+2.3%

Expected GDP growth in 2026

Denne siden findes ikke på norsk

Bli værende på denne siden | Fortsett til en lignende side på norskJan Størup Nielsen

The previously high-flying Danish economy has had its wings clipped as historical growth figures have been revised lower and industrial production has declined, particularly in the pharmaceutical sector. Despite reduced altitude, the Danish economy is still very strong: Unemployment is low, the current account surplus has reached record levels and the public sector has minimal debt. This backdrop provides considerable flexibility during a time when substantial resources need to be allocated towards rebuilding defence capabilities.

As described in the theme article, Statistics Denmark has made large revisions of historical national accounts figures over the summer. Coupled with the surprisingly weak GDP figures for Q1, this has led us to revise down our 2025 growth expectations quite sharply. In the new forecast we expect GDP growth of 1.8% this year, compared to 3.2% in our May forecast.

However, due to the more subdued growth expectations, the basis for comparison for 2026 will be more favourable. So even though we leave our growth profile from May basically unchanged, our revised calculations now show a higher growth estimate for 2026 – from our previous forecast of 2.0% to 2.3%. We also include 2027 in the forecast horizon for the first time. Here we estimate a 1.9% increase.

We believe the risks to our new forecast to be balanced – however, it is worth noting that the significant quarterly variations in Denmark's national accounts data always introduce some natural uncertainty into any economic predictions.

+2.3%

Expected GDP growth in 2026

7

The number of consecutive quarters with positive growth in household consumption

-0.40% point

Spread between deposit rates – Danish central bank and ECB

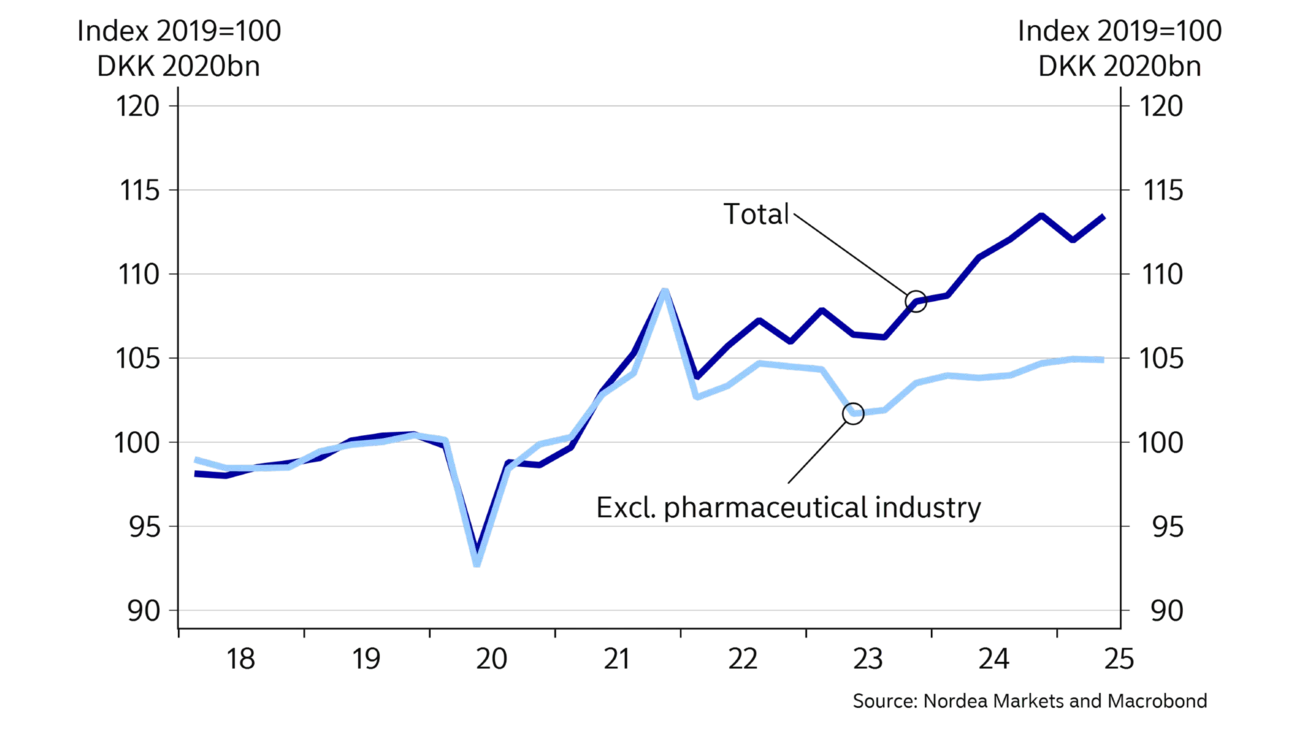

Measured since early 2021, overall economic activity has increased by about 11%. The pharmaceutical sector has accounted for more than half of this economic growth and now represents one-quarter of all Danish industrial turnover. Since 2021, turnover in the pharmaceutical industry has more than doubled.

