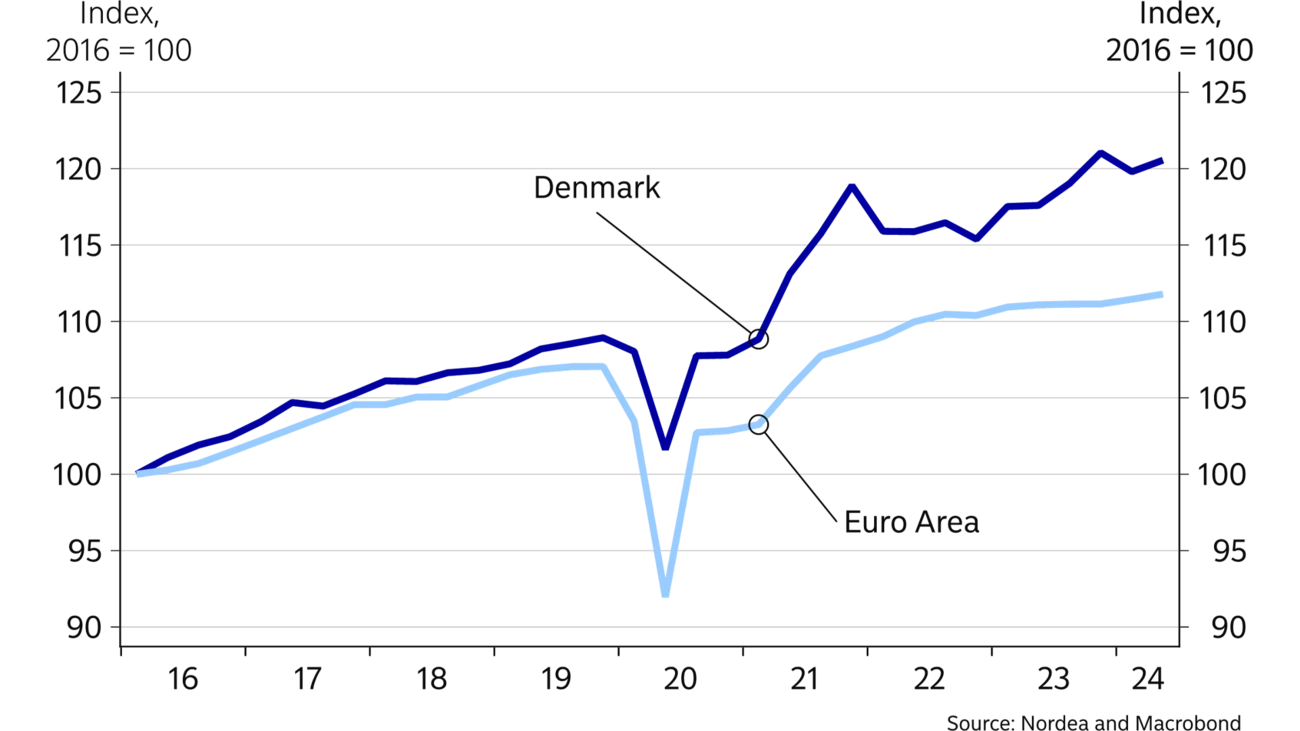

In H1 the Danish economy grew overall by 2.2% compared to the year-earlier period. This is slightly below the average growth rate in 2023, but still above the long-term potential growth rate. It is also significantly higher than in the Euro area where GDP grew by 0.5% in the same period.

We expect the economy will continue to expand, with overall growth at 1.5% for 2024. The down-ward revision of 1% point compared to our latest forecast from April is mainly due to large revisions of historical data. Next year we expect the Danish economy to expand by 1.7%. This estimate is un-changed. Lastly, we have for the first time included 2026 in our forecast period where growth is also expected at 1.7%.

The continued progress in the Danish economy is mainly based on the prospect of lower interest rates, which will boost demand in Denmark as well as in key export markets. In continuation of this, solid real wage increases will pave the way for higher household consumption.

As a starting point we estimate that upside and downside risks to the forecast are balanced. If the global economy slows down more than expected, it will almost inevitably also hit the Danish economy in the form of lower exports, weaker consumption and waning investment activity. Our expectation of continued economic growth may thus turn out to be too optimistic. On the other hand, growth may also be higher than expected in the forecast period if, for example, households increase spending more than expected.

So far 2024 has seen a modest decline in household consumption, partly owing to plummeting car sales at the beginning of the year and stagnating retail sales. It may seem a bit of a paradox that personal spending stagnates during a period with rising employment, strengthening purchasing power and a strong housing market.

A likely reason for the restrained spending could be recent years’ significant rate hikes, which have tripled households’ overall interest expenses over the past two years. This is also reflected in the consumer confidence figures, which still show a lower assessment of households’ financial situation than the historical average. In continuation of this, consumers also consider the economic situation in Denmark to be worse than a year ago.