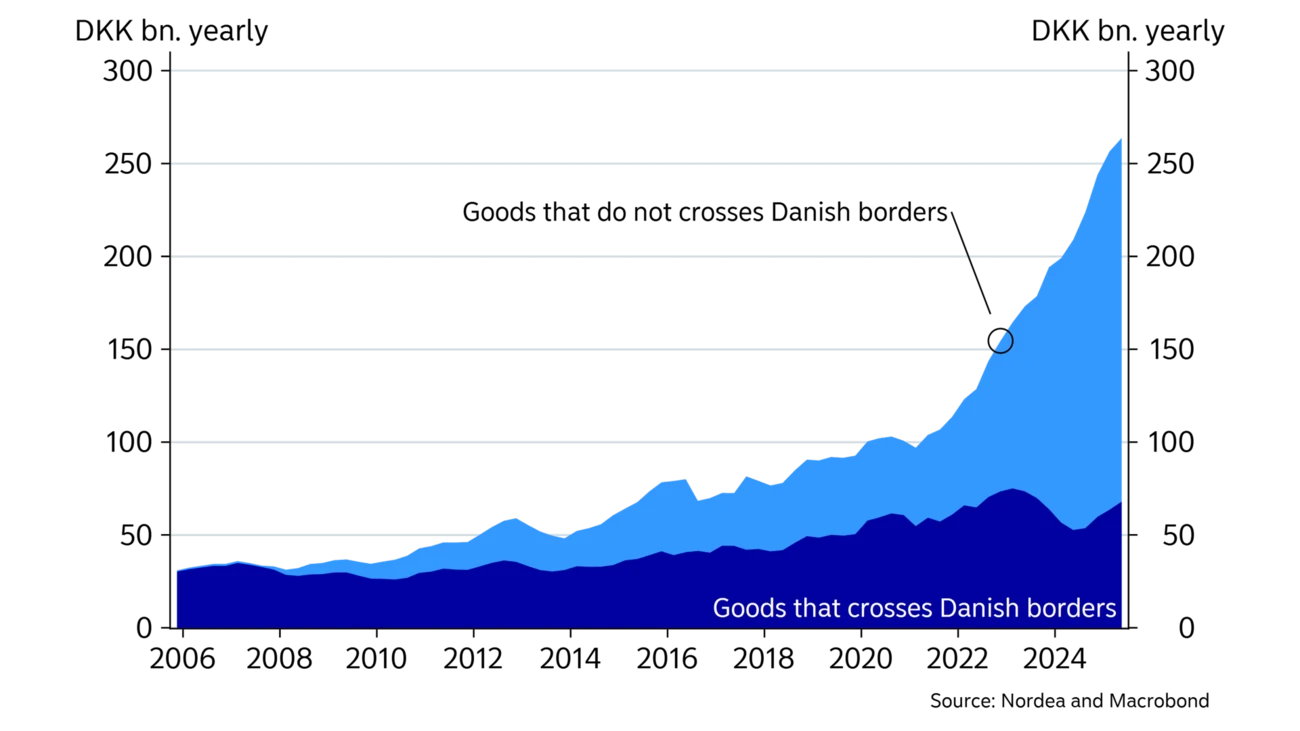

The substantial growth in the pharmaceutical industry has helped to significantly boost exports to the US, while also contributing to increasing the current account surplus to an all-time high.

A large and growing part of production in the pharmaceutical industry takes place outside Denmark. As a result, almost all of recent years’ growth in goods exports has come from production facilities located outside Denmark, particularly in the US. The industry is thus also relatively well protected against the effects of the trade war since a large part of the production takes place locally.

However, production in the pharmaceutical industry has slowed in recent quarters, causing goods exports to contract relatively sharply in Q1 2025. Although growth picked up again in Q2, it means exports will grow significantly less in 2025 as a whole compared to previous years. In the coming years we expect exports to grow further owing to an improved growth outlook in key export markets in the Euro area and the other Nordic countries.