In our forecast we expect personal spending to start accelerating, primarily thanks to positive real wage growth. In addition, the refund of overpaid housing taxes could boost consumption. Lastly, the Danish Parliament adopted a broad-based new tax reform in December 2023. The reform is to be phased in over the coming years, but one of the measures – a higher employment allowance – will take effect from 2025. This should further stimulate household consumption.

| 2023 | 2024E | 2025E | 2026E | |

| Real GDP, % y/y | 2.5 | 1.5 | 1.7 | 1.7 |

| Consumer prices, % y/y | 3.3 | 1.4 | 2.1 | 2.0 |

| Unemployment rate, % | 2.8 | 2.9 | 3.1 | 3.3 |

| Current account balance, % of GDP | 9.8 | 11.5 | 11.7 | 11.2 |

| General gov. budget balance, % of GDP | 3.3 | 2.4 | 1.8 | 1.6 |

| General gov. gross debt, % of GDP | 33.6 | 32.8 | 31.3 | 30.5 |

| Monetary policy rate, deposit (end of period) | 1.75 | 2.85 | 1.85 | 1.85 |

| USD/DKK (end of period) | 6.97 | 6.89 | 6.65 | 6.59 |

Danish foreign trade has increased drastically in the years after COVID-19. Adjusted for inflation, exports have grown nearly 40% – reaching a historical high at the beginning of 2024. This increase has especially been driven by the sale of goods, with the pharmaceutical industry playing an increasingly large role. This has become particularly evident in the development in the export of goods that do not cross the Danish border. It has more than doubled in just a few years.

This year, overall Danish exports are expected to in-crease by around 4%. The lower growth rate compared to last year is in particular due to the export of services, which fell sharply in the first three months of the year owing to a drop in sea transport. In the coming years we expect an annual increase of 4-5%. This is based on expectations of continued growth in the pharmaceutical industry, but also on the fact that other industries will increasingly benefit from higher activity in several key export markets. The prospect of growing demand in key markets such as Germany, Great Britain and Sweden is expected to lift exports.

The large value creation in the pharmaceutical industry is also boosting the current account. The current account surplus is on the rise again after a dip in 2023, primarily due to a lower services surplus where sea transport plays a key role. We expect the current account surplus to remain at a very high level (above 10% of GDP) throughout the forecast period.

The Danish economy is very strong. Growth is solid and employment record high. This is expected to continue unless the global economy slows down significantly.

Since early 2021 each quarter has posted a surplus on public finances. Consequently, in 2023 alone, the total surplus was 3.3%, and Denmark was once again the EU country with the largest budget surplus. The strong public finances have been supported by a major pick-up in employment. This helps to increase the government’s income tax receipts while also reducing expenses such as unemployment benefits. At the same time it is remarkable that the surplus is generated in a period where income from tax on pension returns has been far below the historical average.

The continuous budget surplus has helped reduce public gross debt to around 30%. Coupled with a large balance on the government's account with the central bank, this provides a high degree of freedom in terms of fiscal policy planning and also helps to ensure that Danish government yields are basically on a par with German equivalents.

Strong growth in the pharmaceutical industry has contributed to a steep increase in companies’ intellectual property products investment. On the other hand, fixed residential investment has taken a nose dive by around 25% since early 2022. This can probably mainly be explained by the large rate hikes during that period. However, recent data indicate that the market for residential construction is recovering, as the number of building starts has risen throughout the year. Activity is expected to continue to rise and residential investment may thus again over time contribute positively to overall activity.

At the beginning of 2025, the average price per square metre of single-family and terraced homes is expected to be back at the historical high from the autumn of 2022. The higher prices are owing to solid growth in disposable income as well as a relatively low number of homes for sale. In continuation of this, home prices have been supported by low construction activity in the past 18 months. This is also partly why the average sales period for houses has been significantly lower than previously.

In our new forecast, we expect home prices will rise by 3.3% on average this year. This is an upward revision from the April estimate, which has been revised because the indicators for Q2 point to a large uptick in prices. Given the prospect of further labour market growth and the coming rate cuts, we estimate that sales prices of houses will climb by 3.5%-4.0% in both 2025 and 2026. However, the increase will be limited as more homes will be put on the market.

On the market for owner-occupied flats, we estimate that prices will on average rise at around the same pace as house prices. This development masks significant geographical differences, as the development in new construction has varied in the large cities in Denmark.

The trend in Danish consumer prices has fluctuated a lot in recent years. In October 2022 inflation was 10.1%, which was the highest level since 1982. Exactly one year later in October 2023, inflation had dropped to just 0.1%. Subsequently, inflation has fluctuated around 1.5%, which basically corresponds to the average inflation rate in the period from 2000 and up to the outbreak of the COVID-19 pandemic.

Towards the turn of the year, we expect consumer prices to increase at a slightly higher pace. One reason for this is that food prices are rising again after a relatively large drop in H2 2023. Food and non-alcoholic beverages account for more than 12% of the total inflation index and thus have a big impact on the overall inflation trend. Accordingly, if food prices remain around the current level, they will have contributed positively to overall inflation by more than 0.5% point towards the year-end. In this light, we expect that inflation will exceed 2% again by year-end.