Household consumption has increased for the last seven consecutive quarters. But the level is still below the historical peak during the COVID-19 pandemic in 2021.

| 2024 | 2025E | 2026E | 2027E | |

| Real GDP, % y/y | 3.5 | 1.8 | 2.3 | 1.9 |

| Consumer prices, % y/y | 1.4 | 1.9 | 1.7 | 2.1 |

| Unemployment rate, % | 2.9 | 2.9 | 2.9 | 3.0 |

| Current account balance, % of GDP | 12.2 | 11.8 | 11.3 | 10.5 |

| General gov. budget balance, % of GDP | 4.5 | 2.4 | 1.3 | 1.6 |

| General gov. gross debt, % of GDP | 29.1 | 29.6 | 28.9 | 28.2 |

| Monetary policy rate, deposit (end of period) | 2.60 | 1.60 | 1.60 | 2.10 |

| USD/DKK (end of period) | 7.17 | 6.22 | 6.01 | 5.92 |

Despite the uptick in spending, Danish households continue to increase savings, now setting aside about 15% of their disposable income. This has helped lower household debt quotas to a more than 20-year low. The substantial household savings could potentially trigger a strong consumer-driven recovery. This will be further driven by additional tax cuts from the beginning of 2026 when a new middle-bracket tax rate will be introduced, lifting the top-bracket tax rate threshold. The employment allowance will also increase. In this context, the government has announced a series of tax cuts on electricity, coffee and chocolate, which could also boost household spending in 2026 and 2027. It remains an open question, though, when this potential will translate into actual spending. Consumer confidence figures remain very low, and Nordea’s card transaction data points to modest real growth in domestic spending. On this basis, our forecast assumes that total household spending will grow by around 2.5% next year.

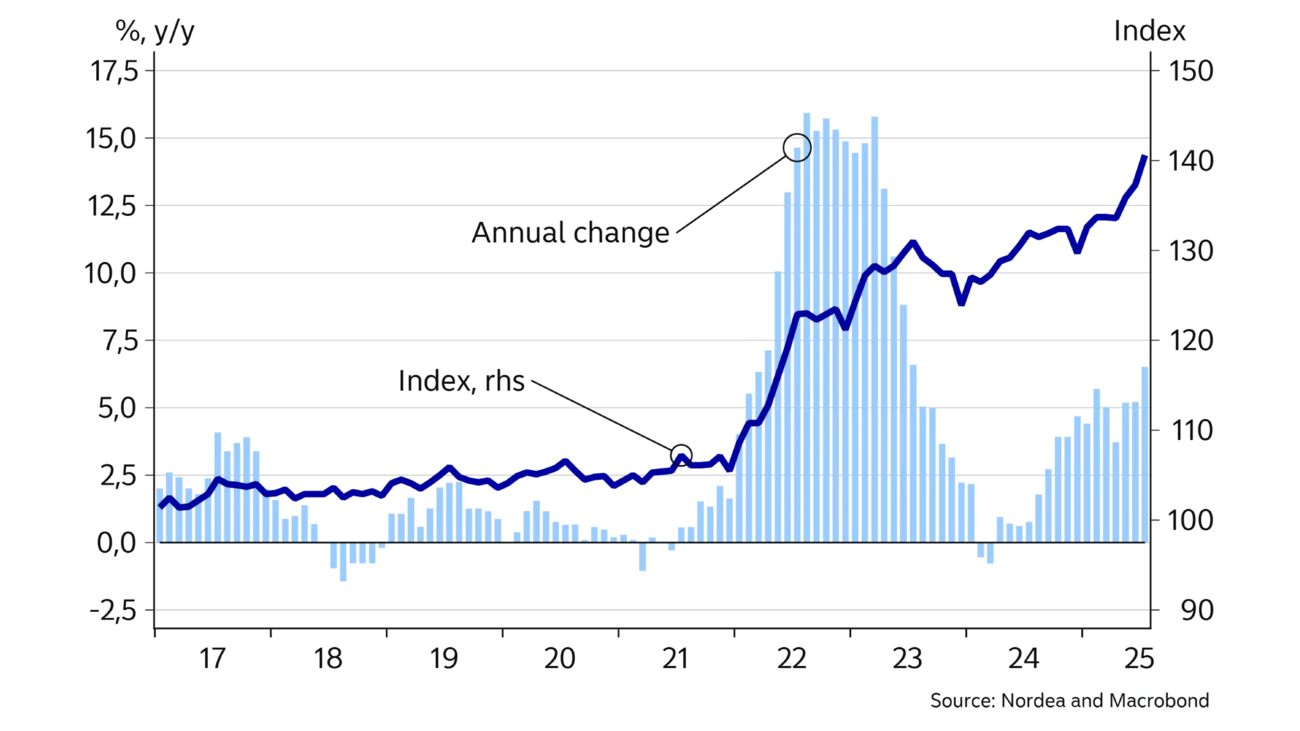

In July, the annual rate of inflation in consumer prices was 2.3%. This is the highest inflation level measured since mid-2023. The upward pressure on Danish consumer prices stems from food products. In the past year, prices of food and non-alcoholic beverages have risen by 6.5%. Coffee prices have, for example, increased by more than 30% and prices of chocolate and beef have gone up by more than 20%. There are currently no signs that food price inflation will fade. In the retail sector, sales prices are set to rise further over the next three months. However, much suggests that the government budget for 2026 will be adopted with tax cuts on coffee and chocolate, which may reduce the upward inflationary pressure. This also applies to electricity prices, where political announcements suggest a significant tax cut. If this happens, it could lower inflation throughout 2026 by 0.3 percentage points viewed in isolation. We expect the average inflation rate to land at 1.9% this year. In 2026, inflation is expected to slow moderately to around 1.7% as tax cuts will dampen price increases temporarily. Nonetheless, in 2027 inflation is expected to exceed 2% again.

The Danish economy has lost a bit of momentum. But the foundation is still very strong.

Over the past year, wages in the private-sector labour market have risen by almost 3%. Thus the gap in real wage developments has now been closed. At the beginning of 2025, new three-year collective agreements were concluded in the private-sector labour market, resulting in annual wage increases of about 3%. This is roughly in line with international trends and it means that Danish companies will not fall behind in terms of international wage competitiveness. At the same time, the pace of wage growth will be high enough to improve wage earners’ purchasing power over the forecast period.

Since 2019, Denmark has maintained the highest public budget surplus of any country in the EU. Last year the surplus reached 4.5% – the highest level since 2007. The long period of large surpluses has led to a drop in gross public debt to below 30% of GDP. Together with a large deposit on the government’s account with the Danish central bank, this provides great fiscal policy flexibility. The government has used this to acquire a majority stake in Copenhagen Airports and committed to participate in the planned share issue in the partly state-owned company Ørsted. The government has also announced further investments to strengthen Denmark’s defence capabilities.

Measured since early 2020, employment has grown by nearly 10%. Employment growth has mainly come from the private sector, but also been supported by a rising number of public-sector employees.

A significant share of the recent employment growth in Denmark stems from the pharmaceutical industry. If this slows, overall job growth could become more subdued in the coming years. In line with this, the number of job vacancies has declined since the beginning of the year, and hiring plans – especially in retail – have turned more cautious.

Overall, this suggests that recent years’ rapid increase in employment is starting to level off. However, this will not be enough to significantly impact unemployment, which is still expected to hover around 3% over the next few years.