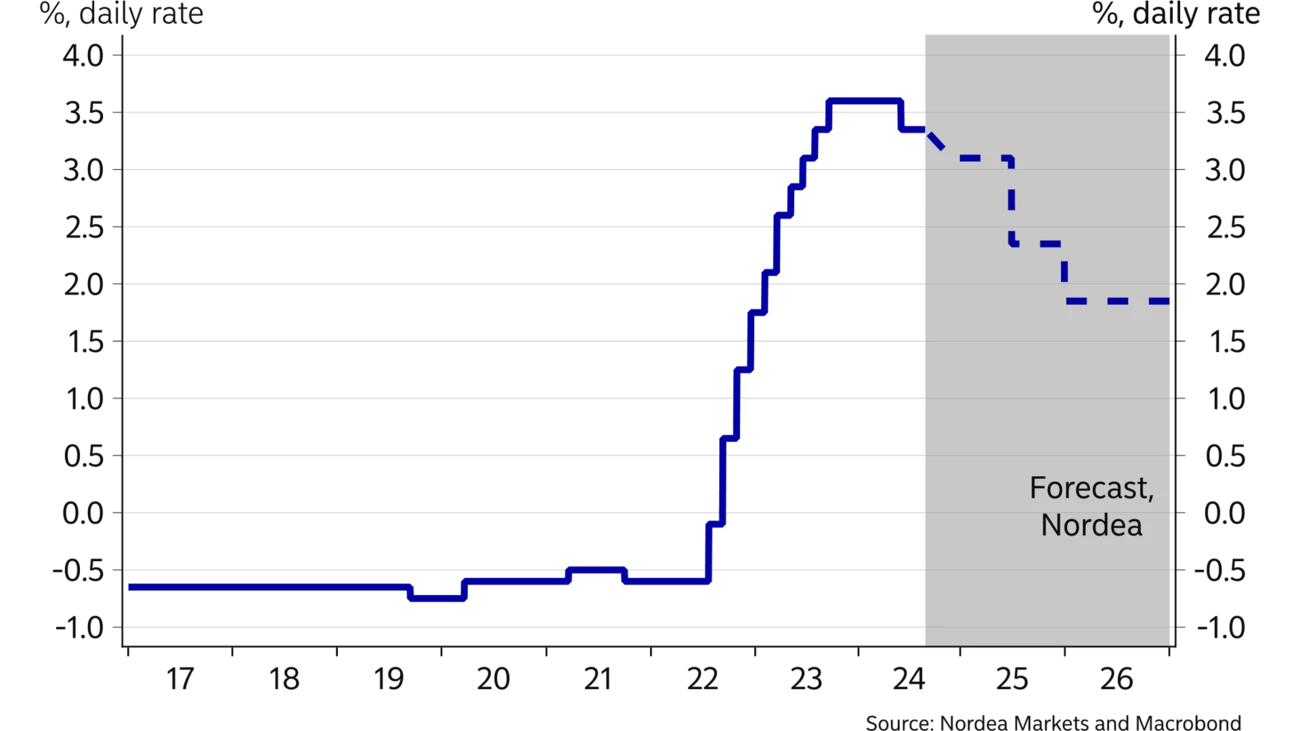

In June the ECB cut rates for the first time since 2019. The cut was a reaction to steadily decreasing inflation in the Euro area. Our forecast assumes that it will be the starting signal to a long process of quarterly rate cuts until end-2025.

The Danish fixed exchange rate regime has been stable for a long period. The last time the Danish central bank had to intervene in the foreign exchange market was in January 2023. At that time the DKK had gradually weakened against the euro, so in the past quarters the DKK has thus fluctuated just around the central parity against the euro. We expect the current gap of 0.4% point between the policy rate in Denmark and the Euro area will be maintained during the forecast period. Thus, prospects are that the Danish central bank de-posit rate will fall to 1.85% by end-2025. In such case it will be the lowest level since early 2023 – but it is still significantly above the historical low of -0.75% in the autumn of 2019 and until the early spring of 2020.

This article first appeared in the Nordea Economic Outlook: Precision Play, published on 4 September 2024. Read more from the latest Nordea Economic Outlook.

Sustainability

Amid geopolitical tensions and fractured global cooperation, Nordic companies are not retreating from their climate ambitions. Our Equities ESG Research team’s annual review shows stronger commitments and measurable progress on emissions reductions.

Read more

Sector insights

As Europe shifts towards strategic autonomy in critical resources, Nordic companies are uniquely positioned to lead. Learn how Nordic companies stand to gain in this new era of managed openness and resource security.

Read more

Open banking

The financial industry is right now in the middle of a paradigm shift as real-time payments become the norm rather than the exception. At the heart of this transformation are banking APIs (application programming interfaces) that enable instant, secure and programmable money movement.

Read more