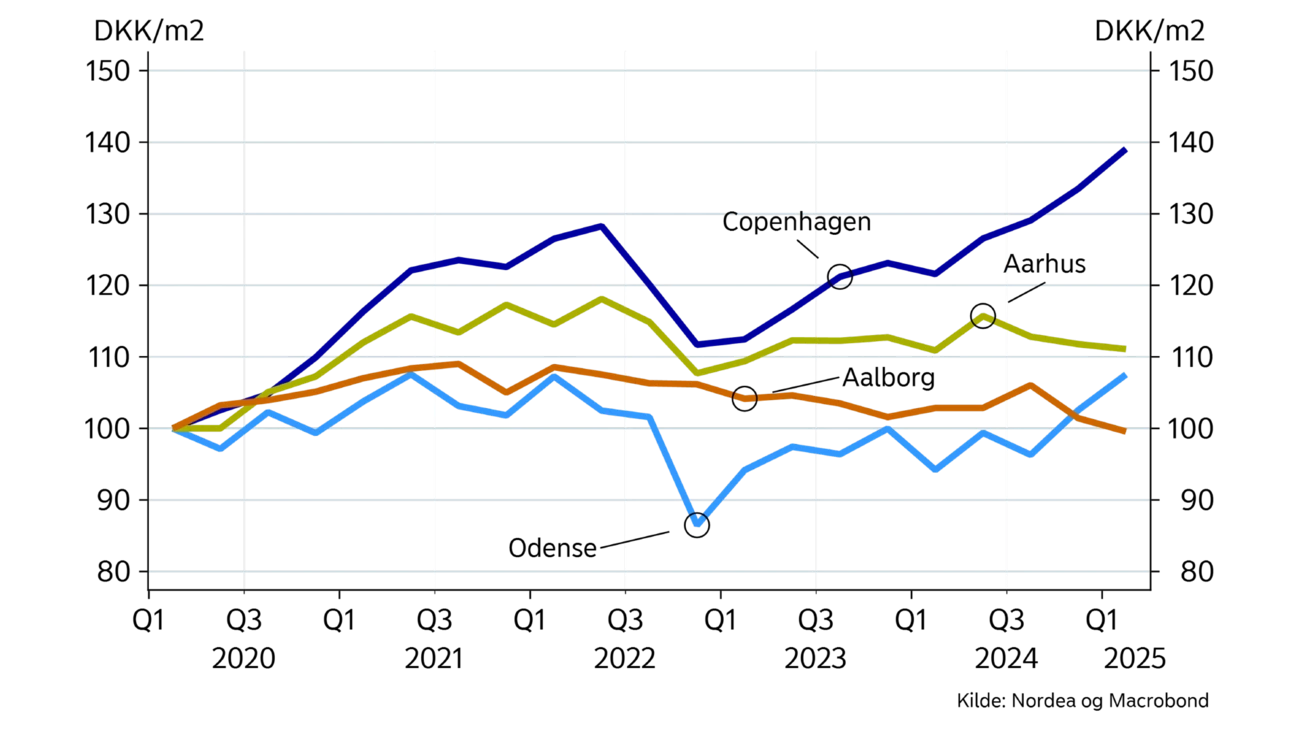

On the surface, the Danish housing market shows strong progress. Over the past year, the average price per square metre for single-family homes has increased by about 5%, while prices for owner-occupied flats have risen by more than 8%. Consequently, nominal housing prices have reached an all-time high. But when price trends are adjusted for inflation trends, real sales prices remain below the previous peak in 2021.

Price increases were mainly driven by the metropolitan area, where prices of owner-occupied flats in Greater Copenhagen have risen by a hefty 14% in the past year. The last time prices rose this much was during the COVID-19 pandemic. Otherwise, similar price increases have not been seen since the years leading up to the financial crisis. The large price increases in Copenhagen are supported by low supply and a limited number of newly built homes.

The situation looks different in many other parts of the country, where a larger supply of homes for sale and limited demand have helped stabilise price increases. This is evident, for example, in the regions of Central Jutland and Southern Denmark, where prices for single-family homes have increased by 3-4% over the past year.

In our new forecast, we expect sales prices to rise by 5.5% this year. This is nearly 1 percentage point more

than anticipated in the May forecast, primarily due to the sharp price increases in the first half of the year. Over the coming years, we expect prices increases to continue – albeit at a gradually more modest pace. These expected increases will primarily be driven by continued growth in household disposable income and a strong labour market. In addition, price increases will be supported by the low inflow of newly built houses in the market for several years, driving up prices of the existing housing stock.

Despite the Danish economy experiencing major ups and downs in recent years, the fixed exchange rate policy has remained remarkably stable. The Danish central bank has not needed to intervene in the FX market to maintain the stability of the DKK against the EUR since January 2023. This is the longest running period without intervention since the introduction of the fixed exchange rate policy more than 40 years ago. Thus the current interest rate differential between deposit rates at the Danish central bank and the European Central Bank is expected to remain unchanged at the current -0.4 percentage points for an extended period.

Due to the prospect of an unchanged interest rate differential, our new forecast includes two rate hikes by the Danish central bank during 2027. If realised, this would be the first monetary tightening since the autumn of 2023. In addition to these expected rate hikes, we also expect continued upward pressure on long-term rates, which could potentially dampen activity towards the end of the forecast period.

This article first appeared in the Nordea Economic Outlook: Steady path, published on 3 September 2025. Read more from the latest Nordea Economic Outlook .

Stay ahead of the curve with our expert economic insights and forecasts. Get the latest analysis on global and Nordic markets delivered straight to your inbox.

Read more

Corporate insights

Despite global uncertainties, Sweden’s robust economic fundamentals pave the way for an increase in corporate transaction activity in the second half of 2025. Nordea’s view is that interest rates are likely to remain low, and our experts accordingly expect a pickup in deals.

Read more

Economic Outlook

Finland’s economic growth has been delayed this year. Economic fundamentals have improved, as lower interest rates and lower inflation improve consumers’ purchasing power. However, the long period of weak confidence in the economy continues to weigh on consumption and investment.

Read more

Economic Outlook

The monetary policy tightening initiated by the ECB in 2022 halted economic growth in Finland and sent home prices tumbling. So why isn’t the monetary policy loosening that began a year ago having a positive effect on the Finnish economy yet?

Read more